Diners at Viaduct Harbour, Auckland, New Zealand

The Kahneman-Tversky Portfolio is a simple Dual Momentum Portfolio where we pick only one of three assets in our investment quiver (providing they have positive momentum relative to SHY – our “risk-free” benchmark fund). The only diversification here is that we split the portfolio and use a long-term (252-day) momentum look-back period for one half and faster (60- and 100-day) lookbacks for the other half.

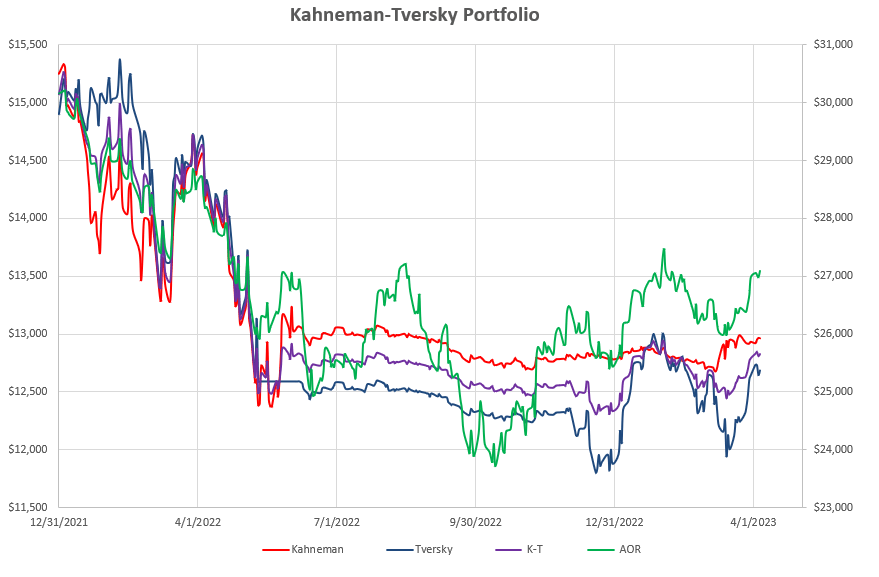

Performance to date looks like this:

with little action over the past 9 months. At present the slow, long look-back, Kahneman portion (red line) is holding Cash and the faster, shorter look-back, Tversky portion (blue line) is invested in VEU (International – ex-US – equities).

with little action over the past 9 months. At present the slow, long look-back, Kahneman portion (red line) is holding Cash and the faster, shorter look-back, Tversky portion (blue line) is invested in VEU (International – ex-US – equities).

