Welcome to the new Carson portfolio. With the advent of the Carson we add another investing model to our arsenal. With few exceptions, ITA portfolios operate on the premise that momentum is a sound foundation for constructing portfolios. The Carson is quite different in that it can be classified as a contrary investing model. With the Carson, sector ETFs are purchased when they are out-of-favor (positioned in the over-sold zone) and sold when they reach the Bullish Percent Indicator (BPI) over-bought zone. Additional information is provided below and as investors follow the Carson model they will see how this investing system operates.

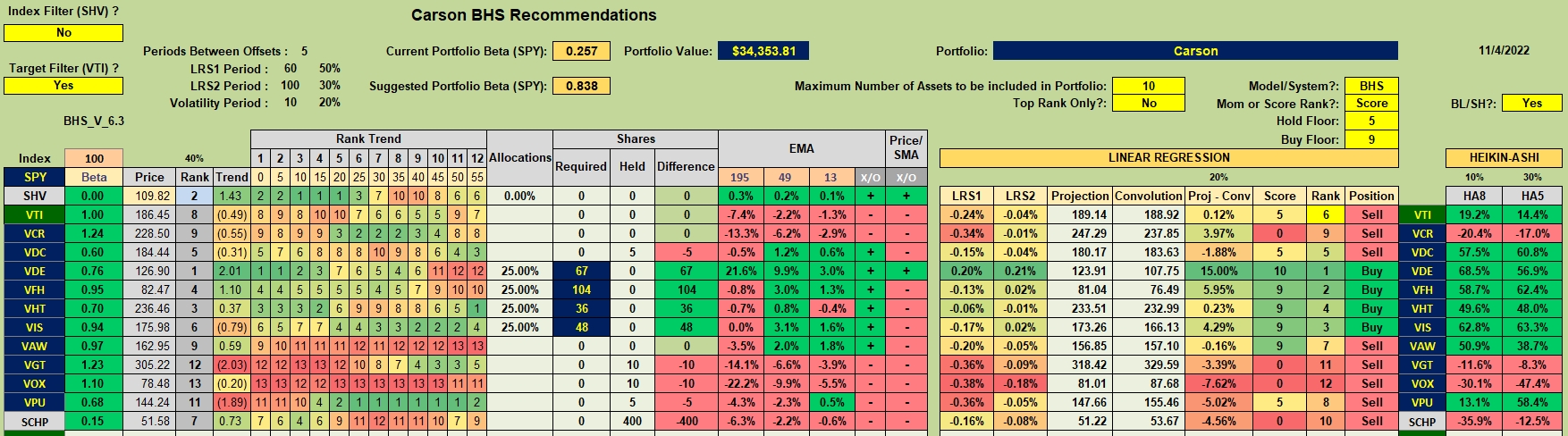

Carson Investment Quiver

To launch the new Carson, I transferred all assets from the Carson BHS and Carson HA over to the Carson LRPC and then changed the name from Carson LRPC to Carson. As readers will recall, $10,000 was placed in each of the original Carson portfolios. That is why this new Carson is a portfolio in the mid-$30,000 range.

Investing Logic: How will this new Carson be managed?

- Populate the investment quiver with 10 sector ETFs. I am using Vanguard ETFs in this portfolio.

- Add a short-term low volatile treasure (SHV) and an inflation protection security (SCHP) to the 10 sector ETFs.

- After the market closes each week, examine the position of each of the 10 sector ETFs.

- If a sector reaches the over-bought zone (70% or higher on the bullish scale) place a 2% or 3% Trailing Stop Loss Order (TSLO) under the ETF.

- If a sector ETF reaches the over-sold zone, purchase the ETF. Buy at market or place a limit order very close to the closing price of the sector ETF.

- The Carson is reviewed every seek as the Bullish Percent Indicators (BPI) will change from week to week.

- Expect the majority of the sector ETFs to spend most of their time between the 30% and 70% zones. During this period invest in either SCHP, SHV, or remain in cash.

