Lumber at Picton Harbor, New Zealand

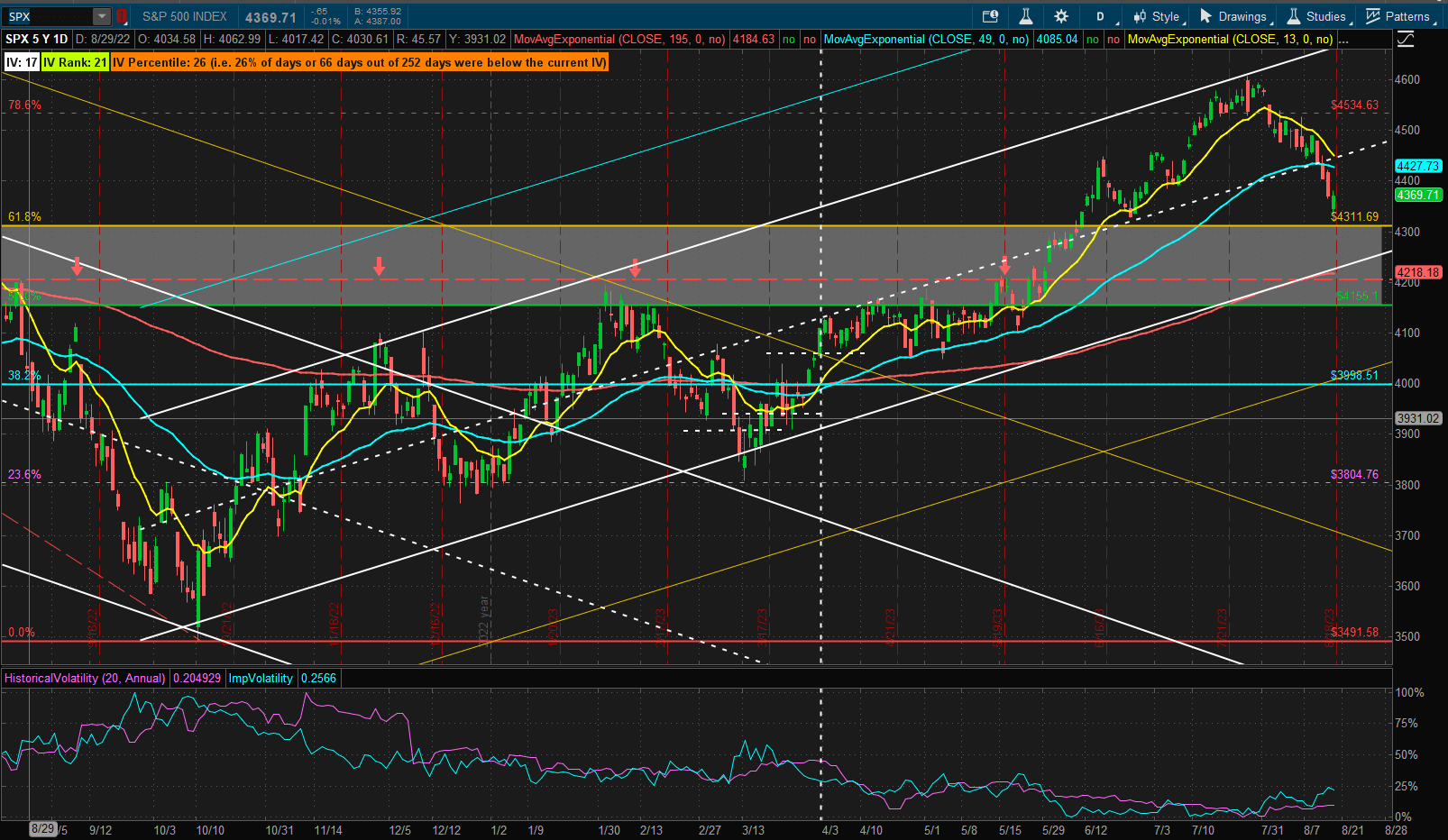

It was another week of poor performance in US equity markets, with a little relief coming later in the day on Friday:

however, we have now crossed below the centre line of the bullish channel, testing the 61.8% Fibonnacci retracement line that could provide support, but may be preparing to test the lower boundary of the channel in the potential support area around 4200 SPX if Friday’s rally is not confirmed in next week’s trading.

however, we have now crossed below the centre line of the bullish channel, testing the 61.8% Fibonnacci retracement line that could provide support, but may be preparing to test the lower boundary of the channel in the potential support area around 4200 SPX if Friday’s rally is not confirmed in next week’s trading.

