Explore time, Auckland Harbor, New Zealand

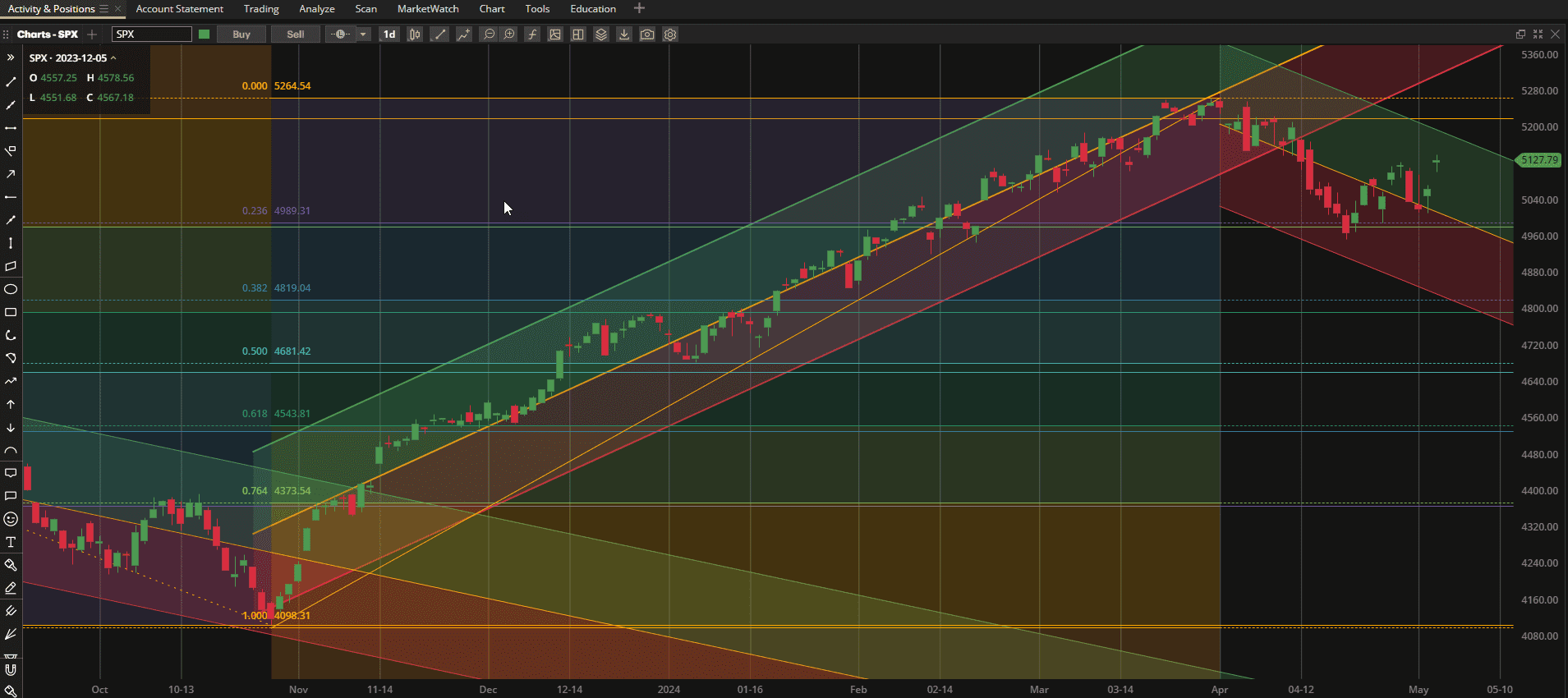

US equities had another week of positive performance closing the week ~0.7% higher than last week’s close. However, again, it was not a smooth ride with major gains coming on a ~1% gap up on Friday:

We are still sitting near the top boundary of a downtrend channel and could still see further weakness from here with a potential test of the support level at ~4800 in the SPX (S&P 500 Index). However, this means that we would have to penetrate strong psychological support at the significant 5000 “round number” level – also the (usually minor) ~23.6% Fibonacci retracement level.

