Baily (as in Baily’s Irish Cream) Lighthouse, Dublin Bay, Ireland

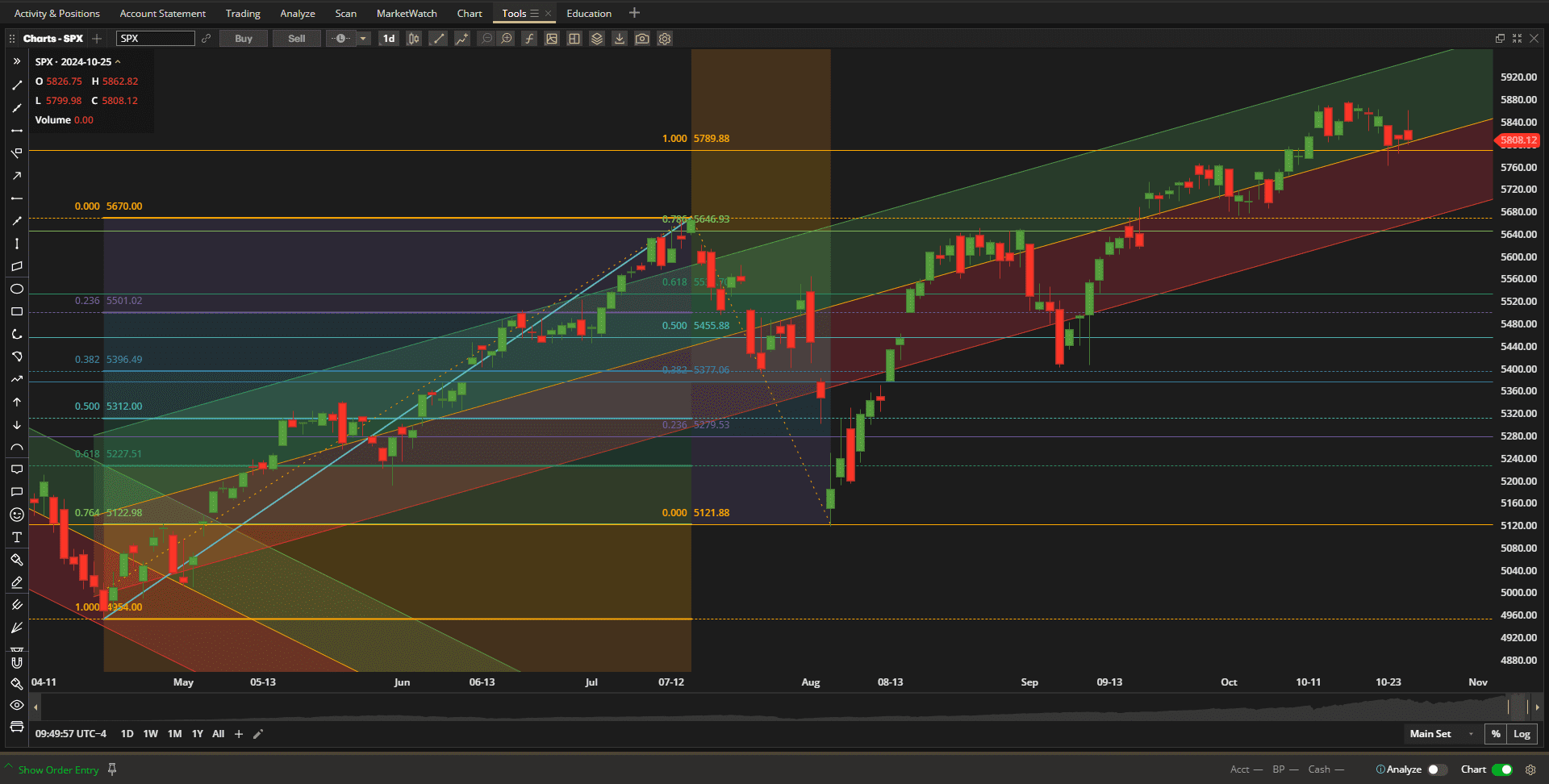

It was a relatively quiet week in the US Equity markets with the SPX (S&P500 Index) pulling back a little to retest the support/resistance zone at ~5800:

We are still in an uptrend but must wait to see whether we bounce off the support/resistance zone or whether we pull back further towards the bottom of the trend channel.

We are still in an uptrend but must wait to see whether we bounce off the support/resistance zone or whether we pull back further towards the bottom of the trend channel.