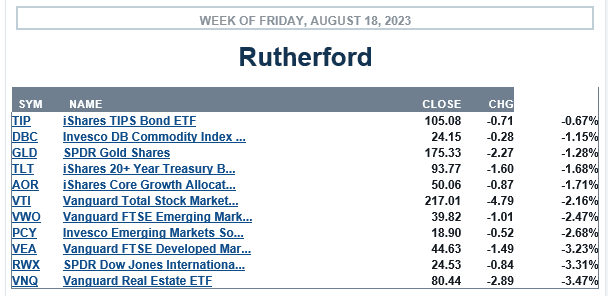

US equities were not the only markets struggling last week:

with no major asset class showing positive gains.

with no major asset class showing positive gains.

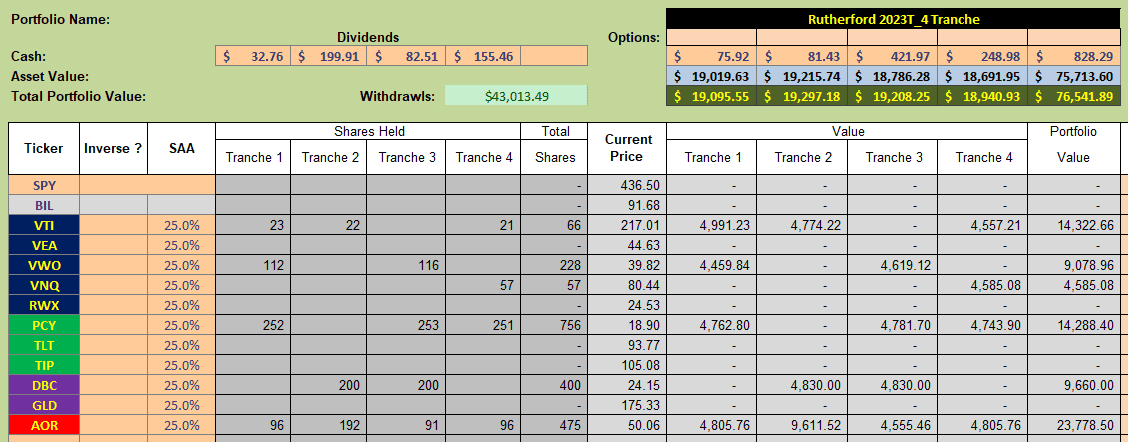

Current holdings in the Rutherford portfolio look like this (sorry for the lack of ticker descriptions but Yahoo is not behaving well again 🙂 ):

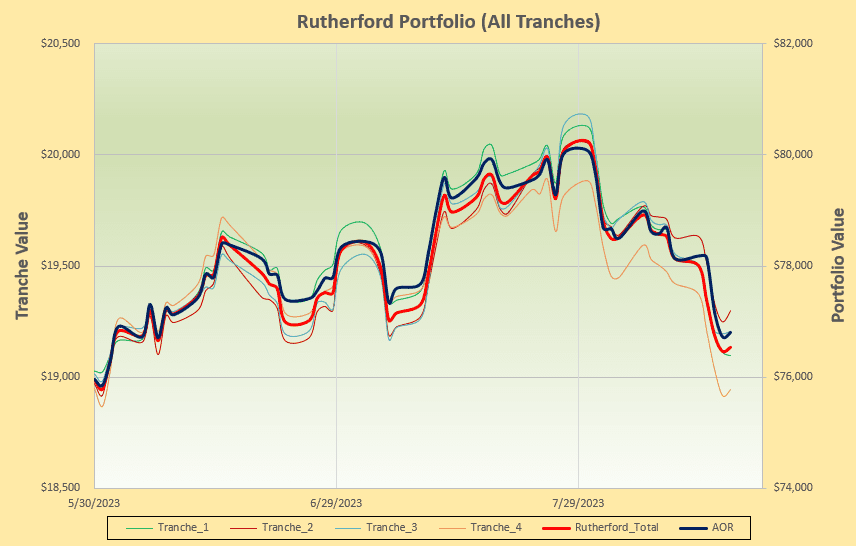

and performance is looking like this:

and performance is looking like this:

reflecting the lack of positive performers.

reflecting the lack of positive performers.

