US$3 Breakfast at local Thai Restaurant – Yes, it did look like that, and it was good! – but hold off on the Wishky 🙂

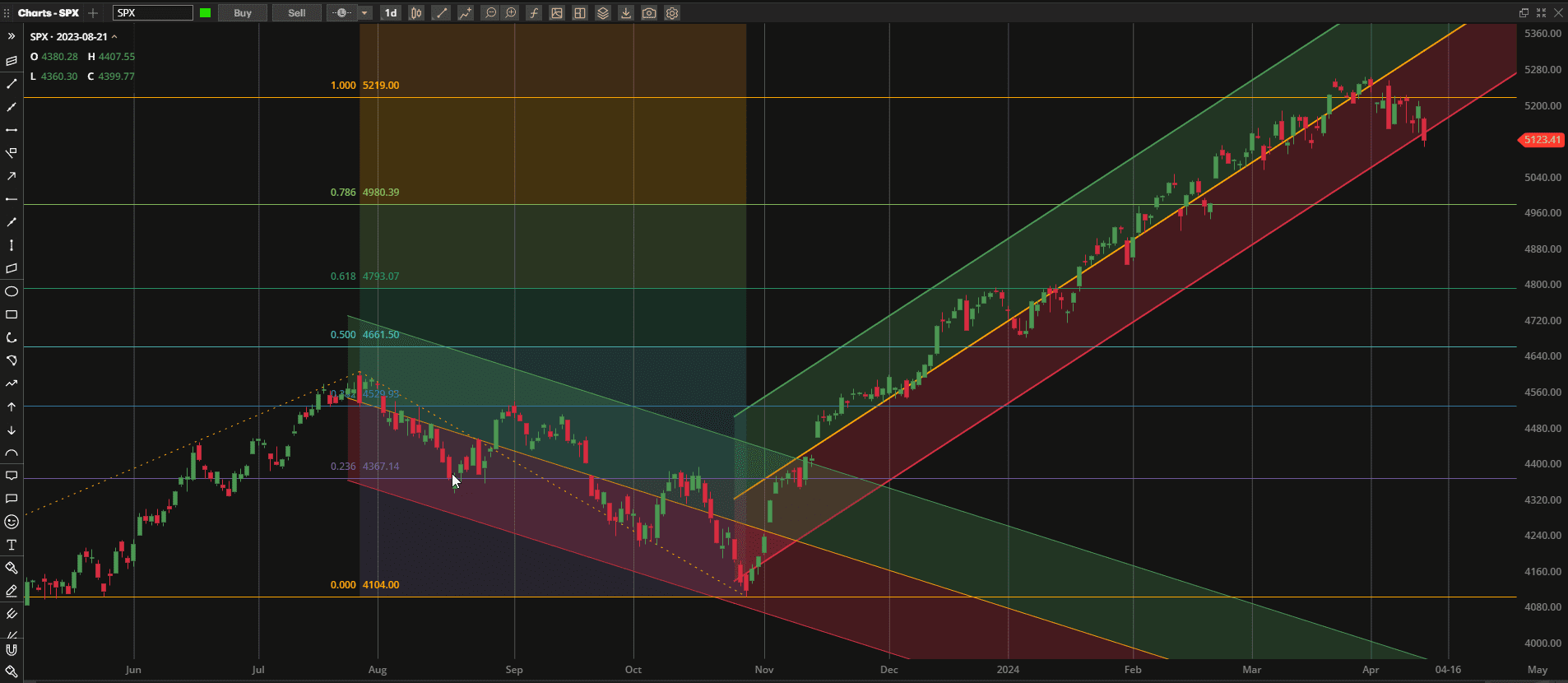

US Equities got slapped around a little this week and closed the week ~1.6% lower than last week’s close:

We are now sitting at the bottom of the bullish trend channel that started last November and we wait to see whether this might be a good entry point if we should bounce from here and the trend continue or whether we are due for a more significant pullback and it might be a good idea to sell a portion of our portfolio, hedge or at least place stop loss orders. We will see what next week brings as we go into a new earnings season.

