Before beginning the BPI blogs I attempt to intuit the direction of the X and O side of the following tables. When the stock market rebounded Friday I assumed we might see a few more X’s show up, particularly within the sectors. Not so as only two sectors are bullish.

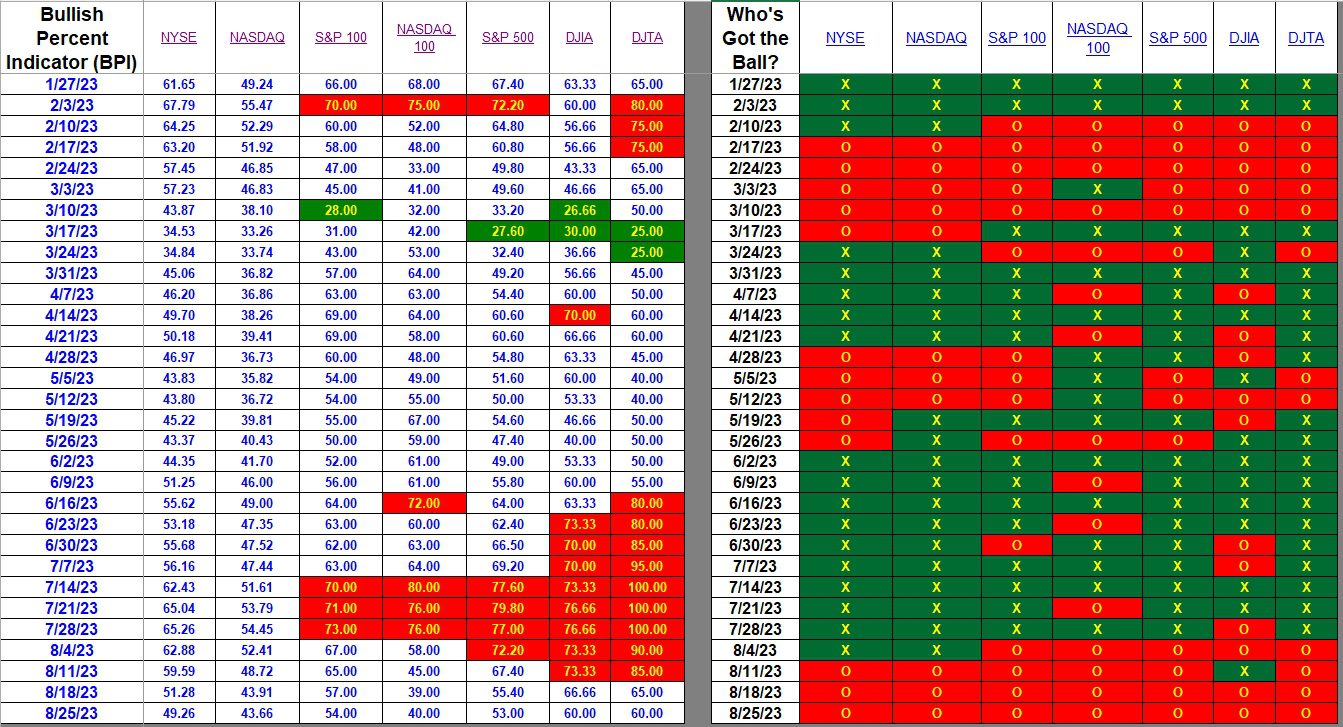

Index BPI

Fewer than 50% of the stocks in the two large indexes (NYSE & NASDAQ) are bullish. We are not in a strong stock market. I expected to see one or more of the indexes signal a bullish trend when the market rebounded on Friday. The upward move was tepid and did not reverse any of the bearish trends.

