Singapore Botanic Gardens – UNESCO National Heritage Site

As we approach the end of February we see that the apparent recovery in US equities may not be as strong as we may have thought. This week saw another drop of ~2.7% in the SPX (S&P 500 Index) from last week’s close and we are now up only 3.4% on the year after hitting the 8.9% mark at the beginning of February:

The pullback takes us to the bottom of the bullish trend channel that started from the October 2022 lows and we now have to wait to see whether this will offer significant support. The pullback also represents a 61.8% (Fibonacci) retracement from the February high that may provide additional technical support. If this support level does not hold we may well re-test the December 2022 lows of ~3800 and a loss on the year.

The pullback takes us to the bottom of the bullish trend channel that started from the October 2022 lows and we now have to wait to see whether this will offer significant support. The pullback also represents a 61.8% (Fibonacci) retracement from the February high that may provide additional technical support. If this support level does not hold we may well re-test the December 2022 lows of ~3800 and a loss on the year.

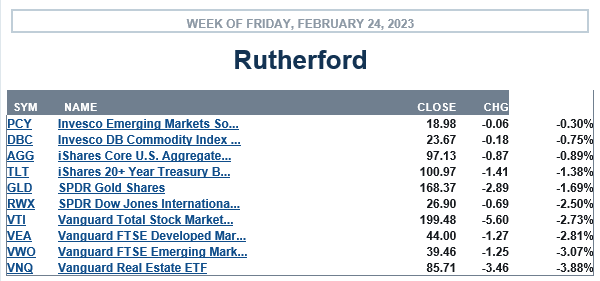

US equities was not the only asset class showing weakness this week with all major asset classes showing losses – so much for the benefits of diversification 🙂

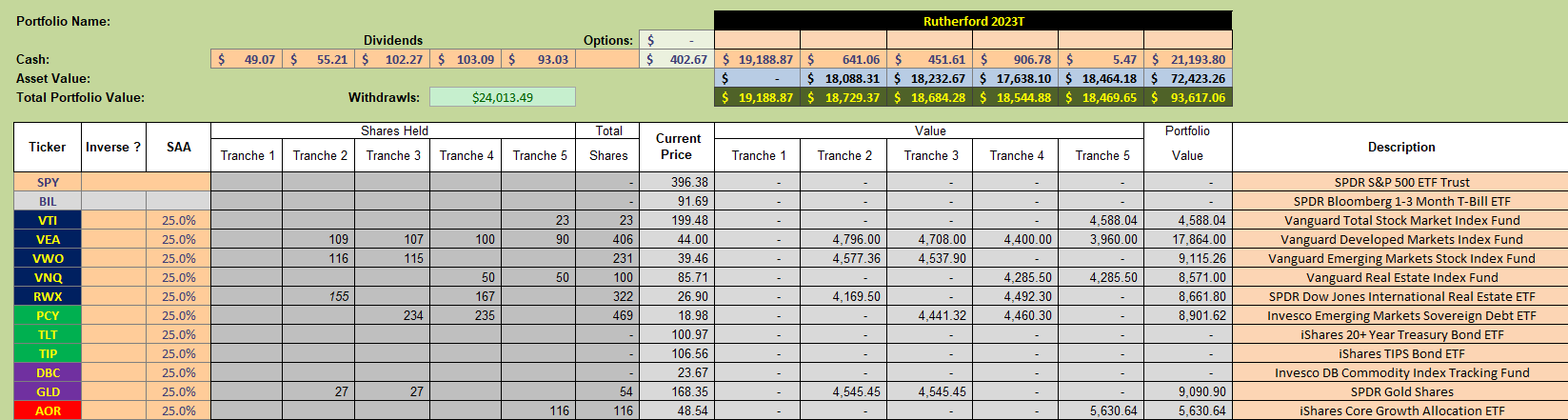

Last week we sold all assets in Tranche 1 of the Rutherford Portfolio:

Last week we sold all assets in Tranche 1 of the Rutherford Portfolio:

