Street Musician

Before delving into the Schrodinger review, SCHA, SCHF and FNDA experienced stock splits of 2 for 1 while FNDX and SCHX split 3 for 1. If you are working with the Investment Account Manager the stock split entry point is Transitions and Global Transaction Activities. I highly recommend this software for serious investors.

Now for the Schrodinger portfolio review. New ITA members need to know the Schrodinger is a computer managed portfolio with Schwab and is referred to as an Intelligent Portfolio. The first $5,000 deposit into this portfolio was at the end of July 2017. With over seven years of experience I have a good idea as to my level of success with Schwab.

Since 7/31/2017 the Internal Rate of Return for the Period is 132.2% while the S&P 500 index returned 122.9%. It is close to a dead heat with the Schrodinger gaining a slight advantage. Not bad for a portfolio where one does nothing except save and add new money to the account. This is truly a passive portfolio.

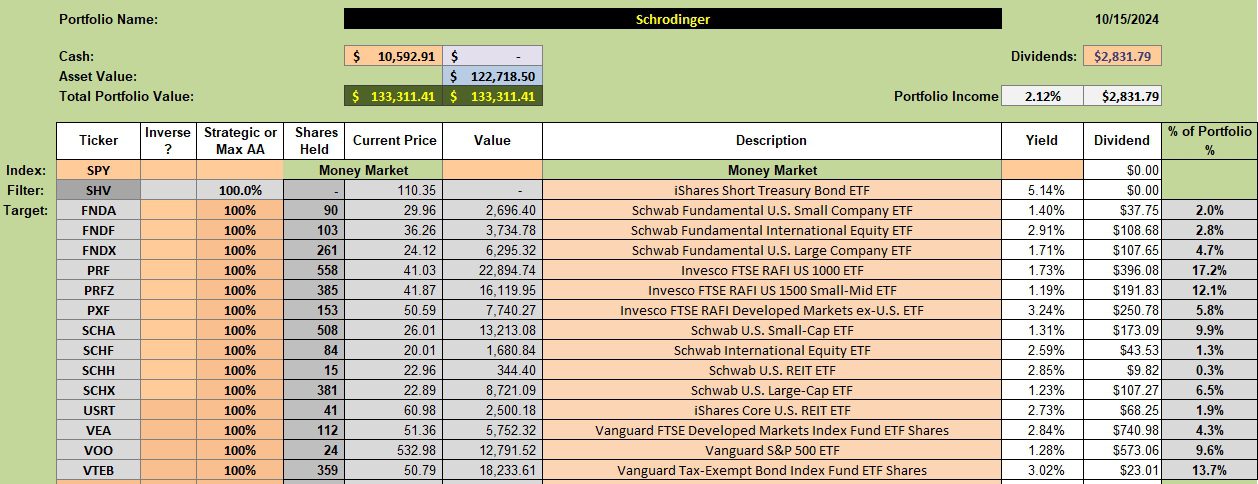

Schrodinger Investment Quiver and Current Holdings

Below is the current Schrodinger portfolio. The Shares Held reflect the latest stock splits. My only criticism of the Schwab Robo Advisor portfolios is the high percentage held in cash and the fact that some holdings are lower than 3% of the portfolio. For example, SCHH does not add value to the Schrodinger. There is no reason to hold such a small percentage in a given ETF.

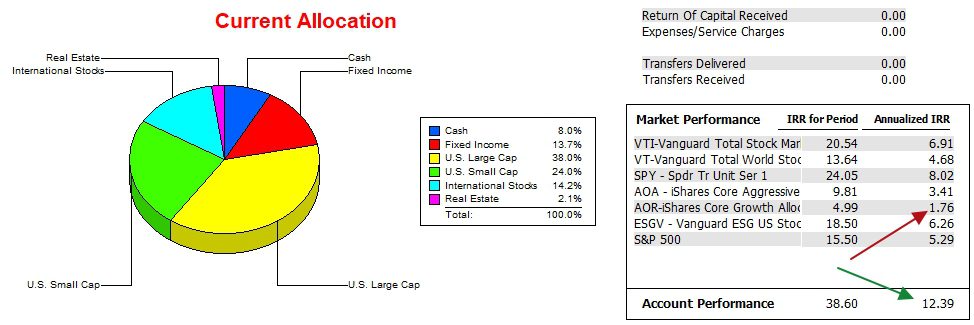

Schrodinger Performance Data

Since 12/31/2021 the Schrodinger has an annualized IRR of 12.4% while the SPY benchmark lags at 8.0%. Note that the SPY ETF is outperforming the S&P 500 index.

Schrodinger Risk Ratios

All risk measurements are positive with the Jensen Alpha improving significantly since October of 2023. The slope of the Jensen is also a very positive signal the portfolio is performing very well.

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Tax efficient Schrodinger has a strong Jensen, beats SPY, which beats S&P 500 . . . . . 🙂 Maybe Schrodinger should be listed with the other benchmarks.

Lee,

When I do relative portfolio comparisons the Schrodinger is one of the benchmarks. Right now the Schrodinger ranks #3 with only the Copernicus and Carson ahead.

Lowell

Lowell, thank you. I am a fan and close follower of your portfolio comparison spreadsheets. 🙂 – Lee

Lee,

I’ll try to remember to update it and post it within a week.

Lowell