Friendly Wildlife in Auckland, New Zealand

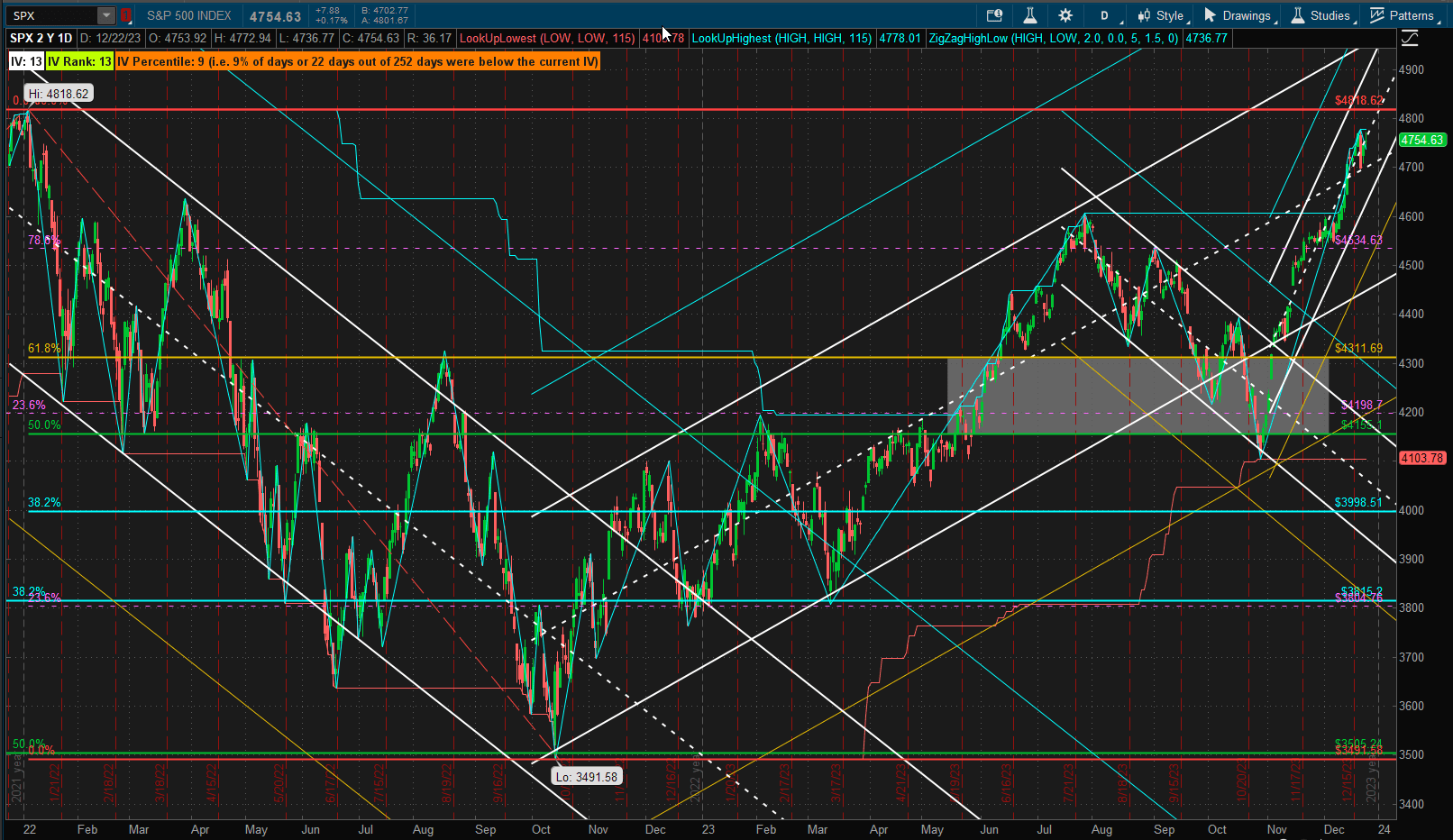

It was a bit of a rocky week for US equities with a scary drop in prices on Wednesday and poor liquidity as investors/traders focussed on the holidays. However the SPX (S&P 500 Index) still managed to close up close to 1% from last week’s close and now sits at about the same level that we were at 2 years ago:

We are now testing the all-time high level at ~4800 and the big question now is whether we will hit this level before the end of the year or shortly into the new Year. 2022 saw a 50% retracement from the all-time highs and now we have a 100% bounce back to the same level.