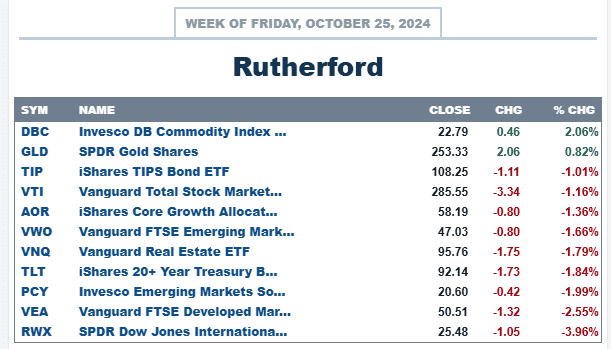

In terms of relative performance, US Equities (VTI) came in with “average” strength with the strongest performance coming from the more defensive Commodity Classes (DBC and GLD).

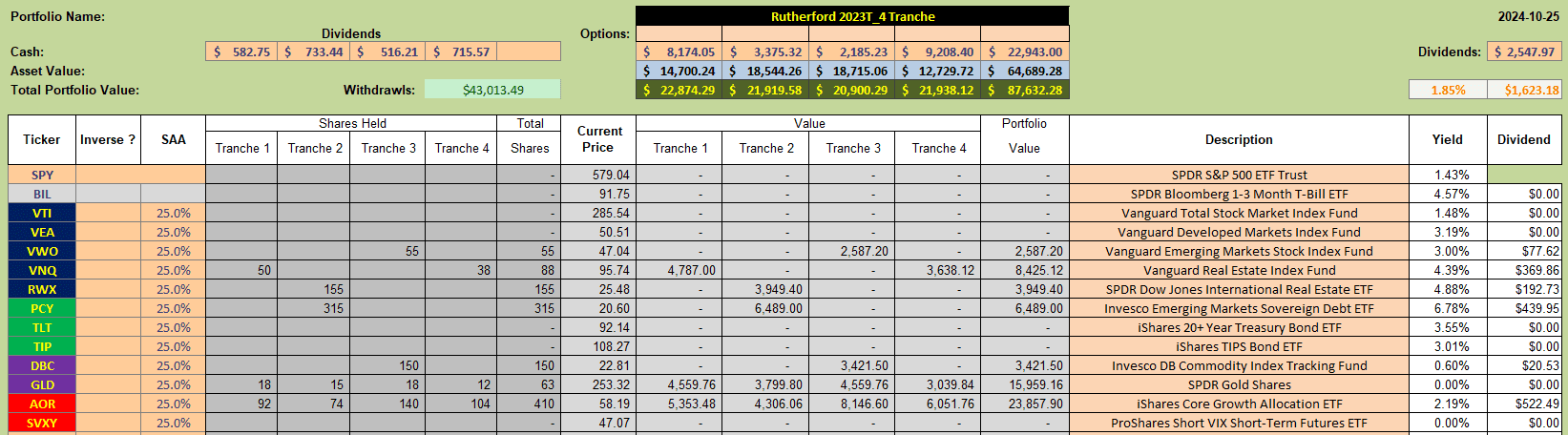

After last week’s purge (to free up some required cash), holdings in the Rutherford Portfolio now look like this:

After last week’s purge (to free up some required cash), holdings in the Rutherford Portfolio now look like this:

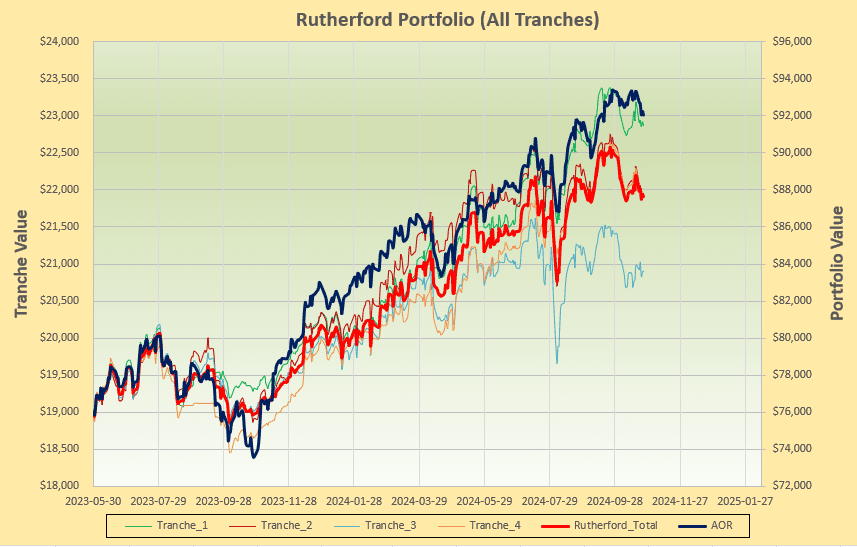

with performance as shown in the following screenshot:

with performance as shown in the following screenshot:

Performance suffered earlier this month due to holdings in TLT (US Long-Term Treasuries) before they were sold in recent weeks.

