Watch your Head! – Macaw coming in to land, Karon Beach, Thailand

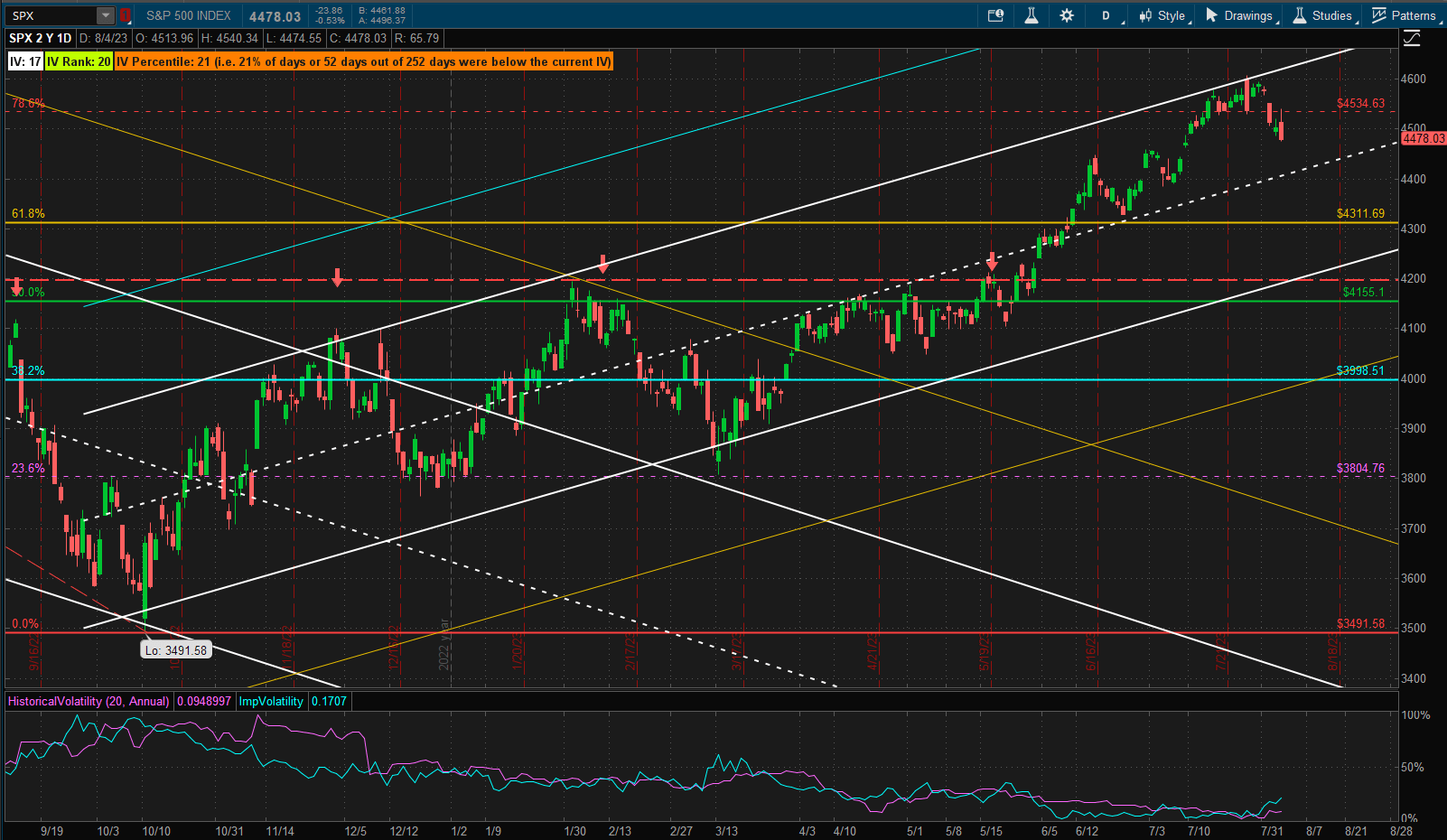

This week we saw an inevitable pullback in the prices of US equities after 2 weeks of finding resistance at the upper boundary of the 1 SD bullish trend channel:

the question now is how deep the pullback may be – will we just maybe pullback to the centre of the channel or will the pullback be deeper and maybe test support at the bottom of the channel and major resistance area at ~4200?

the question now is how deep the pullback may be – will we just maybe pullback to the centre of the channel or will the pullback be deeper and maybe test support at the bottom of the channel and major resistance area at ~4200?

