First snow requiring a test ride on the HJM TriHauler Pro trike.

Happy Valentine’s Day

Today marks the 17th anniversary of the ITA Wealth Management blog. Posts do not go back to 2008 as the site was hacked around 2013 by a Swedish hacker causing the loss of over 1000 posts. I moved to a more secure server since this unfortunate event. Many out-of-date posts have been deleted in order to save storage space. There is still a lot of information on the blog and one can see investment evolution occurred over the past ten years. For example, the Sector BPI investing model was launched a few years ago. Today’s Carson review is the oldest account using this unique approach to portfolio management.

To learn more about the Sector BPI investing model move to the upper right-hand corner of the page and look for the magnifier icon. Click on the icon and type Sector BPI. Another way to gain access is to use Categories and find Sector BPI or look up one of the Sector BPI portfolios.

The latest Bullish Percent Indicator (BPI) sector data indicates there are no changes recommended for the Carson Sector BPI portfolio.

Sector BPI Review:

- When a Sector BPI drops to the 30% bullish zone (oversold zone) or below we place a purchase order for the ETF that covers that particular sector. A recent example is Materials so we currently hold shares of VAW.

- When a Sector BPI moves to the 70% bullish zone (overbought zone) or higher we place a 3% Trailing Stop Loss Order under the ETF representing that sector.

- When excess cash is available, invest in the total market (VOO).

These are the three basic rules that govern the Sector BPI investing model.

Important Point: If new money is added to a Sector BPI portfolio while sectors are holding shares, those sectors will show up as holding fewer shares than recommended. In such situations, invest the new money in VOO.

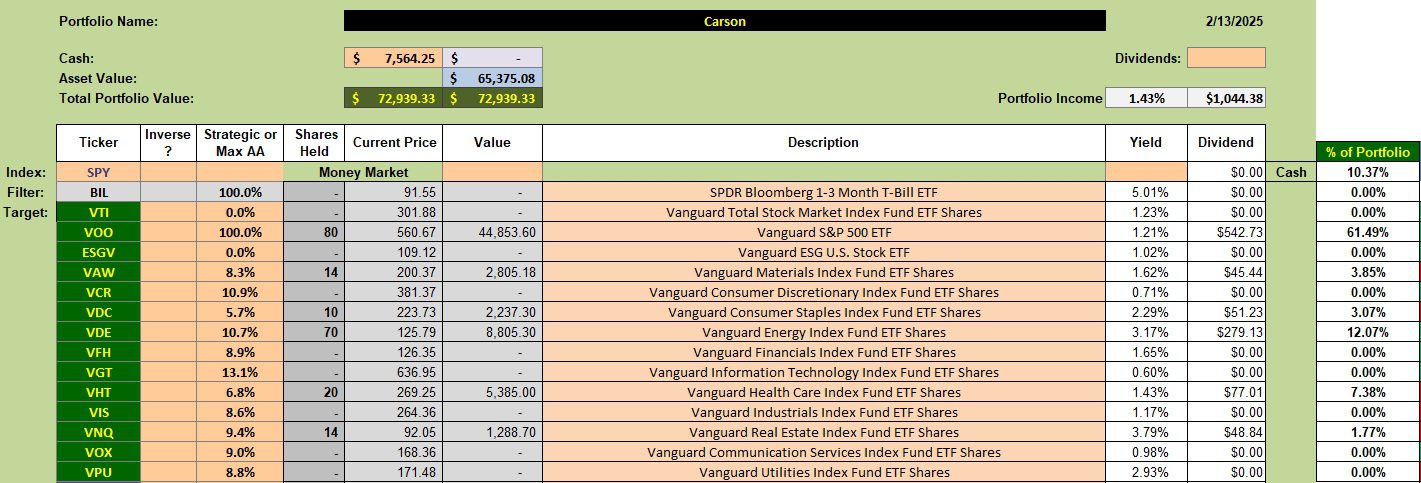

Carson Sector BPI Portfolio

Below is the current makeup of the Carson portfolio. When cash is available, as is currently the case, make sure the recommended sectors are fully populated, if in the buy zone, and then move to investing in the broad market. I use VOO as the ETF to represent the broad U.S. Equities market.

