That’s some Tree Frog! – Gardens by the Bay, Singapore

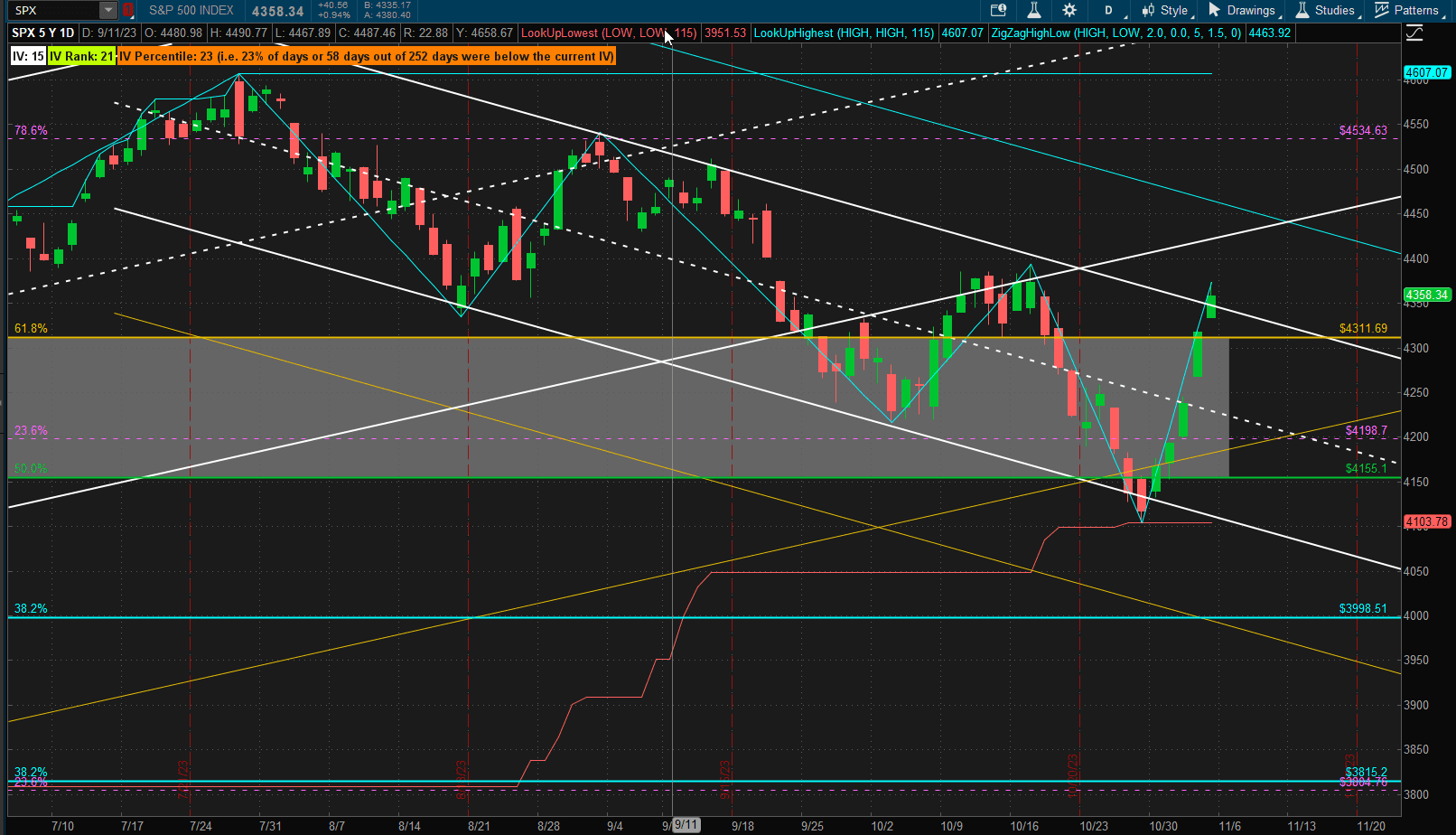

It was a very bullish week in the US Equity markets with the SPX (S&P 500 Index) closing up 5 days in a row and ~6% higher than last week’s close:

We are now sitting at the top of the 1 SD boundary of the shorter-term downtrend channel and back within the 2 SD lower boundary of the longer term uptrend channel – so, basically, in no-man’s land with no clear longer term bias going forward – but I do expect to see hesitation here and at least a small pullback in the downtrend channel.