- When two or more sector ETFs are a Buy, use the ranking system found in the 5th column from the right in the worksheet shown below. Specific decisions as to how many shares to purchase will be explained when this first occurs sometime in the future.

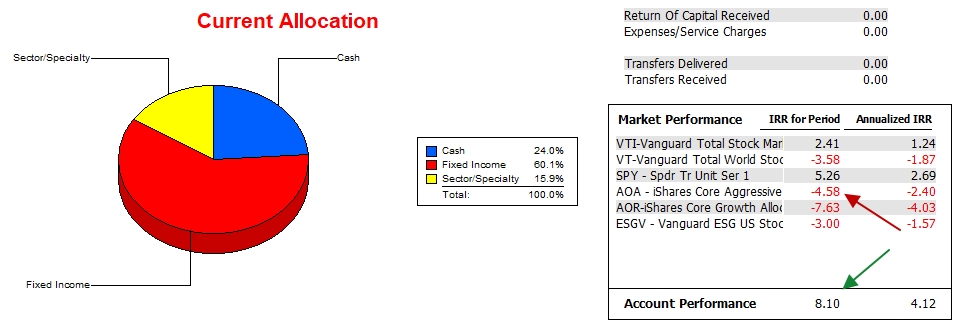

Carson Performance Data

Since positions and cash were transferred from the Carson BHS and Carson HA into the Carson LRPC, I’ll build on prior data collected for the Carson LRPC portfolio.

After the transfers yesterday and using current prices, the Carson is besting all possible benchmarks by a wide margin. Will the Carson BPI portfolio expand or contract this percentage difference? That is the key question.

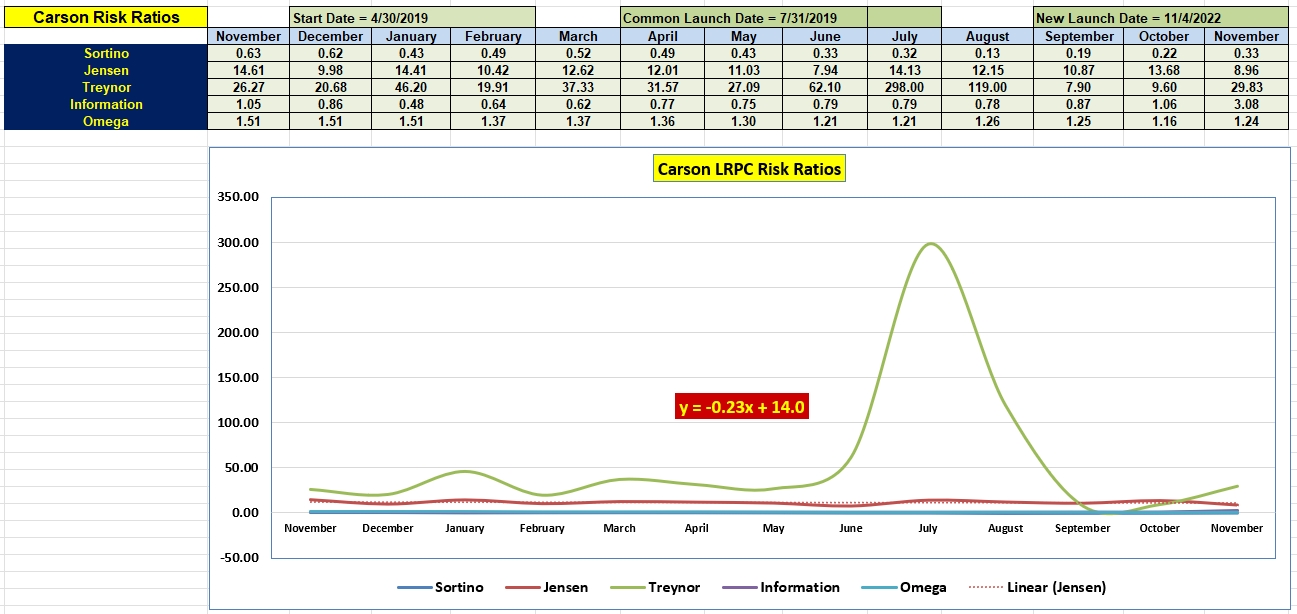

Carson Risk Ratios

It will take at least a year to know if the Carson – BPI model is workable and beneficial to investors.