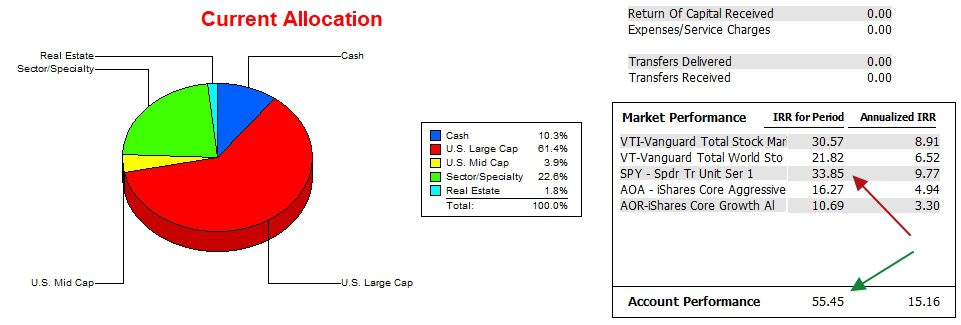

Carson Performance Data Since 12/31/2021

December 31 of 2021 is used as a launch data as that is the date when the most recent ITA portfolio began. The Carson is actually older, but did not begin to employ the Sector BPI model until November of 2022.

Since December of 2021 the Carson has outperformed the SPY benchmark by a wide margin. Most of the positive performance came in the early years when the market was not as strong.

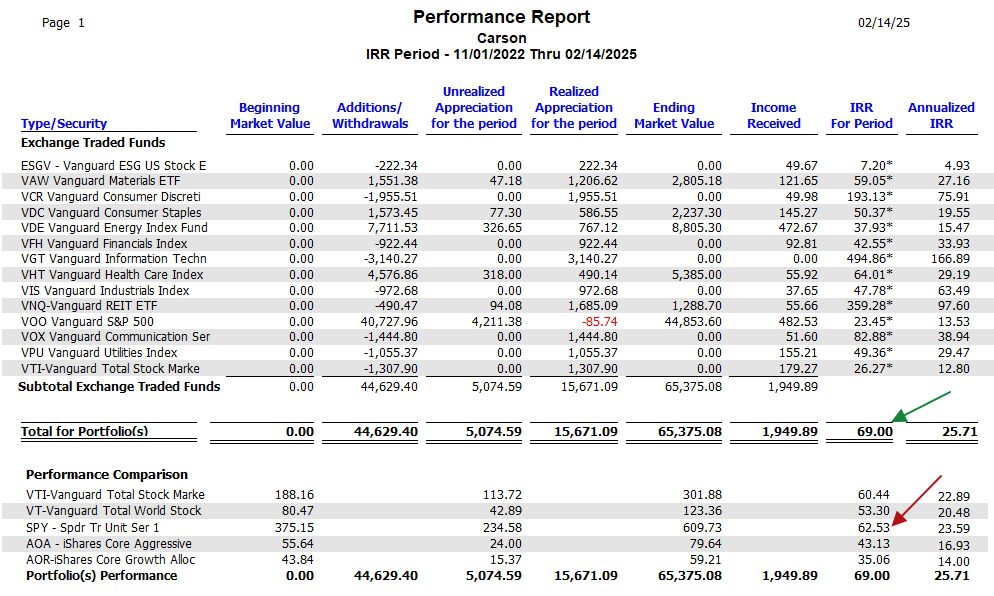

Carson Sector BPI Performance Since 11/1/2022

The following table shows the performance for the different securities used within the Carson during the past 27.5 months. A few sector ETFs contributed the most to the overall performance. One take-away is that the Sector BPI investing model requires a significant amount of effort to track and manage, yet it barely outperforms the S&P 500 ETF, SPY. One benefit to the model is that it provides some downside protection in a recession or worse. Since there are transactions, this is not a tax efficient model. One needs to take these factors into account when taking on the management responsibilities of a Sector BPI portfolio.