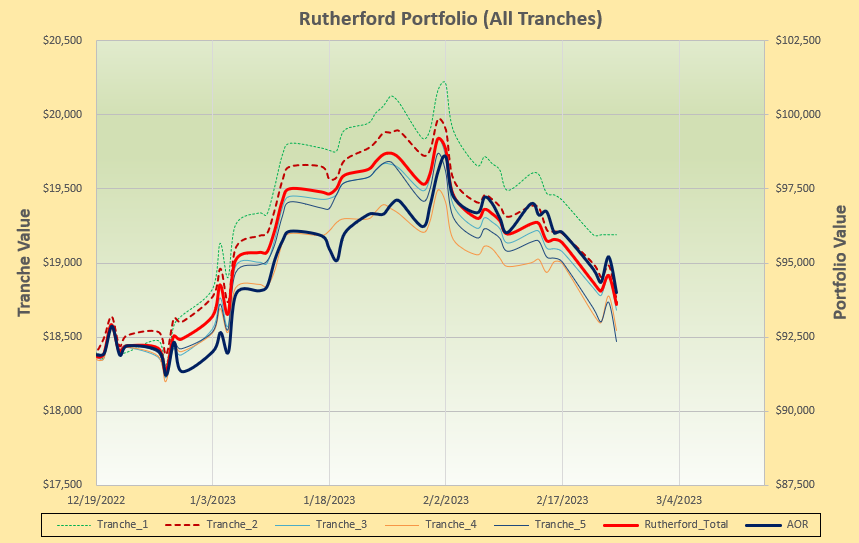

resulting in the following performance from the portfolio:

resulting in the following performance from the portfolio:

i.e still close to but still slightly underperforming the benchmark AOR Fund.

i.e still close to but still slightly underperforming the benchmark AOR Fund.

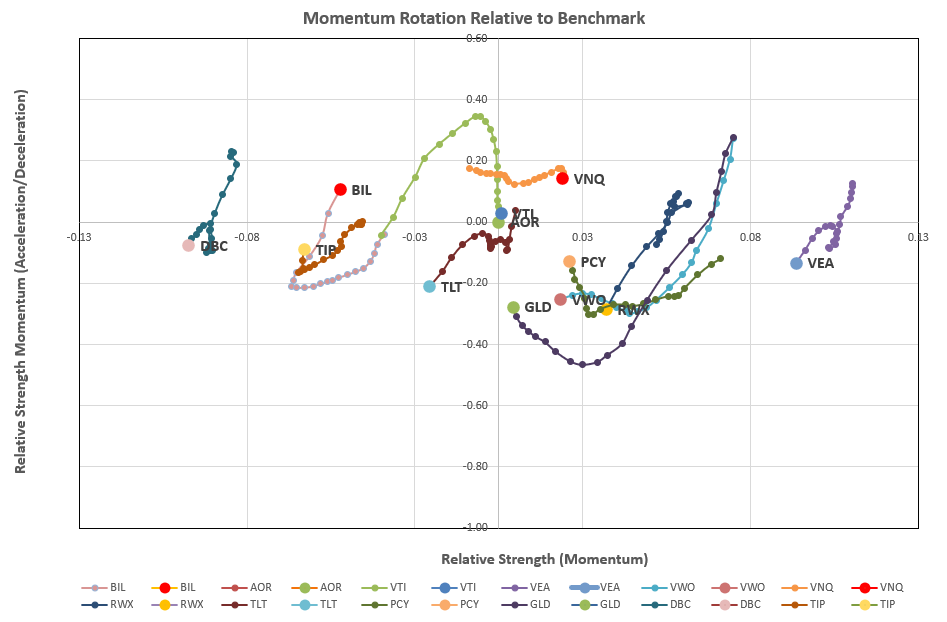

Taking a look at this week’s rotation graphs (since I am using a rotation model to manage this portfolio):

