Yosemite National Park

Schrodinger is the lone Robo Advisor portfolio or what Schwab calls, an Intelligent Portfolio. In this review I will go over the current holdings, performance data, and risks involved. ITA readers know that I advocate both security diversification as well as portfolio diversification. In my opinion, every family should hold an Intelligent Portfolio. If the remaining spouse does not have a clue or interest in money management, all investments can be poured into an account such as the Schrodinger and then forget it.

Of the portfolios tracked here at ITA, the Schrodinger consistently ranks among the top quartile.

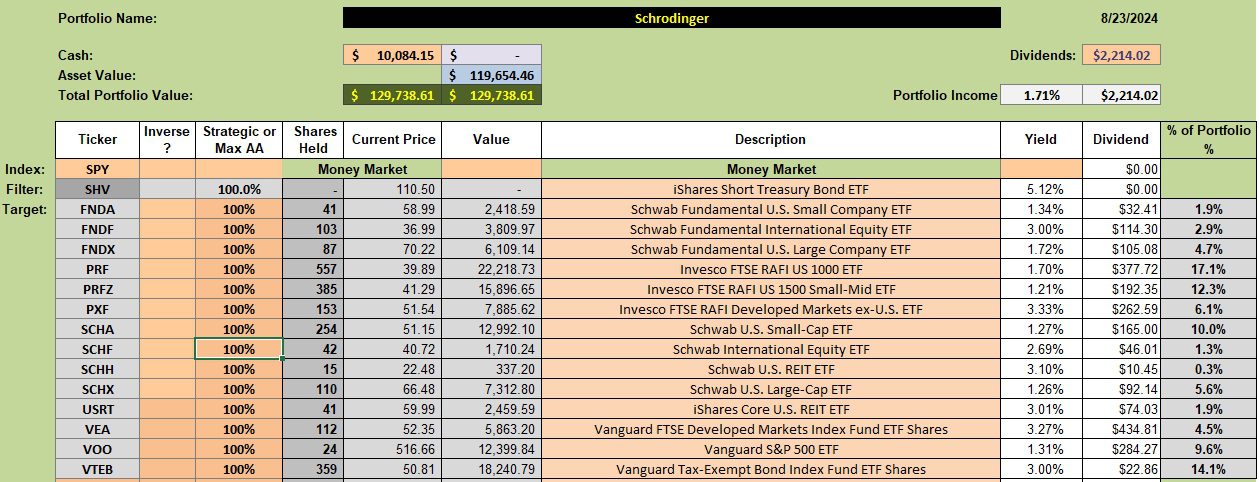

Schrodinger Investment Quiver and Holdings

Below is the investment quiver and holdings for the Schrodinger. With cash this high I expected to see some new investments. It could be that the computer model is waiting for some sort of pull back before more shares are added.

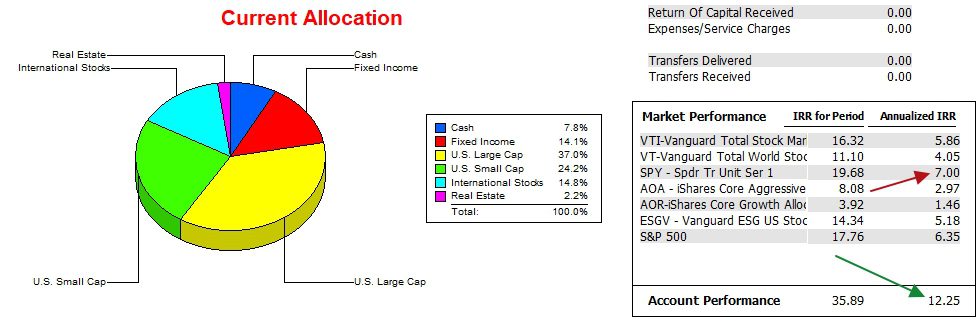

Schrodinger Performance Data

Since 12/31/2021 the Schrodinger has outperformed the SPY benchmark by a wide margin. Over 32 months of data collection the Schrodinger returned 35.9% while the IRR for Period of SPY was a health 19.7%.

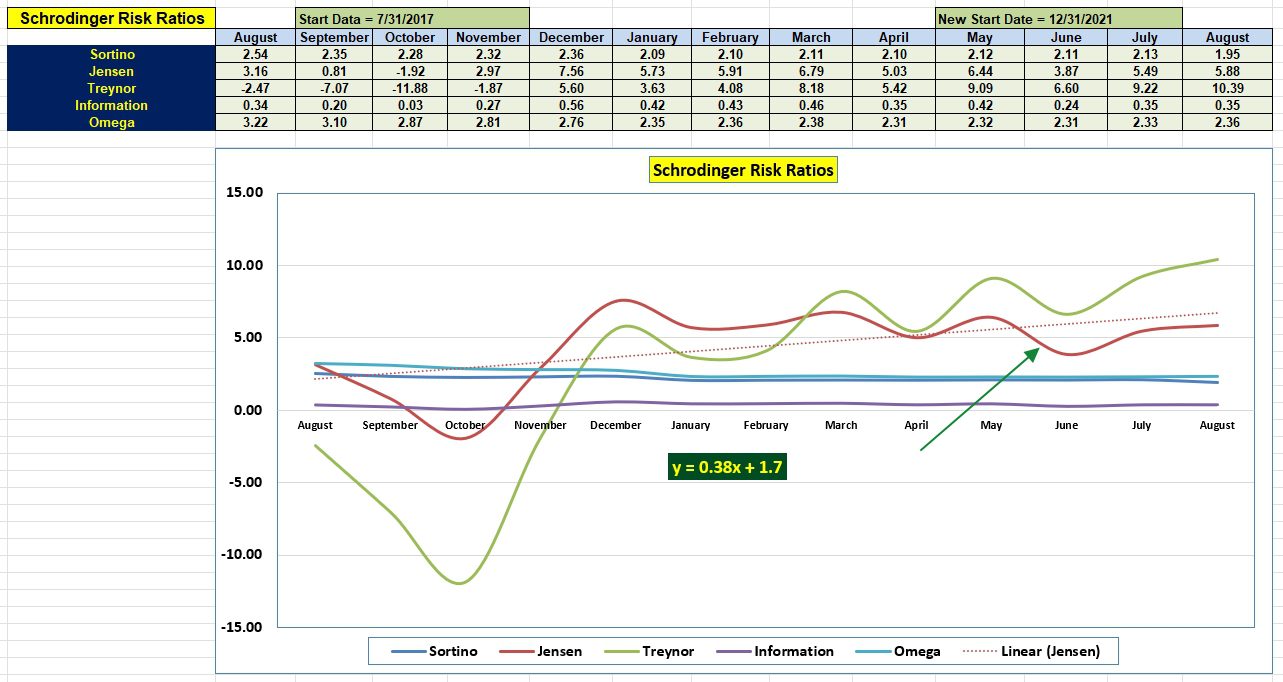

Schrodinger Risk Ratios

Since July the portfolio held even with respect to the benchmark. See the Information Ratio. Risk was reduced a small amount as we conclude from the Jensen Alpha values. Four variables go into the Jensen calculation and one (Risk-Free Treasury Interest Rate) continues to rise placing downward pressure on the Jensen. We will likely see a decline in this rate during the last quarter of 2024.

Another positive signal is the slope of the Jensen (0.38). Overall, the Schrodinger is a healthy portfolio.

If this information is useful, send the URL (https://itawealth.com) on to your friends and relatives.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question