Performance suffered earlier this month due to holdings in TLT (US Long-Term Treasuries) before they were sold in recent weeks.

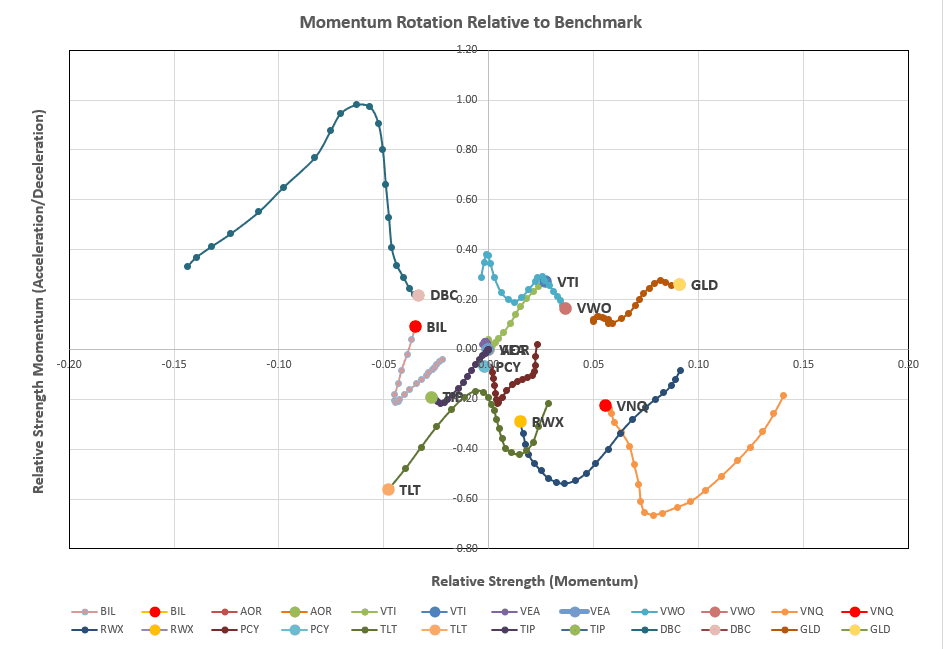

Checking the current rotation graphs:

we see that only GLD and VTI are strengthening in the desirable top right quadrant whilst DBC has shown recent (short-term) strength that is still not positively reflected in the long-term time-frame (position along the horizontal axis).

we see that only GLD and VTI are strengthening in the desirable top right quadrant whilst DBC has shown recent (short-term) strength that is still not positively reflected in the long-term time-frame (position along the horizontal axis).

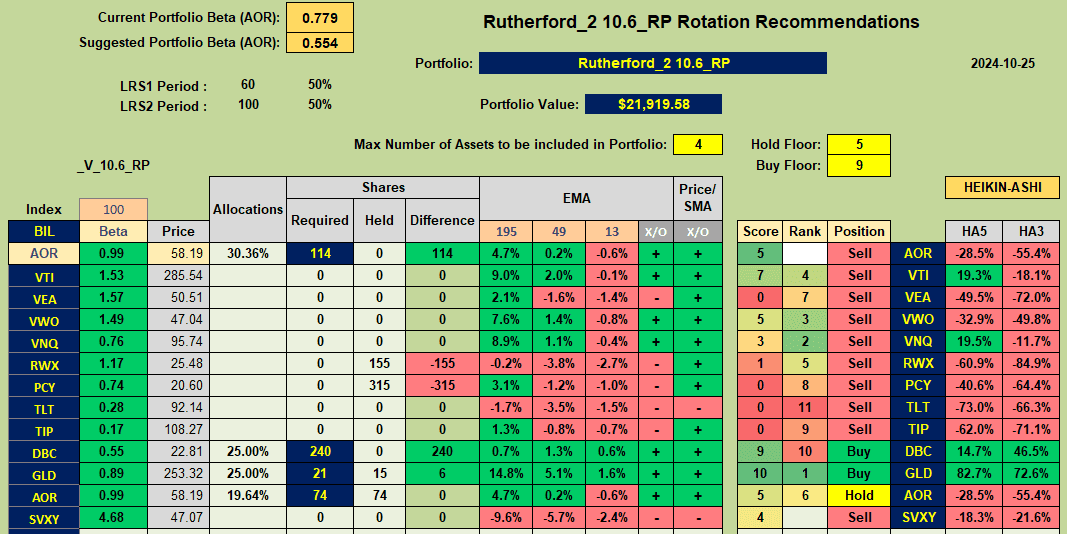

From the ranking/recommendations of the rotation model used to manage this portfolio:

we have Buy recommendations for DBC and GLD with a hold recommendation for AOR. However, a small move higher for VTI (generating a positive short-term HA3 signal) would call for a Buy of VTI.

we have Buy recommendations for DBC and GLD with a hold recommendation for AOR. However, a small move higher for VTI (generating a positive short-term HA3 signal) would call for a Buy of VTI.

