Fish Market at Karon Beach, Thailand

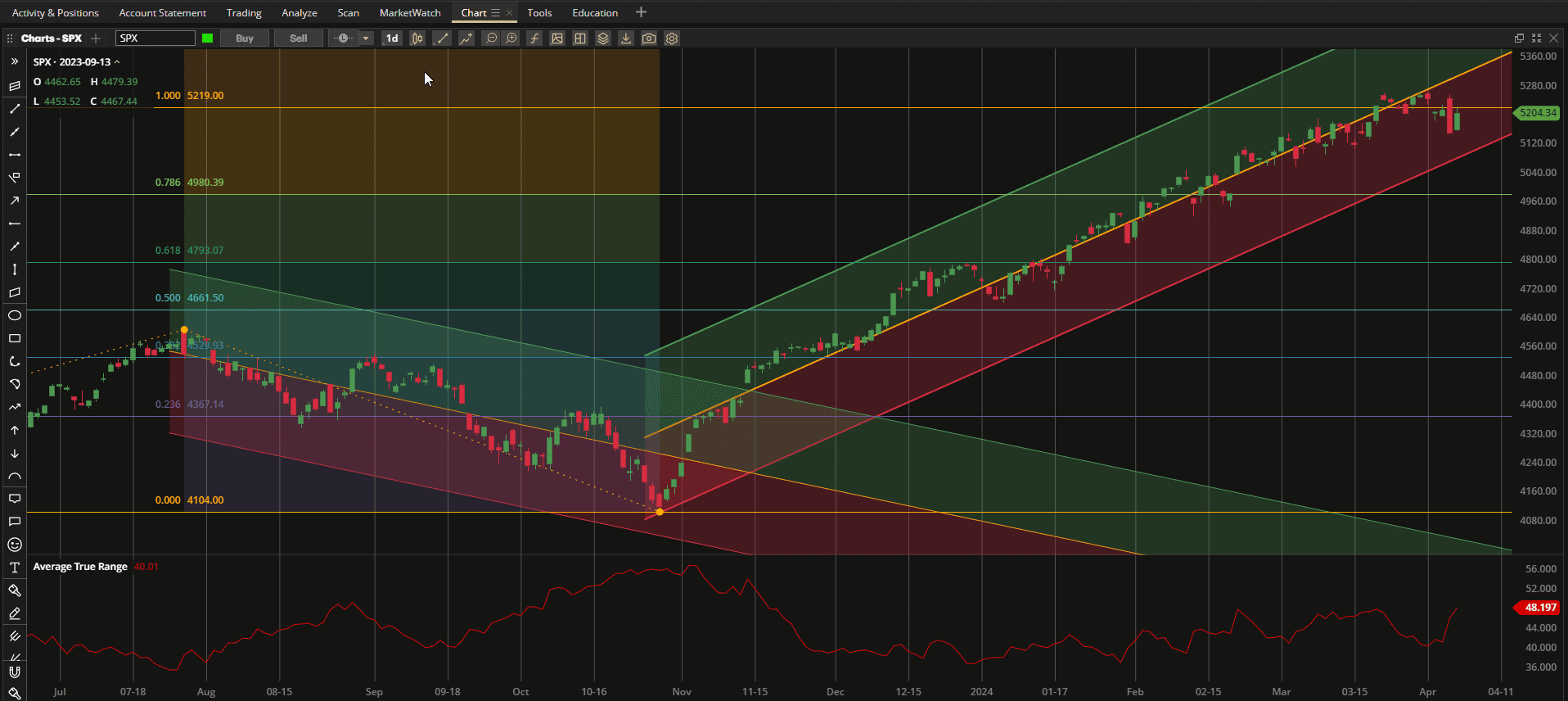

Comments made by members of the Fed regarding the possibility that there may be no interest rate cuts this year scared the US equity markets on Thursday and, although they recovered slightly on Friday, markets closed the week ~1% lower from last week’s close:

That 5200-5220 resistance area that I have been highlighting for the past month is still proving difficult to penetrate.

That 5200-5220 resistance area that I have been highlighting for the past month is still proving difficult to penetrate.

