Grounds of Royal Palace, Bangkok, Thailand

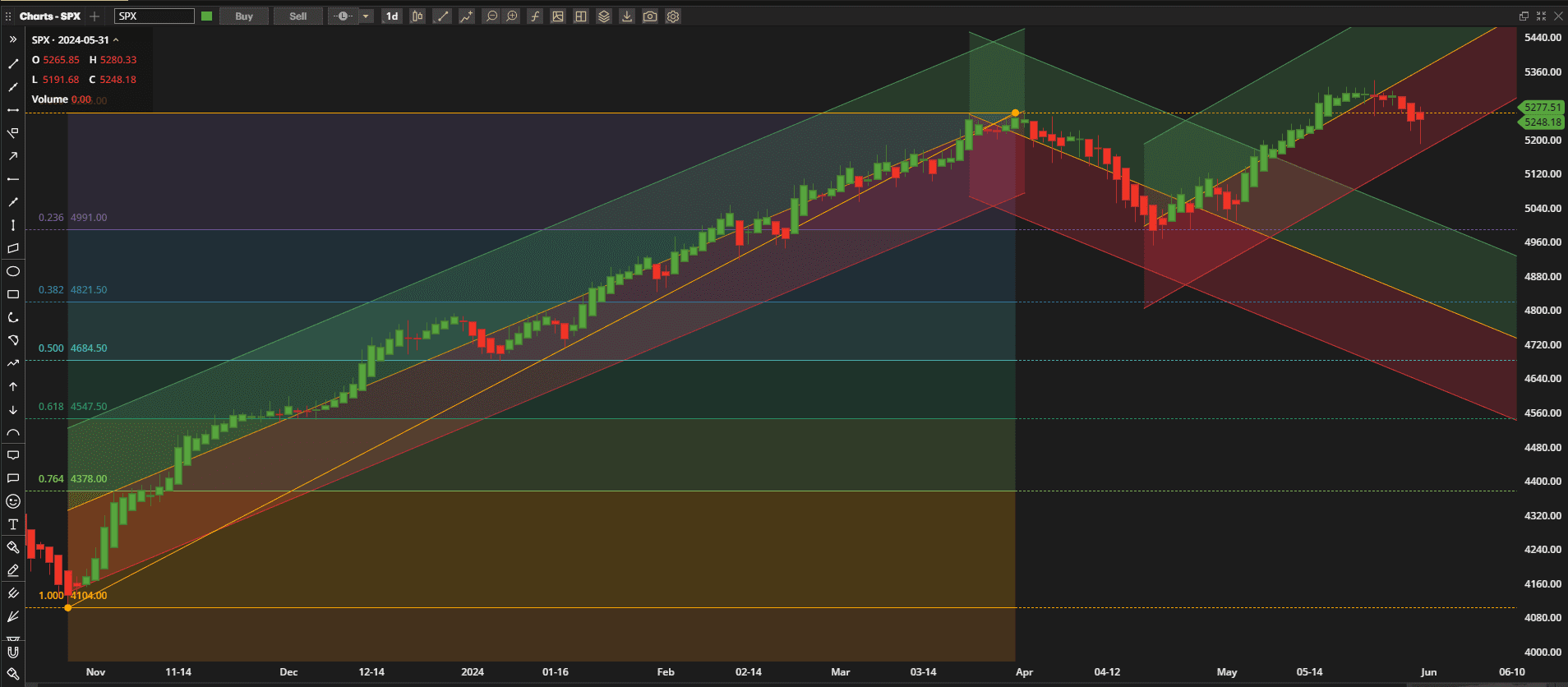

Apologies for being late with this week’s review, I had an emergency and had to go out of town for the weekend and only returned late last night. Last week was not a great week for US equities with the S&P Index closing the week down ~o.5% from last week’s close:

Prices are now sitting near the bottom of the current uptrend channel – so we’ll see where we go from here.

Prices are now sitting near the bottom of the current uptrend channel – so we’ll see where we go from here.