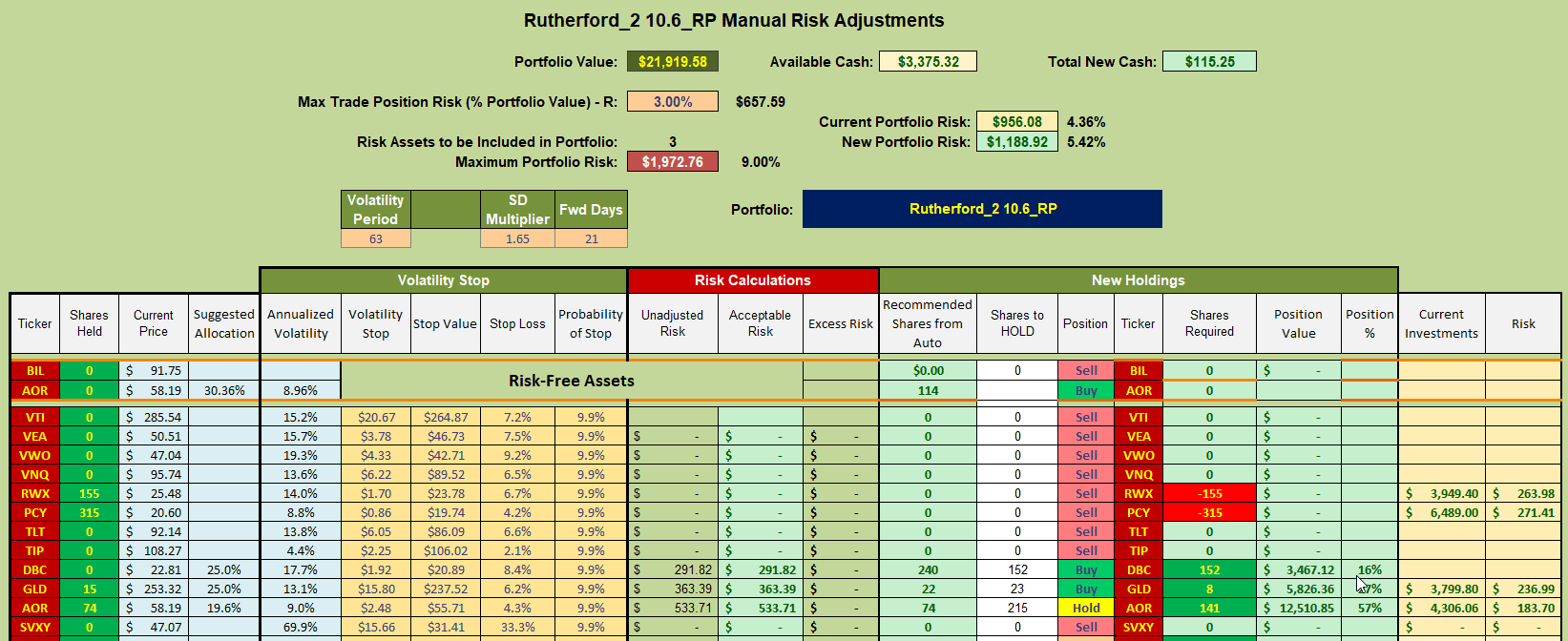

Suggested adjustments for Tranche 2 therefore presently look like this:

suggesting the sale of current holdings in RWX and PCY (releasing ~$10,500 in Cash) and the purchase of a new holding (~$3,500) in DBC. I will make these adjustments and wait to see whether to use the excess Cash to add to current positions in GLD and AOR or whether to open a position in VTI in this tranche (should the current short term momentum continue).

suggesting the sale of current holdings in RWX and PCY (releasing ~$10,500 in Cash) and the purchase of a new holding (~$3,500) in DBC. I will make these adjustments and wait to see whether to use the excess Cash to add to current positions in GLD and AOR or whether to open a position in VTI in this tranche (should the current short term momentum continue).

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

VTI has flipped to a Buy signal so I have purched 20 shares for Tranche 2.

David,

Have you changed anything with the Hawking lately?

~jim

No significant changes Jim – I’ll be posting an update shortly once I’ve recorded the distributions to the end of October.

David