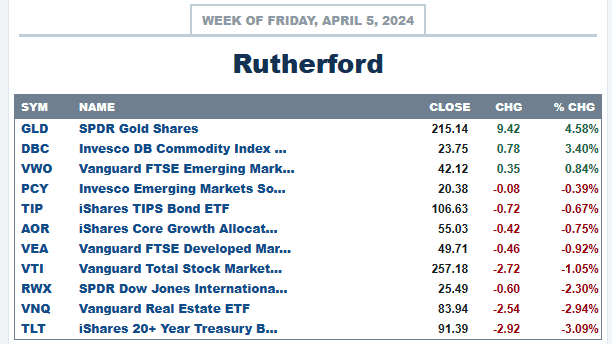

In terms of relative performance, Gold and Commodities (defensive asset classes) clearly led the field – with large gains on the week – with interest sensitive assets (Bonds and Real Estate) taking the biggest hit:

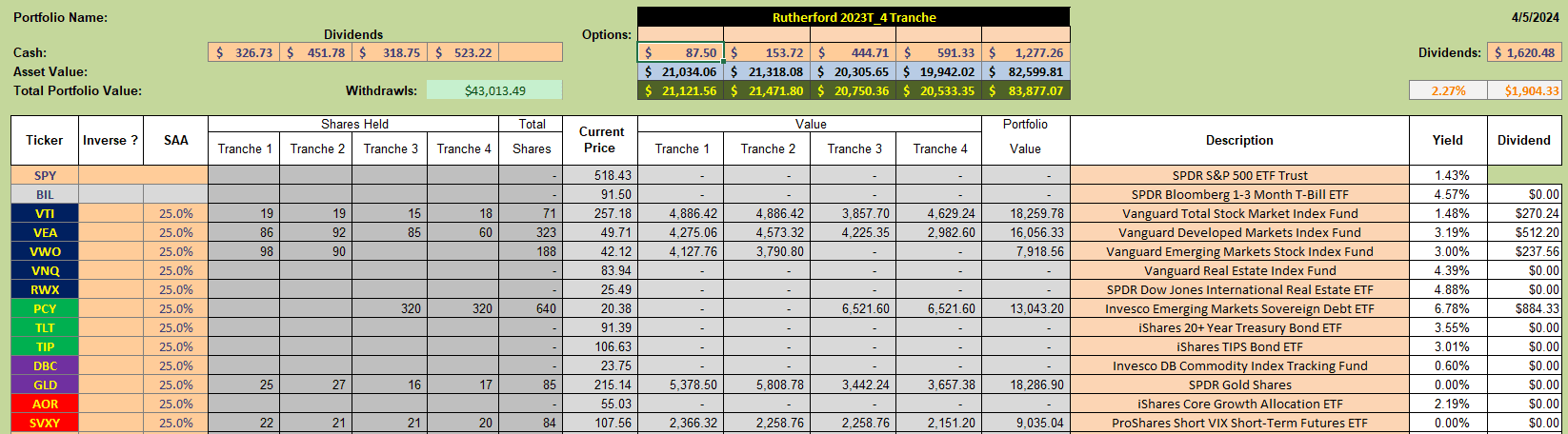

In the Rutherford Portfolio, although we have been rotating out of equities a little over the past 2 weeks, we are still 50% invested in the equity markets. Tranche 1 (the focus of this week’s review) is holding ~65% of available Cash in equities:

In the Rutherford Portfolio, although we have been rotating out of equities a little over the past 2 weeks, we are still 50% invested in the equity markets. Tranche 1 (the focus of this week’s review) is holding ~65% of available Cash in equities:

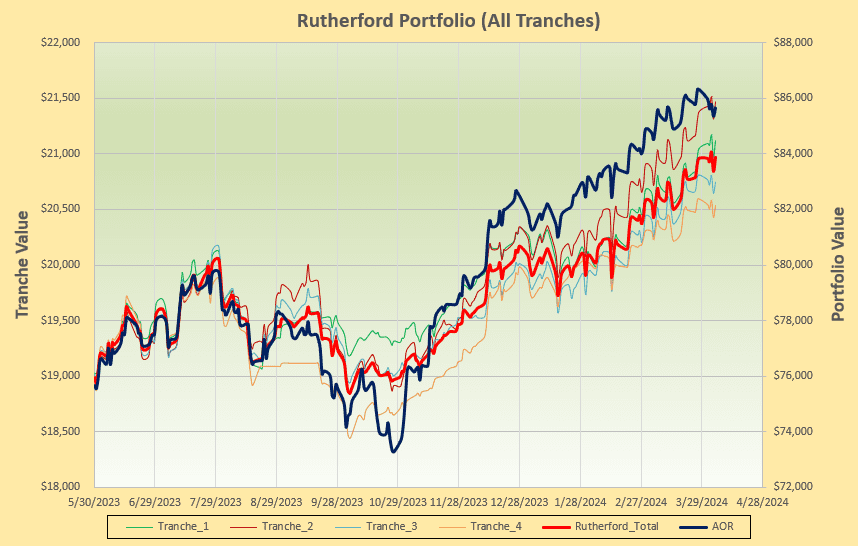

Portfolio performance looks like this where, although the impacts of review date luck may be a little less dramatic using the rotation system/model than other models, the effects are still clear – using the same model, performance is significantly impacted by the timing of adjstments (review date luck):

Portfolio performance looks like this where, although the impacts of review date luck may be a little less dramatic using the rotation system/model than other models, the effects are still clear – using the same model, performance is significantly impacted by the timing of adjstments (review date luck):

In the above figure we see ~5% difference in performance between the best and worst performing tranches over the past 10 months.