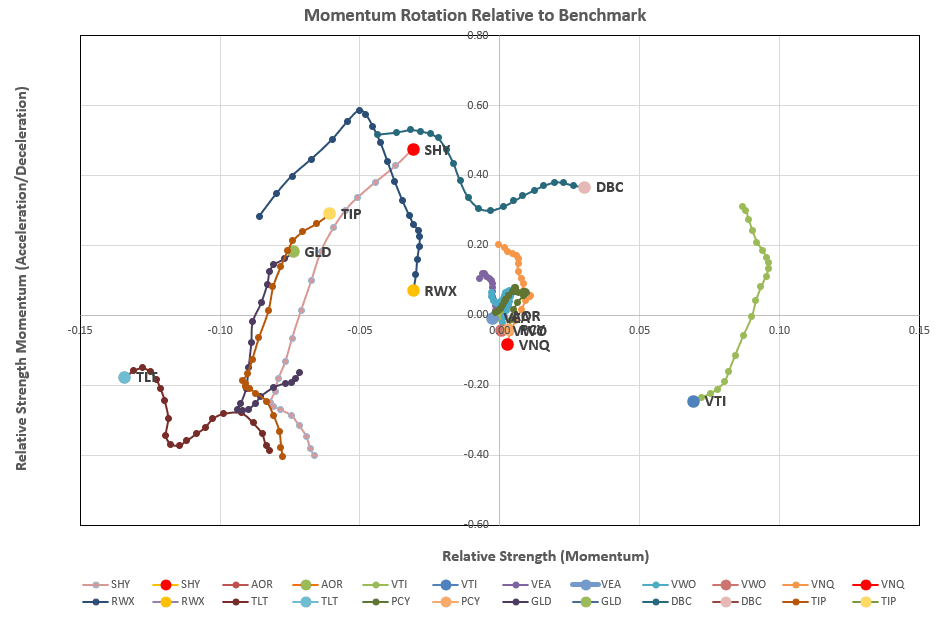

This leads us to check the rotation graphs:

where, with the possible exception of DBC (Commodities), things are not looking good.

where, with the possible exception of DBC (Commodities), things are not looking good.

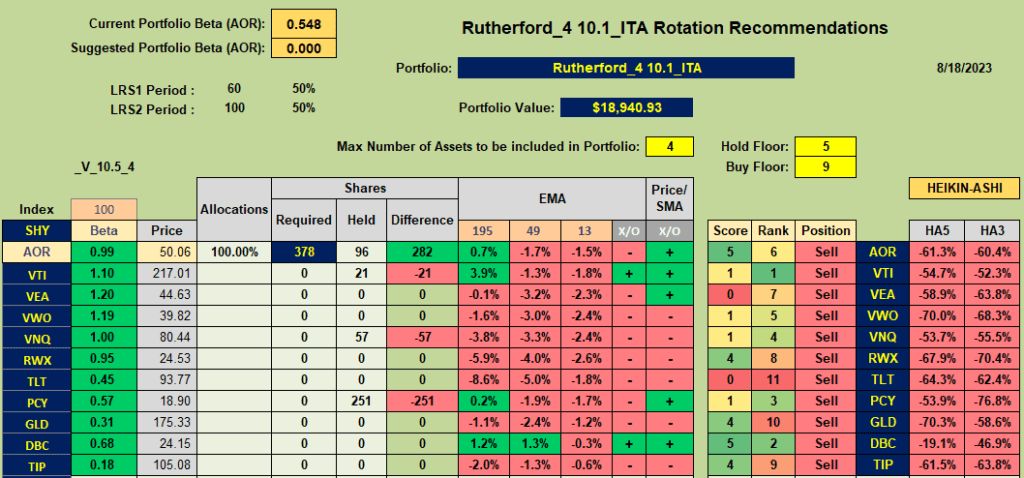

Taking a look at the spreadsheet recommendations:

we see a depressing sea of red with Sell recommendations for all assets – including DBC. Had DBC been held in Tranche 4 (the focus of this week’s review) it would have received a Hold recommendation, but recent weakness does not justify a Buy recommendation. AOR (that is held in Tranche 4) would normally (using other momentum models) also receive a Hold recommendation but, using the current algorithm for the rotation model, the negative cross of the 13/49 EMAs eliminates this and generates the Sell signal.

we see a depressing sea of red with Sell recommendations for all assets – including DBC. Had DBC been held in Tranche 4 (the focus of this week’s review) it would have received a Hold recommendation, but recent weakness does not justify a Buy recommendation. AOR (that is held in Tranche 4) would normally (using other momentum models) also receive a Hold recommendation but, using the current algorithm for the rotation model, the negative cross of the 13/49 EMAs eliminates this and generates the Sell signal.

This may be a little drastic but I shall be selling all holdings in Tranche 4 and moving to 100% Cash. This only affects 25% of the total portfolio at this point.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.