Ruins in Turkey

Just as one sunny day does not constitute a summer, nor does one strong market day speak well for an entire week. Not all indexes and sectors of the market moved up this week as one might have anticipated. Two of the seven indexes reverted to the bearish side of the equation as did two sectors. On the positive side both the NYSE and NASDAQ moved up a few percentage points.

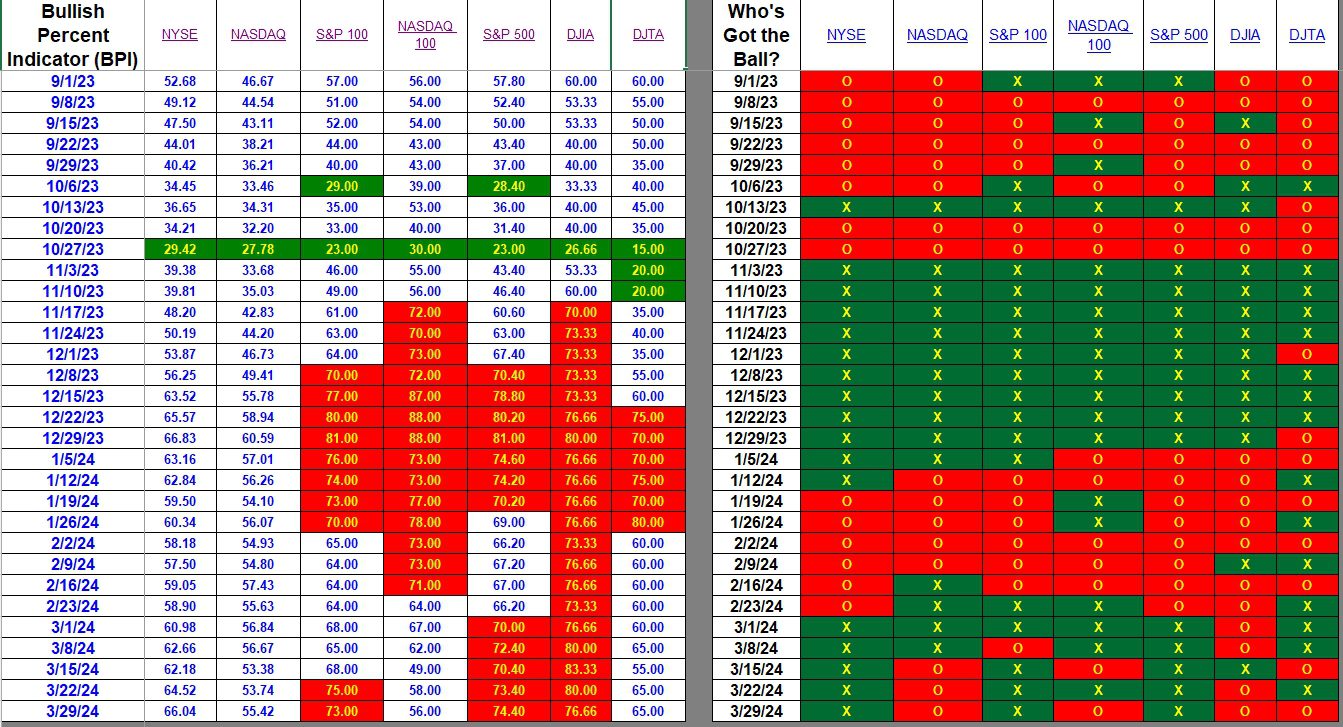

Index BPI

Over on the right side of the following table we see the NASDAQ 100 and DJTA dipped back into bearish territory. DJTA actually remained at 65% bullish so it was action during the week that flipped the Point and Figure (PnF) chart. Two stocks within the NASDQ 100 switched from bullish to bearish. The gains in the NYSE and NASDAQ are more important than the few dips in other indexes.

