“Forgotten Oregon.” Image made on Sauvie Island, near Portland, OR.

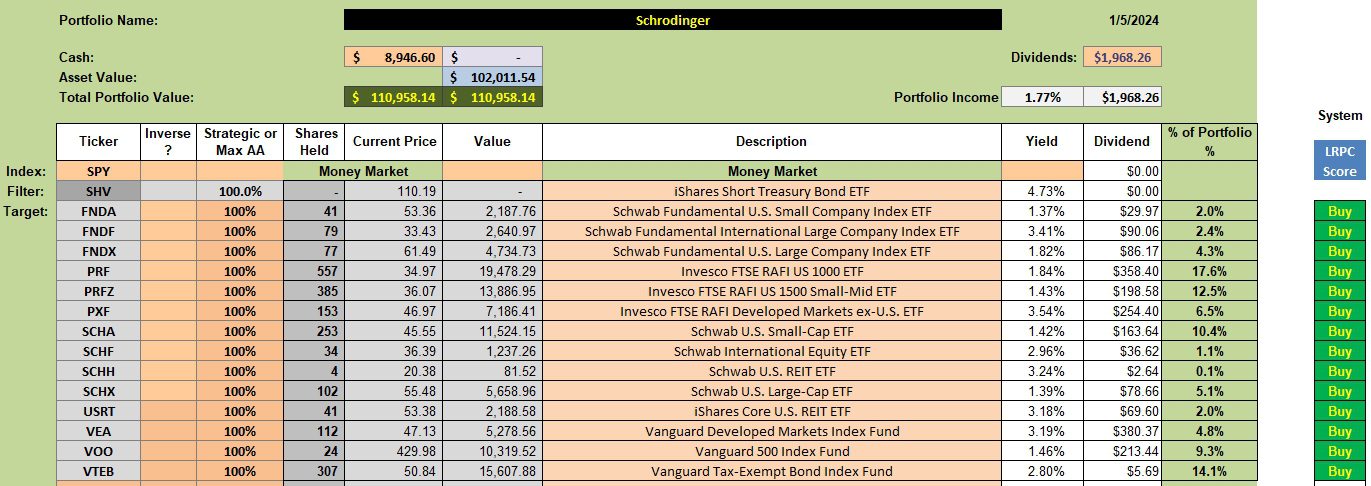

Schrodinger is an excellent portfolio to review on a Monday as no decisions are required. As long-time readers know, the Schrodinger is an Intelligent Portfolio managed by computer algorithms at Schwab. These portfolios are sometimes known as Robo Advisor portfolios. The owner of this portfolio does nothing except add new cash when possible. Computers set up the asset allocation and make all transactions. There is no cost to the investor other than the expense ratios associated with the individual ETFs.

Interested investor might ask – How well has the Schrodinger performed compared to the S&P 500? That question is answered below. The Schrodinger was originally set up about six years ago to answer the question, “Who will manage the family portfolio when I die?” Robo Advisor portfolios is one reasonable answer to that question.

Schrodinger Intelligent Portfolio

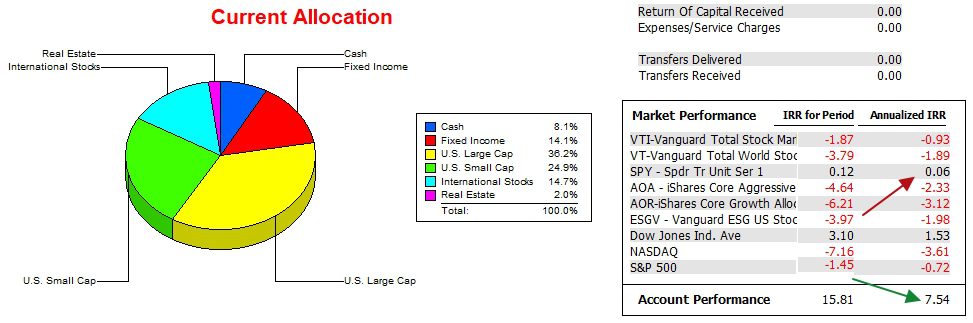

Below is the current asset allocation Schrodinger portfolio. The owner of this portfolio requested a rather aggressive asset allocation. The percentage breakdown is roughly 80% in stocks and 20% in bonds and cash. Schwab holds a higher percentage in cash than I prefer for this type of portfolio. This is how Schwab makes money as they take this cash from all their Intelligent Portfolios and use it as their bank to loan at higher interest rates than they pay the portfolio owner. At least that is my understanding as to why these portfolios carry around 7% to 8% in cash.

