“Old” Photograph

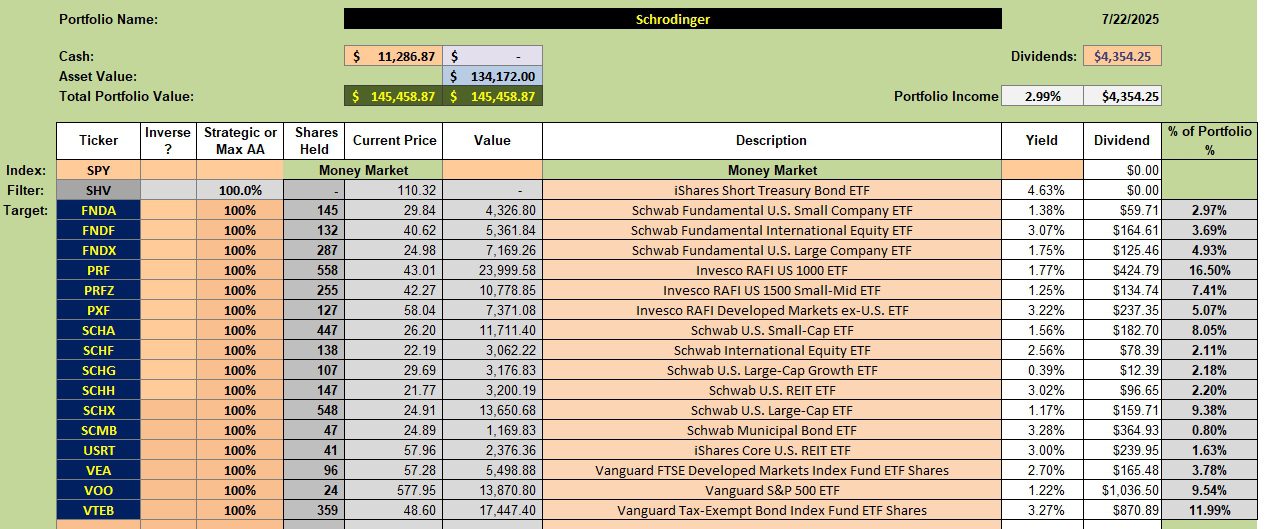

Up for review once more is the Robo Advisor or computer managed Schrodinger. No new shares were recently added despite all the dividends declared for the second quarter. Cash is building to where I expect some purchasing to take place on any market decline.

Schrodinger Asset Allocation

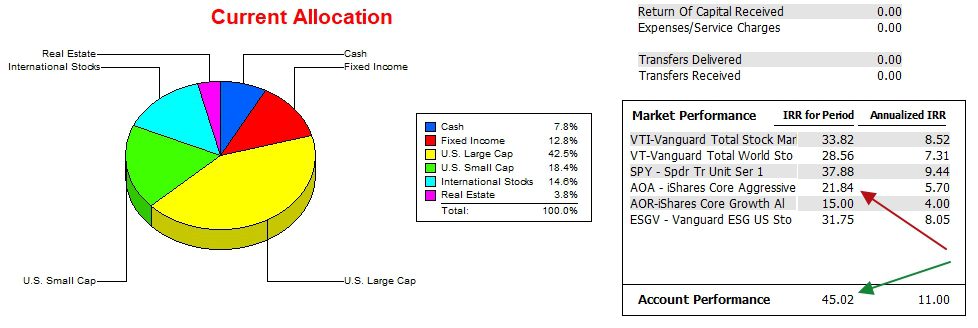

Below is the current asset allocation for the Schrodinger. Cash is up to nearly 8% or approaching a high point. I always have a few questions regarding the portfolio structure. For example, why hold two REITs at such small percentages. Just use one.

Schrodinger Performance Data

Since 12/31/2021 the Schrodinger continues to outperform all six benchmarks I track using the Investment Account Manager software. This “automatic pilot” portfolio is one of the better performing accounts tracked here at ITA Wealth Management.

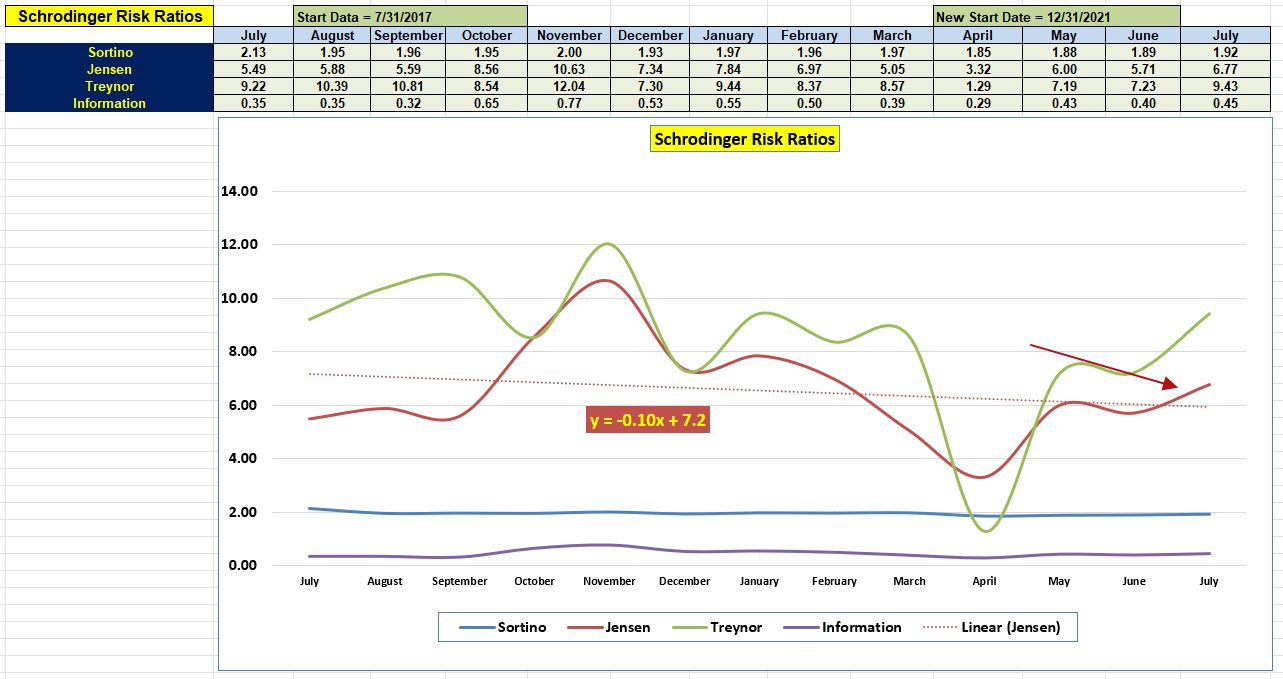

Schrodinger Risk Ratios

While the Jensen Performance Index is off its high from back in November of 2024, it has recovered nicely since the April low. This gain simply reflects a strong equities market. The diversified group of assets is also holding down the risk of this rather aggressive portfolio.

Questions To Ask Your Money Manager

Overall, I continue to be pleased with the performance of the Schrodinger and I highly recommend this management style for those who have little time or interest in keeping track of a portfolio. All one does is save on a regular basis. Last month the owner of this portfolio added another $400 to the cash position.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question