Transportation in Peru

November was an excellent month for the Schrodinger as it increased more than 5% during this period. For new readers to the ITA blog, the Schrodinger is based with Schwab and is known as an Intelligent Portfolio. I refer to this type of portfolio as a Robo Advisor portfolio as it is managed by a computer or a set of algorithms based on information provided by the investor. Age of the investor and willingness to accept risk are two important factors. In the case of the Schrodinger a request was made to concentrate on U.S. Equities rather than invest heavily in developed international equities and emerging markets.

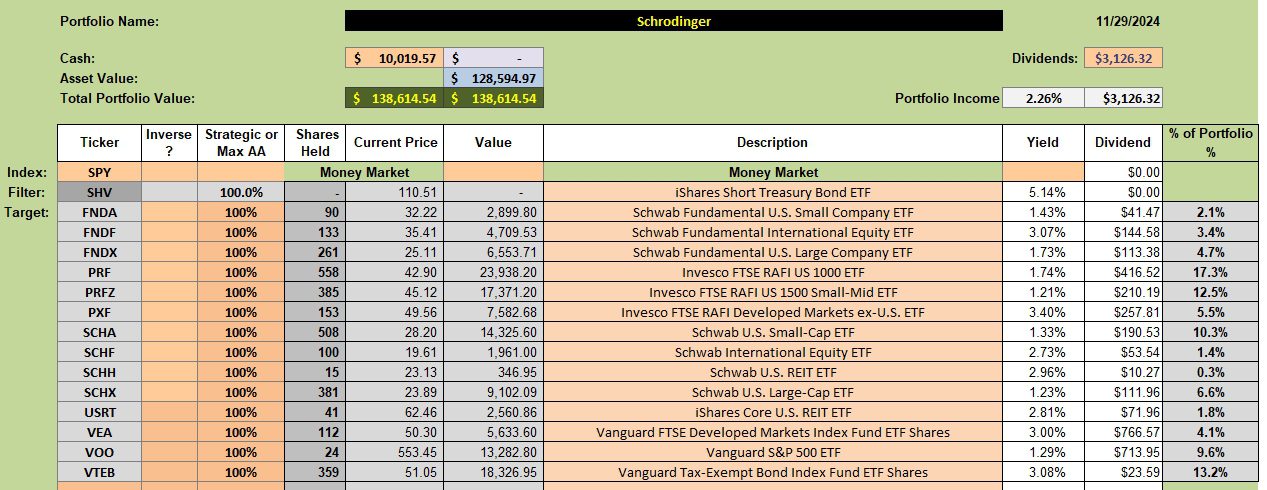

Schrodinger Investment Quiver and Holdings

Below is the current Schrodinger portfolio at the end of November. As readers can see the portfolio holds a high percentage in small- and mid-cap stocks and very little in real estate. The breakdown is more visible in the pie chart in the next screenshot.

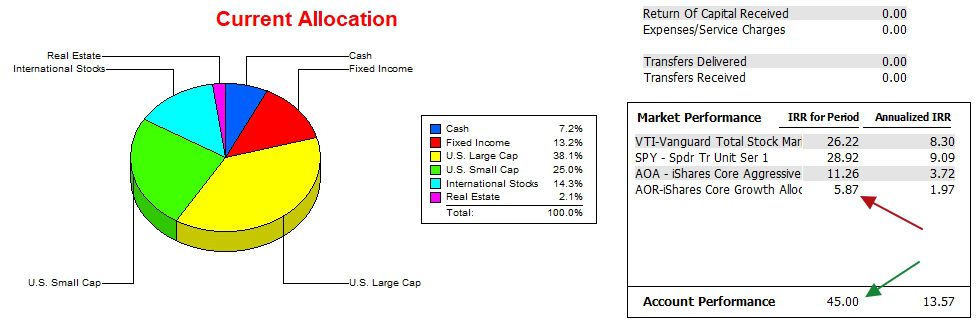

Schrodinger Performance Data

Since 12/31/2021 the Schrodinger has crushed the AOR benchmark and holds a sizable edge on the S&P 500 ETF, SPY.

