Bali Ha’i awaits you – Indonesia

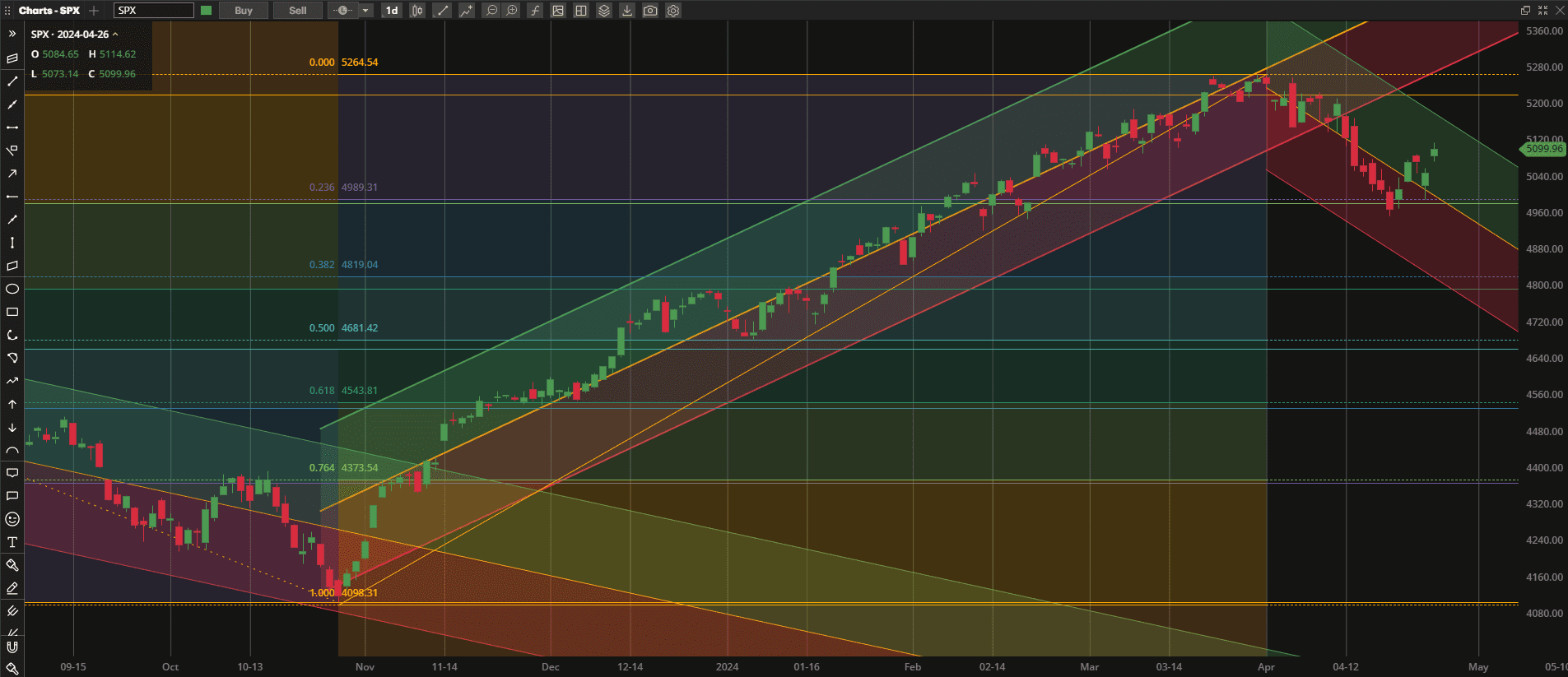

Although US equities closed up ~2.5% from last week’s close it was not a smooth ride – with a bounce from last week’s close early in the week to a retest of the ~5000 support level on Thursday and a jump back up on Friday. We remain in the tentative downtrend channel that started ~1 month ago:

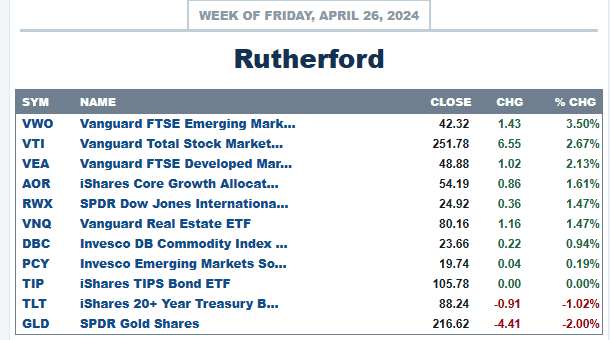

Friday’s strong bounce placed VTI near the top of the weekly performance list for major asset classes:

Friday’s strong bounce placed VTI near the top of the weekly performance list for major asset classes:

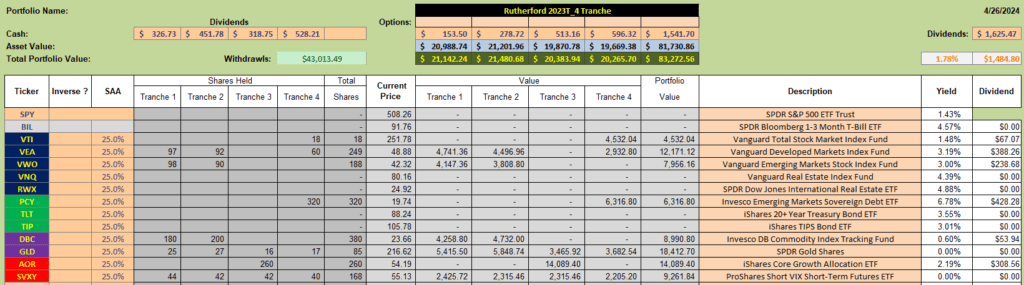

Over the past few weeks we have been rotating out of equities and into more defensive asset classes in the Rutherford Portfolio although the portfolio is probably holding ~50% in equities at the present time (including the equity holdings in the benchmark AOR Fund):

Over the past few weeks we have been rotating out of equities and into more defensive asset classes in the Rutherford Portfolio although the portfolio is probably holding ~50% in equities at the present time (including the equity holdings in the benchmark AOR Fund):

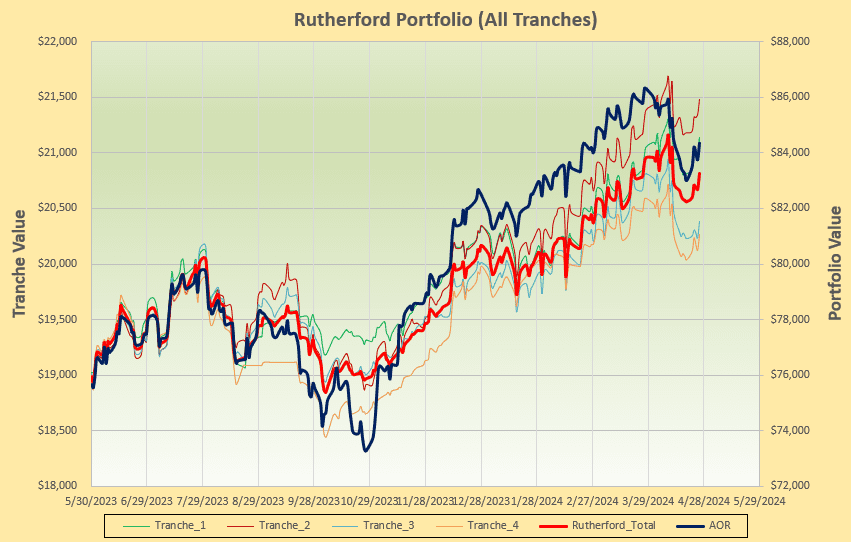

Performance looks like this:

Performance looks like this:

and is closely following that of the benchmark fund.

and is closely following that of the benchmark fund.