Schrodinger Performance Data

Over the past two plus years the Schrodinger has outpaced the SPY benchmark by 7.5 percentage points. That is a significant margin and one that will be difficult to sustain. The following data comes directly from the Investment Account Manager (IAM), a commercial software program.

As I continue to write, serious investors benchmark their portfolios. IAM permits as many as six benchmarks plus three indexes. SPY is a popular benchmark and very appropriate for the Schrodinger.

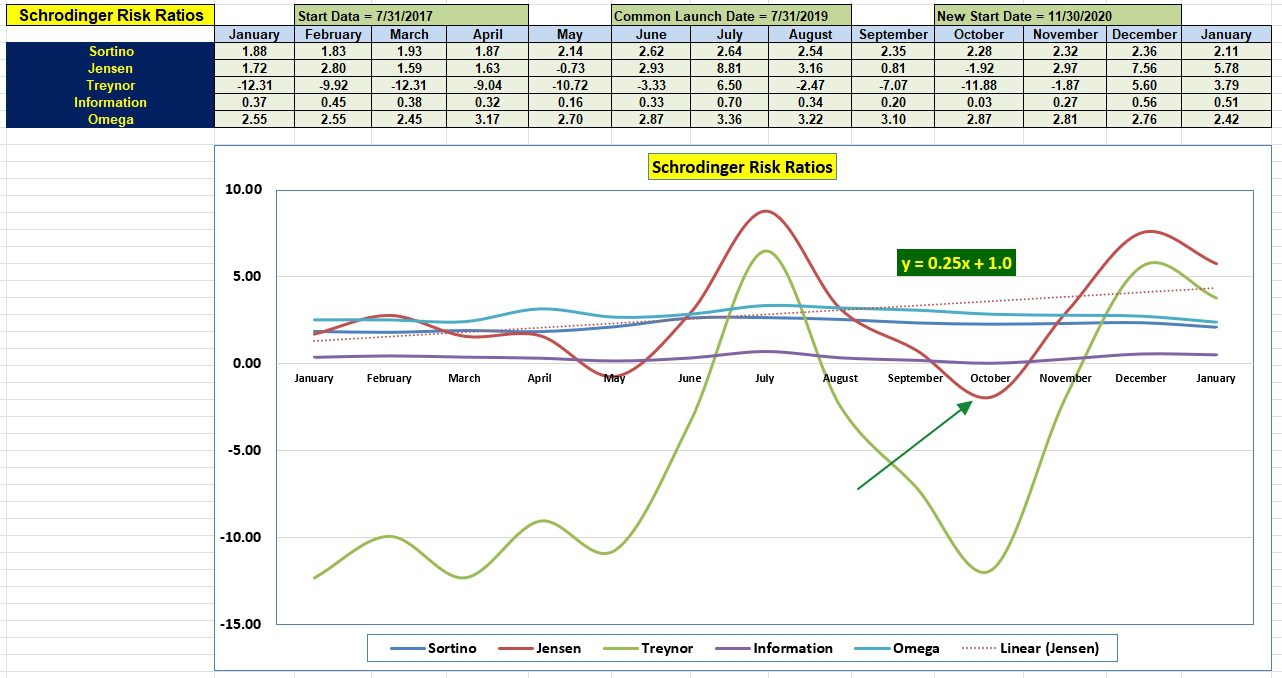

Schrodinger Risk Ratios

Below is the risk record for the past year. This is information one does not find on other investment blogs.

The Jensen had its ups and downs over the past year, but the trend (0.25) is up. Of the five risk measurements, Jensen’s Alpha or Jensen’s Performance Index is the most important of the five. Also valuable are the Information Ratio and Sortino Ratio. I do not use the popular Sharpe Ratio as it penalizes performance to the upside or exactly what we are after. The Sortino Ratio does no such thing and that is why is is more valuable than the Sharpe Ratio when working with portfolios.

Based on the last relative performance data, the Schrodinger ranked #3 when using the Internal Rate of Return (IRR) ranking.

Comments are always welcome.

Copernicus Portfolio Review: 29 December 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.