Botanic Gardens, Singapore

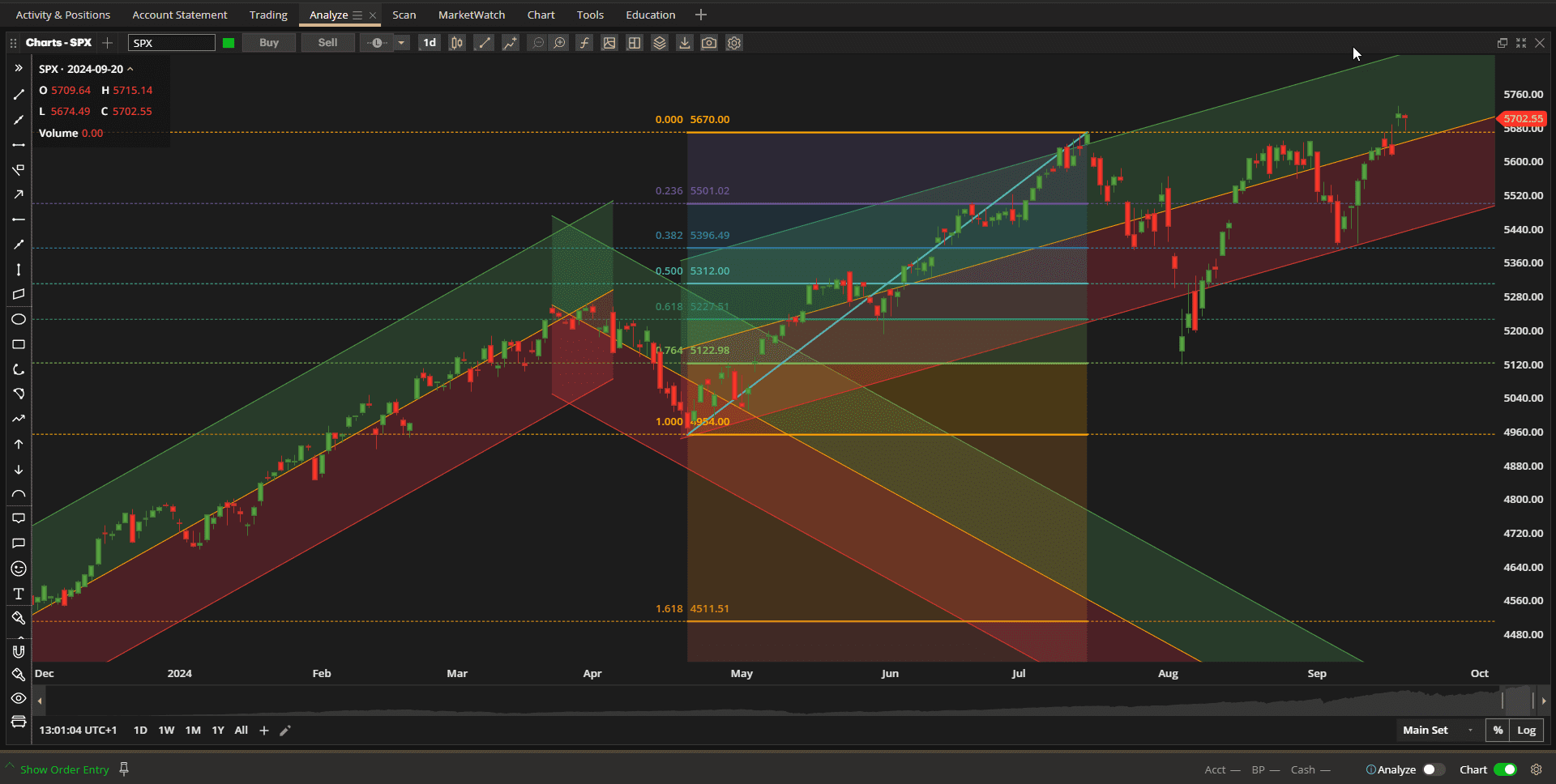

On Thursday the SPX (S&P 500 Index) broke through resistance to hit new all-time highs and confirm that the recent pullback was a mere “breather” in the current uptrend (higher highs and higher lows) that started in May – or even last November (depending on how one defines a low pivot point/level):