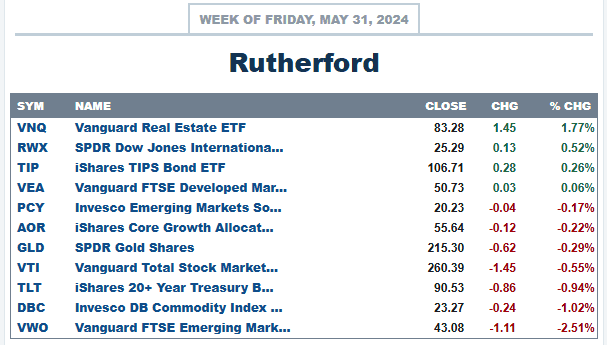

Real Estate was the best performing asset class on the week with relatively strong gains, particularly in the US sector:

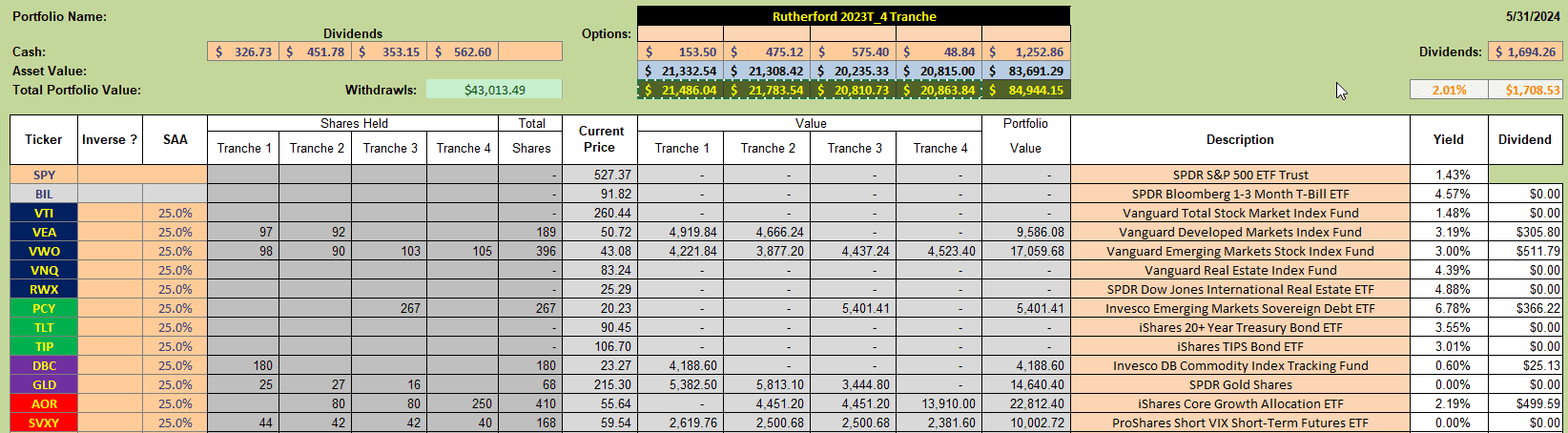

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

with holdings in International Equities (VEA and VWO), Commodities (DBC) and Gold (GLD) in Tranche 1 of the portfolio.

with holdings in International Equities (VEA and VWO), Commodities (DBC) and Gold (GLD) in Tranche 1 of the portfolio.

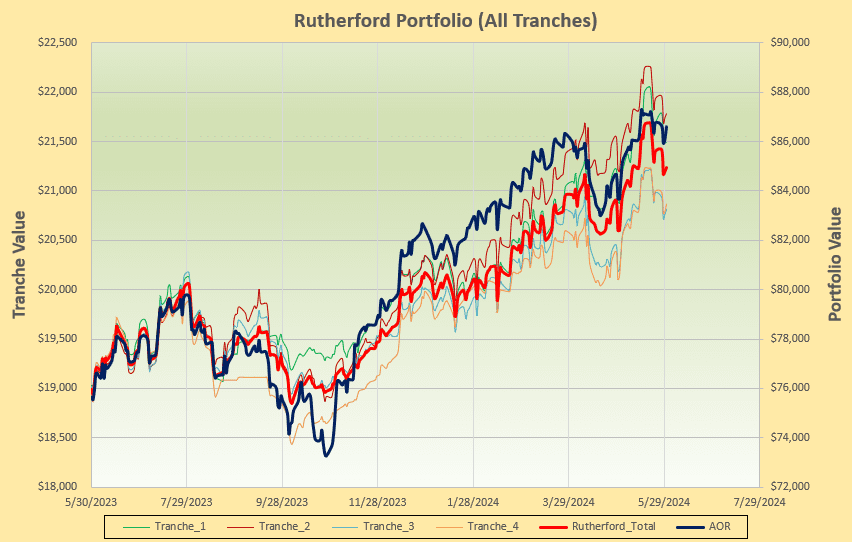

Recent performance looks like this:

and is lagging the performance of the benchmark fund a little over the past couple of weeks.

and is lagging the performance of the benchmark fund a little over the past couple of weeks.