We are now testing the all-time high level at ~4800 and the big question now is whether we will hit this level before the end of the year or shortly into the new Year. 2022 saw a 50% retracement from the all-time highs and now we have a 100% bounce back to the same level.

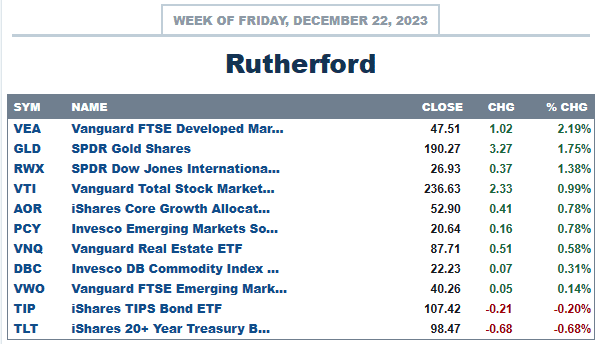

Relative to other major asset classes US equities fared fairly well

although it was outshone slightly by equities in the Developed Markets, Gold (historically strong at this seasonal time of year) and International Real Estate.

although it was outshone slightly by equities in the Developed Markets, Gold (historically strong at this seasonal time of year) and International Real Estate.

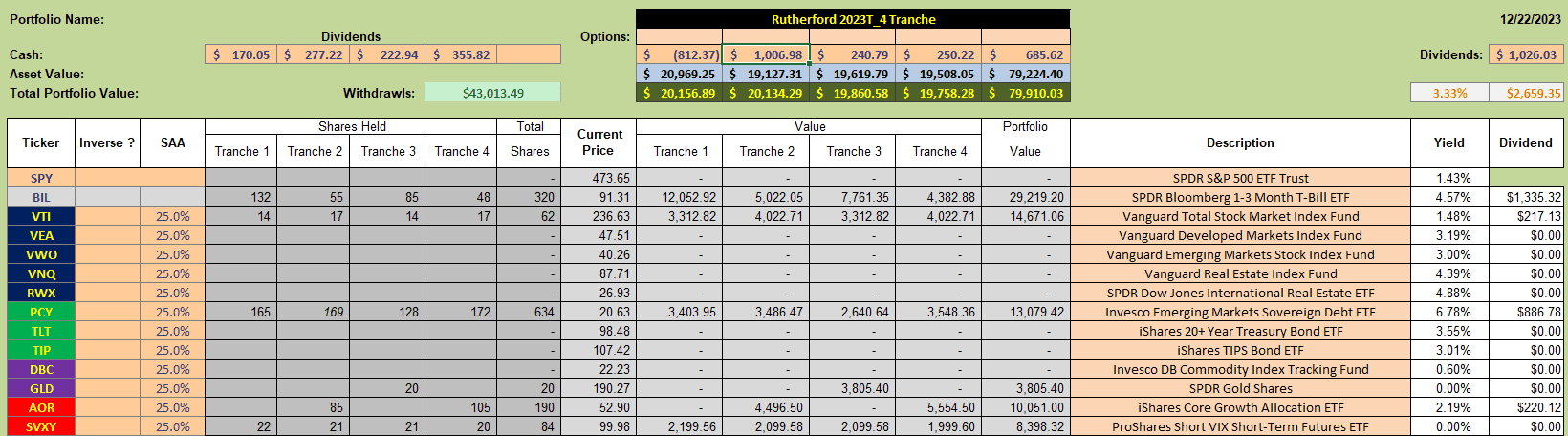

Current holdings in the Rutherford Portfolio look like this:

with ~40% still in BIL (proxy for Cash) since I was too pre-occupied with other things last week to make adjustments in Tranche 1 as I had planned.

with ~40% still in BIL (proxy for Cash) since I was too pre-occupied with other things last week to make adjustments in Tranche 1 as I had planned.

