Orchids, Botanic Gardens, Singapore

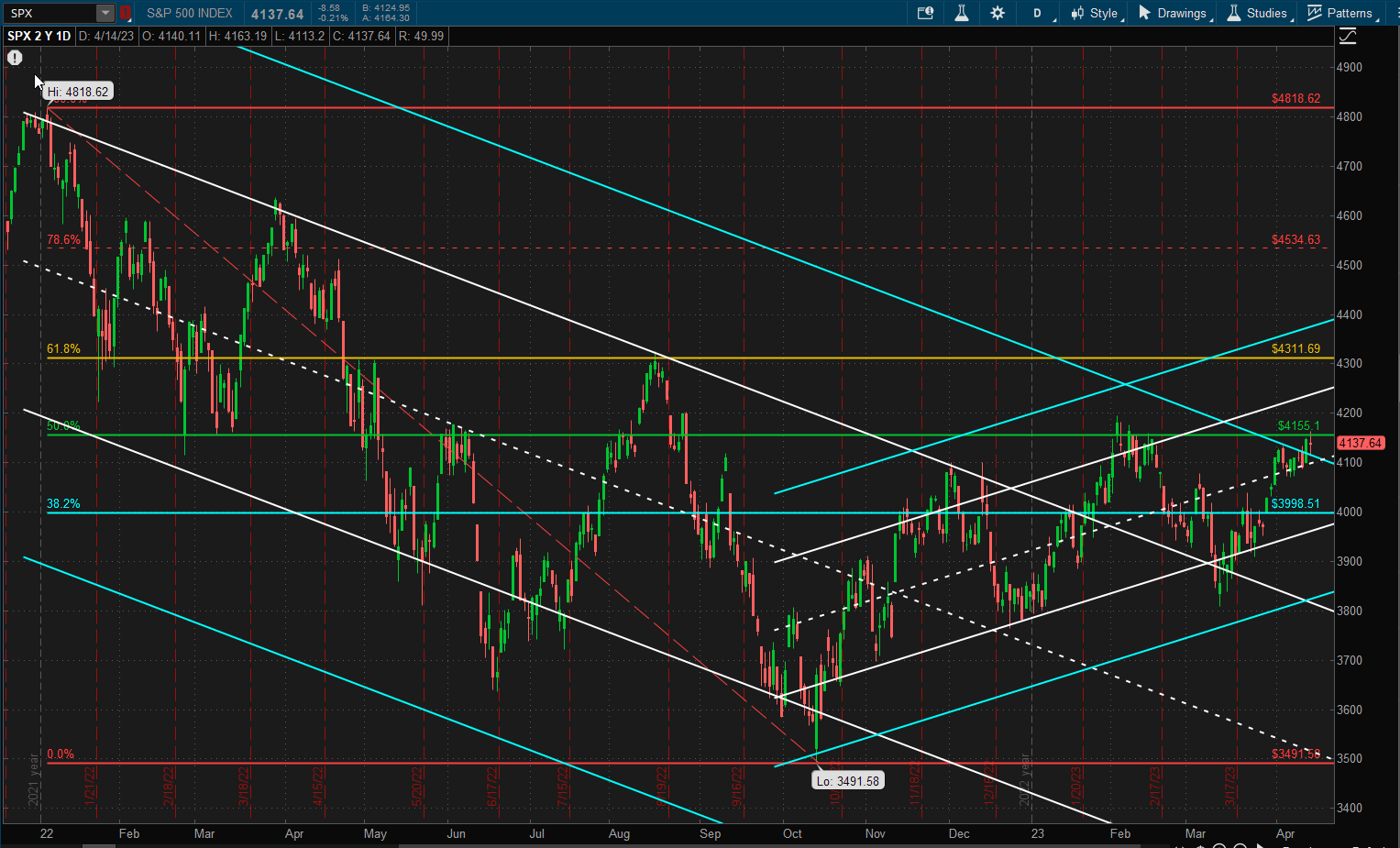

US equities were up ~1% from last week’s close:

and closed just outside the upper 2 SD boundary of the longer term downtrend channel. However, price is at the 50% retracement level of the peak-trough range of this channel that has provided significant support and resistance in the past. We really need to take out the February highs at ~4200 before we can say that we may have a change to a bullish trend.

and closed just outside the upper 2 SD boundary of the longer term downtrend channel. However, price is at the 50% retracement level of the peak-trough range of this channel that has provided significant support and resistance in the past. We really need to take out the February highs at ~4200 before we can say that we may have a change to a bullish trend.