In the above figure we see ~5% difference in performance between the best and worst performing tranches over the past 10 months.

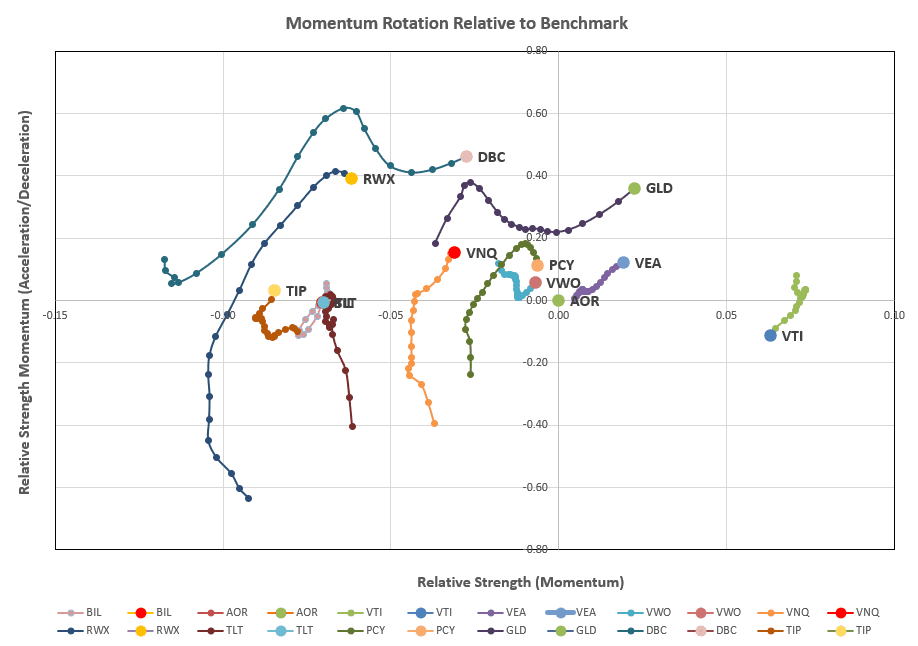

Let’s check to see if any adjustments are called for this week by first taking a look at the rotation graphs:

where we see strong momentum (up and to the right) in GLD, VEA, DBC and maybe VWO particularly, and a significant weakening in VTI, at least in the short term, although longer term momentum is still strong.

where we see strong momentum (up and to the right) in GLD, VEA, DBC and maybe VWO particularly, and a significant weakening in VTI, at least in the short term, although longer term momentum is still strong.

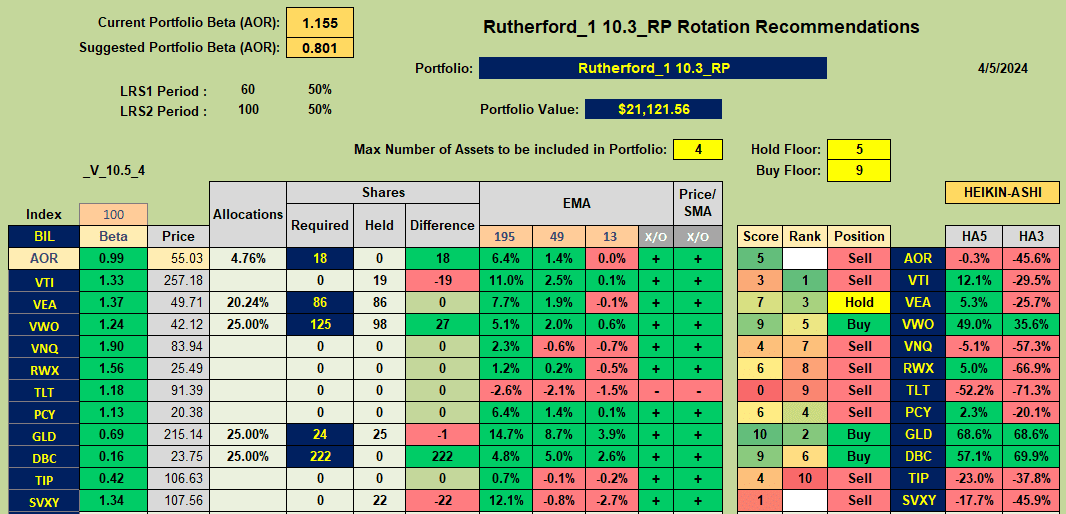

This is confirmed by the recommendations from the rotation model algorithm:

where we see a Sell recommendation for VTI and Buy recommendations for VWO, GLD and DBC. VEA is a suggested Hold recommendation (no new share additions).

