Yellowstone National Park

January is off to a slow start when it pertains to U.S. Equities. As a result numerous sector ETFs have been sold out of a number of ITA portfolios. This leaves considerable cash lying around requiring some action. This is also true for the Carson, the portfolio up for review this morning. Carson is the oldest Sector BPI portfolio and yet it too has had a very short life. Each month we add more historical data as we continue to test the Sector BPI investing model hypothesis. Thus far the results are promising.

Carson Security Holdings

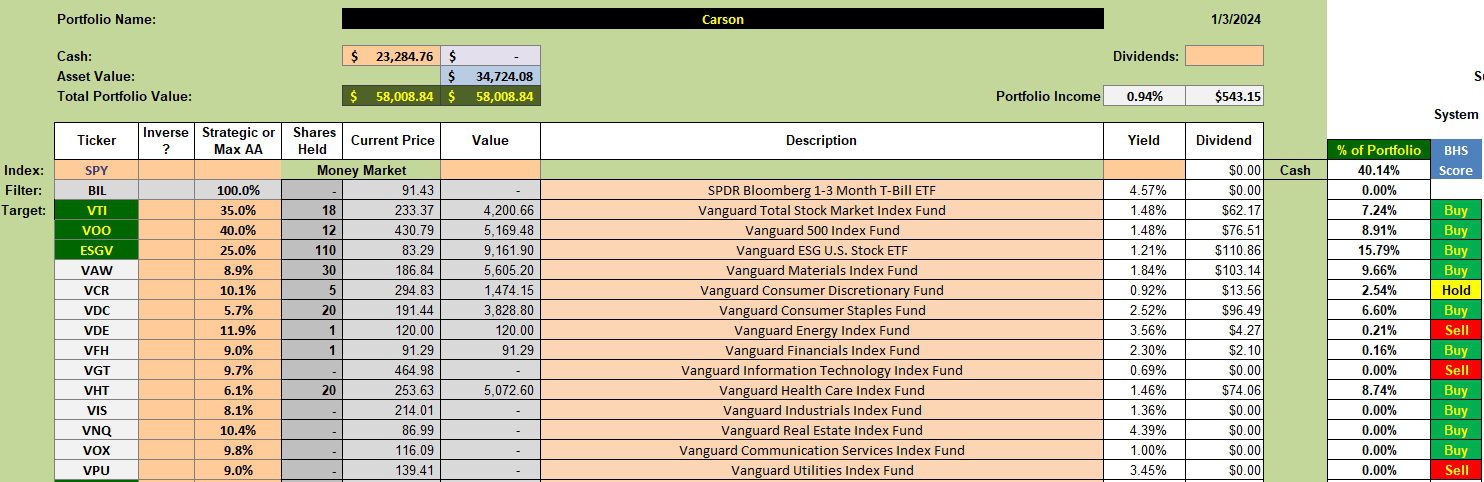

Below is the investment quiver and current holdings for the Carson. Shares of VIS were sold out of the portfolio this week and we now have over $23,000 in cash. With no sectors in the oversold zone we are not going to be purchasing any sector ETFs or those with the light gray background. What to do with the excess cash is explained in a moment.

When cash is available and no sectors are oversold we look to the broad U.S. Equity ETFs such as VTI, VOO, and ESGV.