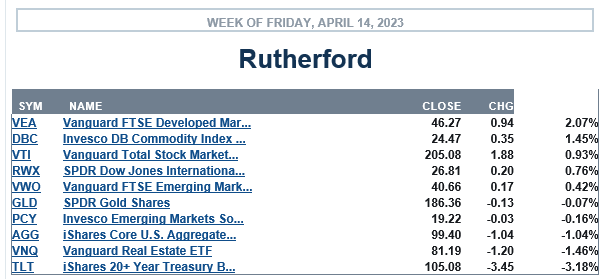

Despite this short-term strength, US equities were out-performed by Developed Market equities:

Long-term US Treasuries were the poorest performing asset class.

Long-term US Treasuries were the poorest performing asset class.

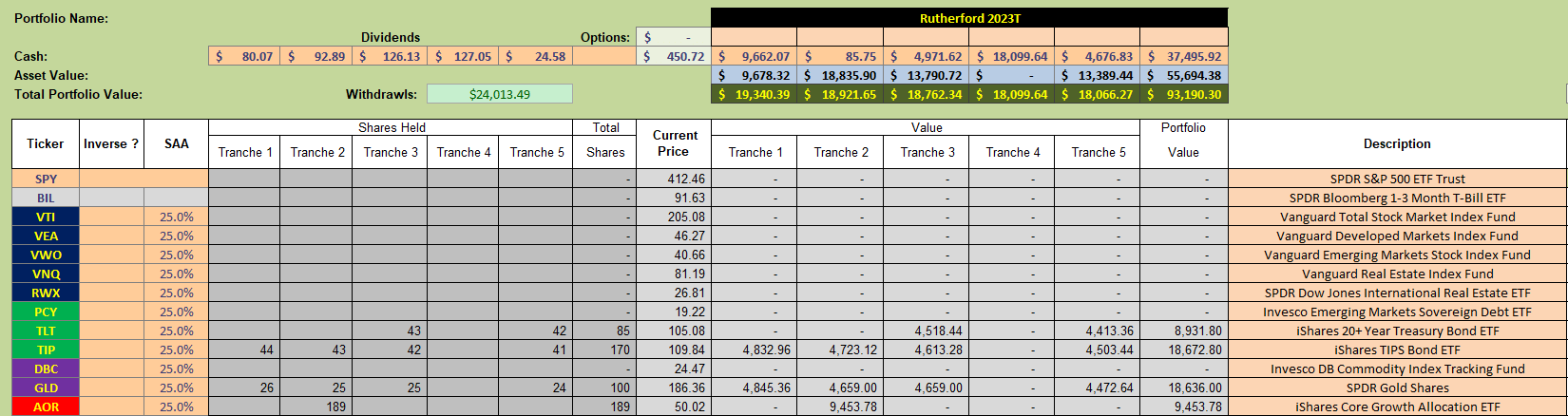

Current holdings in the Rutherford Portfolio look like this:

where we see that Tranche 4 (the focus of this week’s review) is still holding 100% Cash and so has missed out on the recent bounce (review date luck).

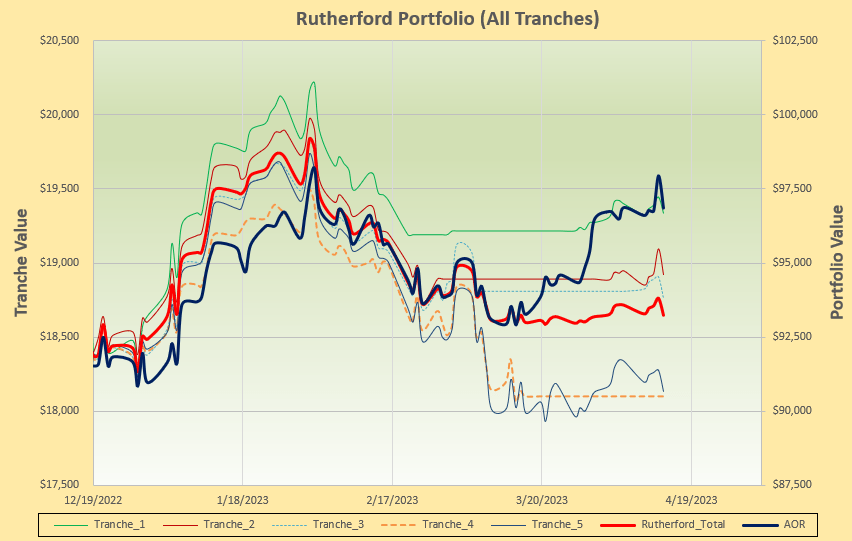

Performance of the portfolio since moving to the rotation model looks like this:

so we are in catch-up mode, albeit with low volatility (risk).

so we are in catch-up mode, albeit with low volatility (risk).