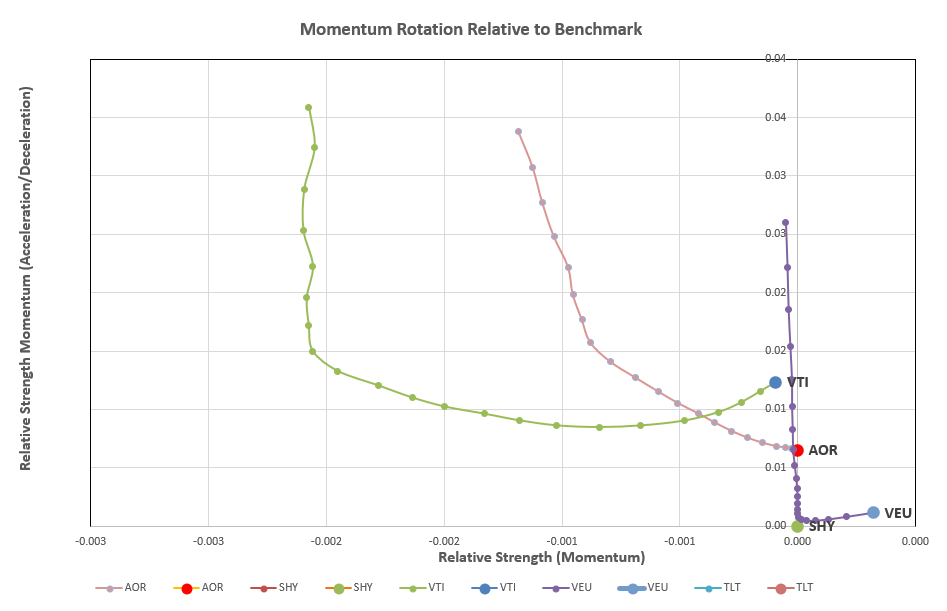

So, we’ll take a look at the rotation grapks, first for the Kahneman portion:

that is showing little action, although all assets are showing positive (left-to-right) movement with VEU now falling in the top right quadrant. TLT is not showing on this chart since I have adjusted the axis scales so that we can see the assets of primary interest – but TLT is well off-the-chart to the far left.

that is showing little action, although all assets are showing positive (left-to-right) movement with VEU now falling in the top right quadrant. TLT is not showing on this chart since I have adjusted the axis scales so that we can see the assets of primary interest – but TLT is well off-the-chart to the far left.

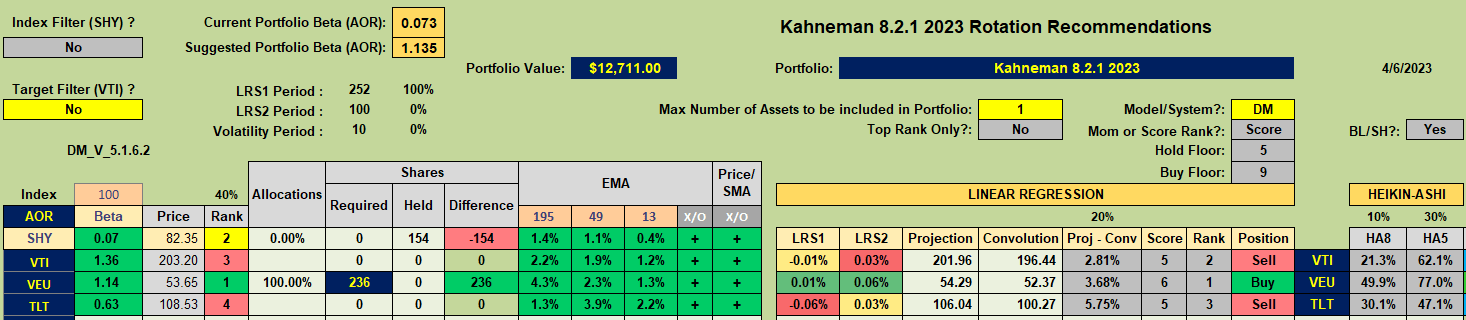

Checking the recommendations:

we see that the model/system is recommending VEU as the ETF to hold.

we see that the model/system is recommending VEU as the ETF to hold.

