Welsh Sheep

“An investment in knowledge pays the best interest.” – Benjamin Franklin

Copernicus is one of the easiest portfolios to manage as all one does is invest available cash in U.S. Equities. Never sell unless there is an absolute emergency.

If one were to simplify the Copernicus I would recommend investing only in VOO. This Exchange Traded Fund (ETF) closely tracks the S&P 500 and historically, it is extremely difficult to outperform this index.

If investing only in equities seems to be too risky, then apply the “William O’Neil Rule” of setting an 8% limit order under every new investment or even better, use a Trailing Stop Loss Order (TSLO). Of course one needs to renew this setting every six months or whatever the time limit your broker sets for limit orders.

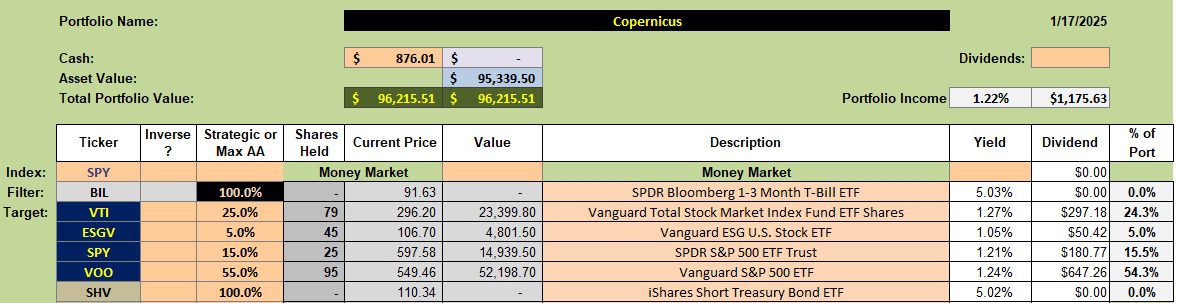

Copernicus Portfolio

Below is the current makeup of the Copernicus. As mentioned above, one could easily simplify this portfolio by investing only in VOO or VTI. Two limit orders are in place. One is to add one more share of VOO and a second is to pick up one more share of VTI.

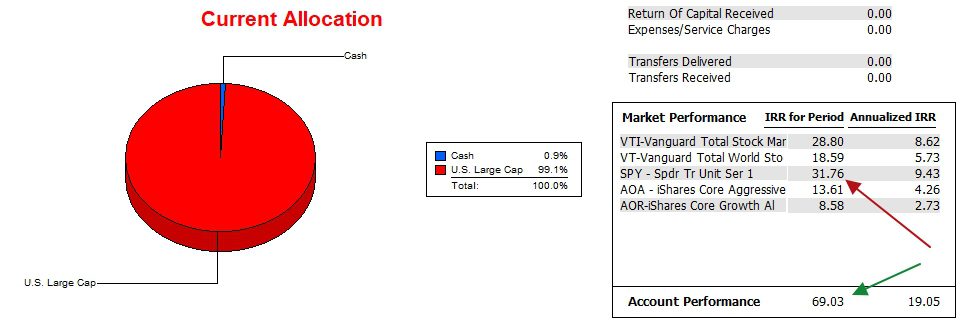

Copernicus Performance Data

We now have three years of data with the Copernicus and due to the advantages of dollar-cost-averaging, the portfolio is far outpacing all possible benchmark. Based on the performance below, it is hard to argue with this portfolio management model. Since shares are not sold it is also benefits the owner tax wise.

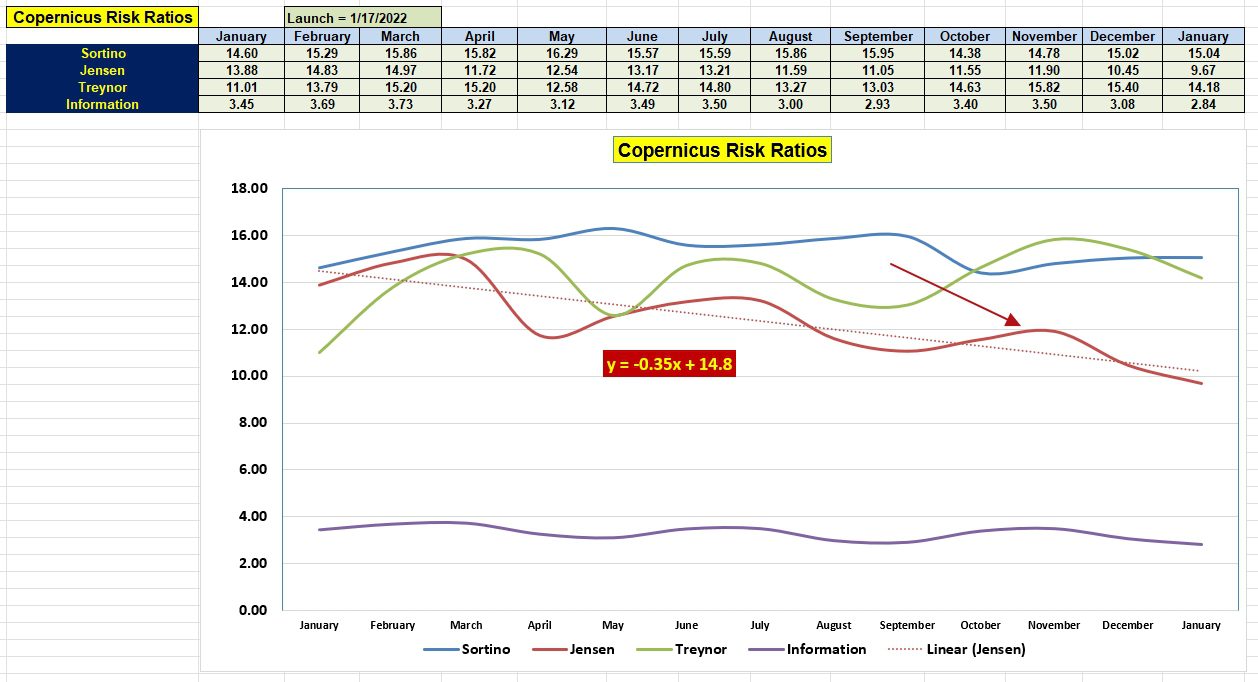

Copernicus Risk Ratios

The Jensen Performance Index is beginning to come down to earth. Any value above zero is excellent. The Jensen is currently hanging around 10 for the Copernicus.

The one negative is the slope of the Jensen Alpha. It will be most difficult to turn this around during 2025 as there are very high values earlier in 2024.

The goal for now is to keep the Jensen in positive territory.

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question