Run down house has a stock market feel.

The following data was scheduled for publication at least one day ago, but I was distracted due to the market plunge. This portfolio is the oldest of the Sector BPI portfolios, but it has not been through a volatile market such as we have experienced over the last few days.

As I mentioned when updating other Sector BPI portfolios, this type of market is a real test of the sector model. Since launching this unique approach to portfolio management we have not seen all sectors oversold at the same time as is currently the case.

Tomorrow I plan to post an update of the Bullish Percent Indicator (BPI) data.

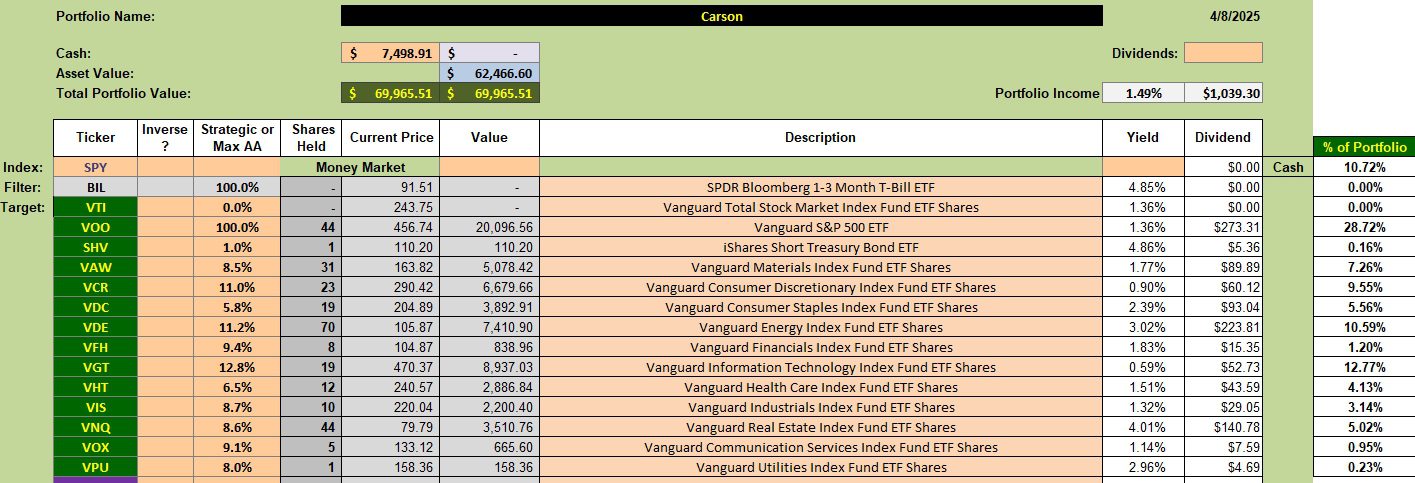

Carson Sector Holdings

Below are the current Carson holdings. Limit orders are in place and some may drop to the limit purchase price as the market continues to decline.