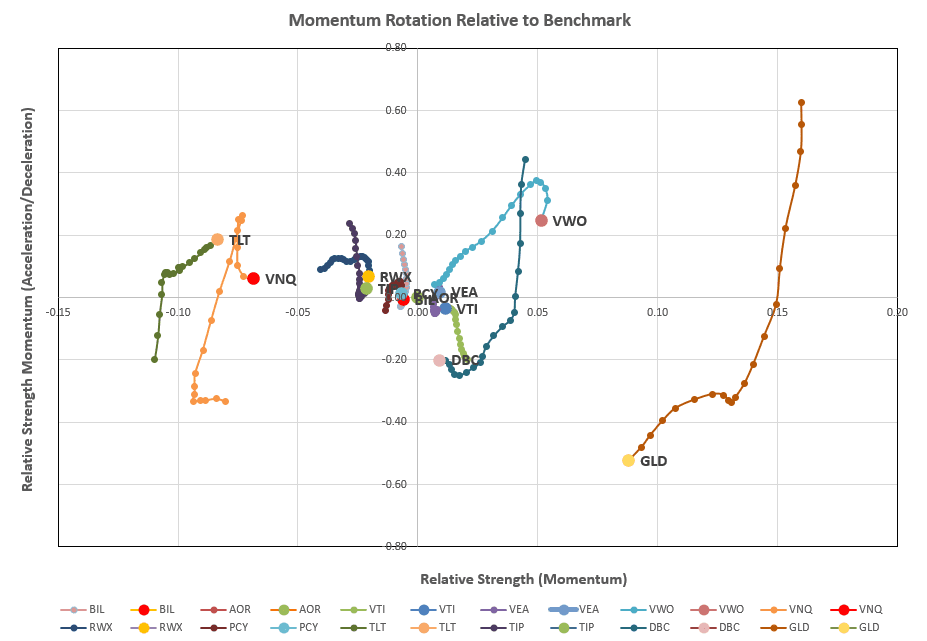

Tranche 1 is the focus of this week’s review so we’ll take a look at the rotation graphs:

where we see significant rotation out of the desirable top right quadrant – with even VWO (Emerging Market Equities) beginning to show short term weakness after a few weeks of strength.

where we see significant rotation out of the desirable top right quadrant – with even VWO (Emerging Market Equities) beginning to show short term weakness after a few weeks of strength.