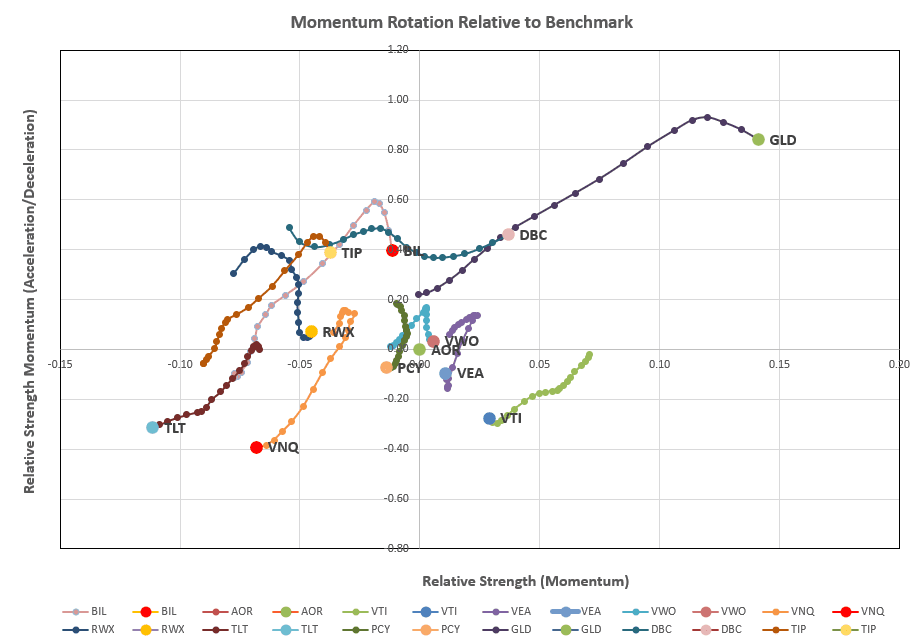

We will check to see whether there are any recommended adjustments to be made in Tranche 4 (the focus of this week’s review) that is the poorest performing tranche to date as a result of review date (timing) luck. First a look at the rotation graphs:

where we see GLD (Gold) and DBC (Commodities) still dominating that desirable top right quadrant.

where we see GLD (Gold) and DBC (Commodities) still dominating that desirable top right quadrant.

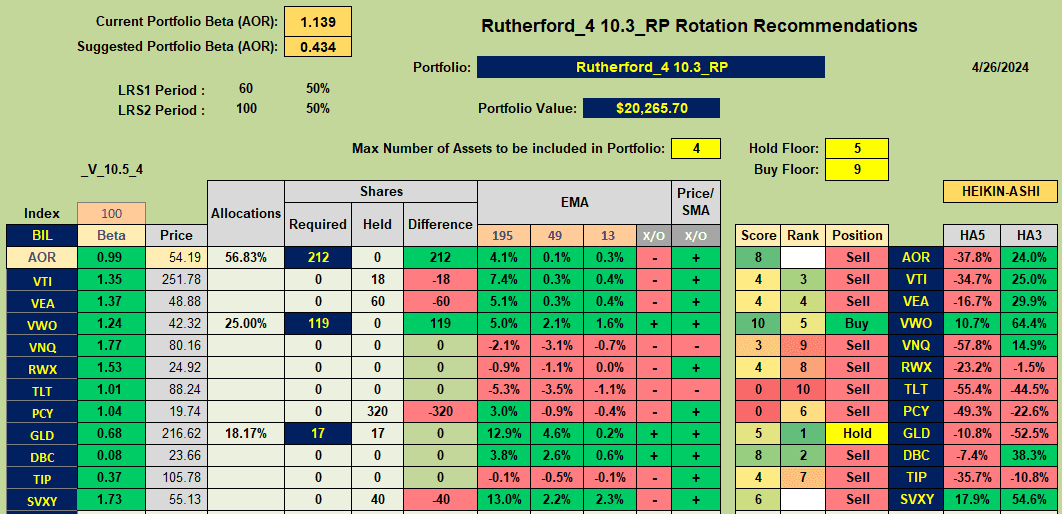

Checking the recommendations from the ranking sheet:

we see a Buy recommendation for VWO (Emerging Market Equities) and a Hold recommendation on GLD. A little surprising perhaps is that there is no Buy recommendation on DBC – although it is close with a Score of 8 (9 is required for a Buy) and only the very short-term HA signal holding us back. This could flip any day from here with a small bounce.

we see a Buy recommendation for VWO (Emerging Market Equities) and a Hold recommendation on GLD. A little surprising perhaps is that there is no Buy recommendation on DBC – although it is close with a Score of 8 (9 is required for a Buy) and only the very short-term HA signal holding us back. This could flip any day from here with a small bounce.