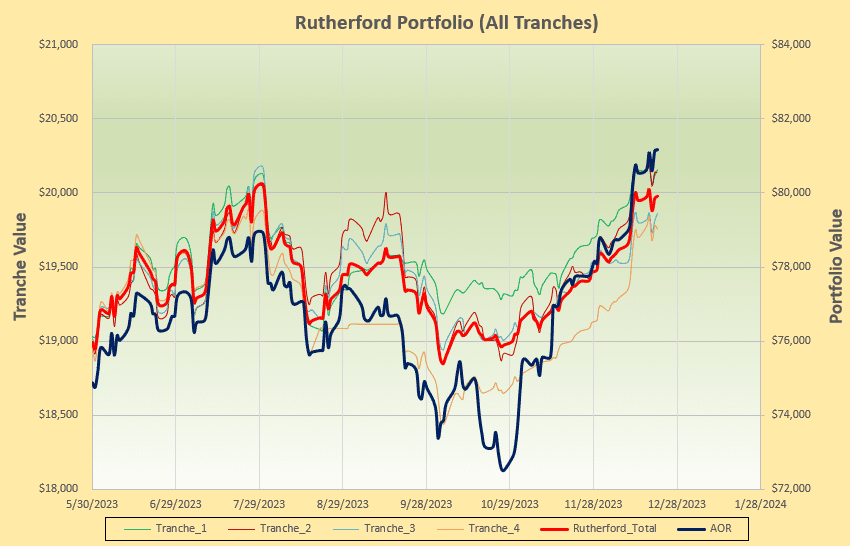

Performance of the portfolio remains pretty much in line with the benchmark AOR fund:

and represents a respectable risk-adjusted performance with smaller relative draw-down offset by slower recovery.

and represents a respectable risk-adjusted performance with smaller relative draw-down offset by slower recovery.

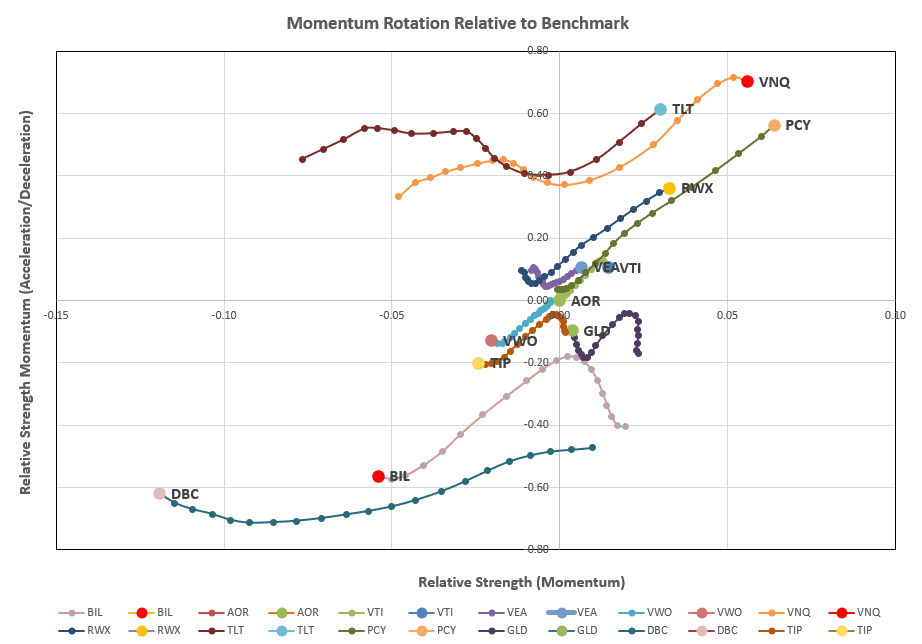

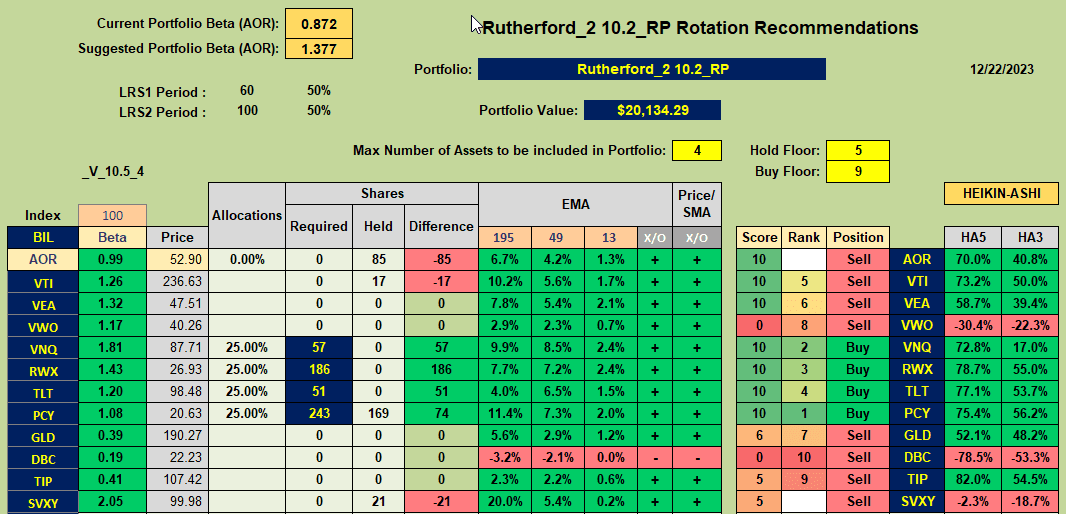

Checking the rotation graphs:

we now see nice positive movement in the desirable top right quadrant with PCY, VNQ RWX and TLT leading the way. This is confirmed in the recommendations from the tranche worksheet:

we now see nice positive movement in the desirable top right quadrant with PCY, VNQ RWX and TLT leading the way. This is confirmed in the recommendations from the tranche worksheet:

where these 4 ETFs are the recommended Buys.

where these 4 ETFs are the recommended Buys.

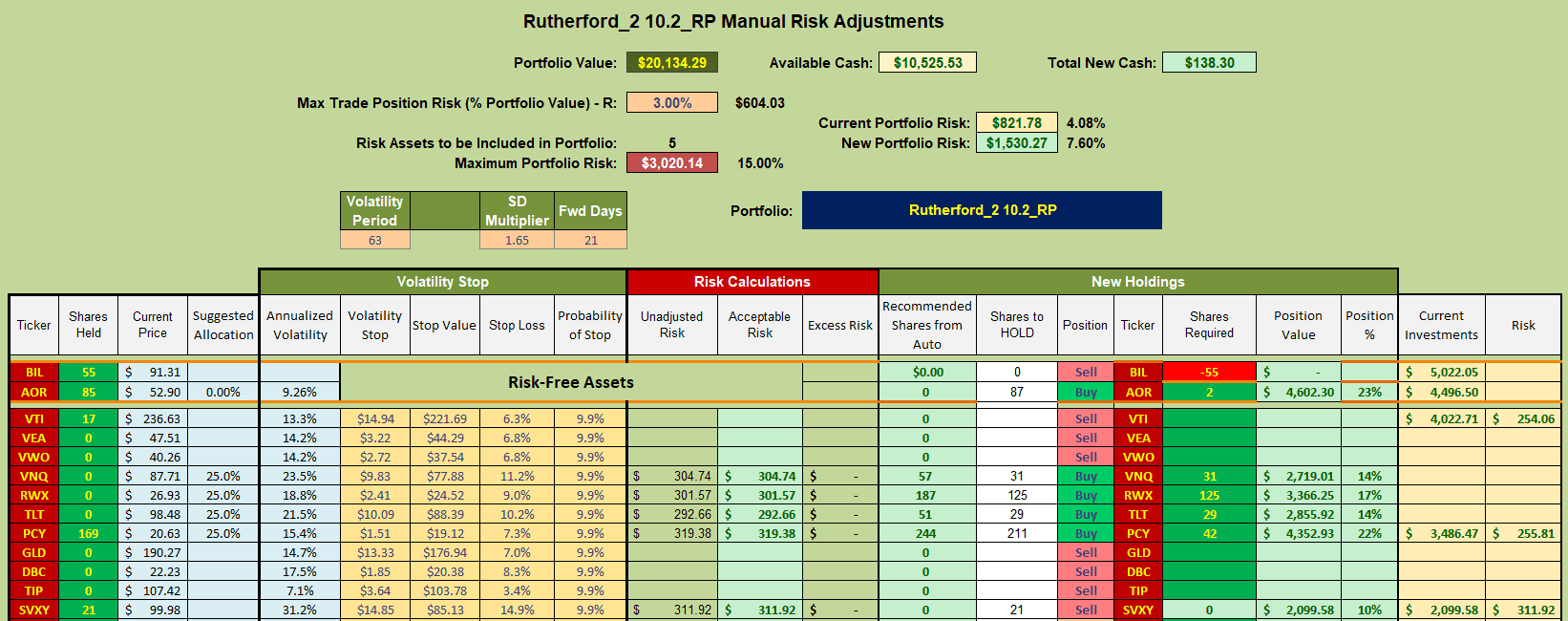

This leaves us with adjustments looking something like this for next week:

i.e. I shall be selling shares in BIL to raise Cash to open positions in VNQ, RWX and TLT and to add a few additional shares of PCY. If I can find the time I will combine these adjustments with adjustments to Tranche 1 (since I missed that opportunity last week).

i.e. I shall be selling shares in BIL to raise Cash to open positions in VNQ, RWX and TLT and to add a few additional shares of PCY. If I can find the time I will combine these adjustments with adjustments to Tranche 1 (since I missed that opportunity last week).

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.