Geothermal Hot Springs, Tarangoa, New Zealand

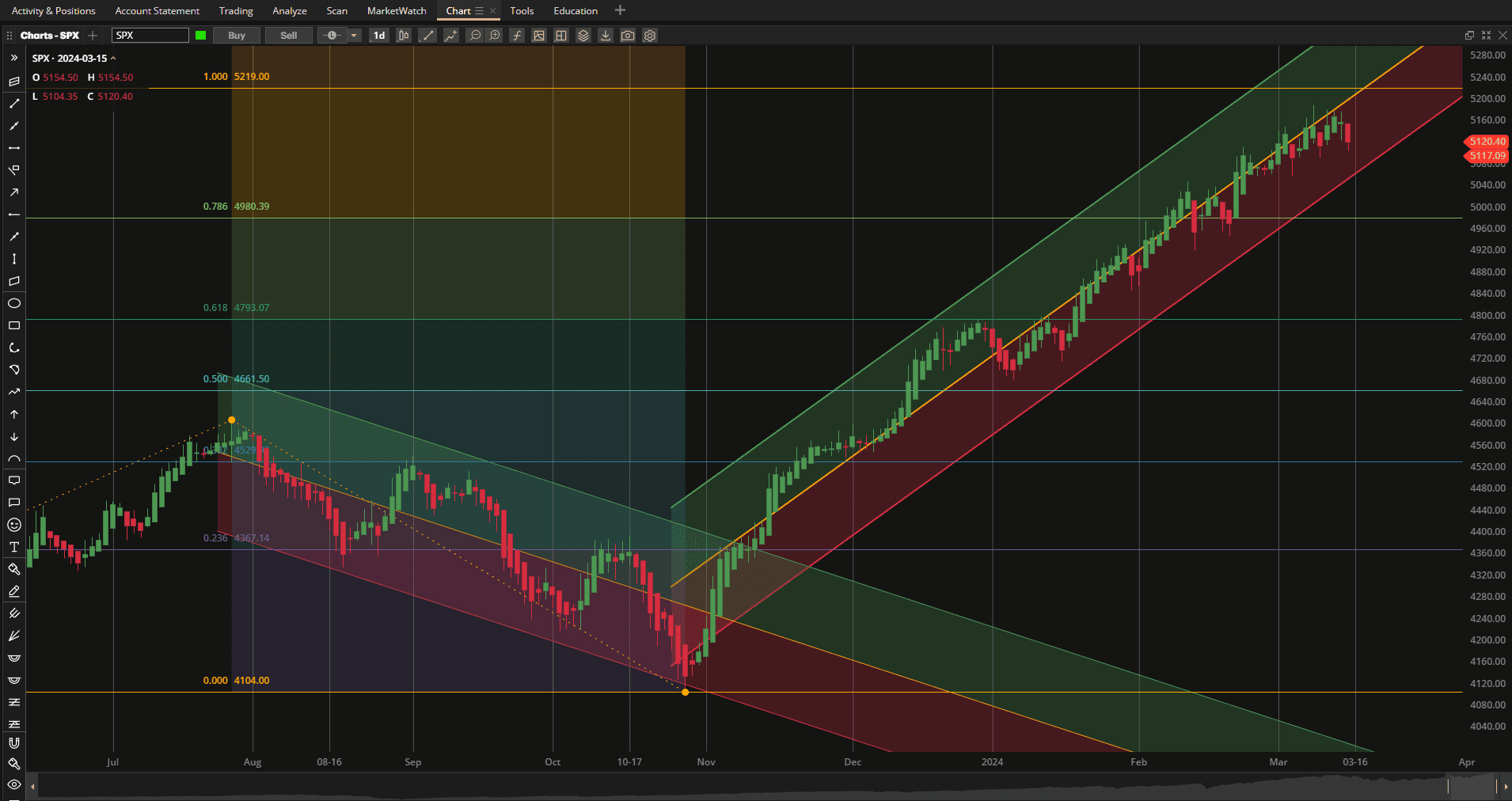

As mentioned in my reviews over the past two weeks we are seeing resistance at ~5200 in the SPX (S&P 500 Index):

