Sierra Nevada Range – Along Route 395

Before updating the Carson I checked to see if any new Bullish Percent Indicator (BPI) revelations emerged since the last update. No changes showed as Discretionary, Staples and Health remain in the oversold zone. As the oldest Sector BPI Plus portfolio it always interesting to see how well the Carson is performing when compared to the S&P 500. Follow along with this review to see how the available cash is used.

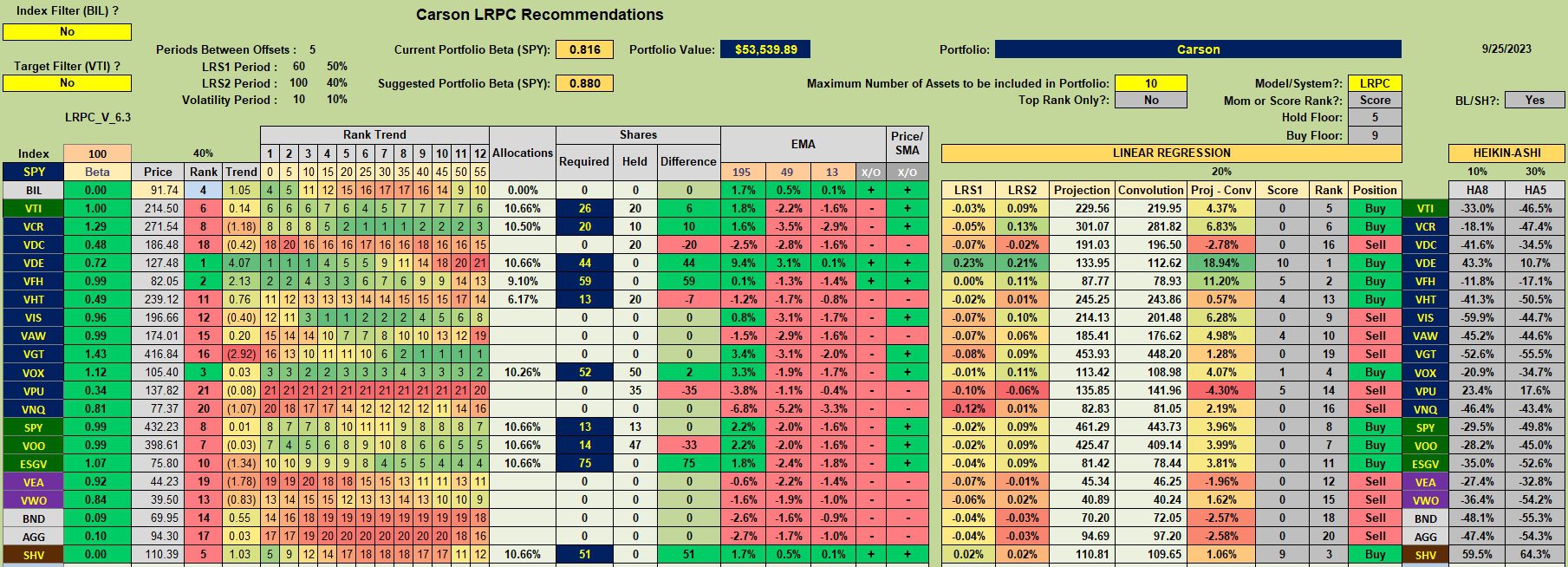

Carson Security Recommendations

From the last BPI data published this past weekend, Discretionary (VCR), Staples (VDC) and Health (VHT) are the three sectors occupying the oversold zone. This assumes one is using Vanguard ETFs. Based on three-year volatility we determine what percentage to hold in each sector ETF and for these three the percentages are:

- VCR = 10.5%

- VDC = 5.7%

- VHT = 6.2%

Excess cash is applied to equity ETFs. When using the LRPC investing model I rely on the Rank shown in the fourth (4th) column from the left. Excess cash goes to VTI (#6), VOO (#7), and SPY (#8) in that order. By this time available cash is down to zero. Note that VTI, VOO, and SPY are all a Buy at this time.

When I began this blog I had two limit orders set for VCR. The limit order for 10 shares at $268 was struck while working on this post. A second limit order for another 10 shares is waiting for the price to drop to $260.

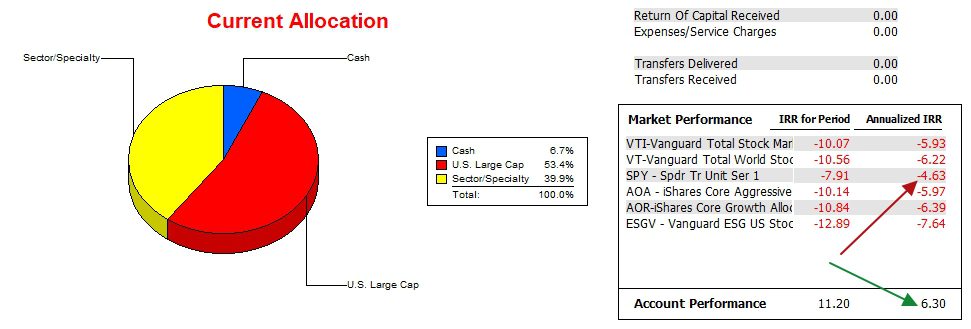

Carson Performance Data

As we approach 21 months of data the Carson is outperforming SPY by a wide margin. The delta is even larger for the other potential benchmarks. The Sector BPI Plus model appears to be working as hypothesized several months ago.

