Sally Lunn’s Bakery located in the oldest house in Bath (1482), England.

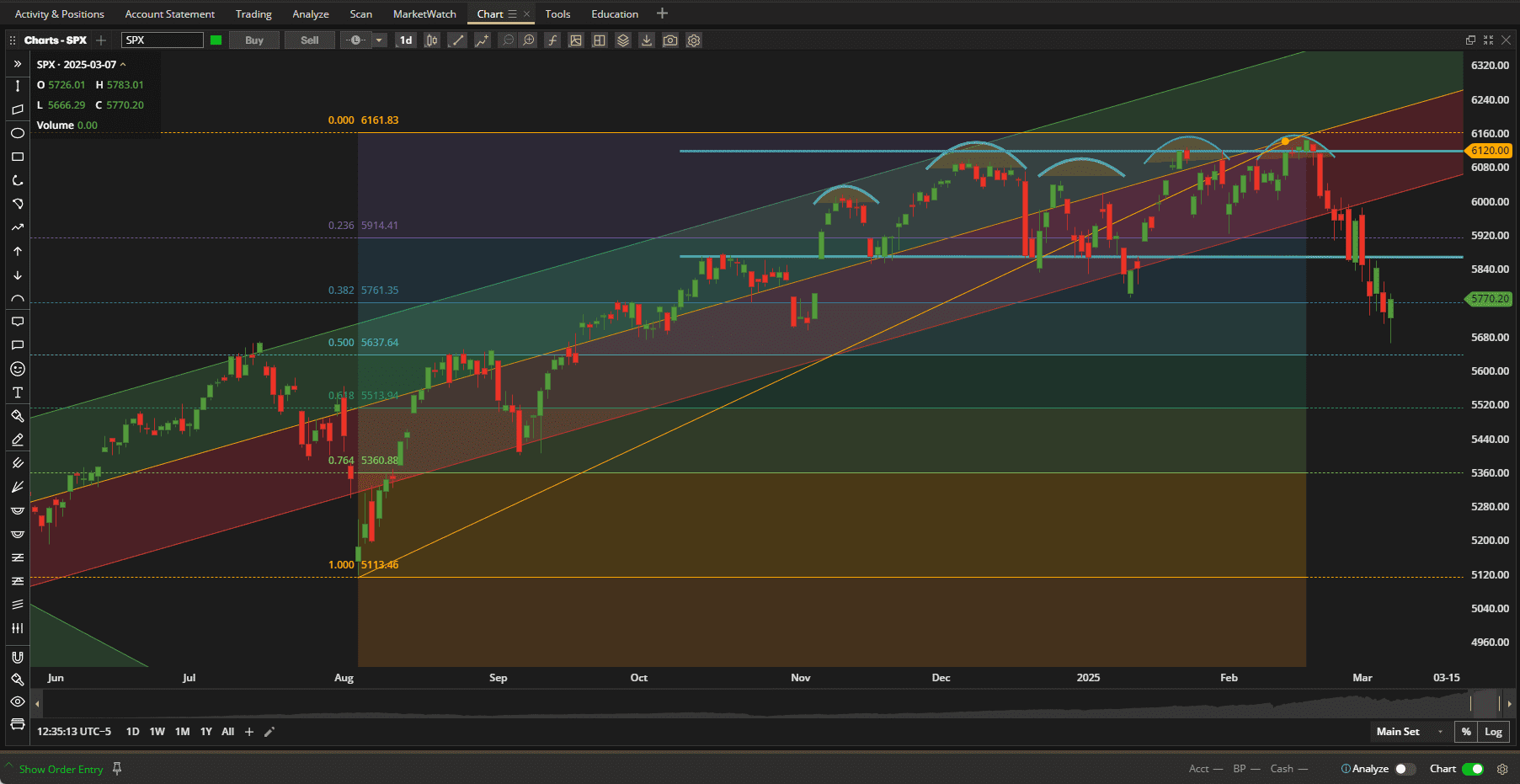

It was a volatile week in the US Equity markets with the SPX (S&P 500 Index) closing down ~3% on the week once the dust had settled on Friday:

Markets are looking a little weak here as we had been in a consolidation range between 5840 and 6160 for ~4 months and have now broken through the support area at ~5840. We also fell below the January pivot low and just touched the next support level at 5680 before rebounding a little on Friday. From here we might expect to see a re-test of the 5840 level, that now becomes resistance or, if there are more concerns over tariffs, a continuation of the pullback and, maybe, the start of a new bearish trend. 5680 looks like an area of strong support since this is a 50% pullback from the August pivot low and the February highs but, if we break through this, the next likely area of support might be at the 61.8% Fibonacci retracement level around 5520. This would also be a 10% retracement from the February highs and generally recognized as a “correction”.