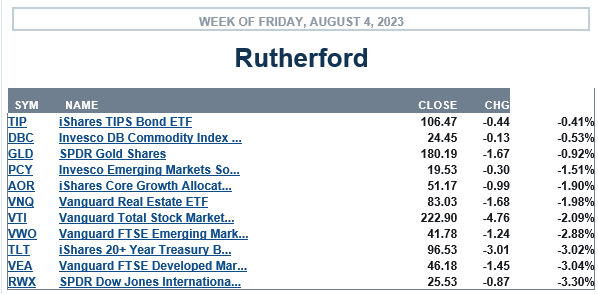

Although the move seemed significant (~2% from lost week’s close) it was far from the worst performing asset class – in fact, no major market asset class showed positive gains on the week:

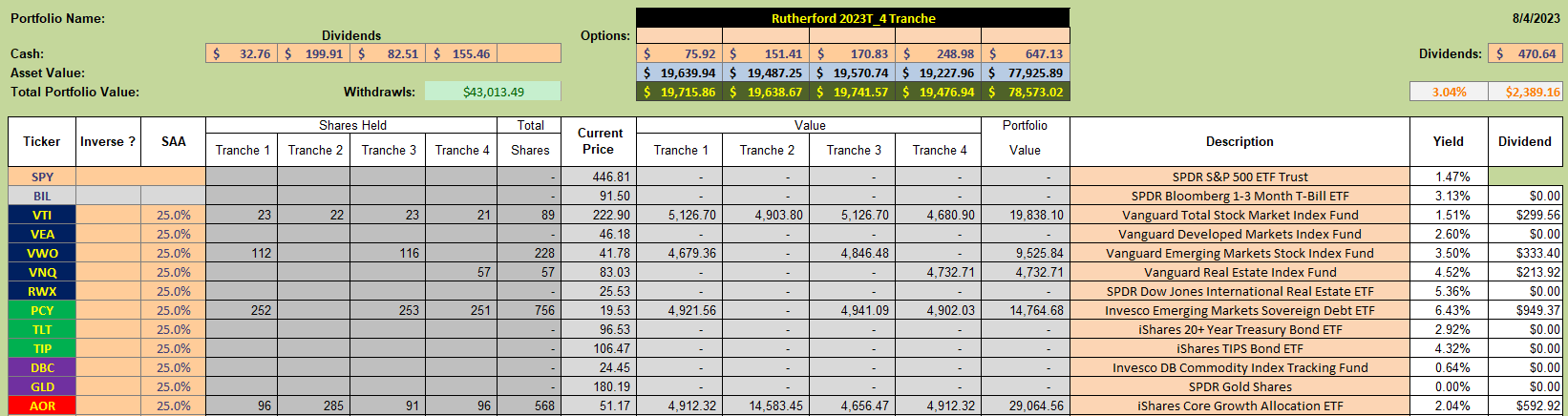

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

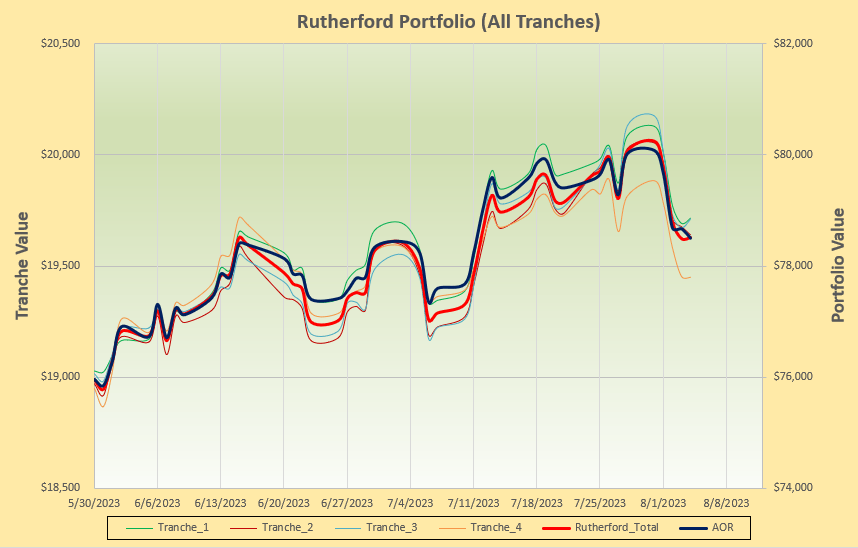

with the following performance:

with the following performance:

i.e. staying abreast of the benchmark AOR Fund.

i.e. staying abreast of the benchmark AOR Fund.

