Cormorant Chicks, Tauranga, New Zealand

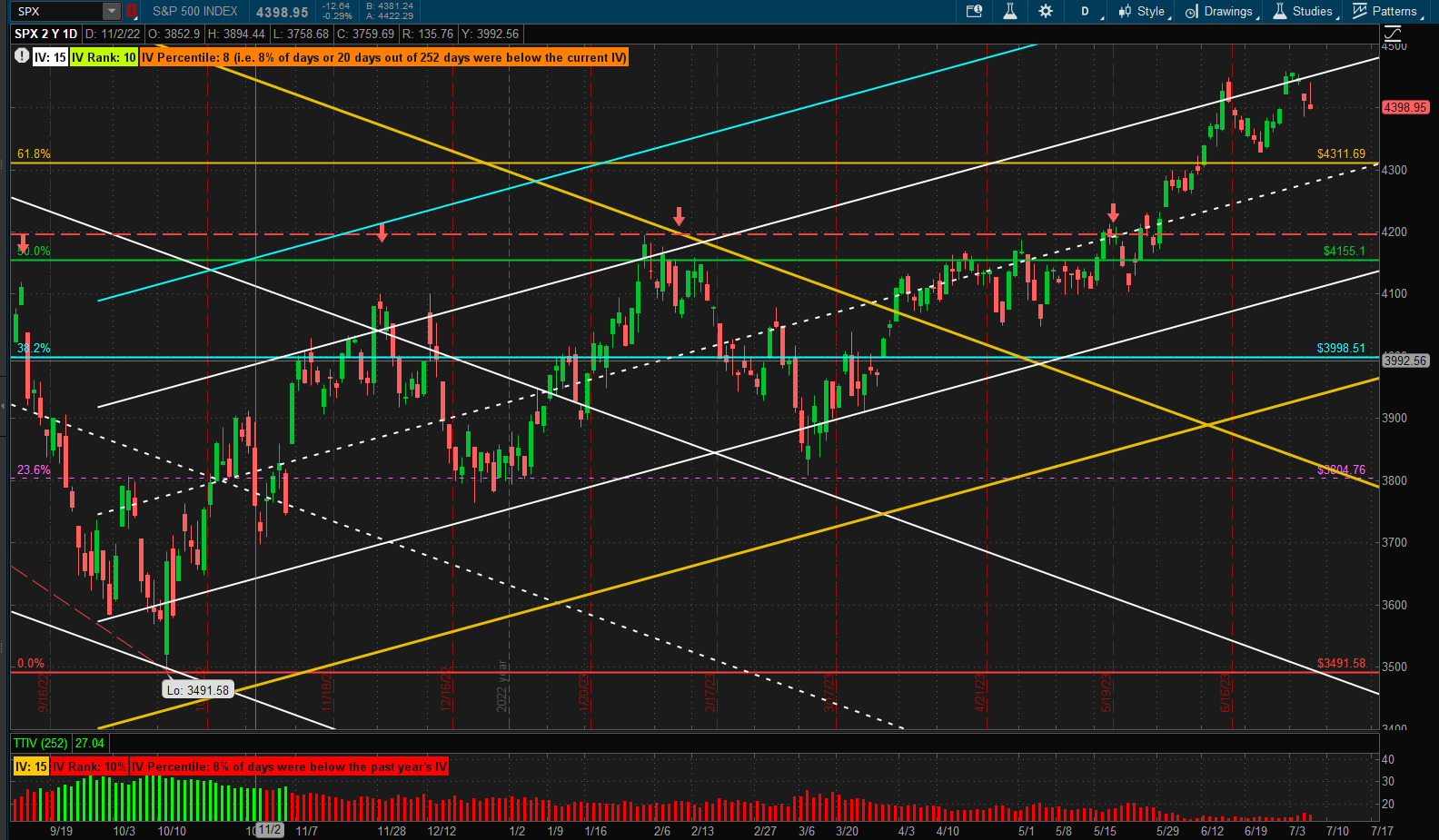

After last week’s pre-holiday fireworks the celebrations fizzed out after the holiday and US equities closed down ~1% lower than last week’s close:

Another re-test of the 4300 level would not surprise me – but then it’s anyone’s guess where we might go from there. Since we are getting towards mid-summer a sideways market into the fall might not be unexpected.