Markets are looking a little weak here as we had been in a consolidation range between 5840 and 6160 for ~4 months and have now broken through the support area at ~5840. We also fell below the January pivot low and just touched the next support level at 5680 before rebounding a little on Friday. From here we might expect to see a re-test of the 5840 level, that now becomes resistance or, if there are more concerns over tariffs, a continuation of the pullback and, maybe, the start of a new bearish trend. 5680 looks like an area of strong support since this is a 50% pullback from the August pivot low and the February highs but, if we break through this, the next likely area of support might be at the 61.8% Fibonacci retracement level around 5520. This would also be a 10% retracement from the February highs and generally recognized as a “correction”.

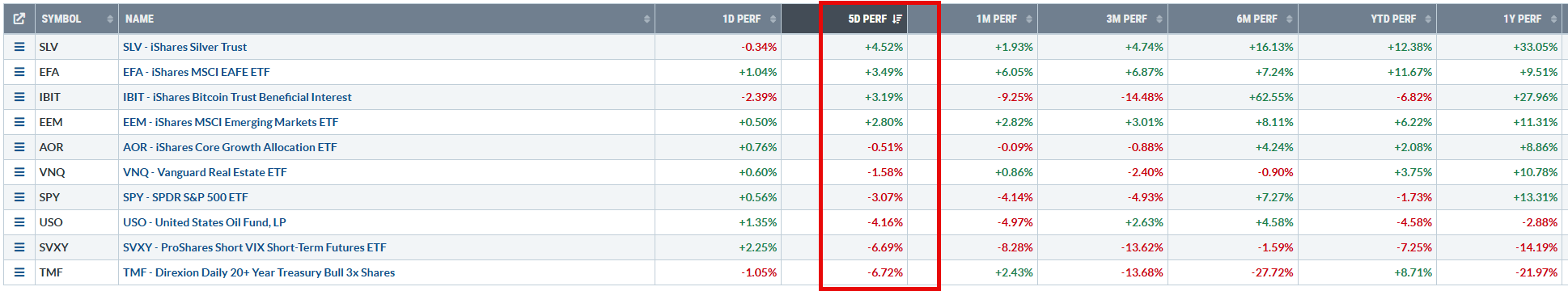

In terms of strength relative to other major asset classes US equities did not fare well:

with Silver and Developed Market equities topping the list with ~4.5% and 3.5% positive returns respectively over the past week. Bonds and Oil suffered the most , each with losses of ~6.7% . The spread between the strongest and weakest performing asset classes was much wider than we see in most weeks.

with Silver and Developed Market equities topping the list with ~4.5% and 3.5% positive returns respectively over the past week. Bonds and Oil suffered the most , each with losses of ~6.7% . The spread between the strongest and weakest performing asset classes was much wider than we see in most weeks.

