Van Gogh visits Mt. Hood in Oregon

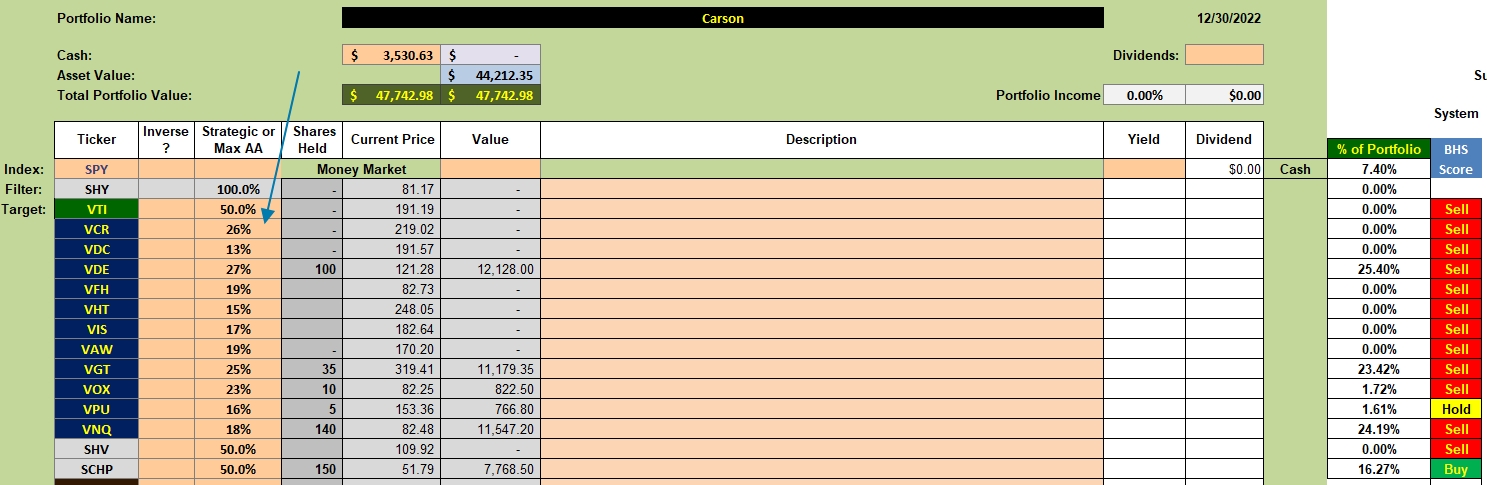

With no Bullish Percent Indicators positioned in either the over-bought or over-sold zones, I could have skipped this update of the Carson. No changes are required at this time. There is one change in the Sector BPI model that I’ll explain in a moment and it has to do with how one determines the maximum to invest in any given sector ETF.

Carson Investment Quiver of Sectors

The primary change is related to how one determines the maximum percentage to invest in a particular sector. From past observations, Energy and Technology were the most volatile and that is why I set 25% as the maximum for each. That got me to thinking. Instead of flying by intuition, why not use mathematics as the Standard Deviation material is available.

The percentages you see below are 0.75% of the three-year Standard Deviation or Annualized Volatility. I then rounded that the nearest percentage. As you can see, Energy (VDE) and Technology (VGT) come in at or close to 25%. So does VCR. Use these Max AA percentages as guidelines. Don’t be a slave to the percentages.

Please excuse the absence of the Descriptions as the ITA downloading file is still not working properly within the Kipling spreadsheet.

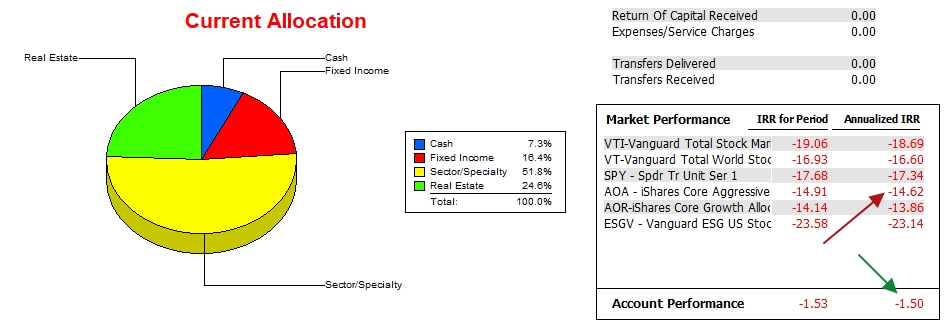

Carson Performance Data

The following data is from the beginning of 2022 through the current date. Instead of concentrating on all the red, check how the Carson has performed against all the possible benchmarks.

Buying Guidelines For BPI Model Portfolios: 9 December 2022

New Carson Launched: 4 November 2022

Carson Portfolio: Creating A New Investing Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Lowell,

So your thinking is you want to take a larger position in the more volatile sectors?

Bob W.

Bob,

Correct. The more volatile positions will move between the Buy and Sell zones more frequently so I want to take advantage of that movement. That is my current thinking.

Right now, 70% or 0.70 x annualized volatility will set the most volatile sector to around 25% of the total portfolio.

Lowell

On yesterday’s (01/08) edition of CNN’s Fareed Zakaria GPS (Global Public Square), at the 29 minute mark Zakaria’s interview with Ruchir Sharma, Chairman of Rockefeller International and Founder & Chief Investment Officer at Breakout Capital starts — the podcast link follows. Sharma observes the rapid restart of the China economy will decrease the value of the dollar and make US inflation more difficult to manage. Implications are investments in 2023 will become more complicated. The final 10 minute conversation, IMHO, is time well spent. Here is the link:

https://podcasts.apple.com/us/podcast/navalnys-daughter-speaks-out-2023-outlook-on-global/id377785090?i=1000593054225

.

“On yesterday’s (01/08) edition of CNN’s Fareed Zakaria GPS (Global Public Square), at the 29 minute mark Zakaria’s interview with Ruchir Sharma, Chairman of Rockefeller International and Founder & Chief Investment Officer at Breakout Capital starts — the podcast link follows. Sharma observes the rapid restart of the China economy will decrease the value of the dollar and make US inflation more difficult to manage. Implications are investments in 2023 will become more complicated. The final 10 minute conversation, IMHO, is time well spent. Here is the link:

https://podcasts.apple.com/us/podcast/navalnys-daughter-speaks-out-2023-outlook-on-global/id377785090?i=1000593054225”

Lee,

Your comment was caught in a Spam filter so I quote it here so other readers will not miss it. Thank you.

Lowell

ITA Readers:

I’ll skip the review of the Carson tomorrow as the market is closed and I already have 3% TSLOs in place for Energy (VDE) and Real Estate (VNQ). The Carson does not hold shares in the Financial sector, the their sector triggering a Sell signal.

The Einstein portfolio is up for review on Tuesday.

For readers in retirement and where protection of capital is paramount, pay attention to your portfolio as the debt limit debate and action could play havoc with the U.S. Stock Market.

Lowell

Energy and Real Estate were sold out of the Carson and in each case the trade made money. This is encouraging for those following the Sector BPI model.

It will take several Buy/Sell cycles to confirm what is still an idea in the Hypothesis stage of development.

Lowell