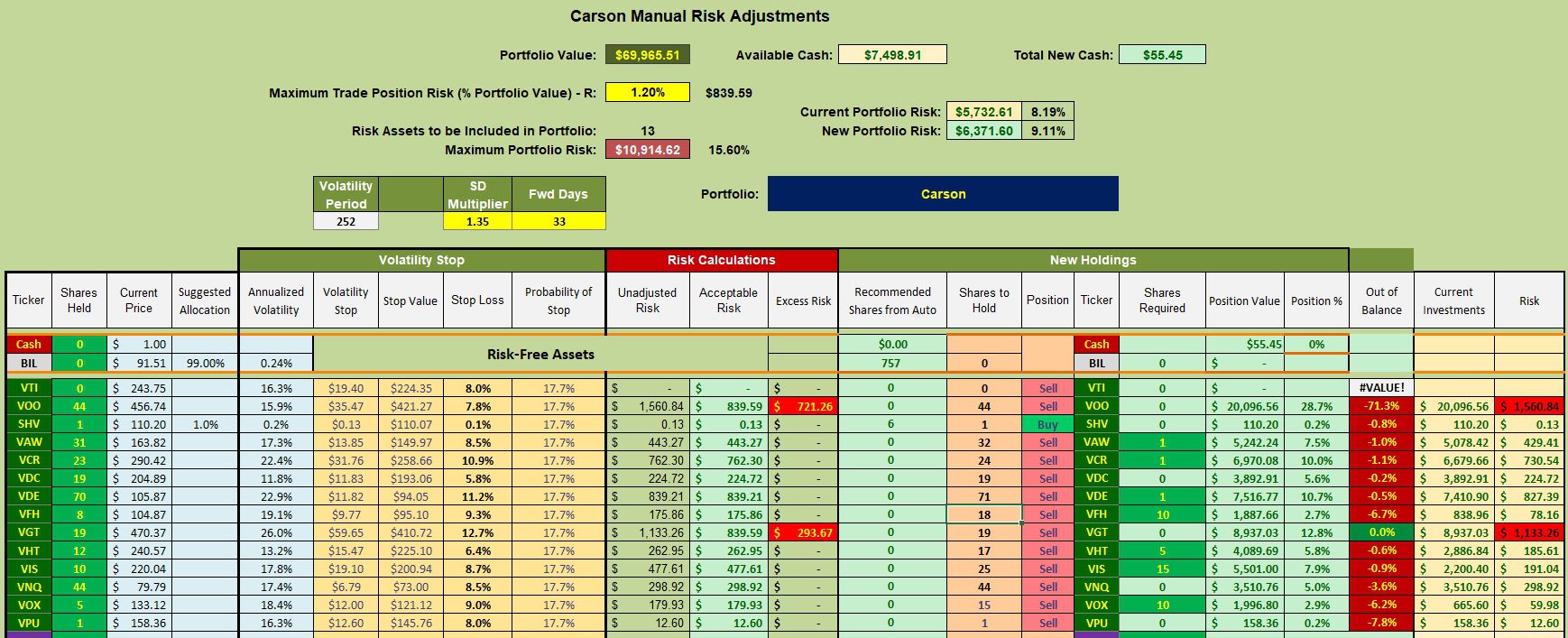

Carson Rebalancing Recommendations

Limit orders are in place to purchase a number of the oversold sectors. Insufficient cash is available to bring all sectors up to their recommended percentage. At this time I did not want to sell shares of VOO in order to raise more cash. If this market persists, I may make such a move when the Carson is reviewed in May. The logic behind this investing model is that oversold sectors will rise faster than the market as a whole.

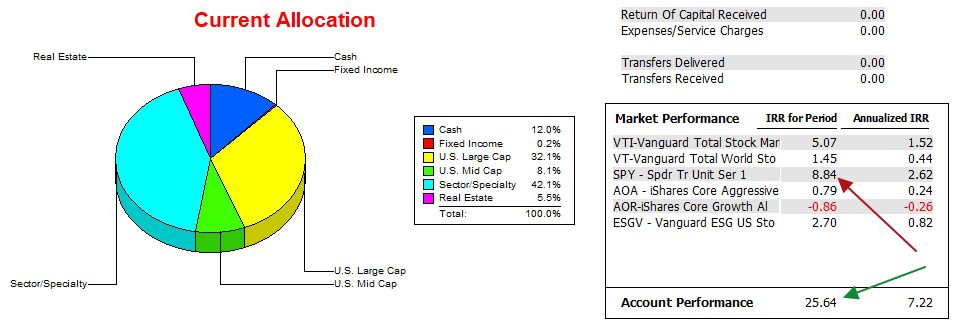

Carson Performance Data

Since 12/31/2021 the Carson has outperformed the SPY (S&P 500) benchmark by a wide margin. The delta is even greater when compared with other potential benchmarks.

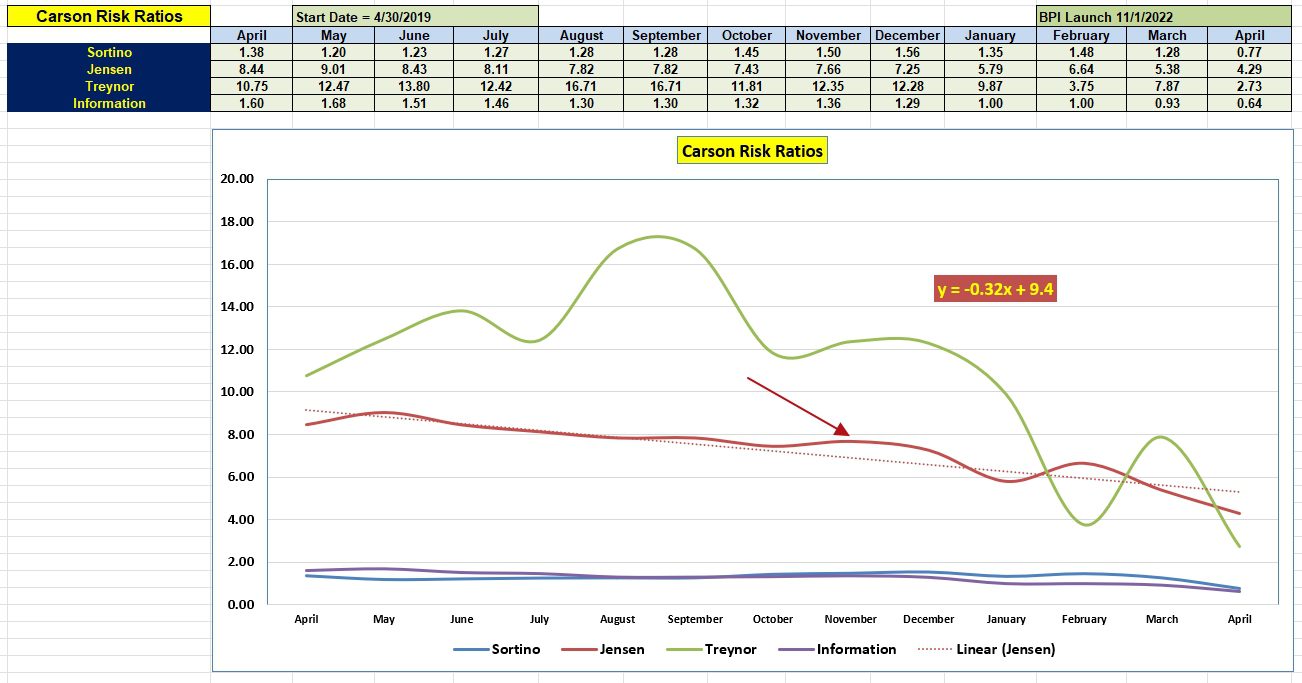

Carson Risk Ratios

When it comes to how risky the portfolio, the decline in the Jensen Alpha is disappointing. The slope of the Jensen should be positive, particularly since the short-term interest rate is declining.

Pay attention to the direction of the Jensen and Information Ratios over the next few months.

Comments are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question