Another re-test of the 4300 level would not surprise me – but then it’s anyone’s guess where we might go from there. Since we are getting towards mid-summer a sideways market into the fall might not be unexpected.

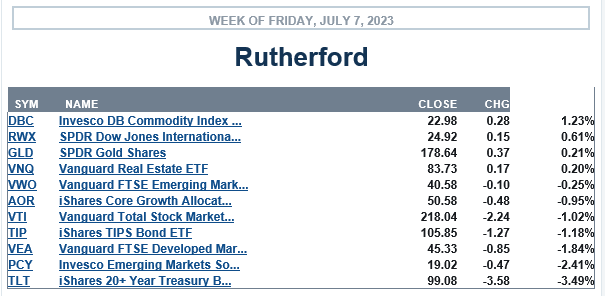

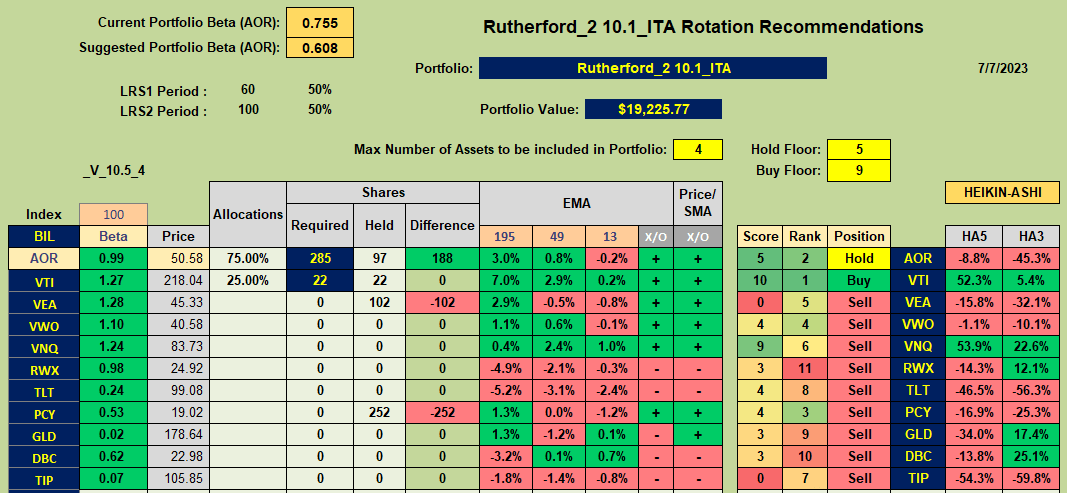

Relative to other asset classes US equities remain in the middle of the pack:

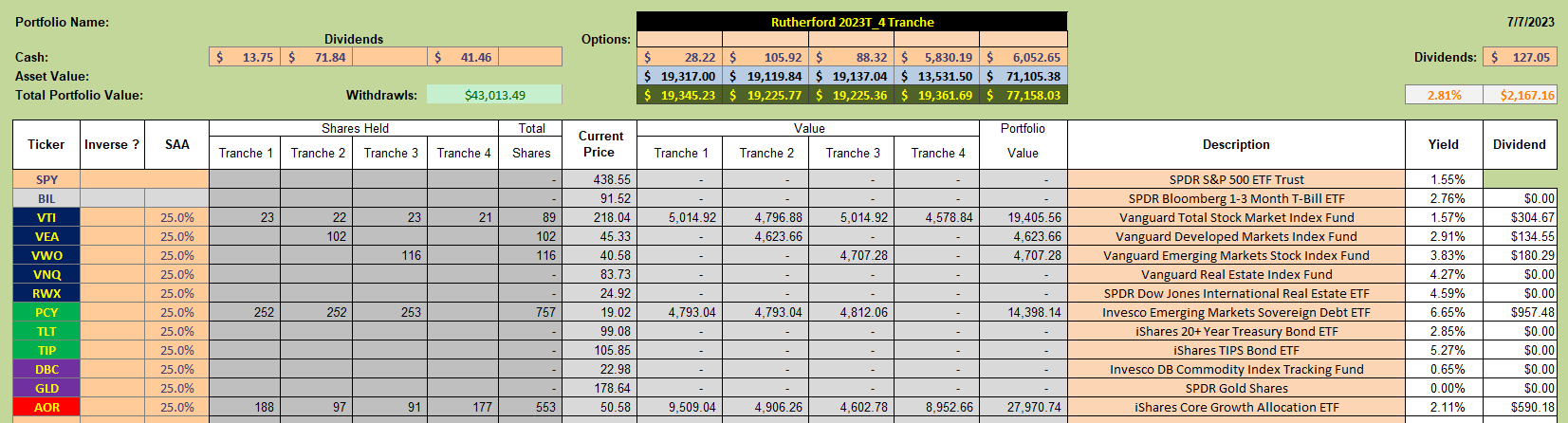

with equities and bonds being represented in the current holdings of the Rutherford Portfolio:

with equities and bonds being represented in the current holdings of the Rutherford Portfolio:

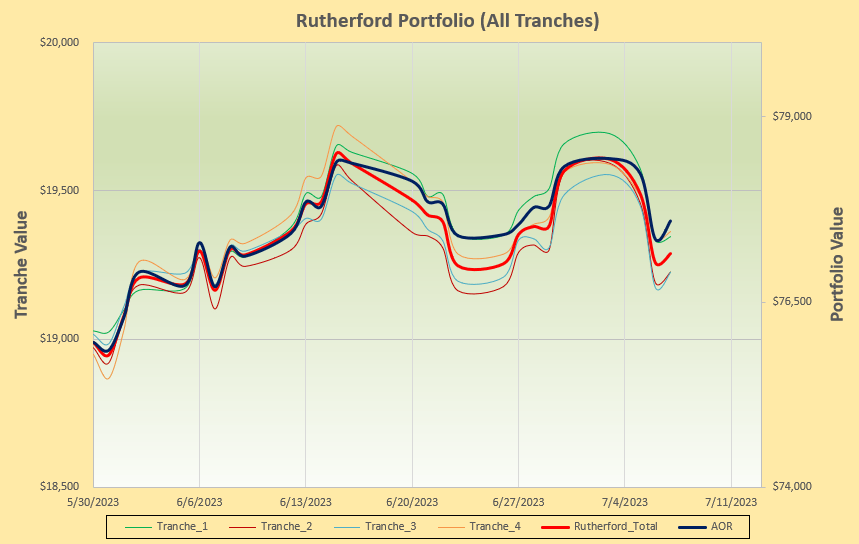

This has resulted in performance looking like this:

This has resulted in performance looking like this:

… or little progress over the past month since moving to a 4-tranche portfolio managed using a momentum rotationsystem. However, this performance mirrors that of the benchmark AOR fund over the same period.

… or little progress over the past month since moving to a 4-tranche portfolio managed using a momentum rotationsystem. However, this performance mirrors that of the benchmark AOR fund over the same period.

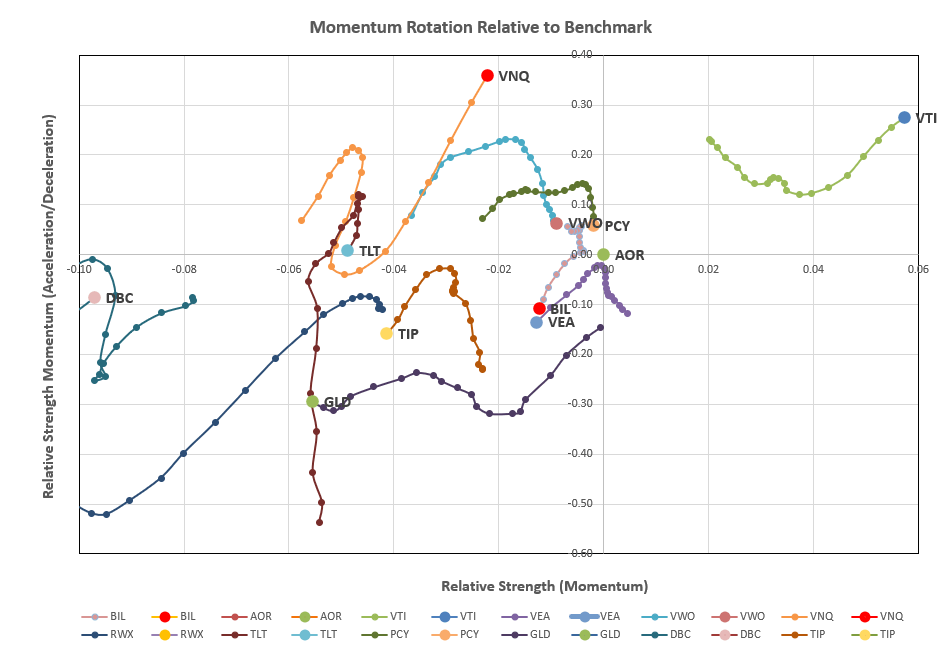

Checking on current rotation graphs:

we note that only US equities (VTI) is clearly showing stronger momentum than other asset classes relative to the benchmark.

