Duck Pond, Japanese Gardens, Dunedin, New Zealand

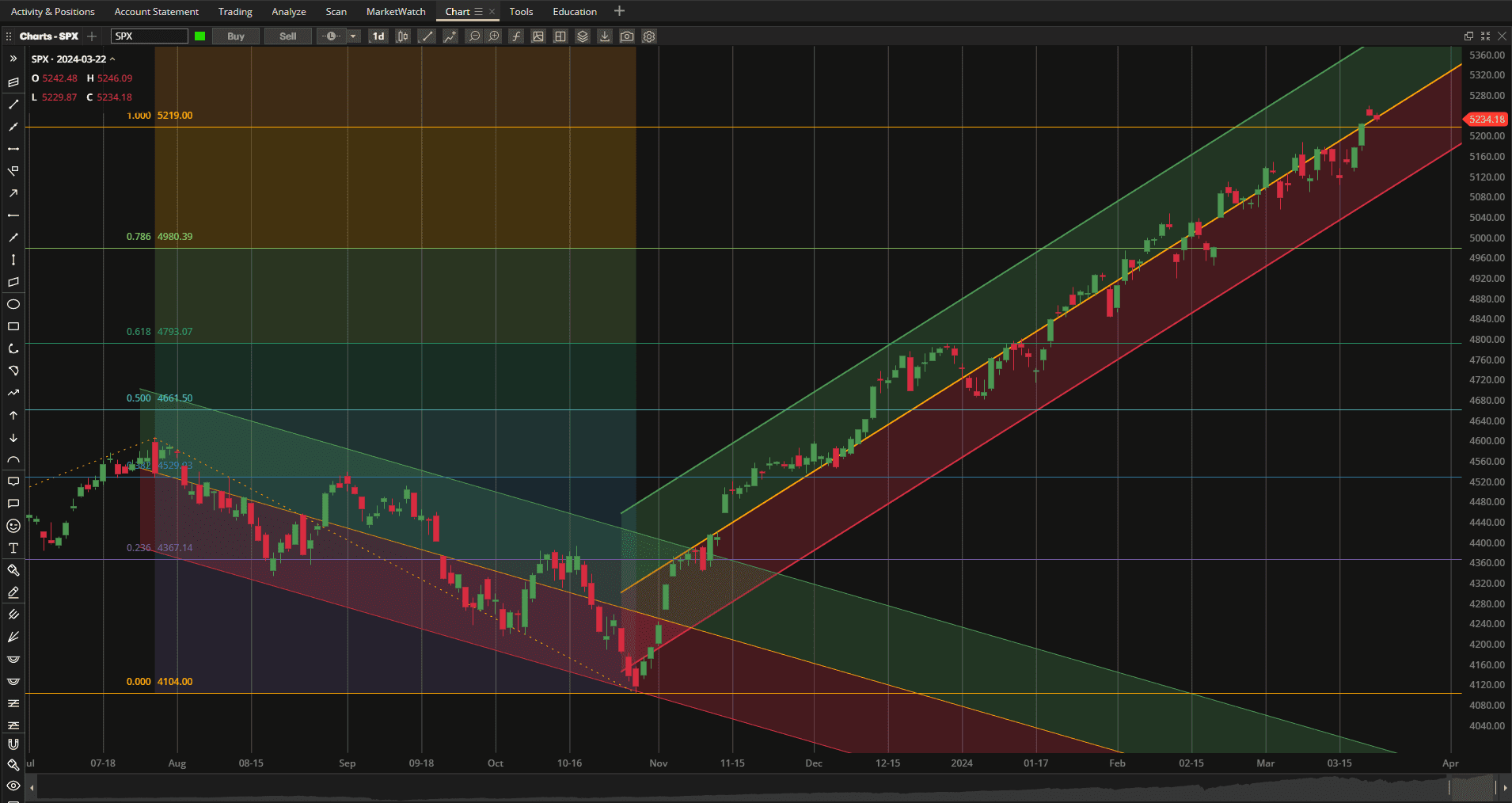

US Equities finally poked their head above the ~5200 resistance level where they have been sitting for the past couple of weeks:

now we wait to see whether we get a continuation of the bullish trend or a pullback to at least the bottom of the channel (that would probably be healthy).

now we wait to see whether we get a continuation of the bullish trend or a pullback to at least the bottom of the channel (that would probably be healthy).

