Fat City at Christmas

How well is the Sector BPI investing model performing is a cogent question? Carson is the oldest portfolio using this investing model and it is less than two years old. Other portfolios were gradually switched to this model as the data began to support a move to this investing approach. It is still early in the game as there have not been many Buy/Sell cycles over the past two years. Thirteen portfolios are now using this model and I report monthly on eleven of the thirteen.

For comparison, the Schrodinger and Copernicus use completely different investing approaches so readers can compare that data with the Sector BPI portfolios. To see all the blog posts, sign up as a Guest and wait to be elevated to the Platinum level. The ITA blog is now free to all who register as a Guest.

Sector Data

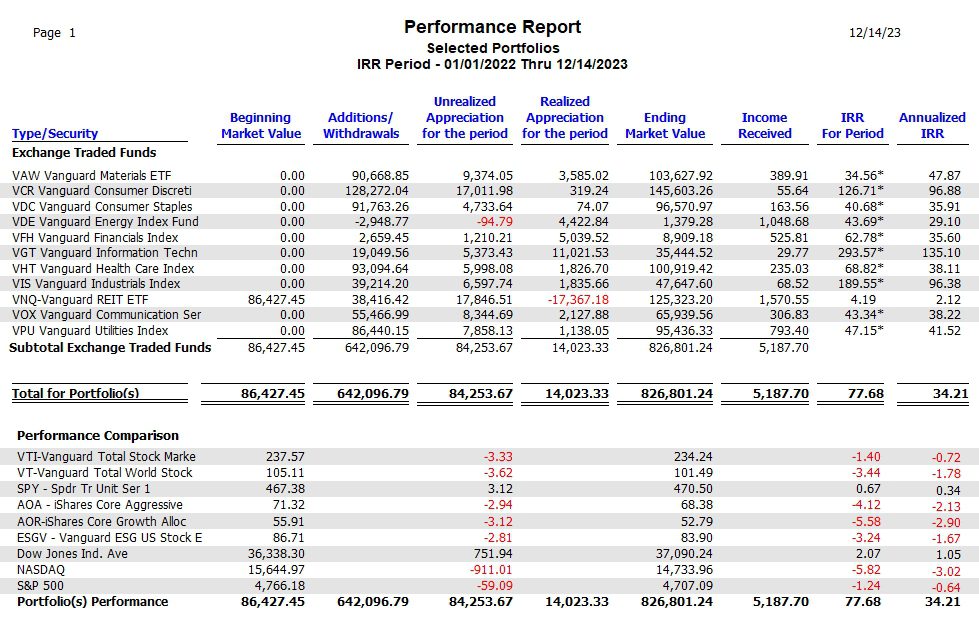

The following data table shows the sector performance from 1/1/2022 through 12/14/2023 (actually 12/13/2023) for the eleven (11) ITA portfolios using the Sector BPI investing model. Several of the ITA portfolios held Real Estate (VNQ) before the Sector BPI model was launched and that is the reason for the Beginning Market Value to show the $86,000 figure.

For comparison a list of potential benchmarks include: VTI, VT, SPY, AOA, AOR, and ESGV. The bottom three are indexes and not available for investing unless one finds a specific ETF such as SPY which mirrors or tracks the S&P 500.

Rather than select an outstanding portfolio for comparison, the following data combines all information from eleven portfolios. The Annualized IRR value of 34.2% compared to the 0.34% for SPY (S&P 500) is a surprise. I did not anticipate the Sector BPI model would perform this well.

None of the Sector BPI portfolios are performing this well as all held other Exchange Traded Funds (ETFs) during this period.

To learn more about how this model works, follow the analysis of portfolios such as the Carson and Millikan. Search for Sector BPI and you will find more detailed explanations.

Investors concerned about risk can also delve into the Risk Ratio data posted with each portfolio review. Pay attention to the Jensen Alpha or Jensen Performance Index.

Questions and Comments are always welcome so post them in the Comment space provided below this blog.

Tweaking Sector BPI Plus Model: 20 May 2023

Tweaking Sector BPI Plus Investing Model: Part II

Millikan Sector BPI Update: 20 July 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.