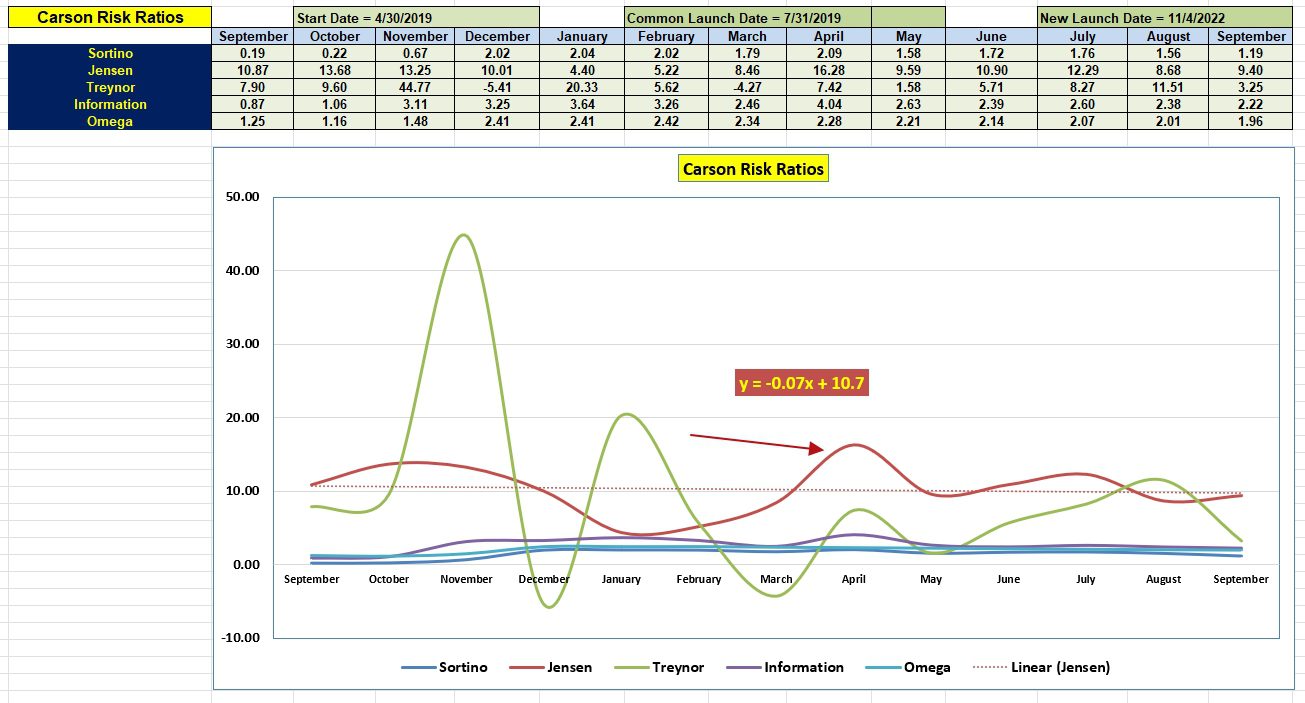

Carson Risk Ratios

Perhaps more important than the relative IRR comparisons is how well the Carson is performing when analyzed through the lens of the Jensen Performance Index or frequently called the Jensen Alpha. While 9.4 is not the high point over the past 13 months, it is still a very high value. While September looks to be a rather poor month for equities, the Carson may improve on the August Jensen figure.

Below are three other examples of the Sector BPI Plus investing model.

Gauss Portfolio Update: 19 March 2023

Millikan Sector BPI Update: 20 July 2023

Franklin Portfolio Review: 21 July 2023

Buying Guidelines For BPI Model Portfolios: 9 December 2022

Tweaking Sector BPI Plus Model: 20 May 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I feel it would be advantageous to add the Schrodinger Schwab Intelligent Portfolio, as modified for ITA, to the Market Analysis table. Here is why.

The Schrodinger frequently performs better than the S&P 500. Recently Schrodinger has frequently ranked at the very top of the tracked portfolios, alongside Carson. Seeing how each portfolio under review stacks up compared to both the currnet possible benchmarks and the robo-portfolio would be very useful. Why not have one more horse in the horse race?

.

Lee,

Are you suggesting something other than what is shown in this blog post and associated data table?

https://itawealth.com/portfolio-performance-comparisons-1-september-2023/

Note that I show the portfolios that are outperforming the Schrodinger.

Lowell

Thank you. I re-read your Sept. 1 , as linked above, then reconsidered my question. What I had in mind was adding Schrodinger to the Market Performance Table, thus showing it in that list as outlined below:

[ sorry I could not post a screenshot ]

Market Performance IRR for Period Annualized IRR

VTI -10.07 -5.93

VT ” ”

SPY ” ”

AOA ” ”

AOR ” ”

ESGV ” ”

Schrodinger ” ”

Finally, as you have pointed out, something like Schrodinger is a good answer or starting point to the fundamental question “Who manages our portfolio after I die?” However, as you have also highlighted, systematic down side protection with a robo advisor is still an unanswered question. From a loss avoidance / risk management point of view, having three model or sub-portfolios active (1) robo, (2) BPI Plus Portfolio, and (3) a JULIA (Just Leave It Alone) “all weather” portfolio

See: https://seekingalpha.com/article/4594340-search-for-all-weather-portfolio JULIA is several screen down

could be an approach for passing on the portfolio

All the best,

– Lee Cash

.

Lee,

I finally got around to reading Craig Lehman’s Seeking Alpha article you linked above. Well worth the time to read. Thank you.

Lowell