We are now sitting at the bottom of the bullish trend channel that started last November and we wait to see whether this might be a good entry point if we should bounce from here and the trend continue or whether we are due for a more significant pullback and it might be a good idea to sell a portion of our portfolio, hedge or at least place stop loss orders. We will see what next week brings as we go into a new earnings season.

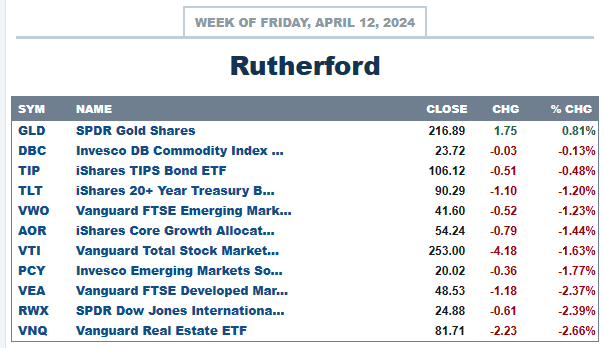

Relative to other major asset classes, VTI came in at the middle of the pack, out-performing most interest rate sensitive assets but again falling behind the defensive asset classes of Gold and Commodities (primarily supported by strength in Oil).

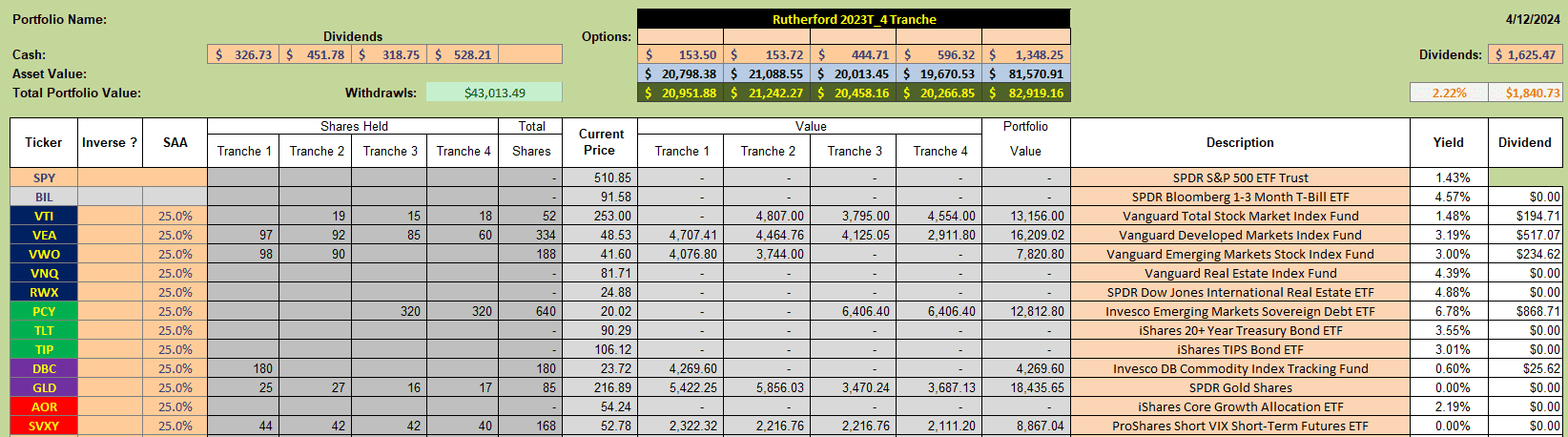

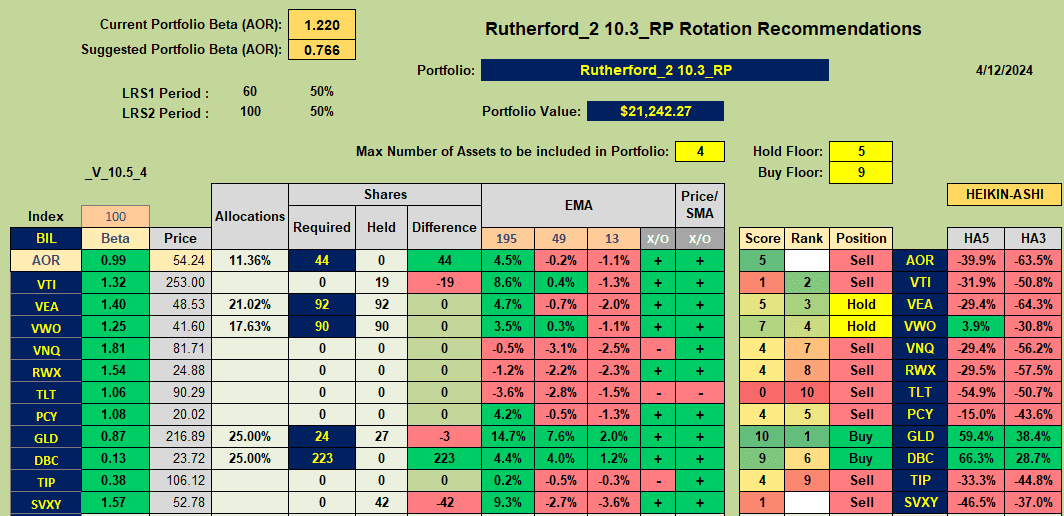

Present holdings in the Rutherford Portfolio look like this:

Present holdings in the Rutherford Portfolio look like this:

as we have been rotating slowly out of the equity markets into more defensive asset classes over the past few weeks.

as we have been rotating slowly out of the equity markets into more defensive asset classes over the past few weeks.

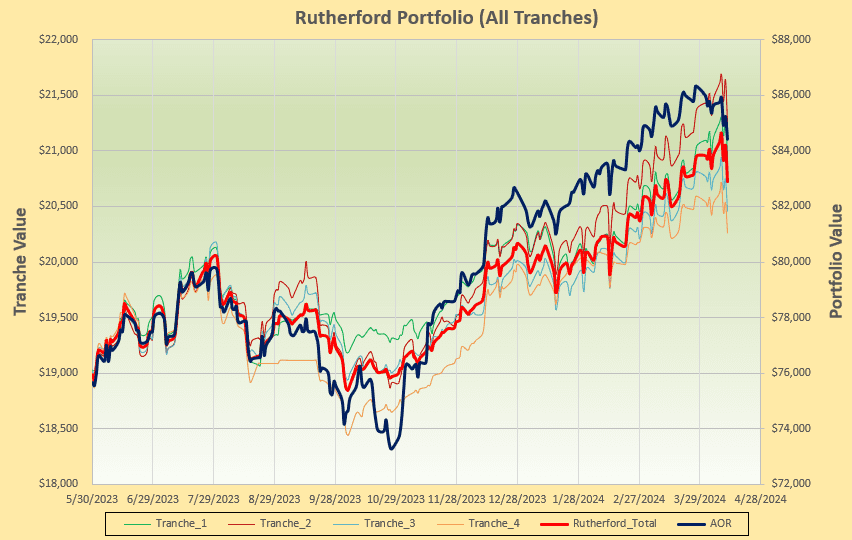

Performance of the portfolio looks like this:

and, although we have taken a hit over the last week, we are not suffering as much as our benchmark AOR Fund.

and, although we have taken a hit over the last week, we are not suffering as much as our benchmark AOR Fund.