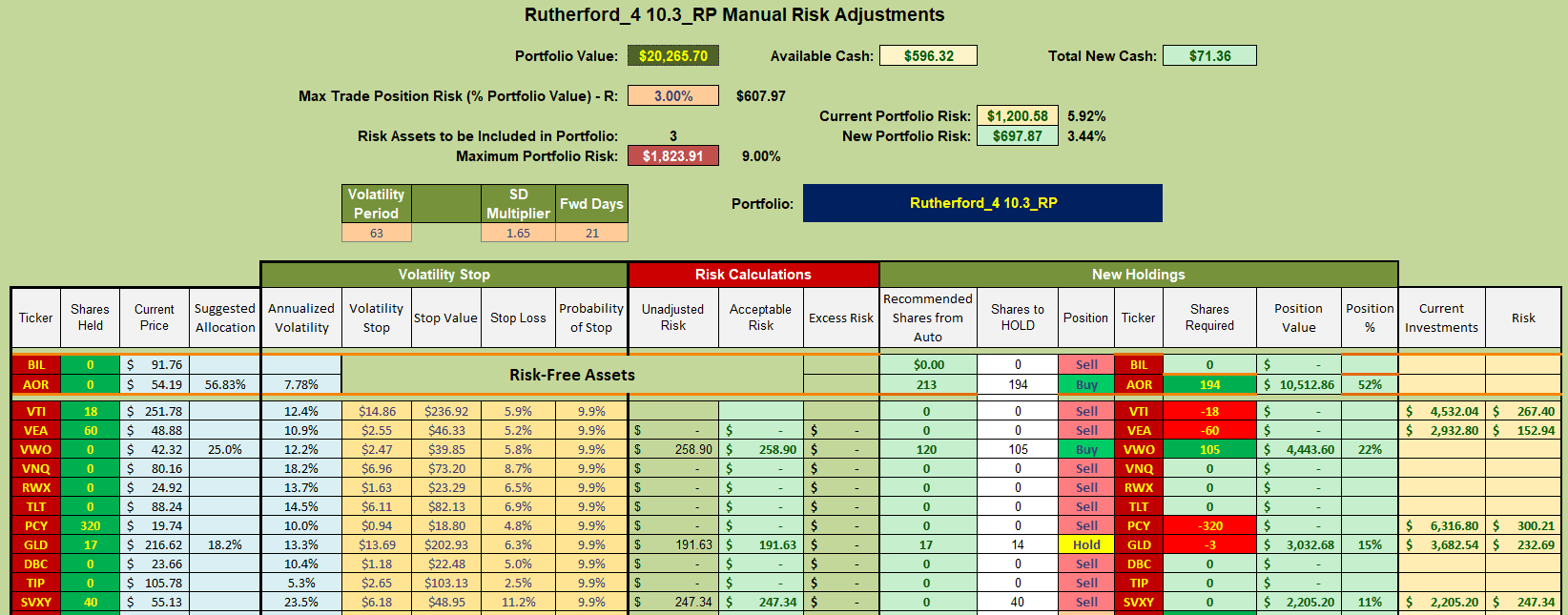

However, I’ll show a little discipline and go with the recommendations such that the adjustments will look something like this:

where I will sell current holdings in VTI, VEA and PCY and use the cash generated to add positions in VWO and AOR. This likely won’t make a huge difference unless there is a geographical shift in where investors decide to place their money.

where I will sell current holdings in VTI, VEA and PCY and use the cash generated to add positions in VWO and AOR. This likely won’t make a huge difference unless there is a geographical shift in where investors decide to place their money.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.