Fishing Vessel Docked in Newport Bay.

Copernicus is the only Buy & Hold portfolio managed here on the ITA blog site. Diversification comes from holding hundreds of companies in the United States. If one prefers to further diversify this portfolio one would add International Equities (VEU) to the options available for purchase.

Thus far the Copernicus has performed very well and without a lot of fuss. All one does is save and when there is sufficient cash place limit orders for one of the four ETFs listed in the following worksheet or screenshot. The Copernicus is a save, buy and forget style portfolio. This is also a tax efficient portfolio, something rarely discussed on this investment site.

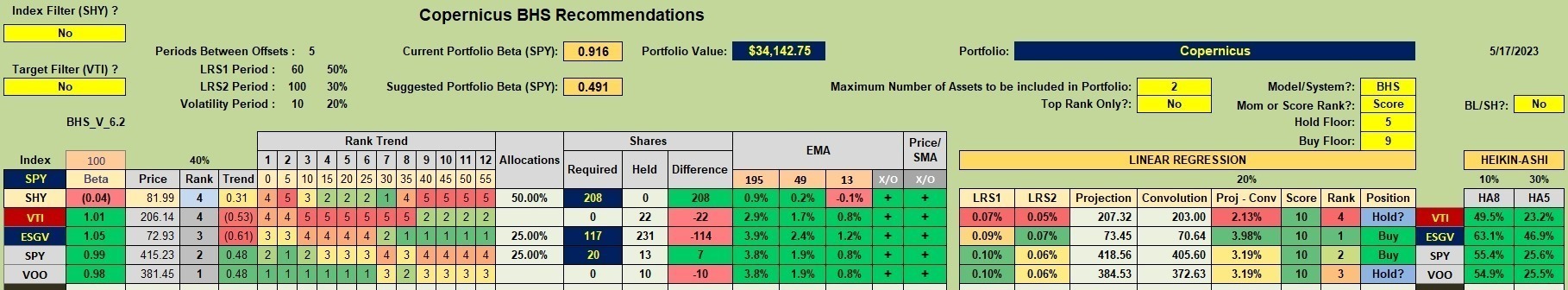

Copernicus Portfolio Options

While I am using four U.S. Equity ETFs, one could easily get by with one or two of the four. At times it is convenient to use ESGV as it is priced well below the other three and this aids in using up available cash. Right now I am holding back on new purchases until the U.S. debt issue is resolved.

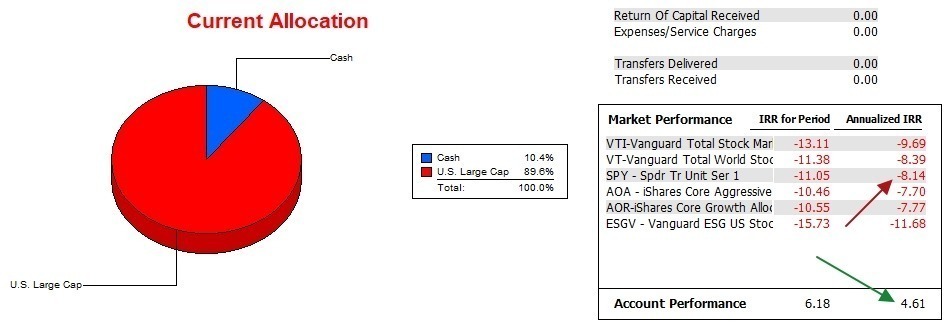

I have a series of limit orders in place that will use the 10% cash holdings should the market dip significantly.

The Copernicus investing model is known as passive investing. Young readers should seriously consider using this approach when planning for retirement. Yes, 20-year olds should plan for retirement. Send this link to your grandchildren.

Copernicus Performance Data

Over the past 16.5 months the Copernicus has performed very well. None of the tracked benchmarks come close to performing as well as the Copernicus.