Since inception on 7/31/2017 the Schrodinger lags the SPY ETF by two percentage points indicating the portfolio holdings in bonds does impact performance.

Keep in mind that the owner of this portfolio added money to this portfolio on a regular bases. If you are holding a similar portfolio with Schwab the securities will likely vary and the performance will certainly differ.

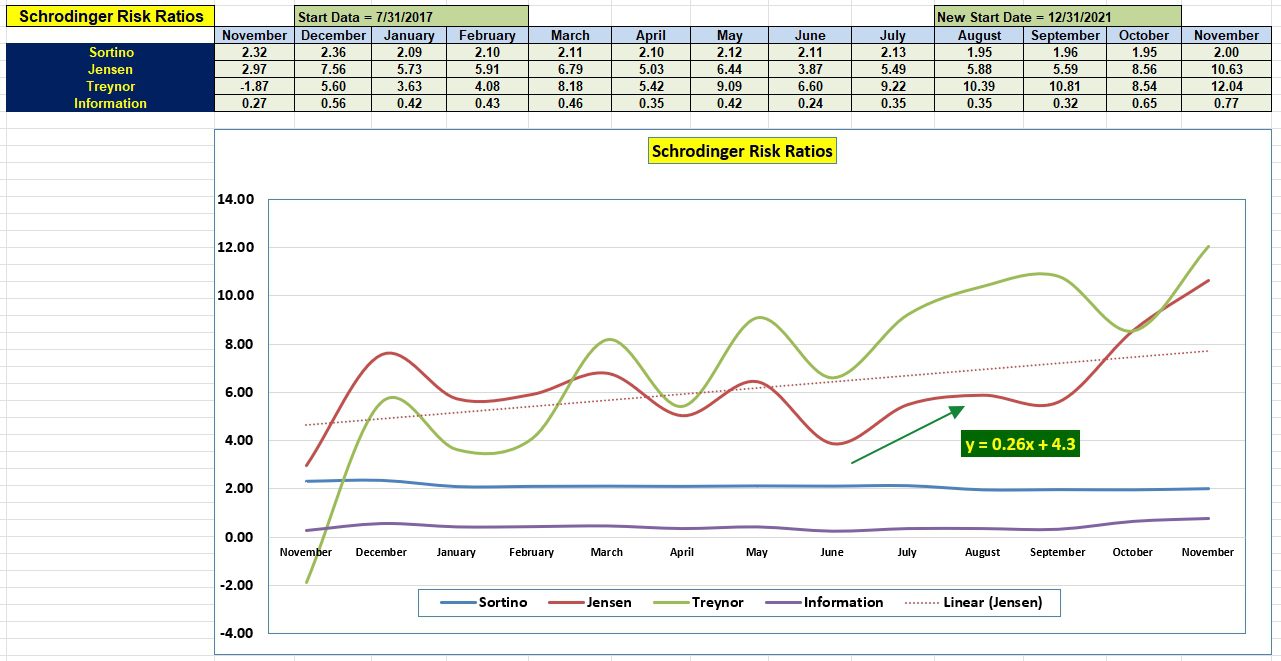

Schrodinger Risk Ratios

The current Jensen Alpha or Jensen Performance Index is very high and will be difficult to maintain. With an emphasis on equities rather than bonds this portfolio is considered high risk. High risk is not showing up in the Jensen calculation. We need to see how the portfolio will weather a recession, much as we had back during the Covid19 period.

I need to mention that since the Schrodinger exceeds $50,000 it is tax managed by computer. It is rare to see any selling so this is a tax efficient portfolio.

Regardless whether the account is taxable, standard IRA or Roth IRA, this style portfolio belongs in most investors portfolio.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Schrodinger continues to produce impressive performance. I wonder, could Schwab be adding some AI algorithms to the system?

– Lee

Lee,

That is difficult to say. If they are, AI algorithms were in place years ago as the portfolio has changed little over the 7.5 years since I set this up for the owner. The most recent change was to add the three Invesco ETFs.

I agree the results are impressive and better than I ever expected. Since the portfolio carries approximately 20% in bonds and cash I expected the performance to lag the S&P 500 index.

Lowell