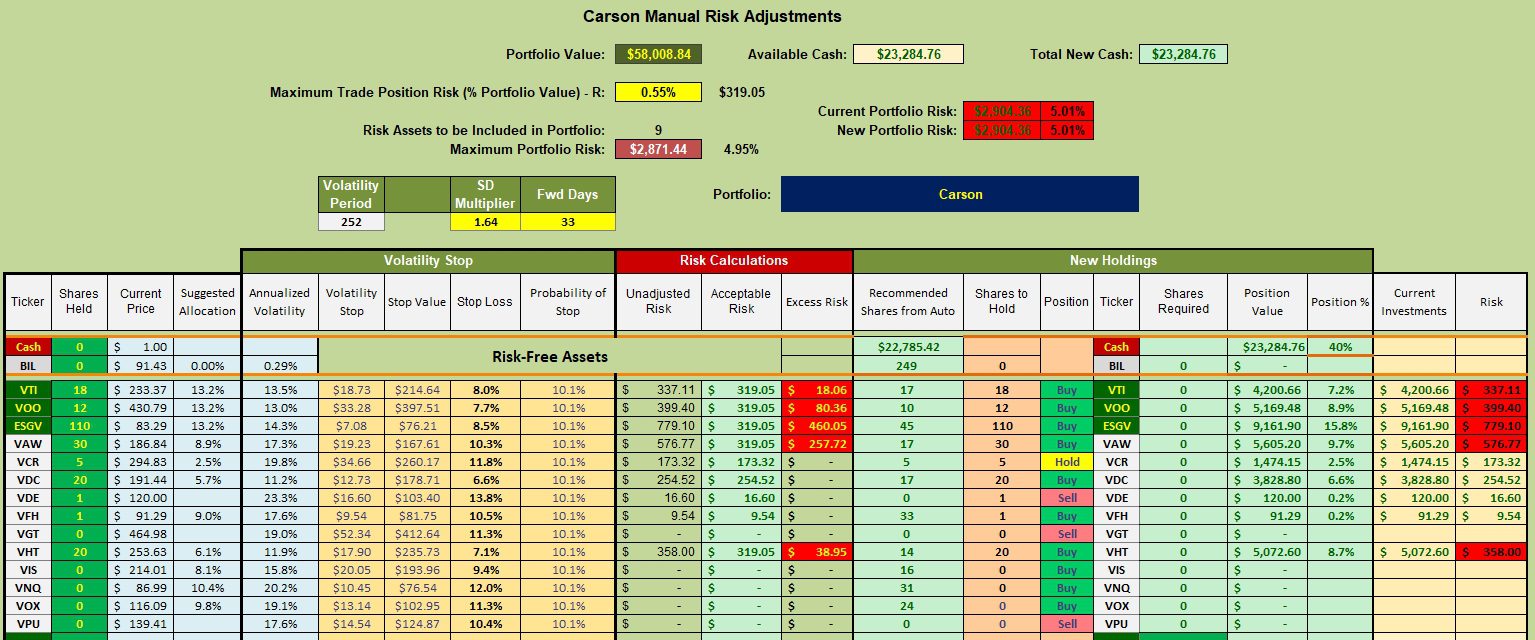

Carson Manual Risk Adjustments

VTI, VOO, and ESGV are all a Buy when the Buy-Hold-Sell model, built into the Kipling spreadsheet, is selected. That worksheet is not shown in this update.

In this manual risk adjustment worksheet we see where the Carson is holding more shares of VTI, VOO, and ESGV than recommended. No problem. What I do in this situation is to place additional limit orders for these three ETFs at prices below current prices. Limit orders as low as 5% and 10% below current prices is common. If you check the fifth column from the left you will see the annualized volatility is such that we can expect any of these three equity ETFs are almost certain to dip below a 10% limit order during this calendar year.

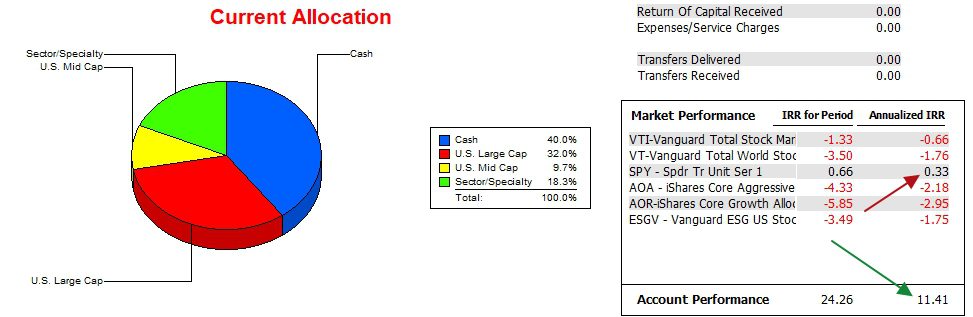

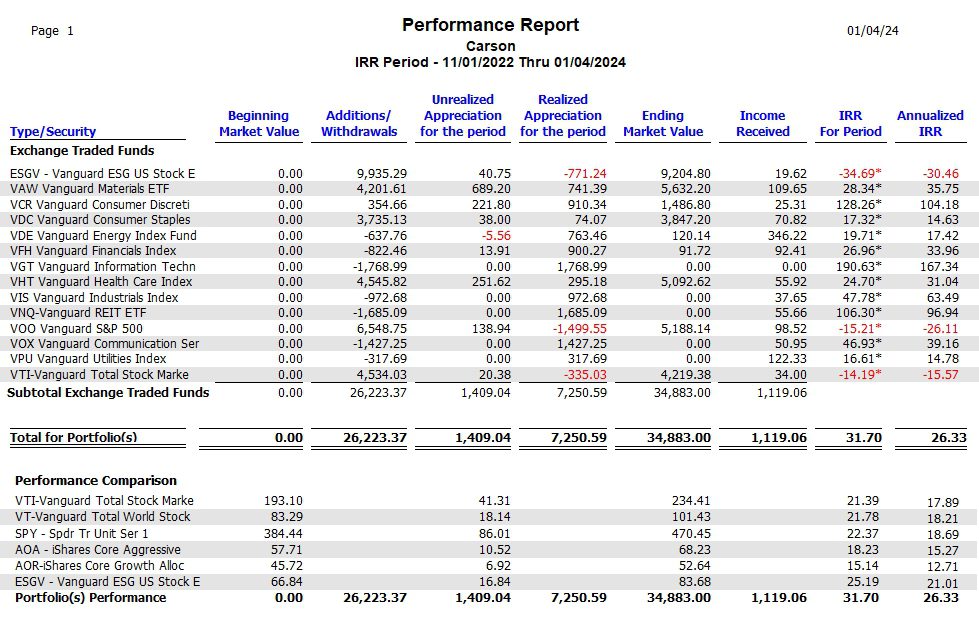

Carson Performance Data

The following data goes back as far as 12/31/2021. The Carson is outperforming the S&P 500 (SPY) by a wide margin and it is crushing the AOA and AOR benchmarks. Keep in mind that the Carson has only been using the Sector BPI model for 13 months. How well has it performed during that period? The last screenshot helps to answer this question.