we note that only US equities (VTI) is clearly showing stronger momentum than other asset classes relative to the benchmark.

It is therefore not surprising to see VTI and AOR as the only assets with Buy or Hold recommendations in the Tranche spreadsheet:

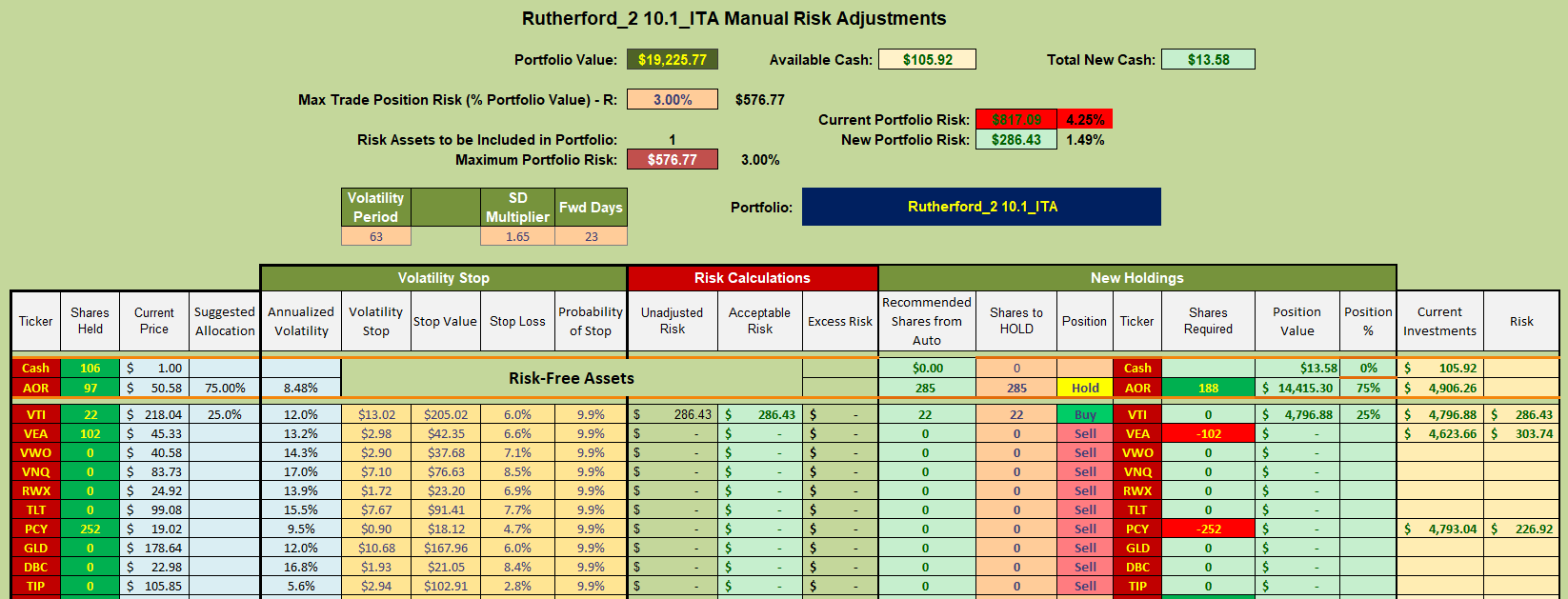

Adjustments to Tranche 2 (the focus of this week’s review) will therefore look like this:

Adjustments to Tranche 2 (the focus of this week’s review) will therefore look like this:

where holdings in PCY and VEA will be sold and the Cash used to add more shares of the benchmark AOR fund to the portfolio.

where holdings in PCY and VEA will be sold and the Cash used to add more shares of the benchmark AOR fund to the portfolio.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.