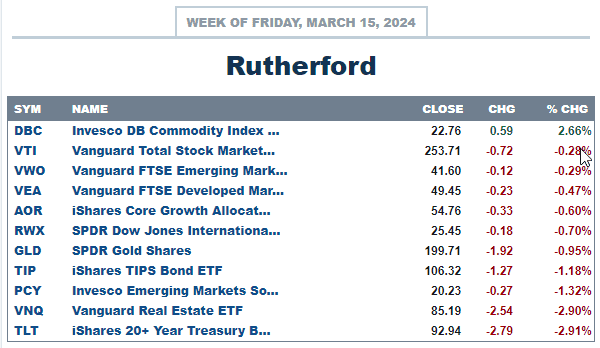

and prices have remained in this general area over that period. US equities actually closed down slightly on the week (~0.3%) but managed to outperform most other major asset classes on a relative basis:

and prices have remained in this general area over that period. US equities actually closed down slightly on the week (~0.3%) but managed to outperform most other major asset classes on a relative basis:

Only commodities performed better due to a surge in oil.

Only commodities performed better due to a surge in oil.

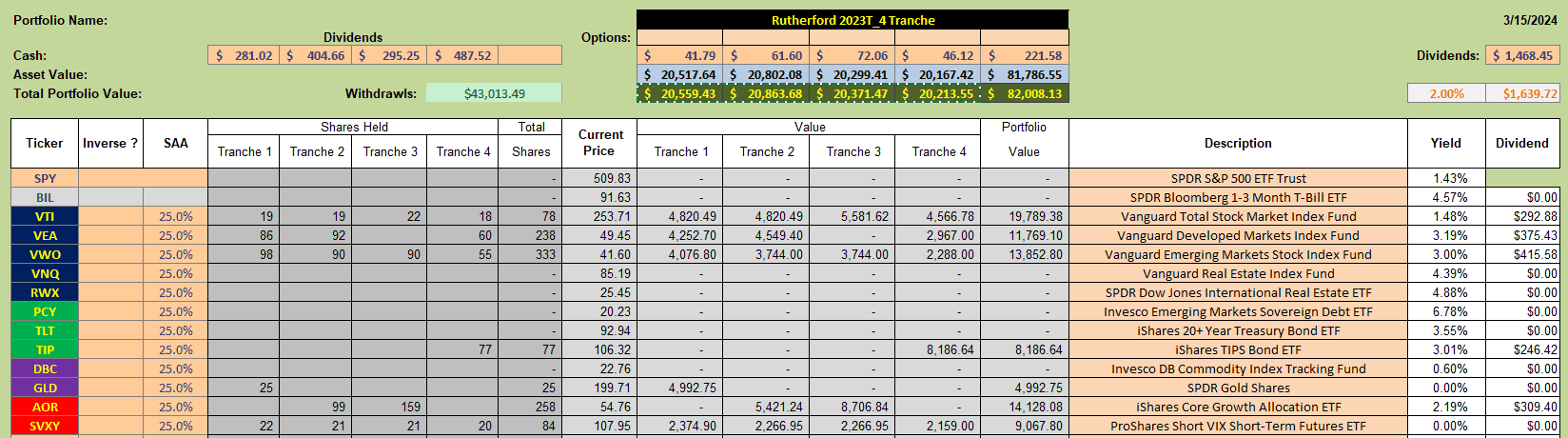

Current holdings in the Rutherford Portfolio look like this:

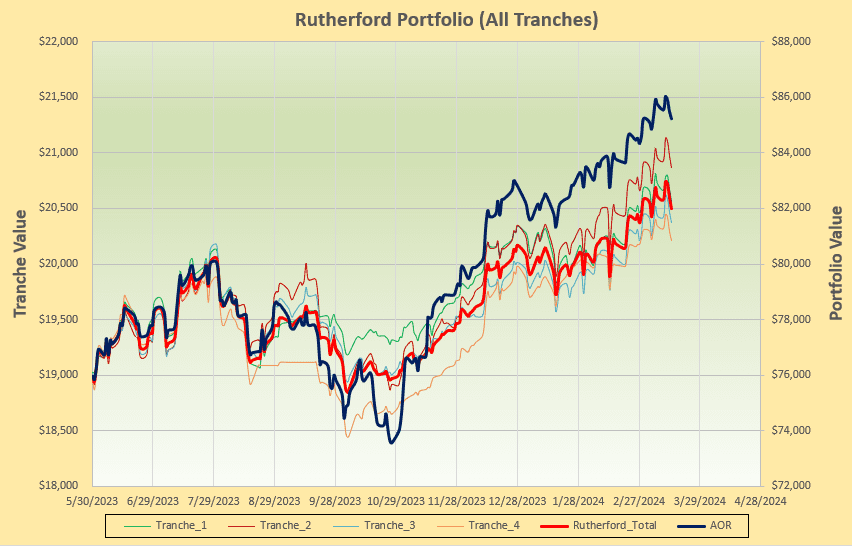

resulting in the following performance:

resulting in the following performance:

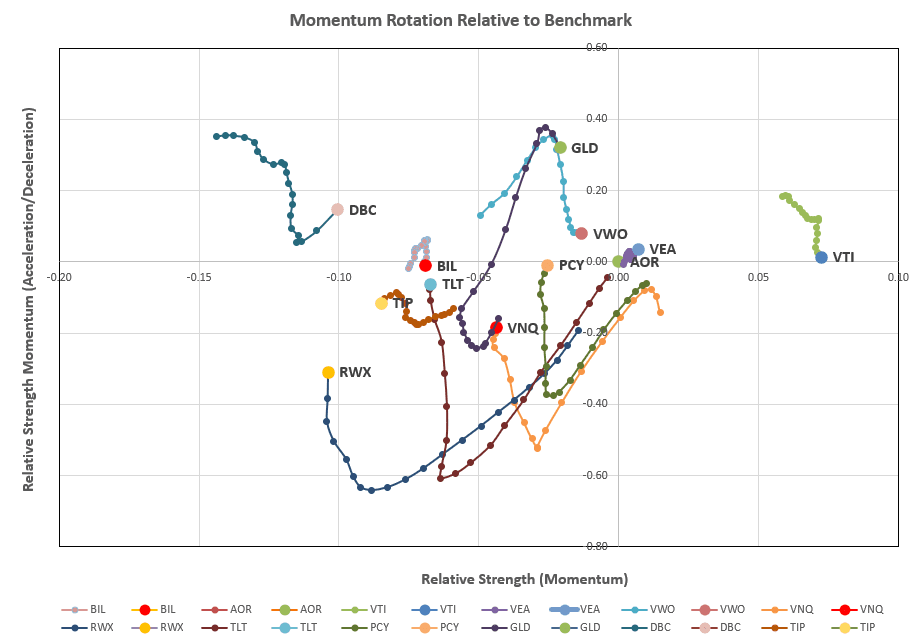

We’ll check the rotation graphs to get a feel for what’s happening in the markets:

We’ll check the rotation graphs to get a feel for what’s happening in the markets:

and see a continuation of the rotational trend out of the desirable top right quadrant.

and see a continuation of the rotational trend out of the desirable top right quadrant.

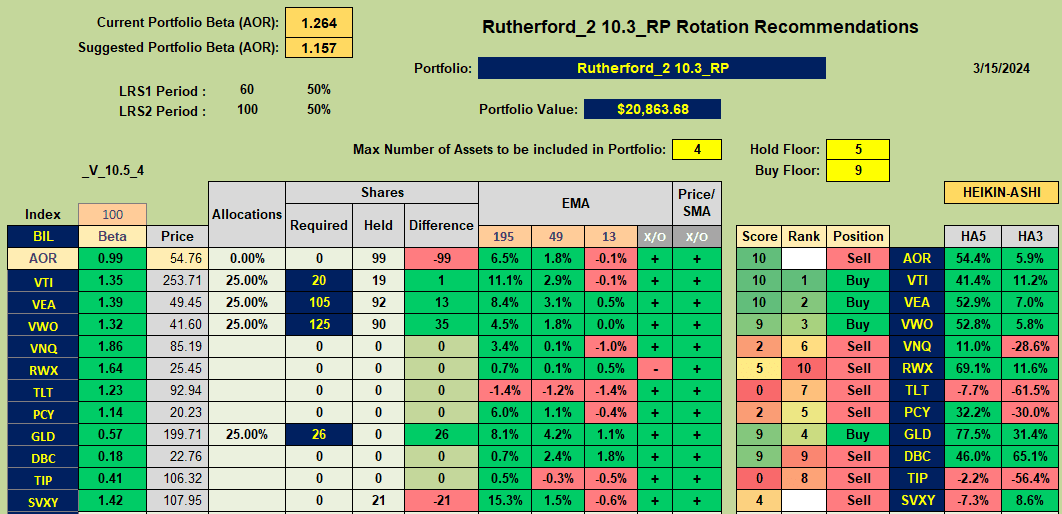

Recommendations from the rotation algorithm look like this:

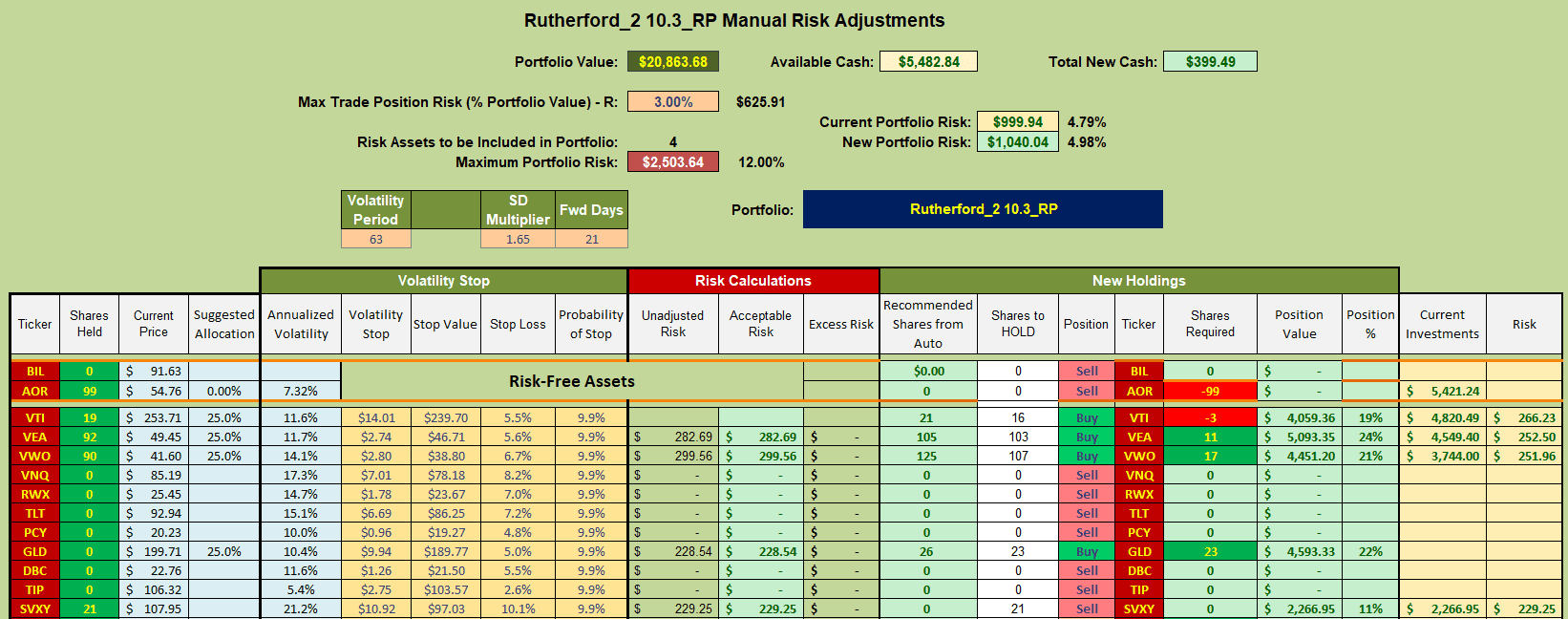

with a continued bias towards global equities. Adjustments to Tranche 2 (the focus of this week’s review) will look something like this:

where I will be selling current holdings in AOR (the benchmark fund) and using the Cash to get back into GLD (Gold). I will not worry about the minor adjustments to the equity ETFs (VTI, VEA and VWO).

where I will be selling current holdings in AOR (the benchmark fund) and using the Cash to get back into GLD (Gold). I will not worry about the minor adjustments to the equity ETFs (VTI, VEA and VWO).

DBC just misses out on the selection process (due to the 4 asset rstriction that I have in place for this portfolio) despite it’s high Score (9) and recent strong performance. We’ll see whether the oil markets cool off next week.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.