When examining the pluses and minuses of this model I am drawn back to the Schrodinger and Copernicus portfolios as both are easier to manage and both are top performers. It is difficult to argue against performance and simplicity.

The asterisk by the IRR For Period indicates the security was not held for the entire period.

Keep in mind that this data is for a shorter time frame compared to the data shown in the above performance screenshot.

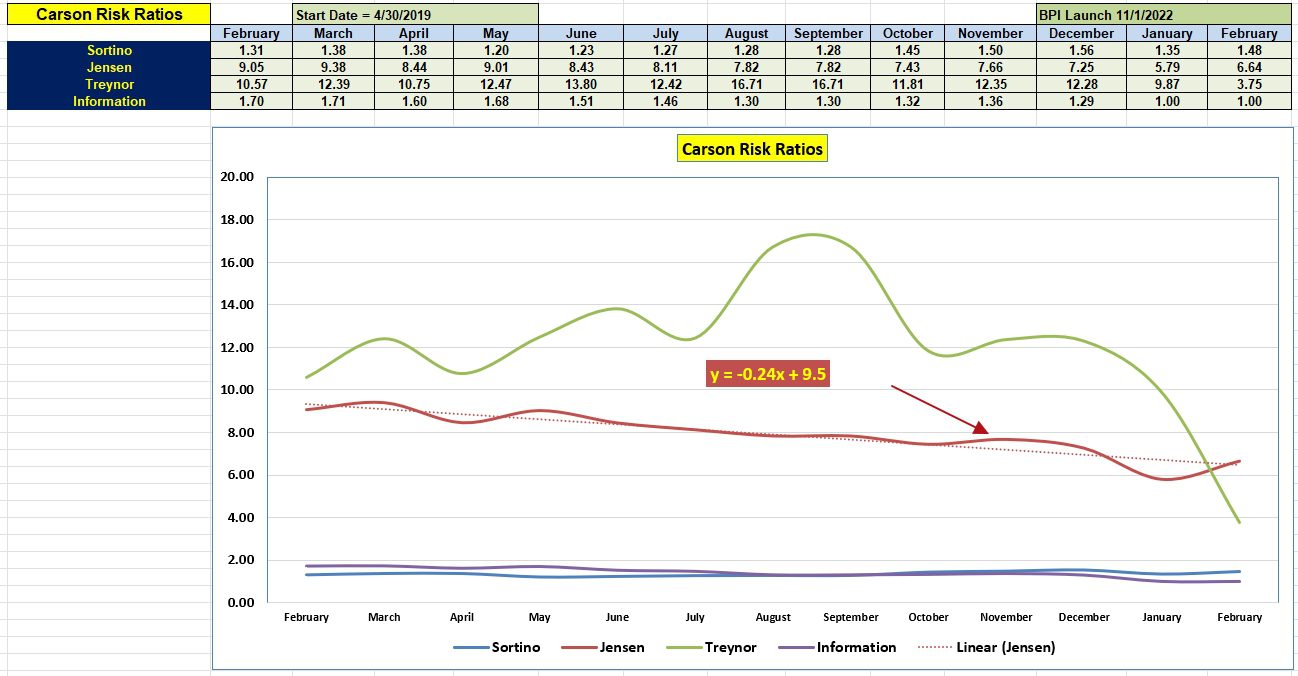

Carson Risk Ratios

Over the past year the Jensen Alpha declined until this month. Two weeks do not constitute a trend so we need to keep watch to see how the Sector BPI model performs when risk is part of the equation.

The Information Ratio follows this same negative trend indicating the Carson is not keeping pace with the SPY benchmark.

Next week will be busy as four portfolios are scheduled for an update. They are: Millikan, Gauss, McClintock, and Pauling.

Comments and questions are welcome. Send the https://itawealth.com link to your friends and relatives.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Materials is back in the Oversold zone.

Lowell