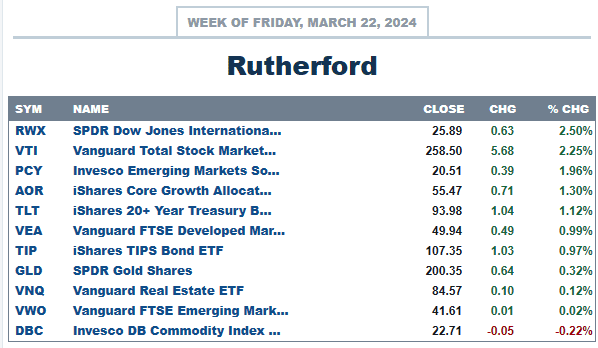

In terms of relative performance, US equities again come out towards the top of the list of major asset classes:

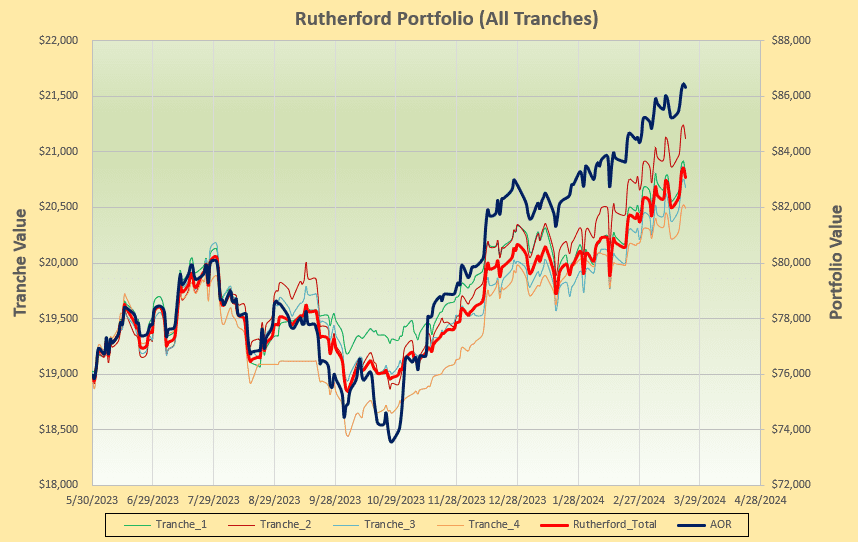

with the performance of the Rutherford Portfolio looking like this:

with the performance of the Rutherford Portfolio looking like this:

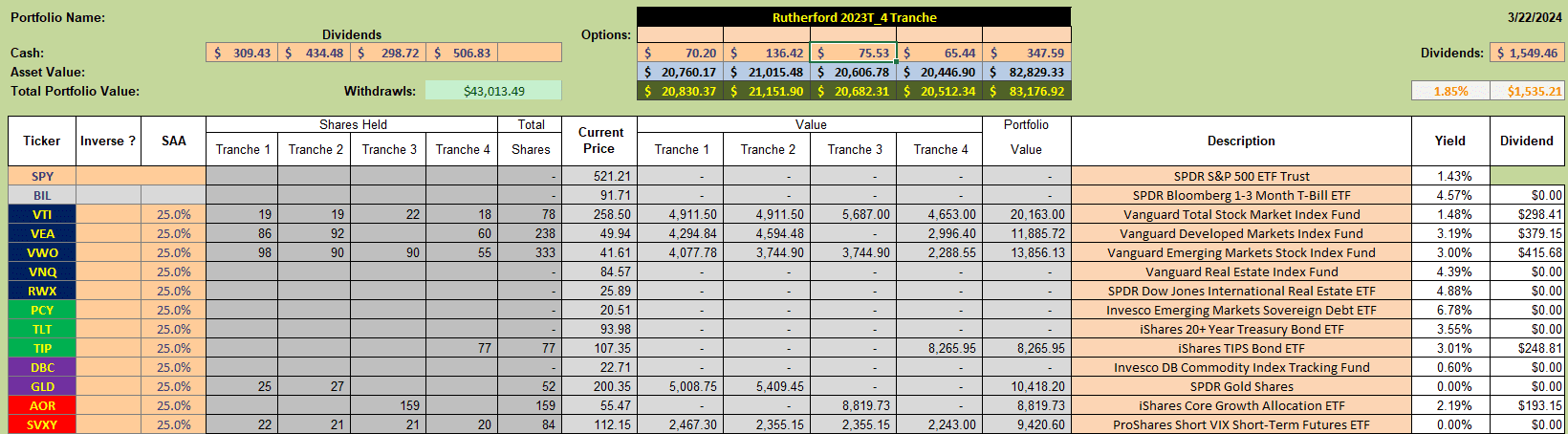

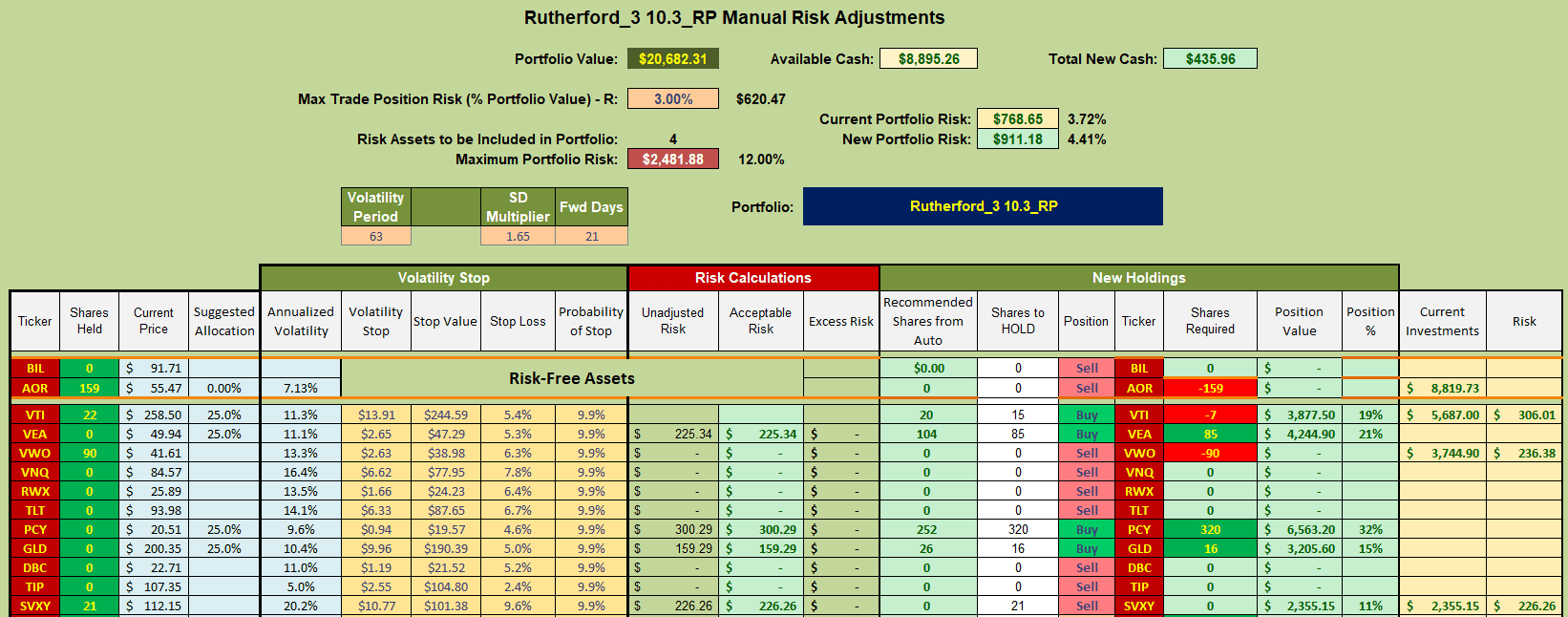

Current holdings in the Rutherford Portfolio are shown in the following screenshot:

Current holdings in the Rutherford Portfolio are shown in the following screenshot:

still favoring the equity markets but with a bit of a buffer from bonds within the benchmark AOR fund that is being held in Tranche 3 (the focus of this week’s review).