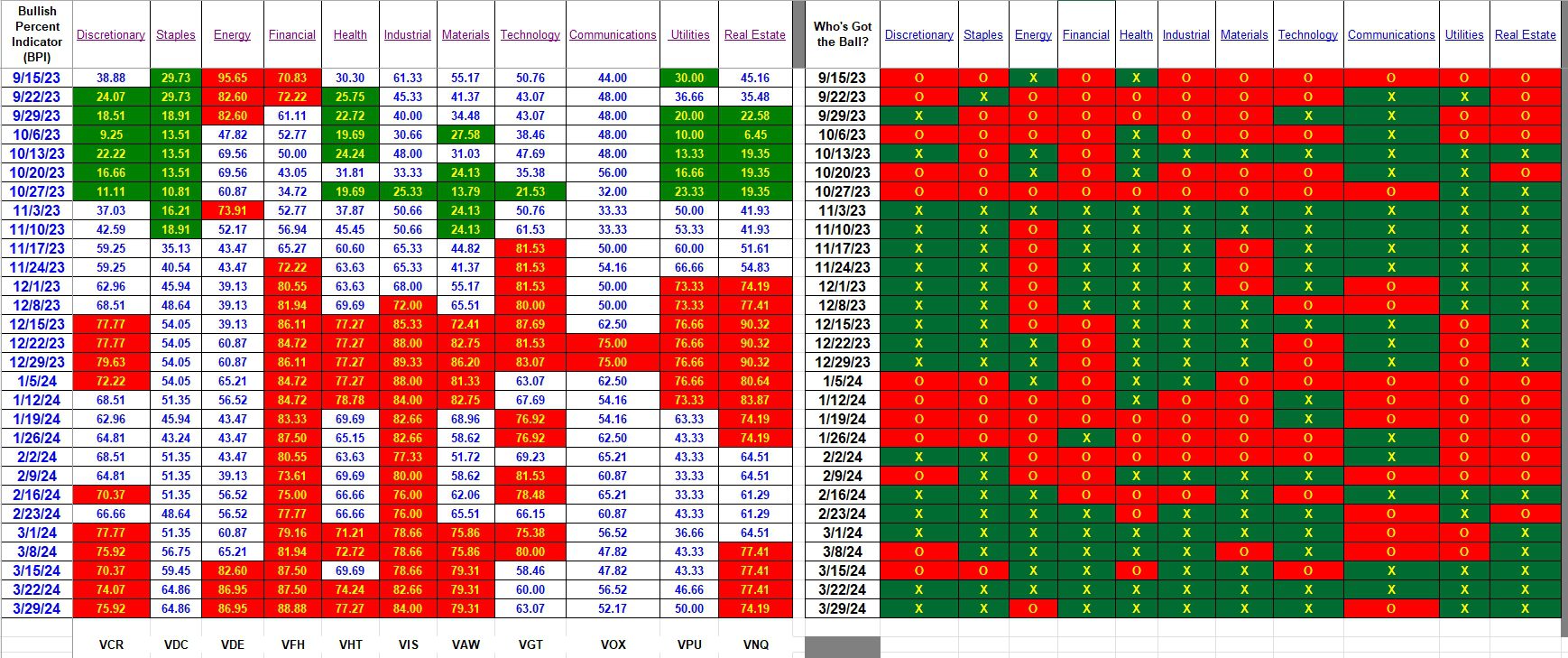

Sector BPI

We look to the sectors to see if any action is recommended for the Sector BPI portfolios. No sectors are in the oversold zone so no purchases are recommended. Utilities at 50% bullish is the closest to a purchase and the Sector BPI portfolios already hold shares in VPU.

Staples and Utilities are the current holdings and neither are in the overbought zone so no Trailing Stop Loss Orders (TSLOs) are recommended. We are in a neutral period where patience is required. If cash is available it is used to add shares of VTI or VOO.