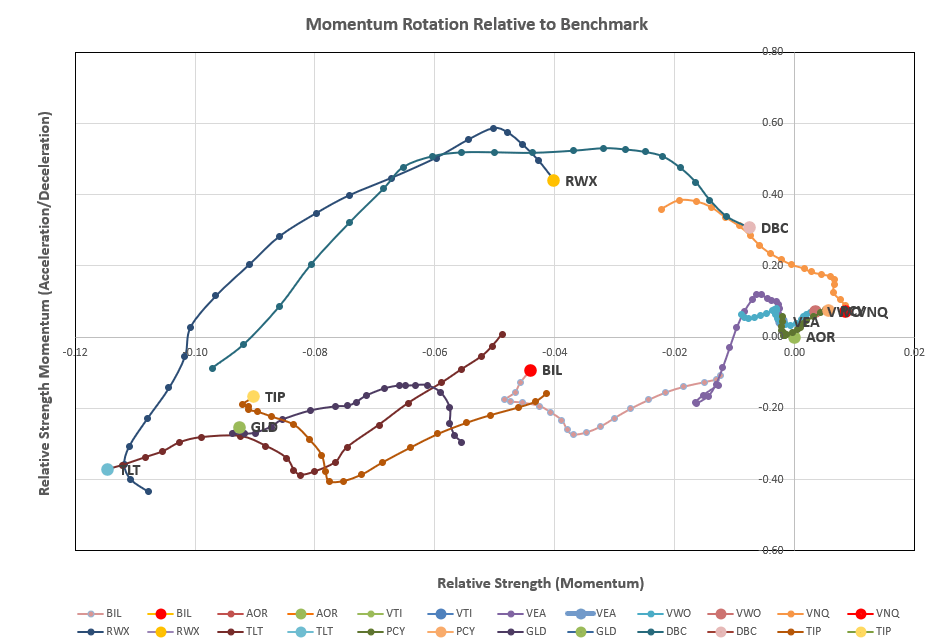

To see if we might want to make adjustments in Tranche 2 (the focus of this weeks review) we check the rotation graphs:

that are not encouraging with almost everything to the left of the vertical axis (negative longer term momentum relative to the benchmark). VNQ lies to the right, but has been moving down over the past month, so is showing weakness in the shorter term. DBC, although still to the left of the vertical axis, has moved a long way over the the past month (strengthened longer term relative strength).

that are not encouraging with almost everything to the left of the vertical axis (negative longer term momentum relative to the benchmark). VNQ lies to the right, but has been moving down over the past month, so is showing weakness in the shorter term. DBC, although still to the left of the vertical axis, has moved a long way over the the past month (strengthened longer term relative strength).