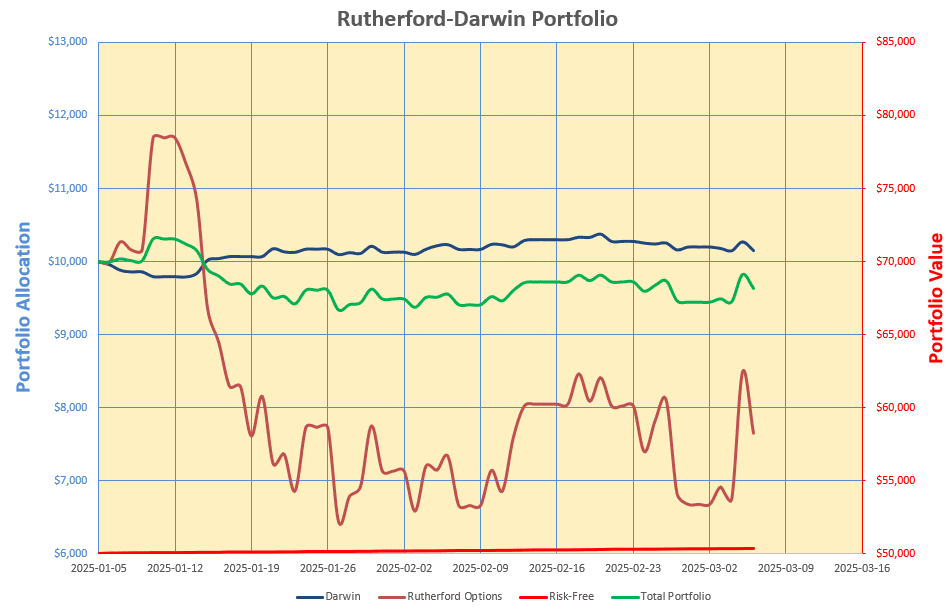

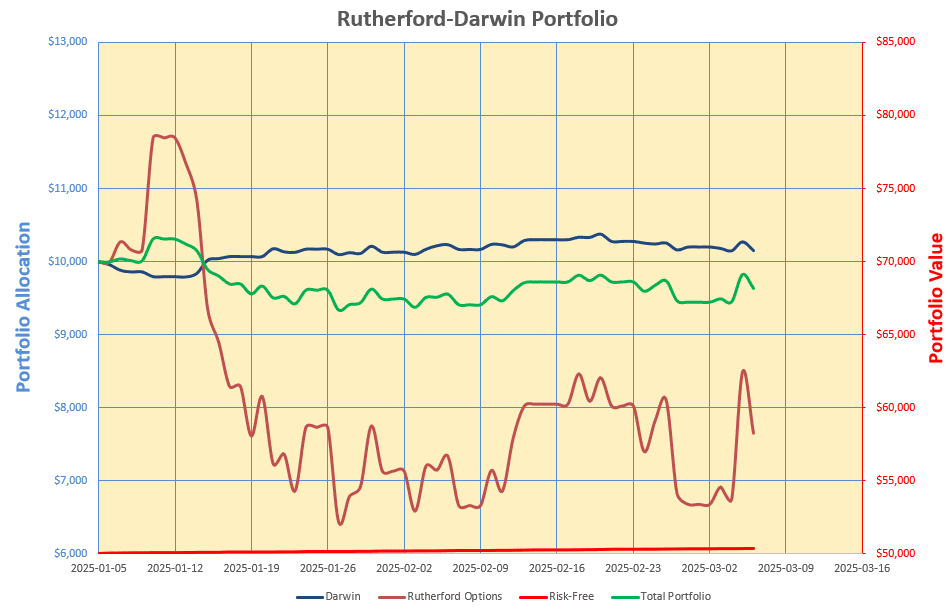

Checking on the performance of the Rutherford-Darwin Portfolio the $50,000 invested in BIL, the risk-free Treasury Bill ETF, continues to generate income with $394 contributed to date.

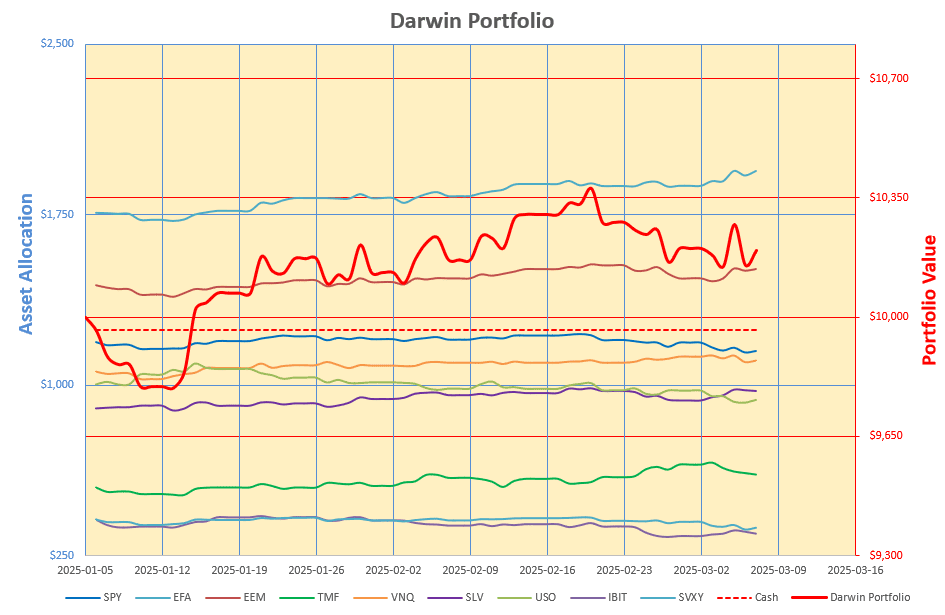

The Darwin portion of the portfolio, consisting of the 10 diversified assets shown in the above screenshot, and managed as a “Buy-And-Hold” portfolio with ~Quarterly adjustmens as necessary, so as to maintain risk parity between the ETFs, just about broke even on the week and is now contributing ~$195 to the portfolio:

The Rutherford portion of the portfolio, that is more actively managed using Options to provide leverage, is still lagging a little, but did have an ~$1,100 gain on the week:

The Rutherford portion of the portfolio, that is more actively managed using Options to provide leverage, is still lagging a little, but did have an ~$1,100 gain on the week:

I did make 2 adjustments during the week by

I did make 2 adjustments during the week by

- Selling my Calls on SPLG (US Equities) – for a $750 loss, as I am no longer bullish on US equities.

- Rolling my Calls on ETA from the $78 strike to the $80 strike. This roll was executed for a 1.90 per contract credit, and has taken $380 of risk off the table.

Combining all sub-portfolios, the picture looks like this:

and looks rather nice (green line) with ~13.6% volatility.

and looks rather nice (green line) with ~13.6% volatility.

I am now holding bullish (Call) positions in EFA, EEM and VNQ and a bearish (Put) position in USO. I am neutral on the remaining ETFs in the quiver and waiting for signs of the next directional trend.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question