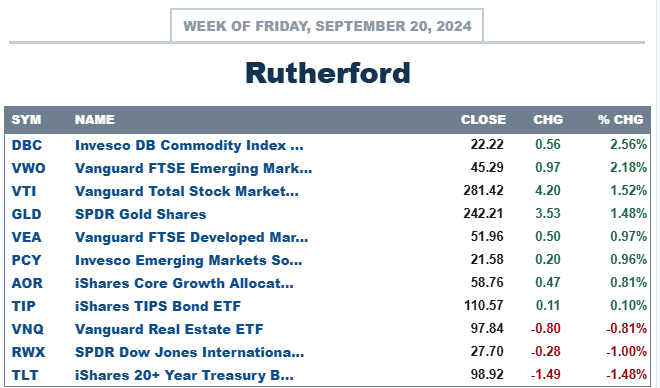

Compared to the performance of other major asset classes, US equities came in towards the high end of the list:

Compared to the performance of other major asset classes, US equities came in towards the high end of the list:

with Bonds and Real Estate taking a bit of a break from their recent high performance levels.

with Bonds and Real Estate taking a bit of a break from their recent high performance levels.

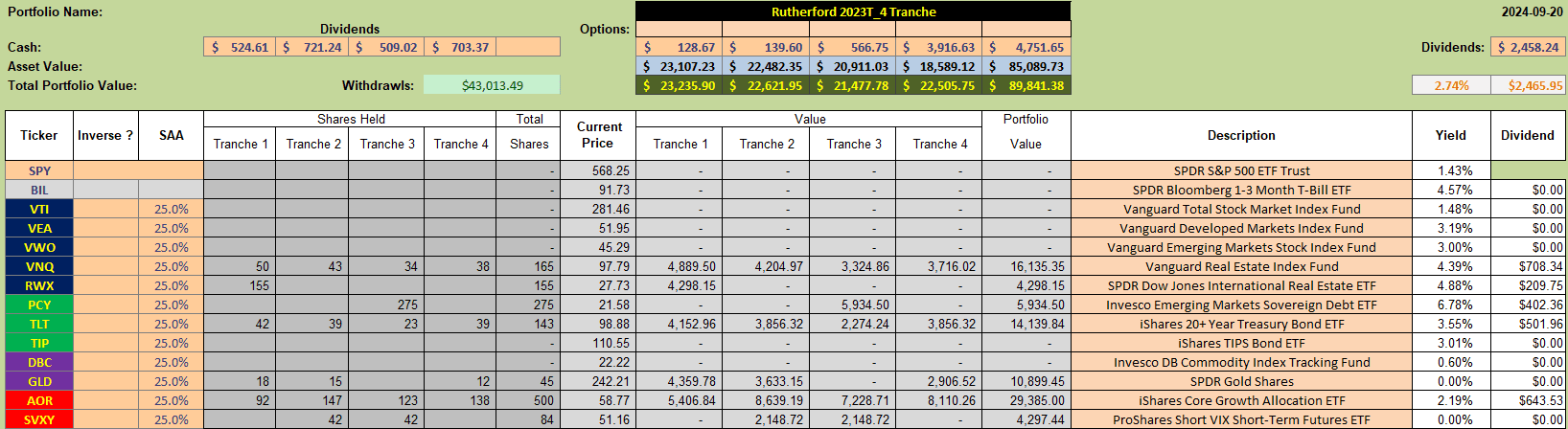

Again, I could not find time to adjust my positions in the Rutherford Portfolio other than to sell my holdings in VTI in Tranche 4. Current holdings in all tranches now look like this:

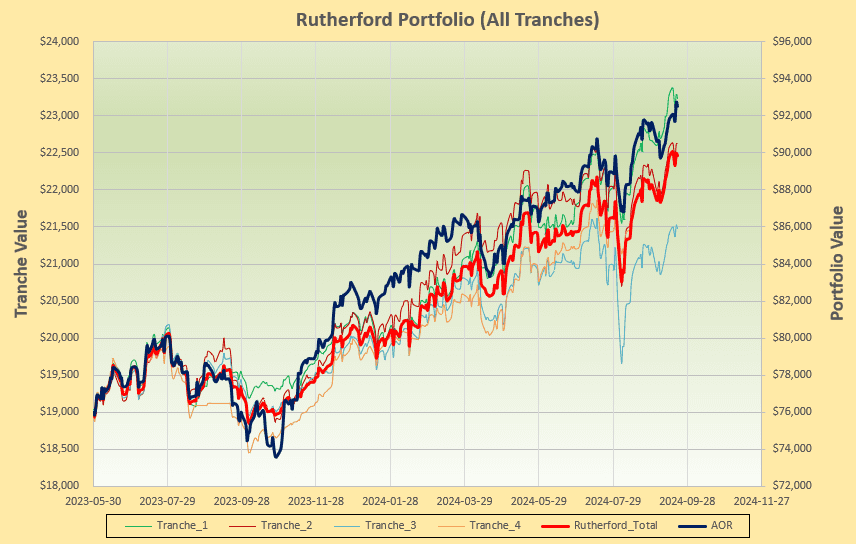

that has generated the following performance:

that has generated the following performance:

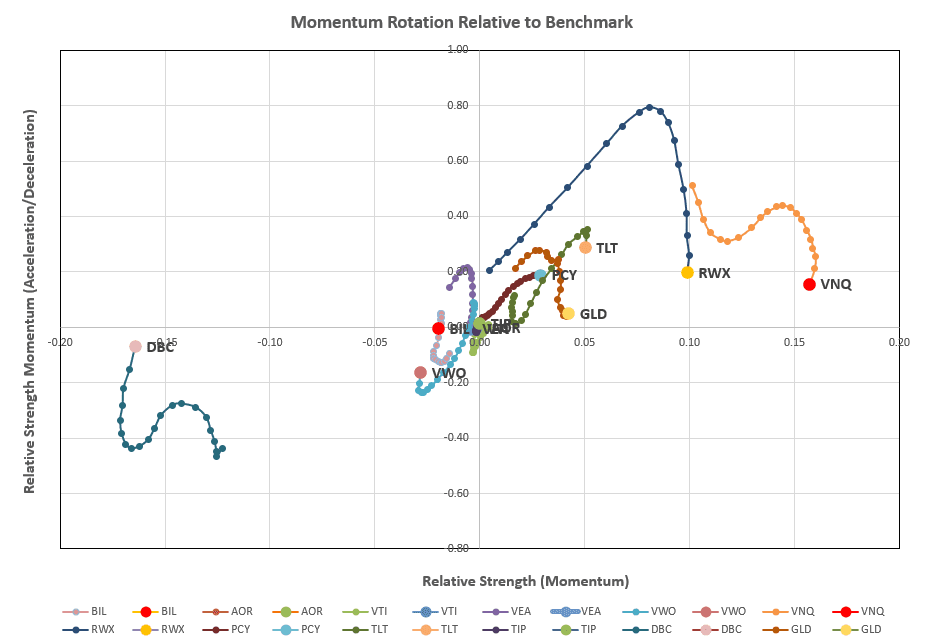

This week we focus on Tranche 1 of the portfolio, that is holding positions in VNQ, RWX (Real Estate), TLT and GLD in addition to the benchmark AOR Fund. Current rotation graphs look like this:

This week we focus on Tranche 1 of the portfolio, that is holding positions in VNQ, RWX (Real Estate), TLT and GLD in addition to the benchmark AOR Fund. Current rotation graphs look like this:

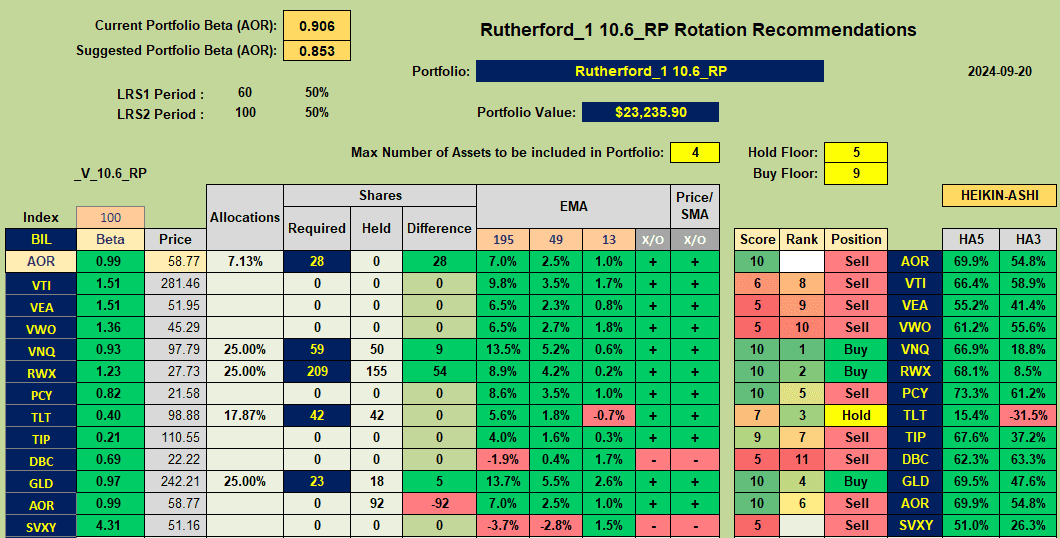

generating the following recommendations:

generating the following recommendations:

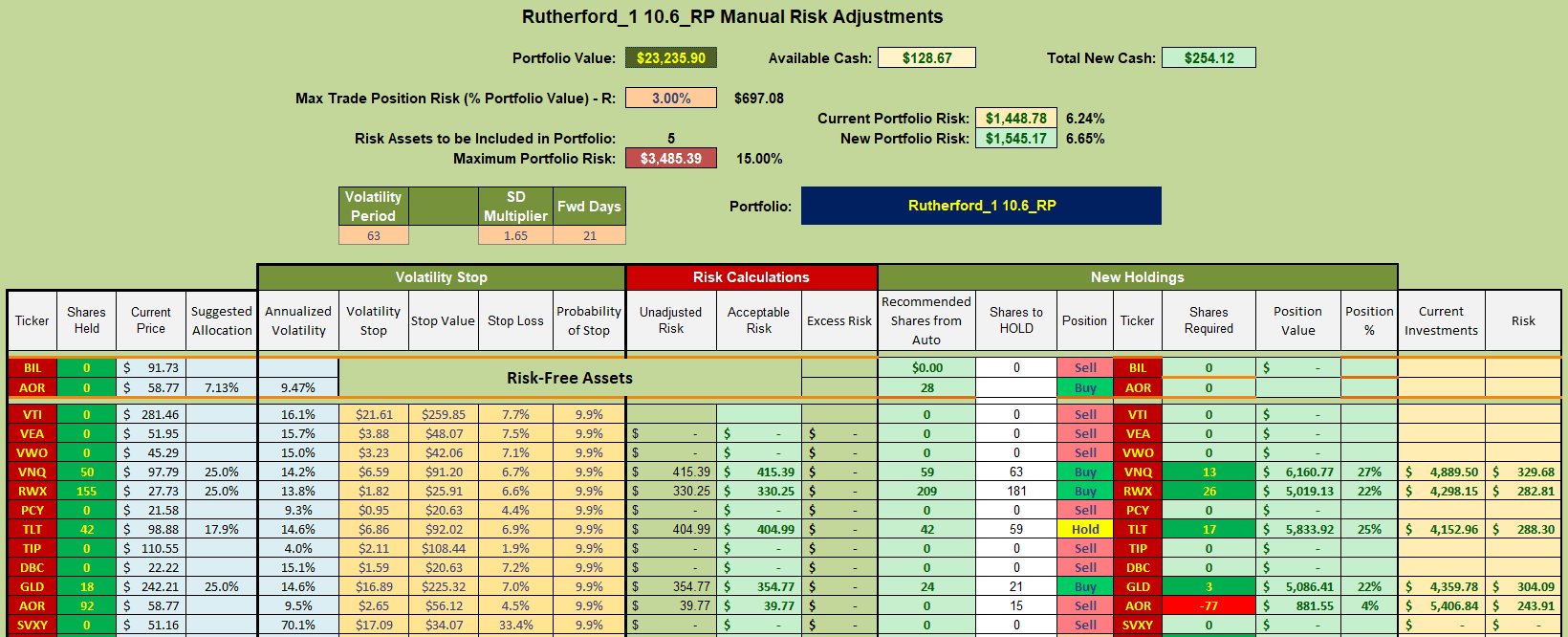

that would suggest only minor adjustments be made to the portfolio:

that would suggest only minor adjustments be made to the portfolio:

I therefore plan to ignore these adjustments since they are so minor and I am still travelling in different time zones with limited internet accessability.

I therefore plan to ignore these adjustments since they are so minor and I am still travelling in different time zones with limited internet accessability.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

David,

Beautiful work of art.

L.