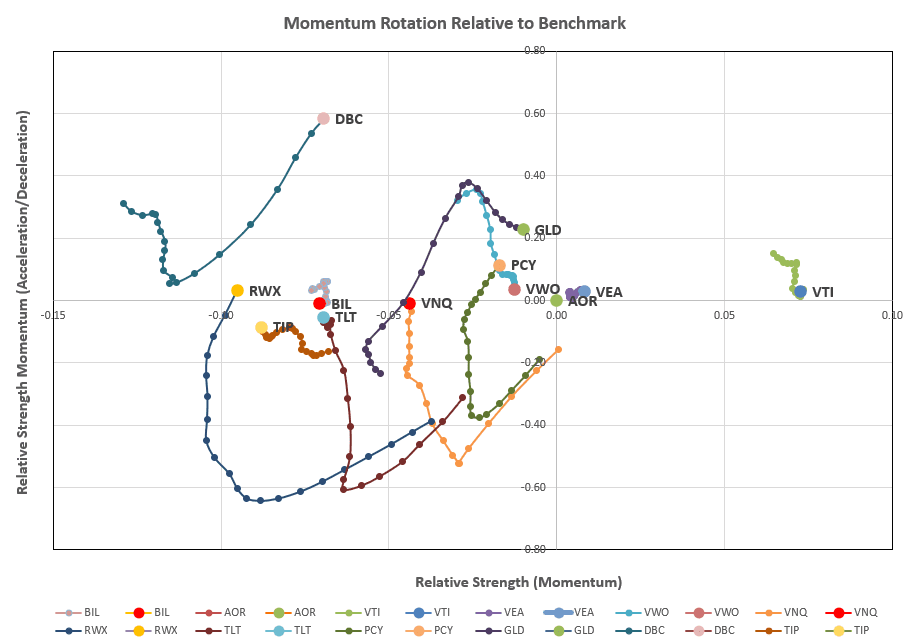

Checking the rotation graphs:

as in previous weeks, we still only see VTI (US Equities) in that desirable top right quadrant.

as in previous weeks, we still only see VTI (US Equities) in that desirable top right quadrant.

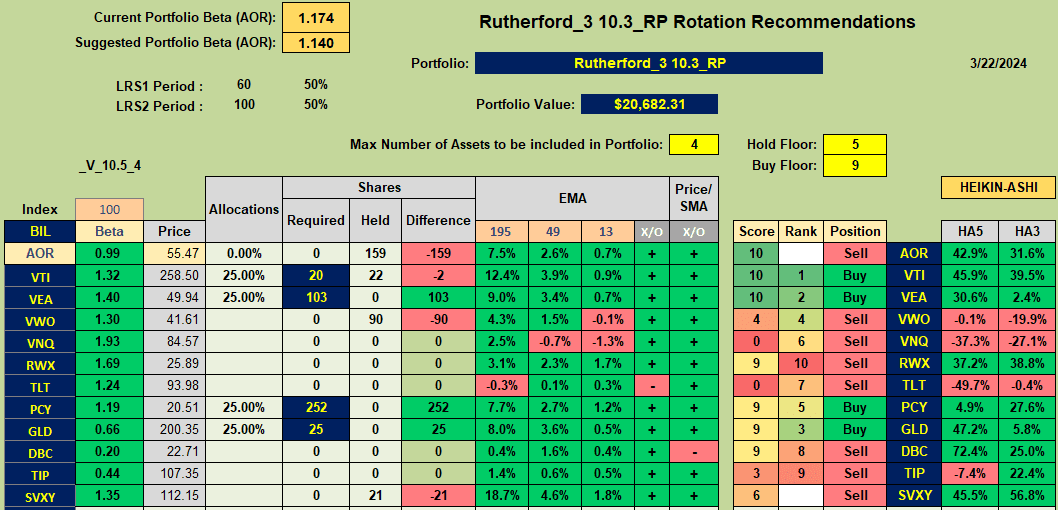

Recommendations from the rotation model look like this:

with Buy recommendations for US and Developed Market Equities (VTI and VEA), International Bonds (PCY) and Gold (GLD).

with Buy recommendations for US and Developed Market Equities (VTI and VEA), International Bonds (PCY) and Gold (GLD).

Following these recommendations, a few adjustments are called for this week:

and I shall be selling holdings in Emerging Market Equities (VWO) and the benchmark AOR Fund and using the funds generated to add positions in Developed Market Equities (VEA), International Bonds (PCY) and Gold (GLD). These adjustments move this tranche of the portfolio to a slightly more defensive position.

and I shall be selling holdings in Emerging Market Equities (VWO) and the benchmark AOR Fund and using the funds generated to add positions in Developed Market Equities (VEA), International Bonds (PCY) and Gold (GLD). These adjustments move this tranche of the portfolio to a slightly more defensive position.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.