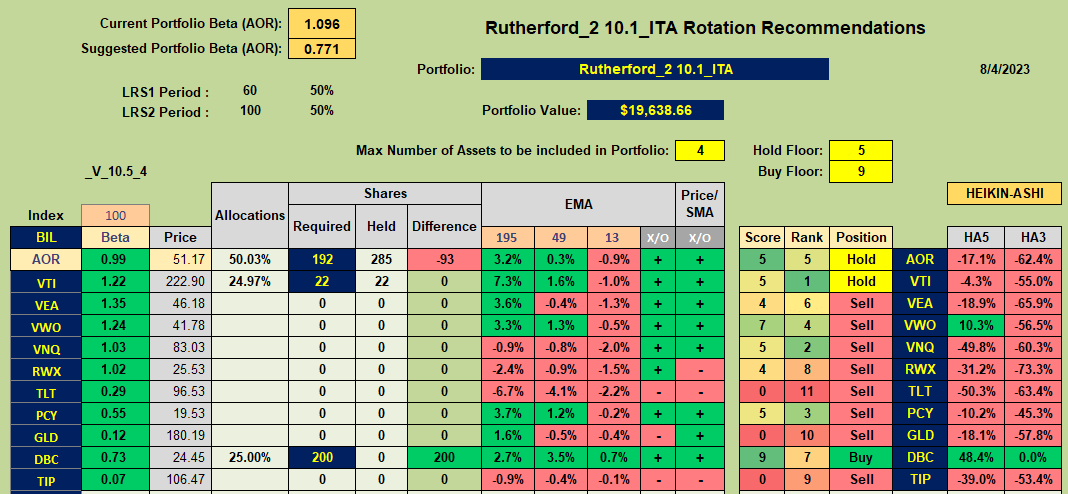

How does the rotation algorithm being used to manage this portfolio interpret these graphs?:

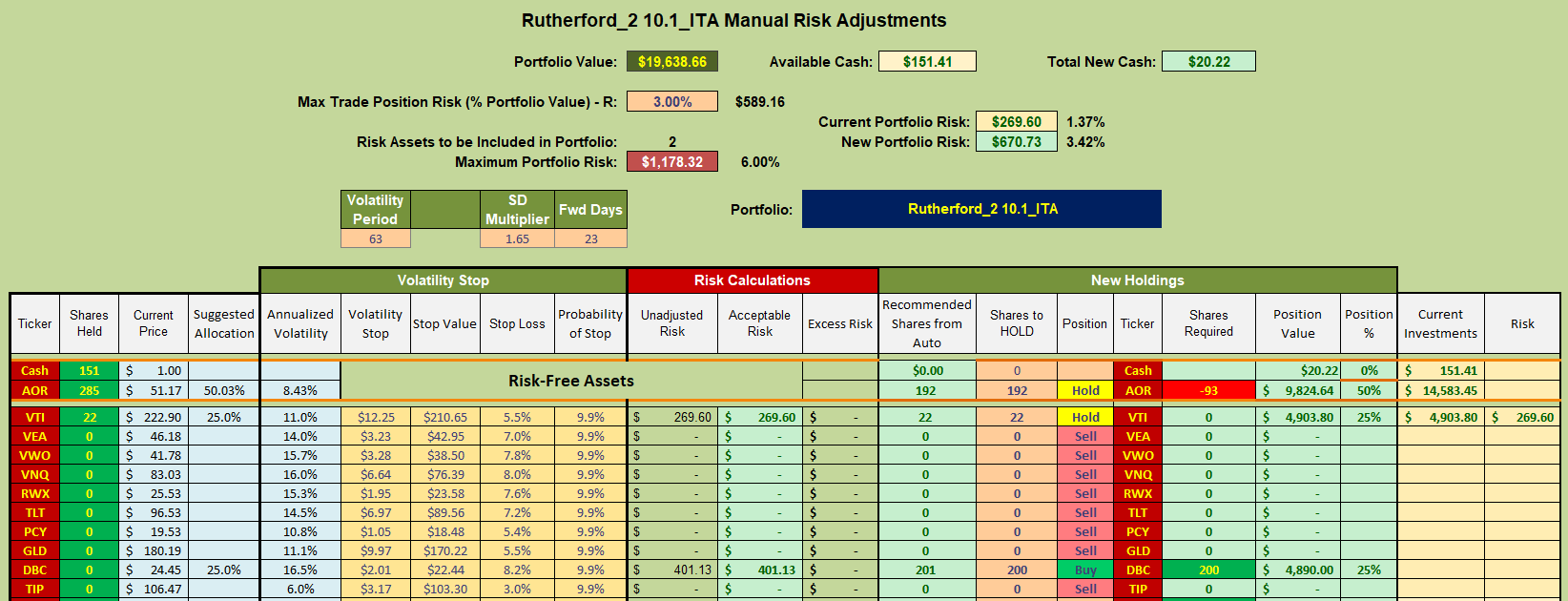

not a lot of enthusiasm here with Hold recommendations on VTI and AOR (the assets currently held in this Tranche) – but it does generate a Buy recommendation for DBC. So, we’ll dip a toe in the water and add a few shares of DBC to the portfolio this week. This is an attraction of tranching a portfolio since we don’t have to go “all-in” – we can buy a few shares, that might be a nice early entry if the trend continues, or it will not hurt us too much if the rally falters. If it continues, we will likely be buying more shares next week….

In order to purchase these shares I will sell a portion of the current holdings in AOR:

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.