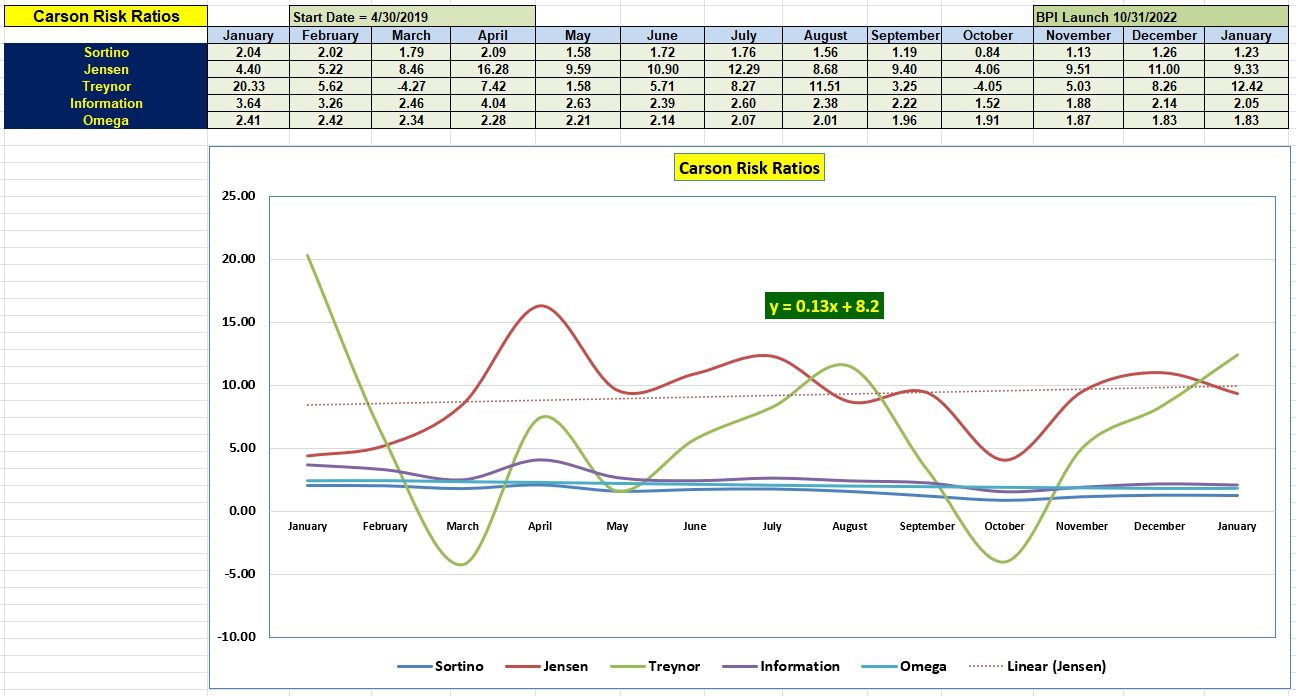

Carson Risk Ratios

Below are portfolio risk measurements not found on other investment blogs. Pay most attention to the Jensen as it takes into account the following four metrics.

- The annualized IRR of the portfolio.

- The annualized IRR of a benchmark. I use SPY as it sets a very high bar.

- A risk-free U.S. short-term treasury. I use the interest rate of SHV.

- The beta of the portfolio. This information is built into the Kipling spreadsheet.

Another important metric is the Information Ratio. Both the Jensen and Information values are off from the December values. Over the past year the trend of the Jensen is positive (slope = 0.13) so that is very good news.

Carson Sector Portfolio Report

Below is extremely useful data when it comes to analyzing the Sector BPI model. This data records all the information for the Carson since I first moved the portfolio over to the Sector BPI model. The three negative contributions come from VTI, VOO, and ESGV. None of the sector holdings are negative. Each is purchased when the sector BPI is listed as 30% or below bullish and sold only after the BPI data hits the 70% mark or overbought combined with a 3% TSLO trigger. That last sentence is rather complicated and the syntax is weak.

To restate the sell argument, when a sector hits 70% or higher bullish stocks based on BPI data we place a 3% TSLO on the sector ETF. I take this a step further, but it is not necessary. For example, if the BPI data happens to come in a 76% bullish, I place a 2.4% TSLO under the ETF. Not every broker permits decimal TSLO settings. Schwab does and this is another reason to prefer Schwab as a broker.

I am always attempting to tweak or improve the Sector BPI model. With zero back-testing to rely on we only have these regular updates as a way to test the investing model.

Tweaking Sector BPI Plus Model: 20 May 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.