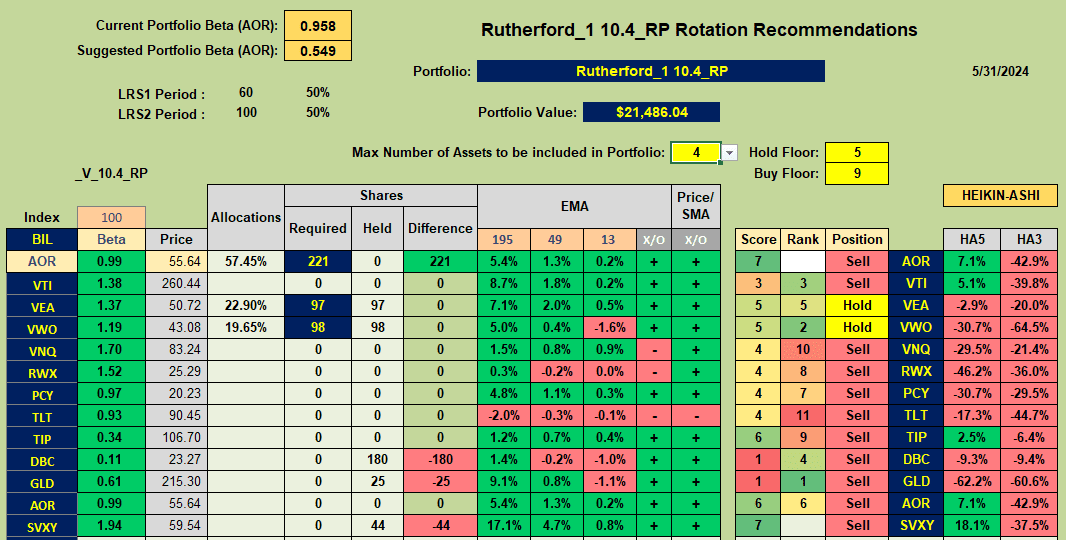

A look at the recommendations from the Rotation model being used to manage this portfoli:

shows no Buy recommendations and only Hold recommendations for VEA and VWO.

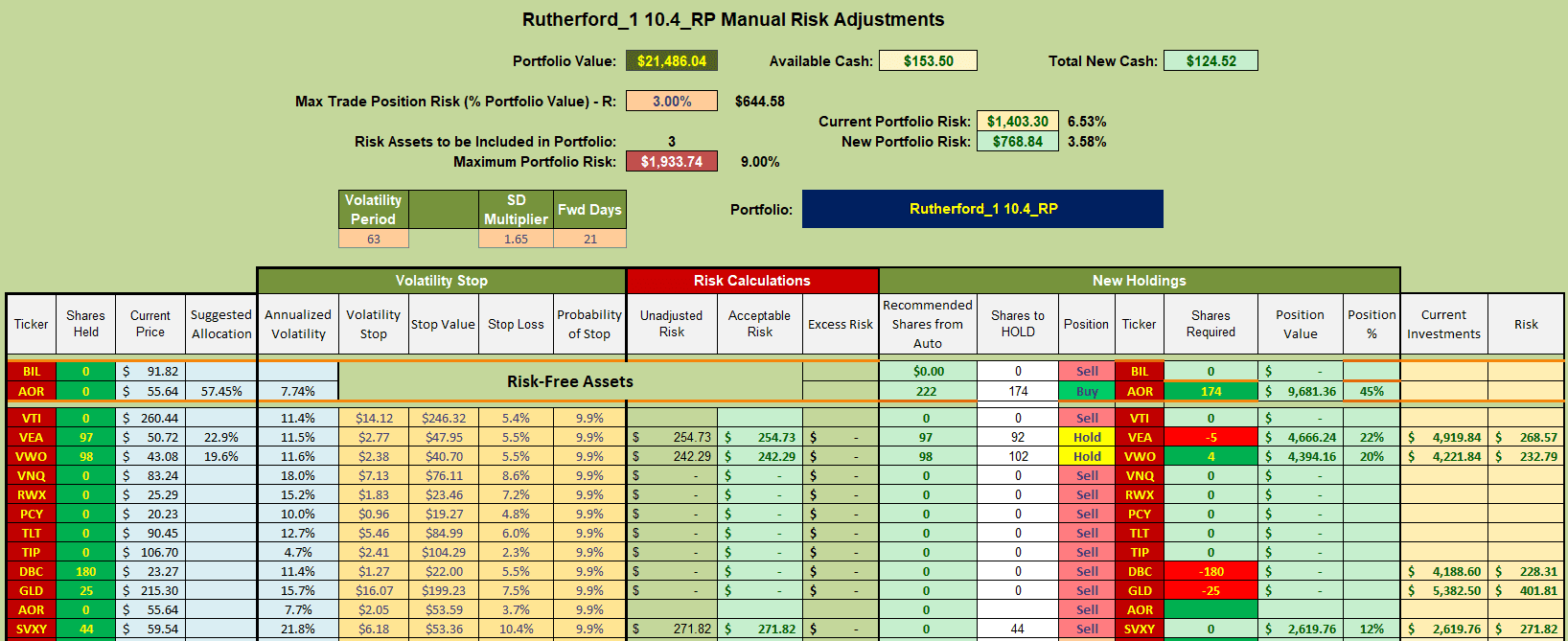

Consequently, this week’s adjustments will look something like this:

where I shall be selling the positions held in DBC and GLD and using the cash generated to buy shares in AOR, the benchmark fund.

where I shall be selling the positions held in DBC and GLD and using the cash generated to buy shares in AOR, the benchmark fund.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.