We are still sitting near the top boundary of a downtrend channel and could still see further weakness from here with a potential test of the support level at ~4800 in the SPX (S&P 500 Index). However, this means that we would have to penetrate strong psychological support at the significant 5000 “round number” level – also the (usually minor) ~23.6% Fibonacci retracement level.

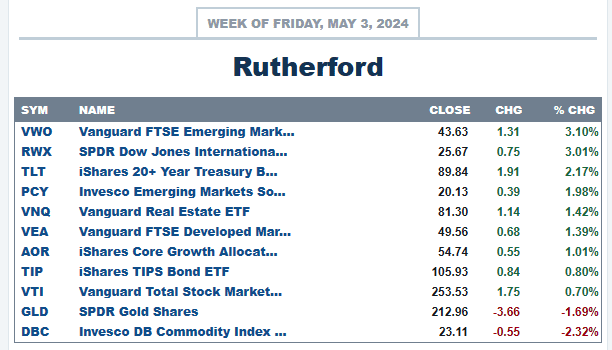

Despite the positive performance of US equities this placed them near the bottom of the list in terms of relative performance of major asset classes over the past week:

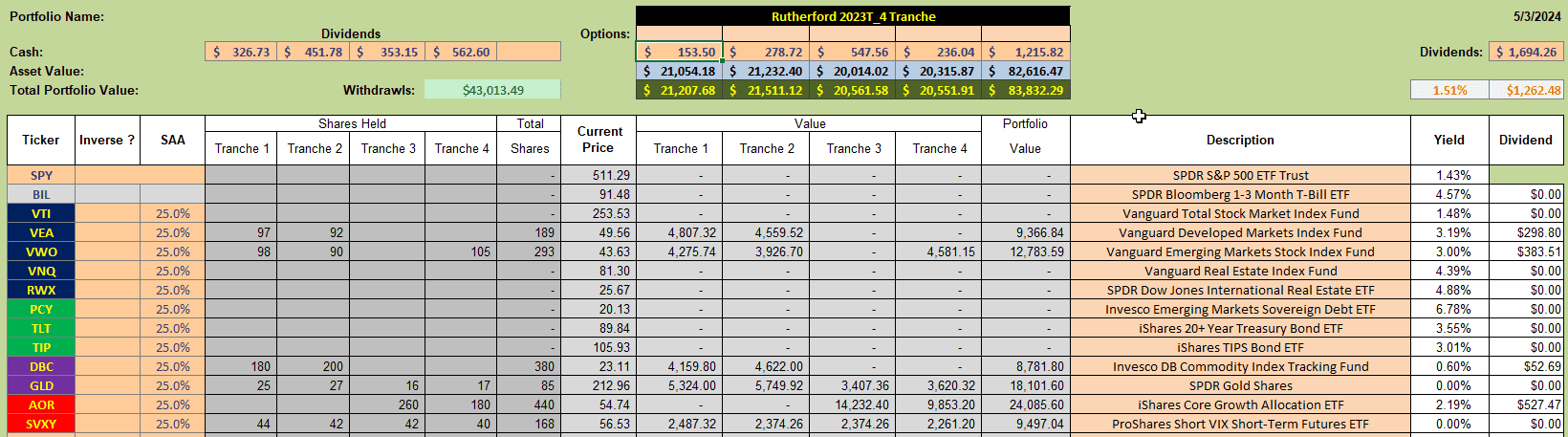

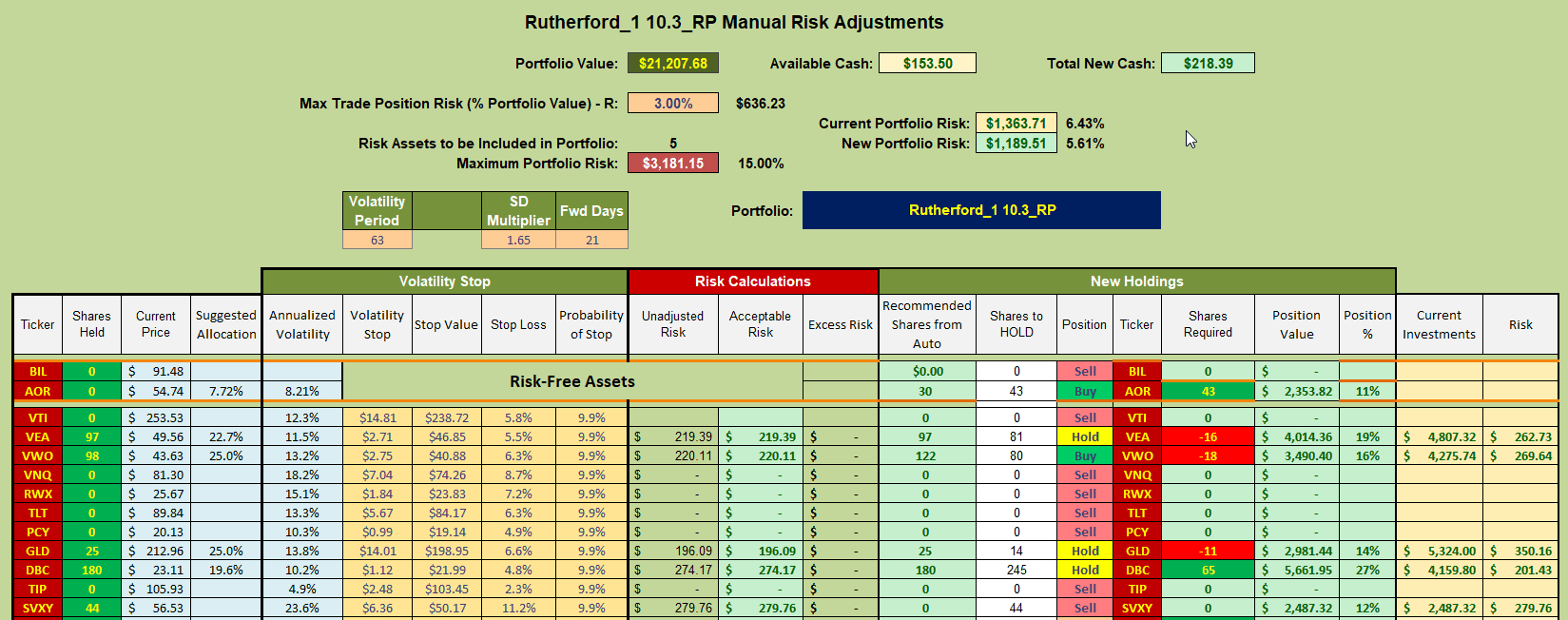

Last week I added more shares of VWO (the top performing asset class on the week) to the Rutherford Portfolio such that total holdings in the portfolio currently look like this:

Last week I added more shares of VWO (the top performing asset class on the week) to the Rutherford Portfolio such that total holdings in the portfolio currently look like this:

and relatively well diversified in these uncertain times.

and relatively well diversified in these uncertain times.