The Treynor is very high due to a significant percentage of the portfolio being in cash. Holding cash reduces the portfolio beta and that in turn raises the Treynor Ratio.

The new Carson kicks off with one of the lowest Jensen values over the past year so we are not creating something out of the ordinary.

Carson Portfolio: Creating A New Investing Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Lowell,

I want to set up a “what if” scenario for your comment.

Assume that you had invested all cash in sectors a few weeks ago when most, if not all, sectors were below a BPI of 30.

What happens if months later none of the sectors had reached a BPI of 70 but a couple had fallen back to below 30? Would you continue to hold the previously purchased sectors and ignore the sector that fell below 30?

What happens if the market starts to fall significantly? I’m assuming you would not have set TSLOs until after a sector reached a BPI of 70. Would you end up holding the sectors during the duration of the fall?

I suspect I will just have to wait and watch your weekly reviews to understand how the new strategy will work. Should be interesting.

~jim

Jim,

I would continue to hold until the sector ETF(s) reached the 70% bullish level. If months transpire and the ETFs are still below 30% I would use dividends coming from SCHP and the SHV treasury ETF to purchase more shares.

I suspect many of the sector ETFs will live in the period between over-bought and over-sold.

Lowell

Jim,

I went back and pulled out the oldest BPI post.

https://itawealth.com/bullish-percent-indicators-18-september-2021/

Yes, 2021 was a very good year and there were not many buying opportunities. I suspect many sector ETFs would hit the 3% TSLO and preserved capital for what was to come in 2022.

Lowell

Jim,

Another possibility is to place an 8% TSLO on the ETF as soon as it is purchased so as to limit the loss.

Lowell

Check this BPI to see when some buying opportunities began to show up in 2022.

https://itawealth.com/bullish-percent-indicators-4-february-2022/

Lowell

Lowell,

Thanks for the responses. Are the BPIs based on the Relative Strength Indicator (RSI)?

~jim

Jim,

The BPI data comes from Point and Figure (PnF) graphs. Here is an example of a PnF chart for VTI.

https://schrts.co/AqsjUZWb

I have my charts set up with some specific percentage changes based on recommendations from Jeremy du Plessis’ book on the Definitive Guide to Point and Figure …

Lowell

Since the new Carson portfolio is connected to the weekly BPI sector data, I’ll need to look at this portfolio each Monday. Since no sectors were in the Buy zone last week, no changes are planned for the Carson.

Lowell

On a down day, such as we experienced today, I go into the Bullish Percent Indicator graphs for each sector to see if any dropped into the over-sold zone (30% or below bullish). When I checked this afternoon, none reached that point, but Telecom and Utilities were running between 30% and 40% bullish. Another down day or two and one of these sectors may well move into the Buy zone. Since I don’t know exactly when the charts are updated, I’ll check again tomorrow just in case one of these sector ETFs moved into the Buy zone. If that happens I’ll report it here and put it in the Forum so readers will have access to that current information.

Lowell

With the broad market moving up today it is highly unlikely any of the 10 sector Bullish Percent Indicators will fall into the over-sold zone or below the 30% bullish line. As a result, I’ll likely forgo the Carson review this week. If I do one it will be short and to the point.

Since none of the 10 sectors were in the Buy zone when I launched the new Carson, and sectors could rise from this point on, I seeded the portfolio with a few sector ETFs, but not many. I did not purchase any that were over-bought (70% or higher). Rather, I purchased (seeded) a few sector ETFs that were in the 40% bullish zone.

If these few ETFs fall back into the over-sold zone, I still have plenty of cash to pick up more shares when a buy signal is flashed.

Lowell