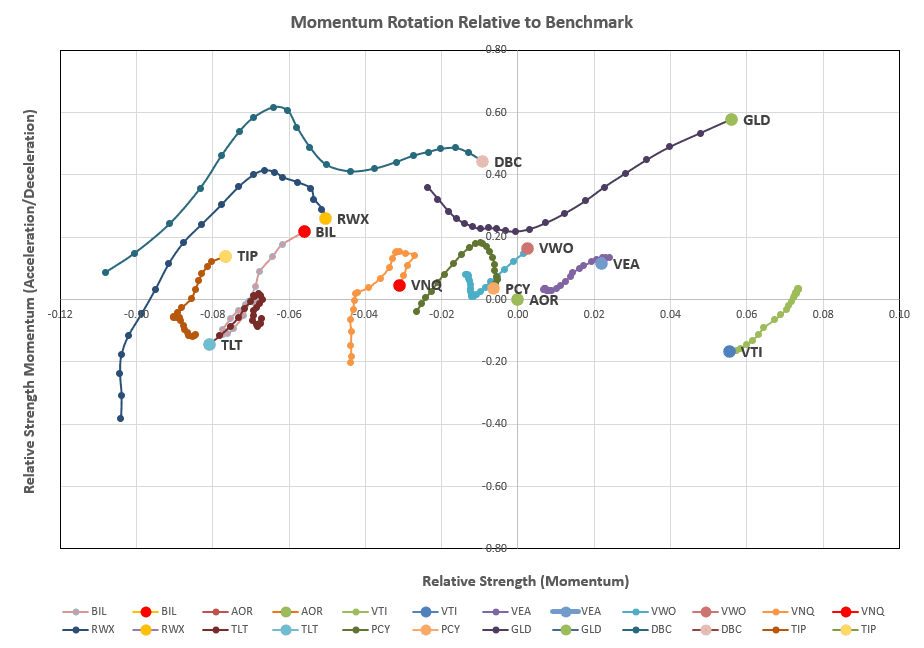

It’s time to see whether we might make any adjustments in Tranche 2 of the portfolio (the focus of this week’s review) so let’s take a look at the rotation graphs:

where we see Gold (GLD) and Commodities (DBC) soaring above all other major classes moving strongly left to right and with long tails (a sign of strength).

where we see Gold (GLD) and Commodities (DBC) soaring above all other major classes moving strongly left to right and with long tails (a sign of strength).

It is therefore not too surprising, when checking the recommendations from the rotation model, to see these assets as Buy candidates:

International equities are still suggested Hold recommendations, but VTI (US Equities) has moved into the Sell category (consistent with it’s right to left movement in the lower right quadrant of the rotation graphs).

International equities are still suggested Hold recommendations, but VTI (US Equities) has moved into the Sell category (consistent with it’s right to left movement in the lower right quadrant of the rotation graphs).