We are now sitting at the top of the 1 SD boundary of the shorter-term downtrend channel and back within the 2 SD lower boundary of the longer term uptrend channel – so, basically, in no-man’s land with no clear longer term bias going forward – but I do expect to see hesitation here and at least a small pullback in the downtrend channel.

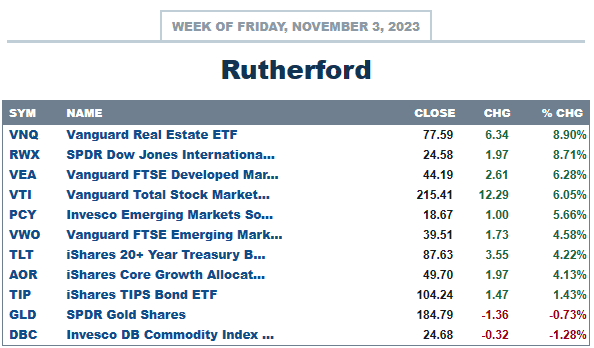

Compared to other major asset classes:

equities performed well, although were beaten out of the top spots by Real Estate. Commodities and Gold lost out on the enthusiasm.

equities performed well, although were beaten out of the top spots by Real Estate. Commodities and Gold lost out on the enthusiasm.

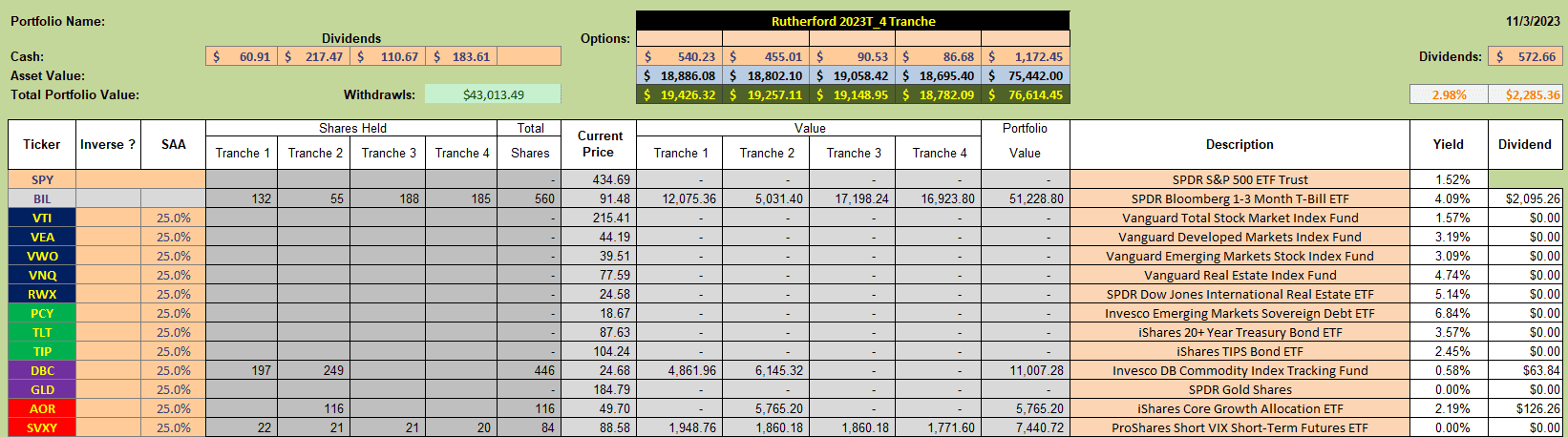

Since the Rutherford Portfolio is not holding equities at present, and is holding significant (~60%) Cash or short term T-Notes:

the portfolio did not benefit from the bounce:

the portfolio did not benefit from the bounce:

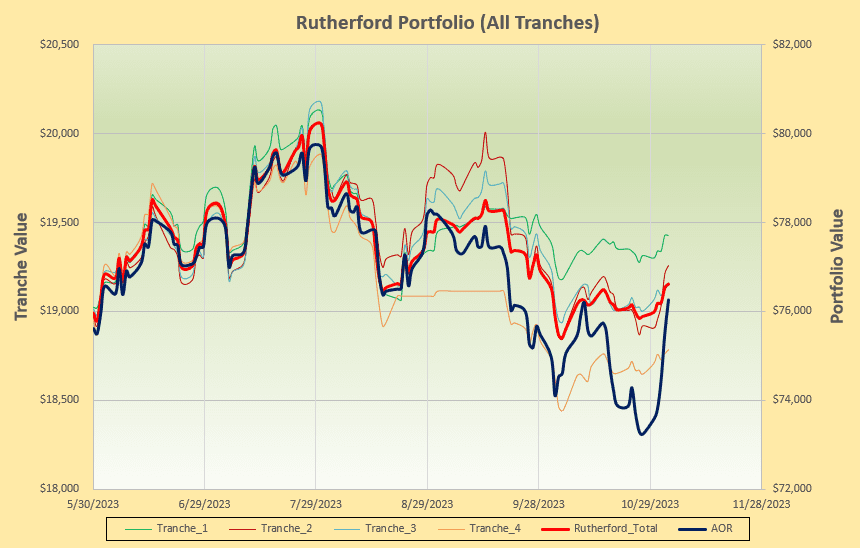

allowing the benchmark AOR fund to catch up quickly to the more conservative holdings in the portfolio. However, the portfolio remains slightly ahead of the benchmark and has not had to weather the volatility of the past month.

allowing the benchmark AOR fund to catch up quickly to the more conservative holdings in the portfolio. However, the portfolio remains slightly ahead of the benchmark and has not had to weather the volatility of the past month.

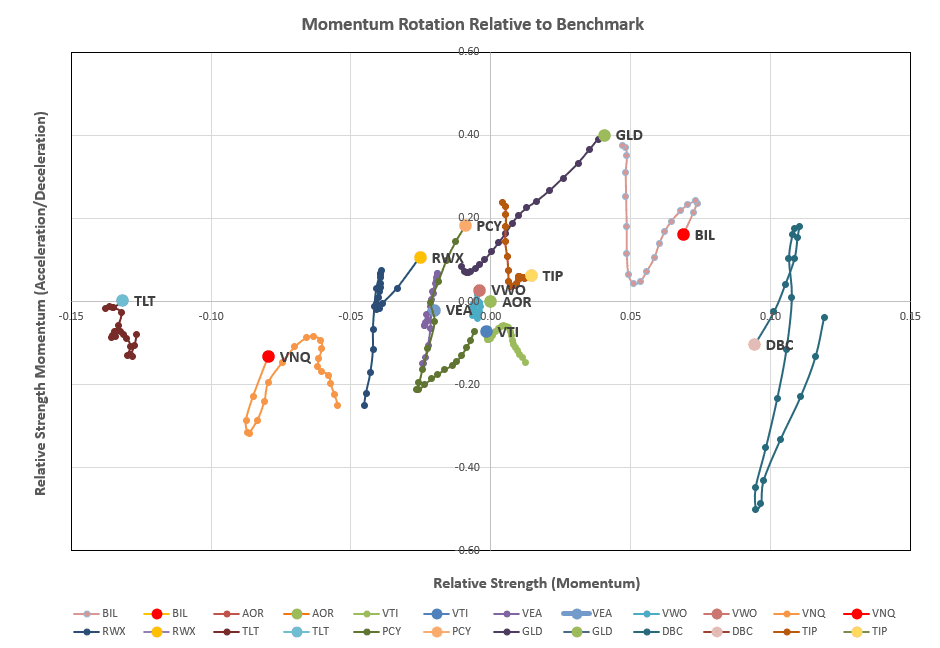

Checking on the rotation graphs for potential adjustments in Tranche 3 (the focus of this weeks review):

we see a relative weakening in Commoditions (DBC) and even in treasuries with Gold (GLD) showing relative strength. This is confirmed in the recommendations from the rotation model:

we see a relative weakening in Commoditions (DBC) and even in treasuries with Gold (GLD) showing relative strength. This is confirmed in the recommendations from the rotation model:

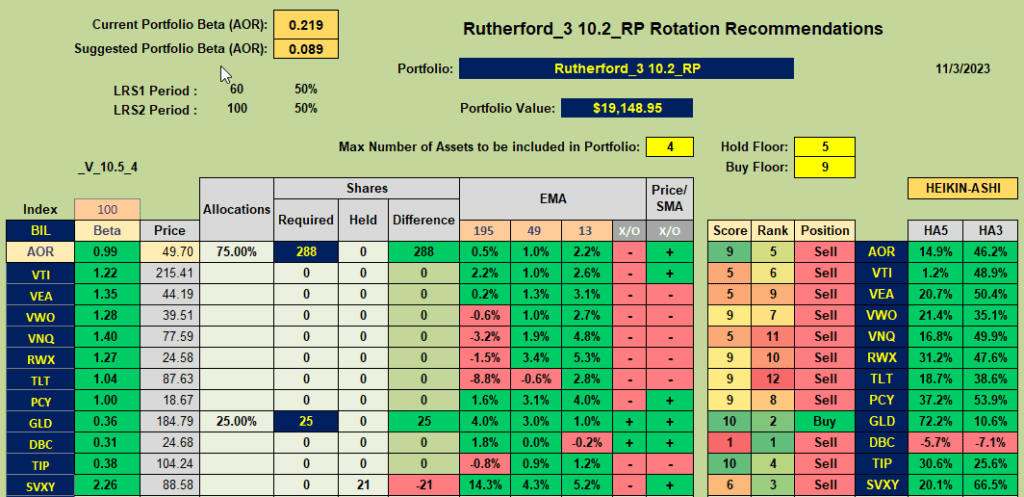

where Buy recommendations for TIP, VNQ and VWO (all with Scores of greater than or equal to 9) are precluded by relative weakness in the EMA numbers.

where Buy recommendations for TIP, VNQ and VWO (all with Scores of greater than or equal to 9) are precluded by relative weakness in the EMA numbers.

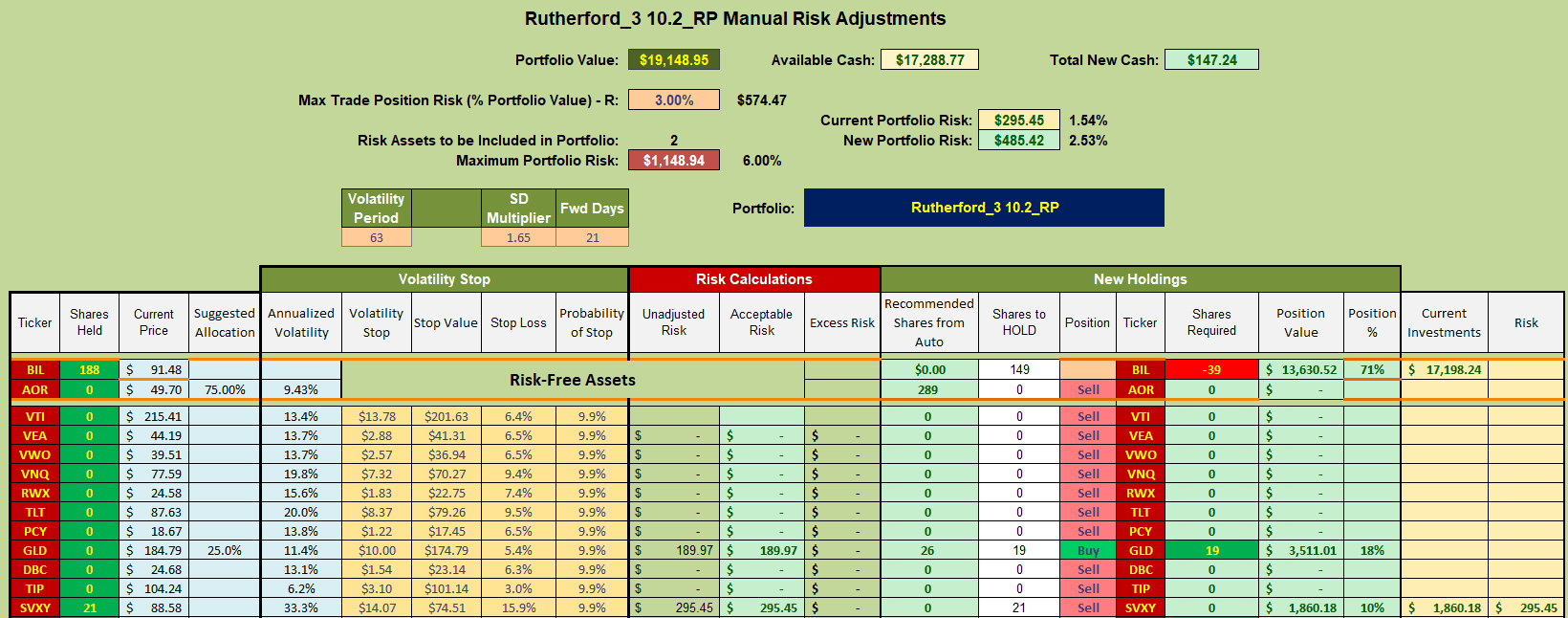

This week’s adjustments will look like this:

with Cash from the sale of T-Notes being used to buy shares in GLD. Still no (direct) equity positions at this point – we’ll see what happens in the next week.

with Cash from the sale of T-Notes being used to buy shares in GLD. Still no (direct) equity positions at this point – we’ll see what happens in the next week.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.