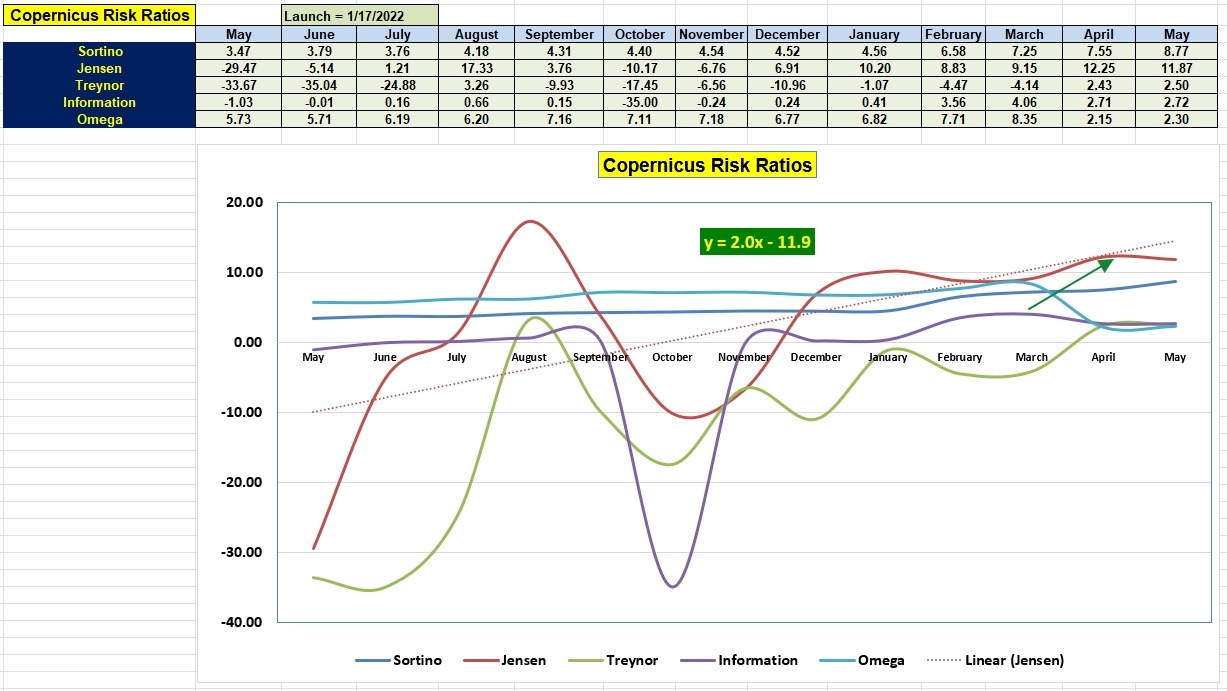

Copernicus Risk Ratios

Even on a risk adjusted basis the Copernicus is performing at an exceptional level. When the market dipped in 2022 the owner of this portfolio (Copernicus) continued to feed new cash into the portfolio. This infusion of new money permitted me to purchase more equity shares at lower prices. As the U.S. Stock Market rebounded those shares purchased in 2022 improved the IRR percentage and we see the benefits in the Jensen Alpha or Jensen Performance Index. Check the values since last December when we begin to see the benefits of dollar-cost-averaging.

It has not always been smooth sailing for the Copernicus. Check the October and November values and you will see a grim period for this portfolio. The concept is to stick with the plan.

The Copernicus is the portfolio model I highly recommend for young investors. In addition, use a Roth IRA when possible as I expect taxes are not likely to go much lower than they are now.

Notice: The ITA Wealth Management blog is now free to those who register as a Guest. After registration, give me a few days to elevate you to the Platinum level. Past paying clients are new grandfathered into a Lifetime membership. This will continue as long as I am able to maintain this blog site.

Readers of this blog are encouraged to spread the word. Let your friends and relatives know about this investment site. If you use social media, place the link on your site.

Copernicus Portfolio Review: 11 August 2022

The Elements of Investing: Part II

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.