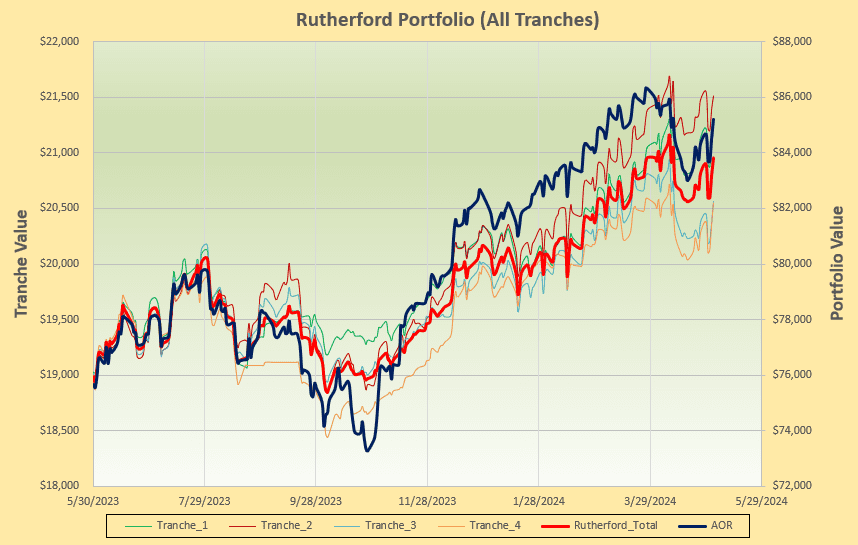

Performance of the portfolio, to date, is looking like this:

pretty much in line with the benchmark AOR Fund.

pretty much in line with the benchmark AOR Fund.

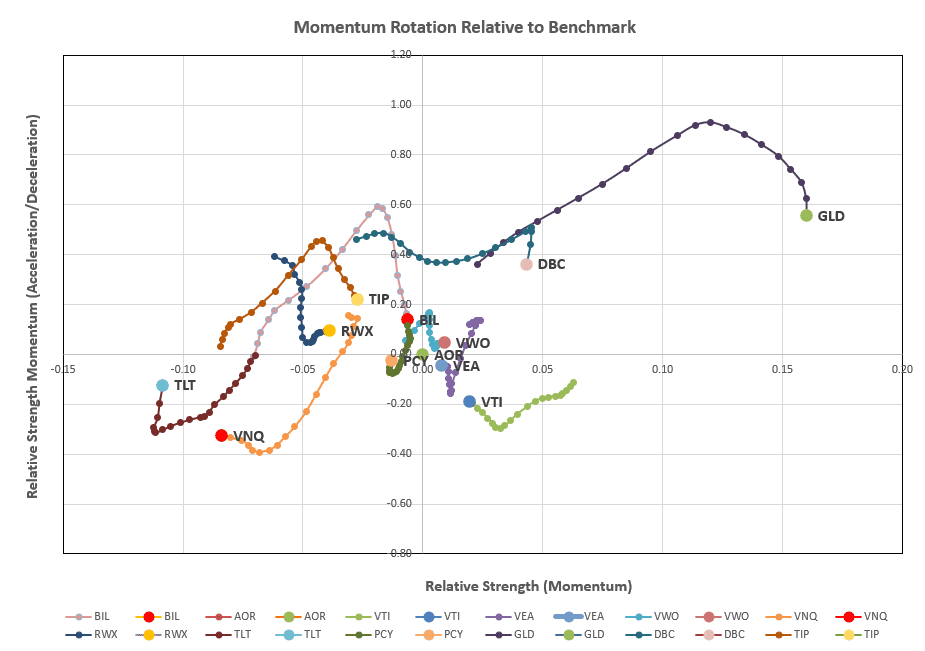

Checking the rotation graphs:

we see the recent weakning of performance in the defensive sectors (Commodities and Gold) but without strong rotations into the desirable top right quadrant other than mild progress in VWO (Emerging Market equities). So, let’s check the ranking/recommendation sheet for the rotation model:

we see the recent weakning of performance in the defensive sectors (Commodities and Gold) but without strong rotations into the desirable top right quadrant other than mild progress in VWO (Emerging Market equities). So, let’s check the ranking/recommendation sheet for the rotation model:

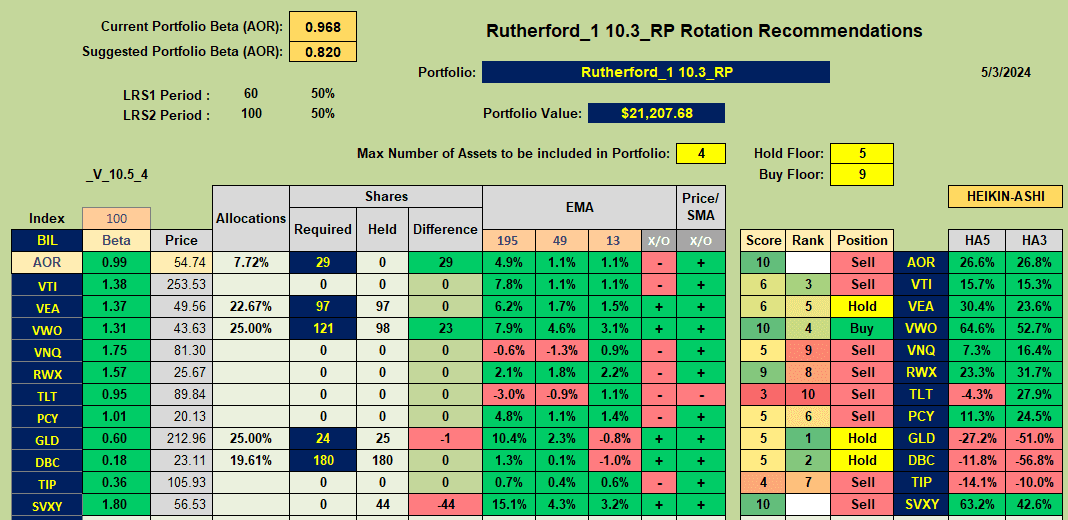

that is showing a Buy recommendation on VWO with Hold recommendations on VEA, GLD and DBC. Since all these assets are currently held in Tranche 1 (the focus of this week’s review) there are no adjustments to be made to the portfolio at this time:

that is showing a Buy recommendation on VWO with Hold recommendations on VEA, GLD and DBC. Since all these assets are currently held in Tranche 1 (the focus of this week’s review) there are no adjustments to be made to the portfolio at this time:

Rather than make the small adjustments to current holdings and adding shares of the diversified AOR benchmark fund I shall just be leaving allocations as they currently stand.

Rather than make the small adjustments to current holdings and adding shares of the diversified AOR benchmark fund I shall just be leaving allocations as they currently stand.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Hello David. I’m embarrassed to say that I don’t quite follow your scoring system. For example, with RWX. How can it have a score of 10 and still br a sell. Thx John

No need to be embarassed John – the algorithm I’m using is a little complex (and I feel it could/should be better) but, with RWX at a Score of 9 (rather than 10 – but that is not significantly different) it would normally qualify as a Buy. There are 2 other (required) conditions preventing this. 1) My Max number of assets to hold in the tranche is set at 4 – and adding RWX would exceed this limit. 2) – and this is the dominating reason – is that the 13-day EMA is below the 49-day EMA (negative X/O) – this rules out RWX, even if I had Max assets set at 10. As I say, I have a feeling that the algorithm could be better – but I haven’t been able to figure out how to improve it to reflect rotation selection/allocation. I am comfortable testing this system as a portion of my total diversified portfolios, since I don’t think that it will get me into too much trouble – but I am hesitant to recommend it as being better (in the long term) than any of the other systems that I am using.

Hope this makes sense.

David

John,

RWX is a “falling knife” at the moment – so we are looking for confirmation of a turn-around. But it’s very close – we need the yellow line to cross over the blue line in the following (link) picture:

https://www.dropbox.com/scl/fi/t5tlqxa2tuw3qvmupm912/RWX-2024-05-05_19-05-26.png?rlkey=opea5wba9eysd89pwnzrc3nuz&dl=0

Hope this helps illustrate.

David

Thank you for taking the time David. I found your information very useful.