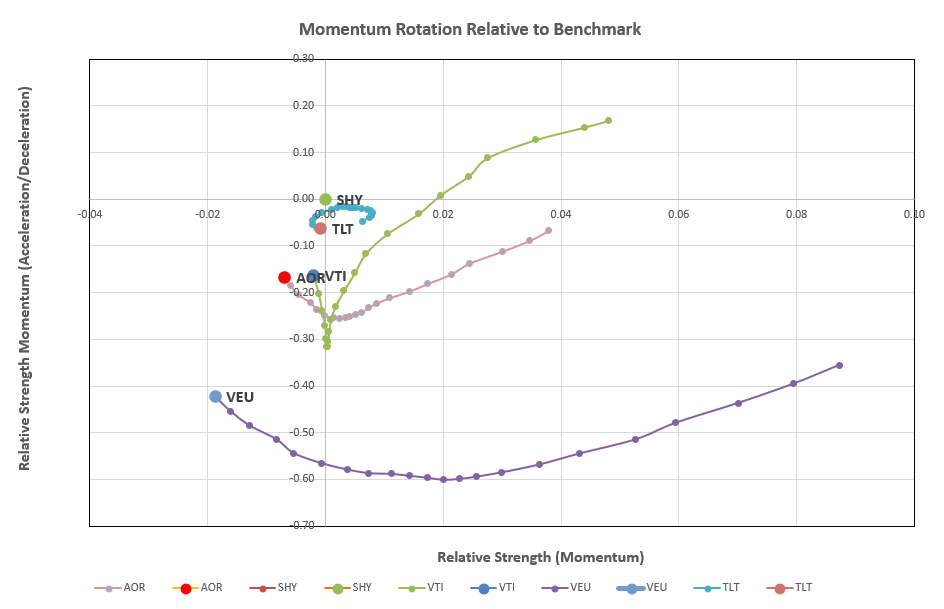

Moving to the faster-reacting Tversky portion of the portfolio:

we note that most assets are showing weakness (right to left movement) – this in contradiction to the slower moving Kahneman dynamics.

we note that most assets are showing weakness (right to left movement) – this in contradiction to the slower moving Kahneman dynamics.

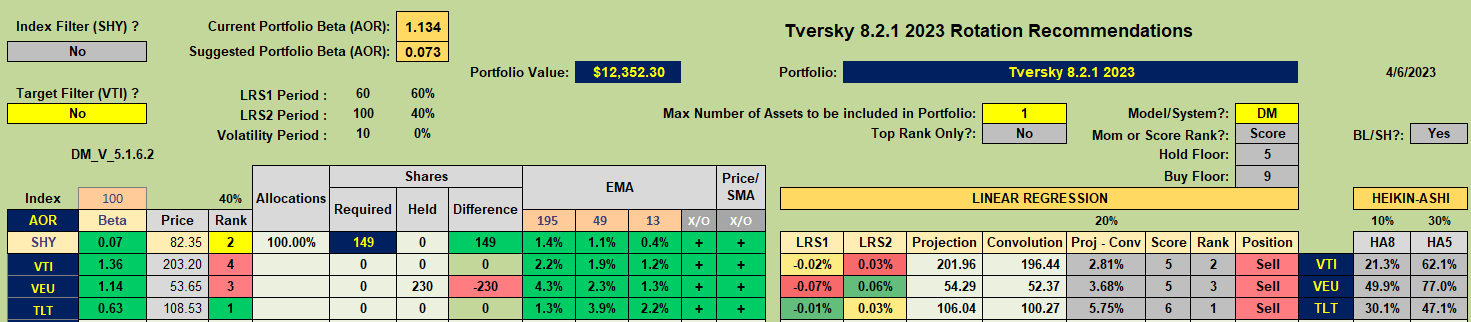

This is reflected in the recommendations:

where the recommendation is to move from VEU (currently held) to Cash. Although TLT is ranked #1 based on “conventional” Rate-Of-Change momentum (4th Column from the left) it is not recommended as a Buy because momentum as calculated using ratio’d relative strength is less than SHY – but the 2 methods are not that different and either one could easily “flip”. I shall be watching this carefully and may switch to TLT if both methods recommend this.

where the recommendation is to move from VEU (currently held) to Cash. Although TLT is ranked #1 based on “conventional” Rate-Of-Change momentum (4th Column from the left) it is not recommended as a Buy because momentum as calculated using ratio’d relative strength is less than SHY – but the 2 methods are not that different and either one could easily “flip”. I shall be watching this carefully and may switch to TLT if both methods recommend this.

At the end of the day we have a situation where the recommendation of one half of the portfolio is recommending VEU and the other portion is recommending Cash. Although this is the exact opposite of assets currently held in the total Portfolio it does not change the composition of the total portfolio. I will not, therefore, be making any practical adjustmens to the portfolio – but I will be adjusting the spreadsheets to reflect the move from one portion of the portfolio to the other – a simple paper adjustment for record keeping/system performance records.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.