ITA Sector BPI Portfolio Report

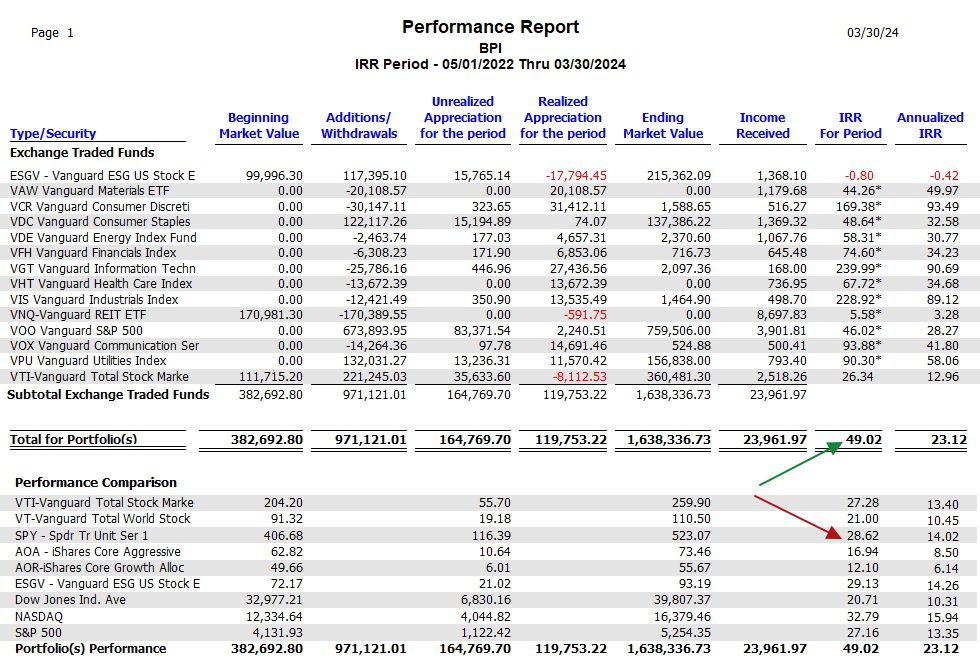

As a group, how are the sector ETFs performing for the thirteen portfolios currently using the Sector BPI investing model? The first sector ETFs were purchased in May of 2022 for the Carson portfolio. Many of the ITA portfolios have only been using this investing model for a few months. Let me point out that not all first quarter dividends are included in the performance calculations so the portfolio results will be even higher than stated below.

All these calculations are taken care of in the Investment Account Manager, a commercial portfolio tracking product. I highly recommend its use for serious investors. If you decide to purchase this software, be sure to mention my name as you might receive a discount.

Over the period identified in the following table the 13 ITA portfolios generated an IRR for Period of 49.0% while the S&P 500 gained 27.2%. Since one cannot invest in the S&P 500 we use the SPY ETF and it slightly outperformed the actual index 28.6% to 27.2%.

Take note of the difference in the performance of ESGV over this period if one held shares the entire time vs. how the ESGV ETF performed within the ITA portfolios. This is an example of poor timing or the inherent problem of timing the market. My adding shares of ESGV ETFs at different periods was a major drag on performance.

While the Sector BPI investing model appears to be working quite well thus far, I still consider the model to be in the hypothesis phase. The model has not experienced a significant number of buy/sell cycles. This is the reason I highly recommend readers diversify portfolio models. Branch out and use the Schrodinger and Copernicus as two other examples of portfolio management. A third is the Rutherford as it is built around the long standing Asset Allocation approach.

If I recall correctly, and Hedgehunter can check my memory, the asset classes found in the Rutherford come from Mebane T. Faber’s book, “The Ivy Portfolio.” There are a few variations or adjustments to the Faber model, but it is very similar. If I were to set up a Rutherford style portfolio, and I’m seriously considering doing so, I would base the asset class percentages on the three-year volatility calculations, much as I do for the eleven sector holdings. In addition, the portfolio would operate as a Buy & Hold style where selling takes place only in the case of an emergency. Should the market decline this summer it might be an opportune time to launch such a portfolio.

One reason holding me back from setting up such a portfolio is including an important asset class commodities. When it comes to filling out taxes, the commodities ETF is a pain in the tush. I use TurboTax to complete taxes. If there are readers who hold DBC or a similar commodities ETF and have not found commodities taxes in the US to be a problem, drop a comment in the space provided below. I’m interested in hearing from other readers.

Share the ITA blog line ( https://itawealth.com ) with your friends and family.

Tweaking Sector BPI Plus Model: 20 May 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Memory returned. The Rutherford asset allocation investment quiver is a combination of David Swensen’s portfolio of six assets and Faber’s ten assets. There are several overlaps making up the core (10) of the Rutherford portfolio.

Lowell

If your issue is the K-1, use PDBC rather than DBC.

Brett,

Does PDBC not require a K-1 form? I see where the performance of PDBC is even worse than DBC and DBC is nothing to write home about. I may just forget Commodities entirely as it rarely adds value to the portfolio.

Lowell

No k-1 and expense ratio is lower as well. Only issue is IF it has gains it pays it all out at the end of the year. So best in a tax advantaged account.

Brett,

If you are wondering why your comment did not show up immediately, I have the software set so I need to approve your first comment. This reduces spam operators. From now on your comments should be available immediately.

Lowell

I will not be posted a BPI blog this morning as there is nothing new to report other than this was not a good week (4/5/2024) for U.S. Equities. Regardless of the poor performance this week, no sectors dropped even close to the oversold zone so I would only be repeating myself.

No action is require of Sector BPI portfolios.

Lowell

I ran another check on the BPI data and no sectors are close to the oversold zone as of 4/10/2024.. No action is required at this time.

Lowell

No sectors dropped into the oversold zone despite the poor week (4/12/2024) for U.S. Equities. Therefore, I’ll forgo a blog post on BPI data this week.

The Schrodinger is up for review this week and I’ll likely run a check on the Pauling as not all asset classes are in balance.

Lowell