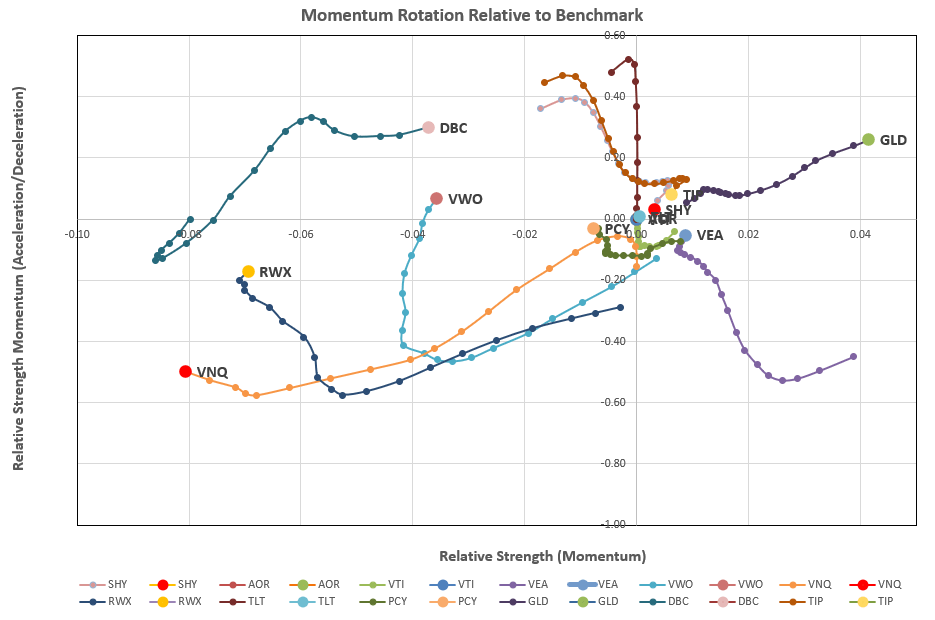

Let’s take a look at this week’s rotation graphs:

where we see Gold (GLD) still looking strong in the preferred top right quadrant.

where we see Gold (GLD) still looking strong in the preferred top right quadrant.

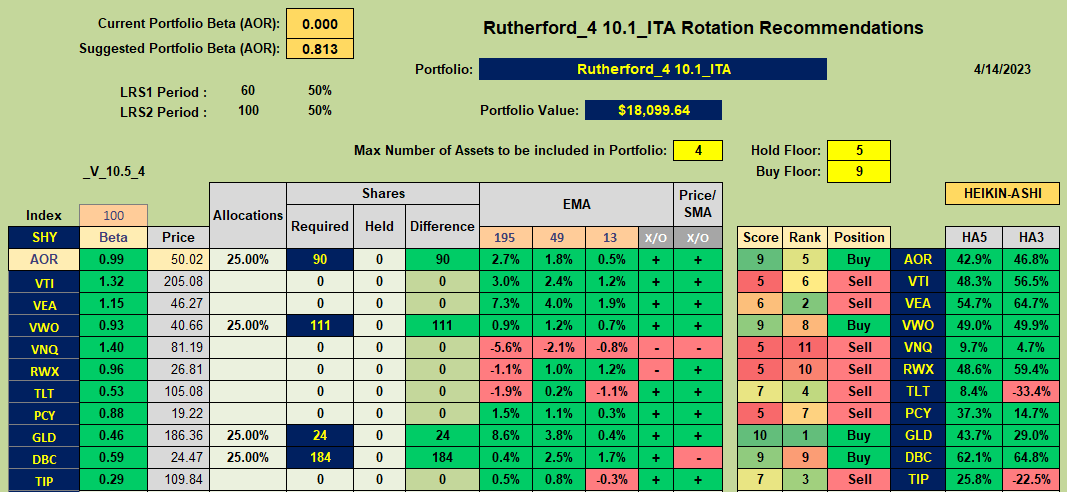

Checking the recommendations:

confirms GLD as the top ranked ETF joined by DBC (Commodities – that also showed strength in the past week), VWO (Emerging Market equities) and AOR (our benchmark equity/bond fund).

confirms GLD as the top ranked ETF joined by DBC (Commodities – that also showed strength in the past week), VWO (Emerging Market equities) and AOR (our benchmark equity/bond fund).