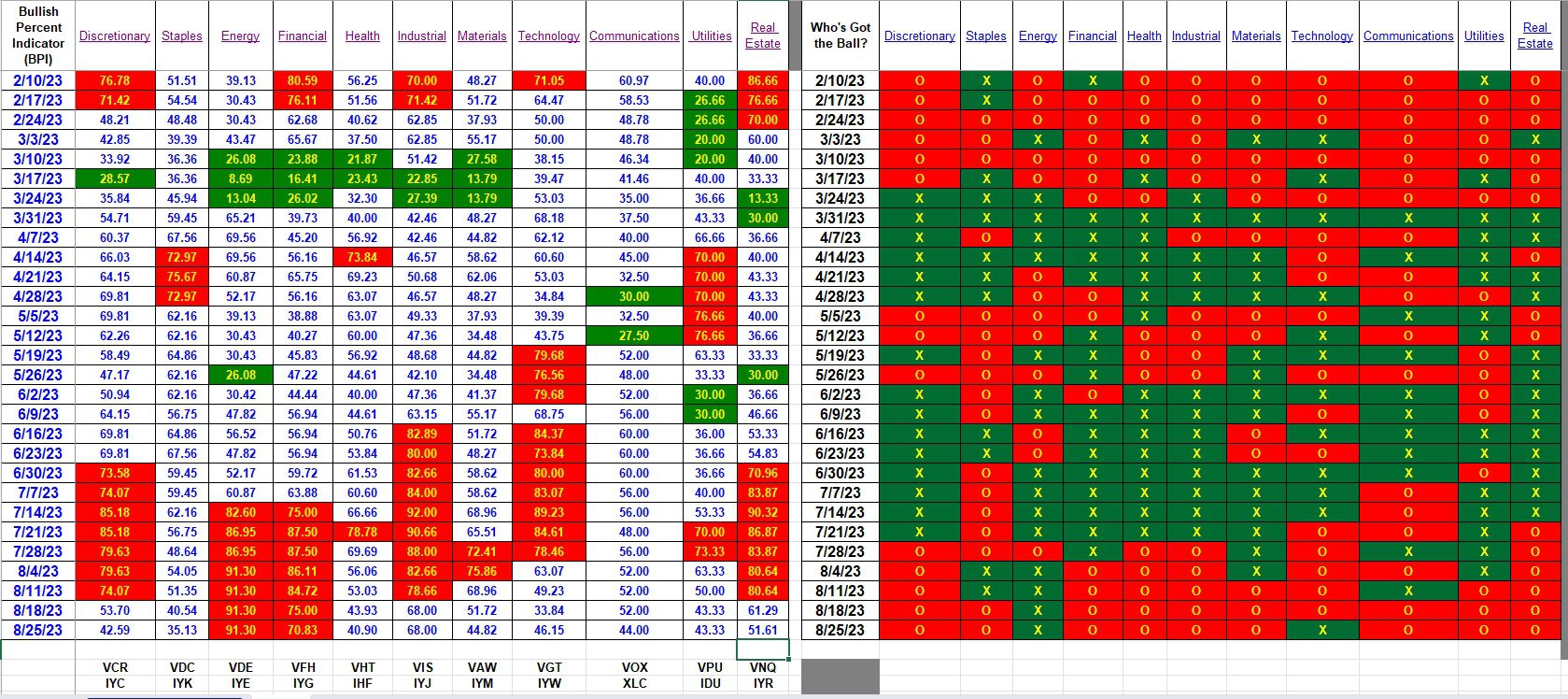

Sector BPI

Technology did manage to flip from bearish to bullish while the majority of the sectors witnessed more stocks moving into bearish territory. Check the percent changes on the left side of the tables for detailed information.

Staples is close to a Buy so I’ll monitor the sector BPI values this week.

The Argument for Self-Management

Explaining the Hypothesis of the Sector BPI Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Good morning.

Clearly, the Xs and Os prevail and outweigh the hot winds of hype. 🙂

Thank you,

– Lee

Lee,

Correct. The O’s are dominating at this point. Let’s hope we see a transfer to X’s in November and December or after Halloween.

Lowell