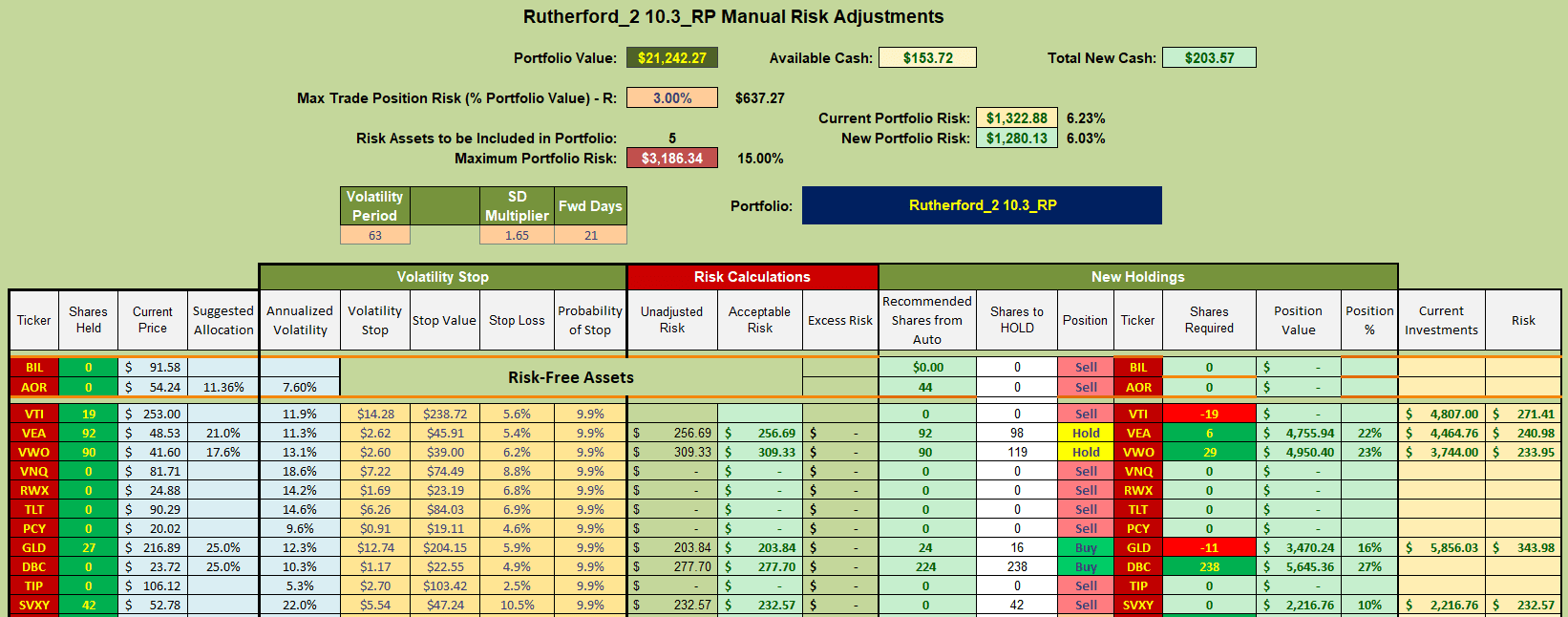

Consequently, adjustments for this week will look something like this:

where I shall be selling current holdings in VTI (in Tranche 2) and using the Cash to buy shares in DBC. I will not make minor changes to current holdings in VEA, VWO or GLD to avoid trading costs on adjustments that are unlikely to have a significant impact on total portfolio performance.

where I shall be selling current holdings in VTI (in Tranche 2) and using the Cash to buy shares in DBC. I will not make minor changes to current holdings in VEA, VWO or GLD to avoid trading costs on adjustments that are unlikely to have a significant impact on total portfolio performance.

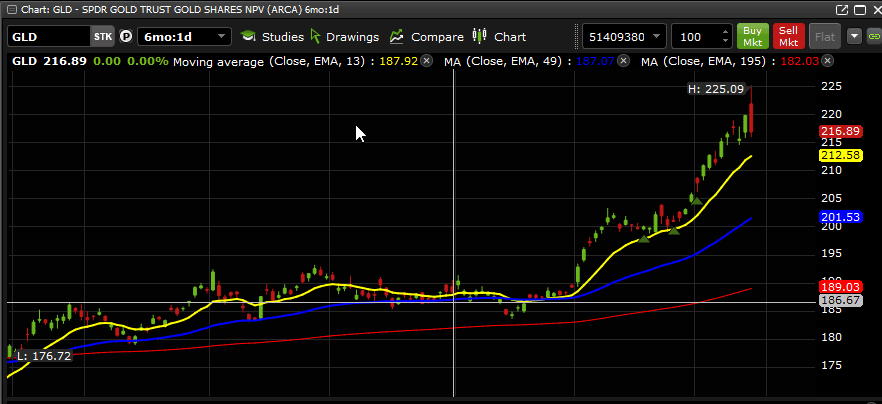

I know that a lot of ITA Wealth members do not like to hold Gold or Commodities in their portfolios for various reasons (no dividends, tax filing implications etc) but these asset classes have performed well over the past ~2 months and this is why I like to have them in the quiver for diversification when called for. The green arrows show entry points for the Rutherford Portfolio – I would like to see a faster reaction/earlier entry – but that is difficult without hindsight and “curve-fitting” of historical data:

Since these assets got slapped down a little on Friday (with everything else) it may not be a bad entry point to add positions next week – that is, if we believe in momentum rather than mean reversion 🙂 . But that is why I go for system diversification.

Since these assets got slapped down a little on Friday (with everything else) it may not be a bad entry point to add positions next week – that is, if we believe in momentum rather than mean reversion 🙂 . But that is why I go for system diversification.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.