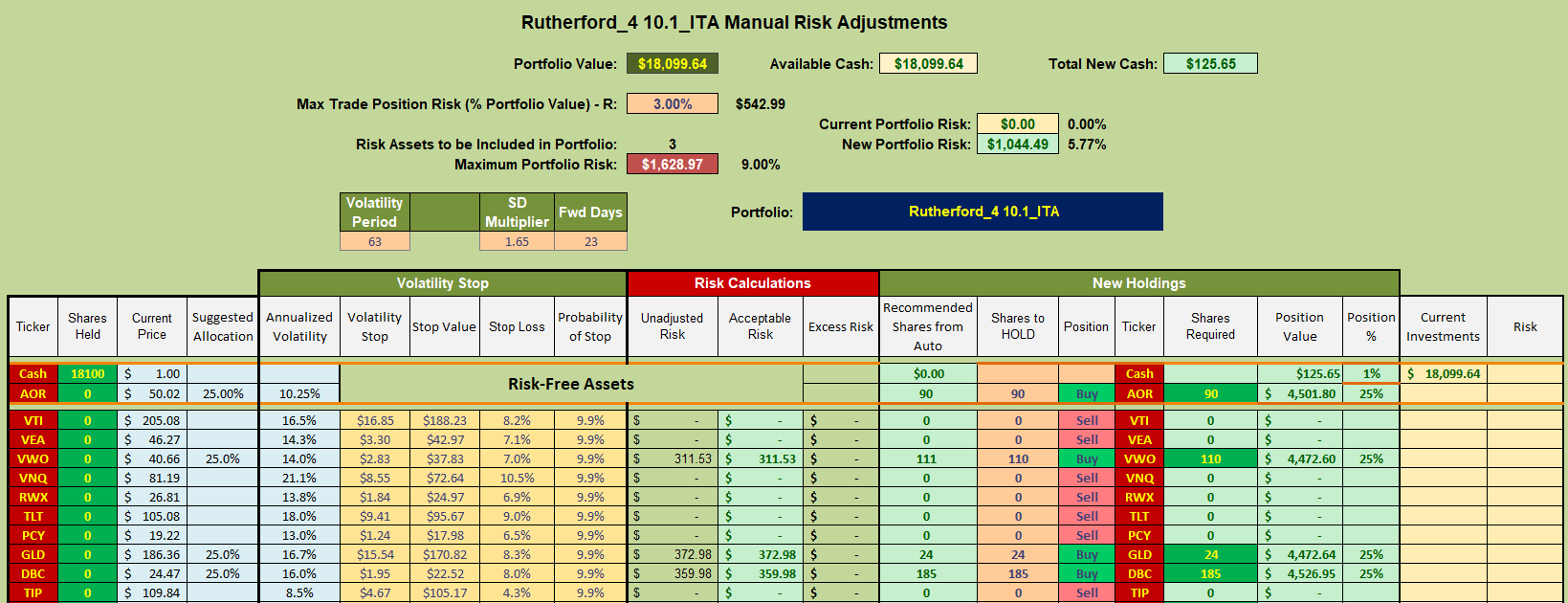

Accordingly I will use the available Cash to allocate to Tranche 4 as shown below:

It is interesting to note that VWO and DBC are recommended Buys rather than VEA. As can be seen from the above rotation chart, VEA has stronger long-term momentum than VWO or DBC (further to the right on the horizontal axis) but the latter 2 ETFs are showing stronger short-term strength (more positive on the vertical axis). This is one reason that I am not convinced that I’ve got the logic quite right for the algorithm that is generating the recommendations. However, in a way, it is similar to Lowell’s BPI model in that it is selecting assets that have been out of favor and are now showing short-term strength – i.e. may be mean-reverting. I am reluctant to play with the algorithm too much/often because it gets me into the dangerous area of data snooping/fitting when I am looking for robustness in the long term – so I need to be a little patient and let it run for a while.

It is interesting to note that VWO and DBC are recommended Buys rather than VEA. As can be seen from the above rotation chart, VEA has stronger long-term momentum than VWO or DBC (further to the right on the horizontal axis) but the latter 2 ETFs are showing stronger short-term strength (more positive on the vertical axis). This is one reason that I am not convinced that I’ve got the logic quite right for the algorithm that is generating the recommendations. However, in a way, it is similar to Lowell’s BPI model in that it is selecting assets that have been out of favor and are now showing short-term strength – i.e. may be mean-reverting. I am reluctant to play with the algorithm too much/often because it gets me into the dangerous area of data snooping/fitting when I am looking for robustness in the long term – so I need to be a little patient and let it run for a while.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.