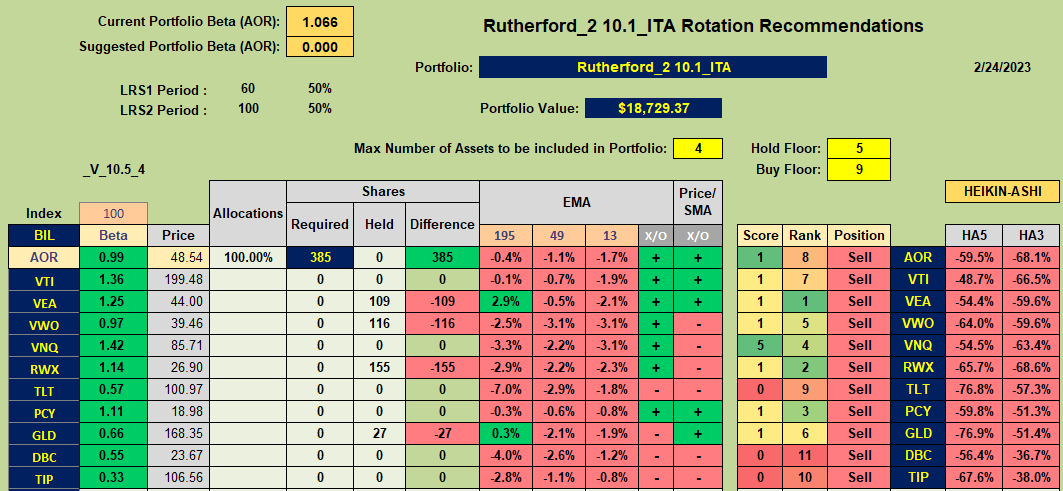

we don’t see a lot of positive action in the top right quadrant that shows strength. This is reflected in the recommendations from the model:

we don’t see a lot of positive action in the top right quadrant that shows strength. This is reflected in the recommendations from the model:

where, as we saw last week we have sell recommendations for all assets in the Rutherford quiver.

where, as we saw last week we have sell recommendations for all assets in the Rutherford quiver.

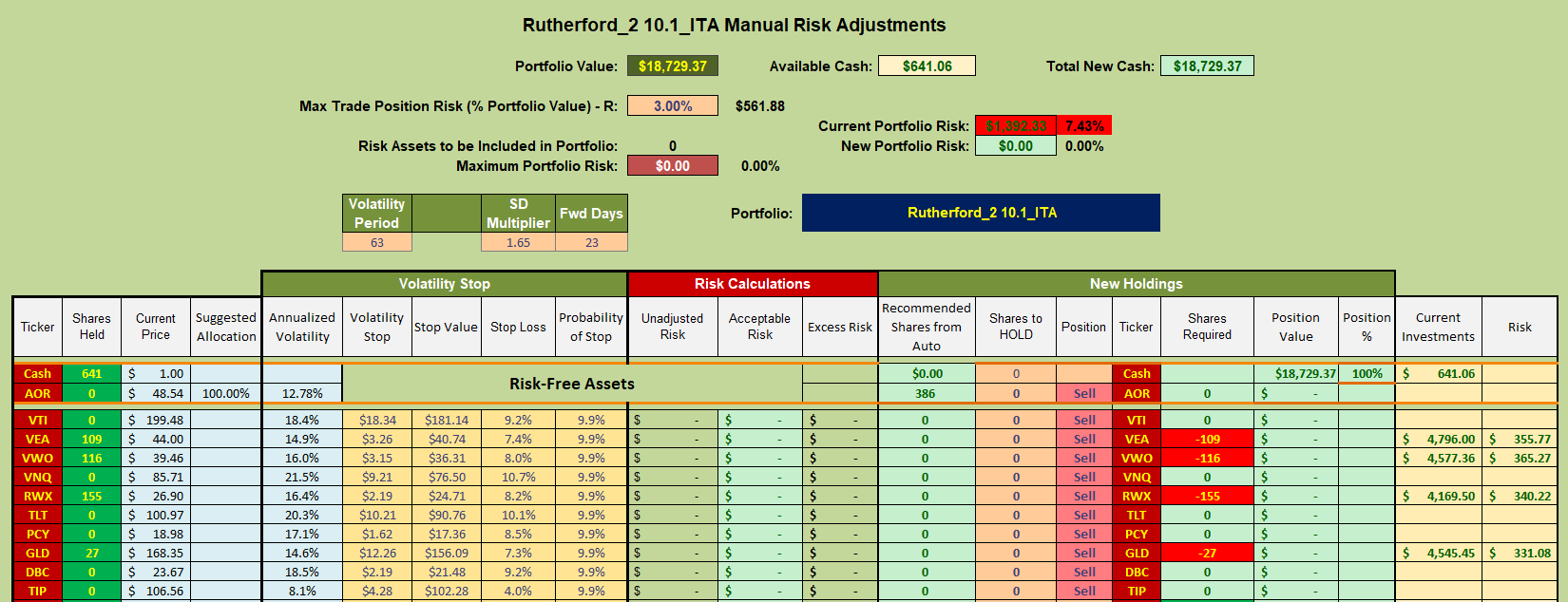

Accordingly I will be selling all assets held in Tranche 2 and moving to Cash:

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.