where we see a Sell recommendation for VTI and Buy recommendations for VWO, GLD and DBC. VEA is a suggested Hold recommendation (no new share additions).

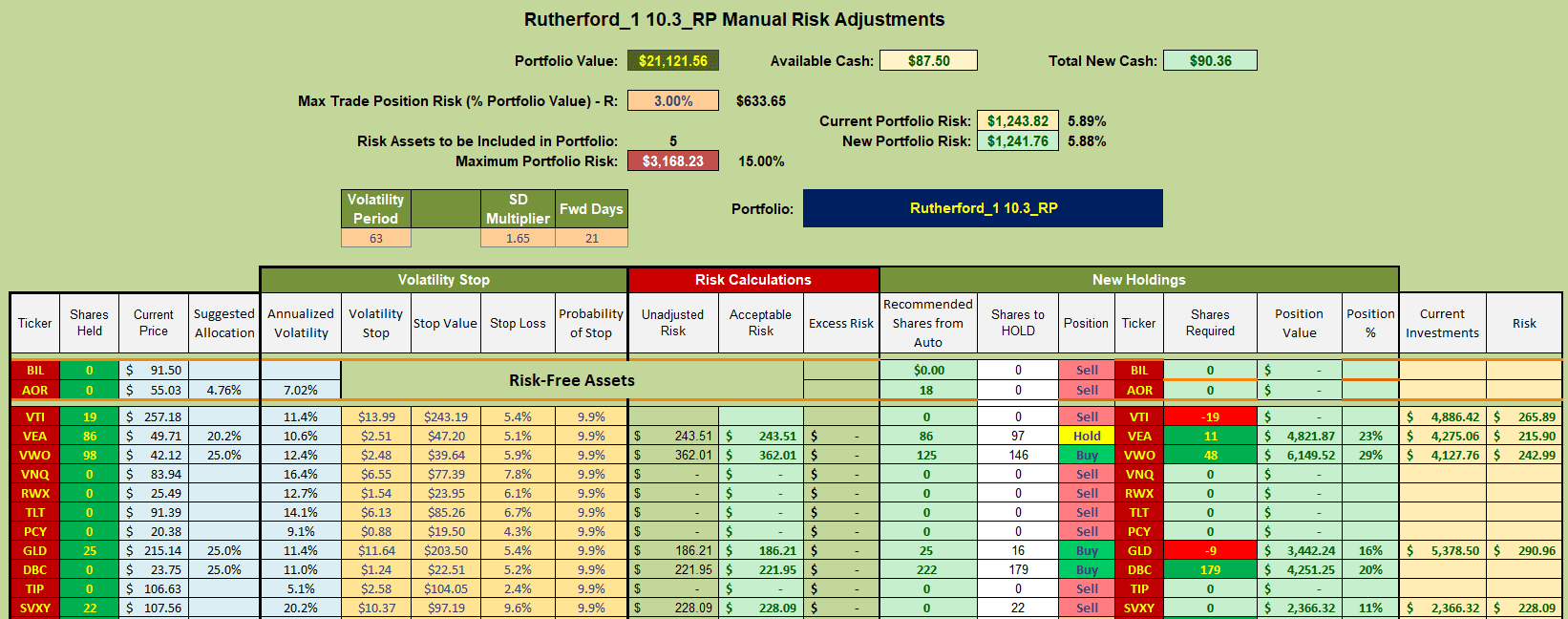

Consequently, adjustments for next week will look something like this:

where I shall be selling current holdings in VTI (US Equities) and using the cash generated to buy shares in DBC (Commodities). I won’t bother to adjust current positions in VEA, VWO or GLD so as to avoid trading costs on small adjustments that aren’t likely to change performance significantly.

where I shall be selling current holdings in VTI (US Equities) and using the cash generated to buy shares in DBC (Commodities). I won’t bother to adjust current positions in VEA, VWO or GLD so as to avoid trading costs on small adjustments that aren’t likely to change performance significantly.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.