New Year at Marina Bay Sands, Singapore

At the end of 2023 the Darwin Portfolio is showing a profit of 17% (16.4% annualized IRR) since inception in November 2022. This is not as good as the return on the S&P 500 Index (up 18.5% over the same period) but beats the performance of a more diversified portfolio as exemplified by the AOR Fund (up 12.8%). I therefore take this as a positive sign.

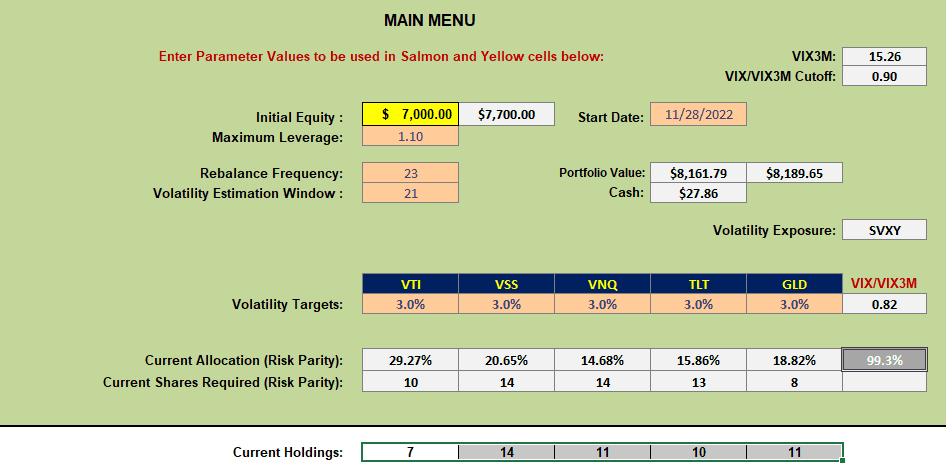

The Darwin Portfolio is a low maintenance portfolio of 5 ETFs representing a global diversification of asset classes – VTI representing US Equity markets, VSS representing International equity markets, VNQ representing US Real Estate, TLT representing US Treasuries/Bonds and GLD as a commodity diversifier. Approximately 90% of the portfolio is held in these 5 assets on a Risk Parity allocation basis with a targeted maximum volatility on each asset set to 3% of total portfolio value. These 5 ETFs are complemented by a ~10% allocation to SVXY – a volatility based ETF – for additional diversification. The Portfolio is managed allowing 10% leverage (borrowed money) if called for. At the present time no leverage is used and the portfolio is close to 100% invested.

The portfolio is only adjusted if allocations, as determined by risk parity calculations, get seriously out of balance (>20%). At the present time 4 of the 5 ETFs are slightly out of this range but I will not be adjusting because my broker is moving my account (to my dismay) to a new platform on January 12 – so I will wait until I get to familiarize myself with the new platform.

Current positions and recommendations look like this:

The methodology is not super-sensitive to small deviations from calculated values.

The methodology is not super-sensitive to small deviations from calculated values.

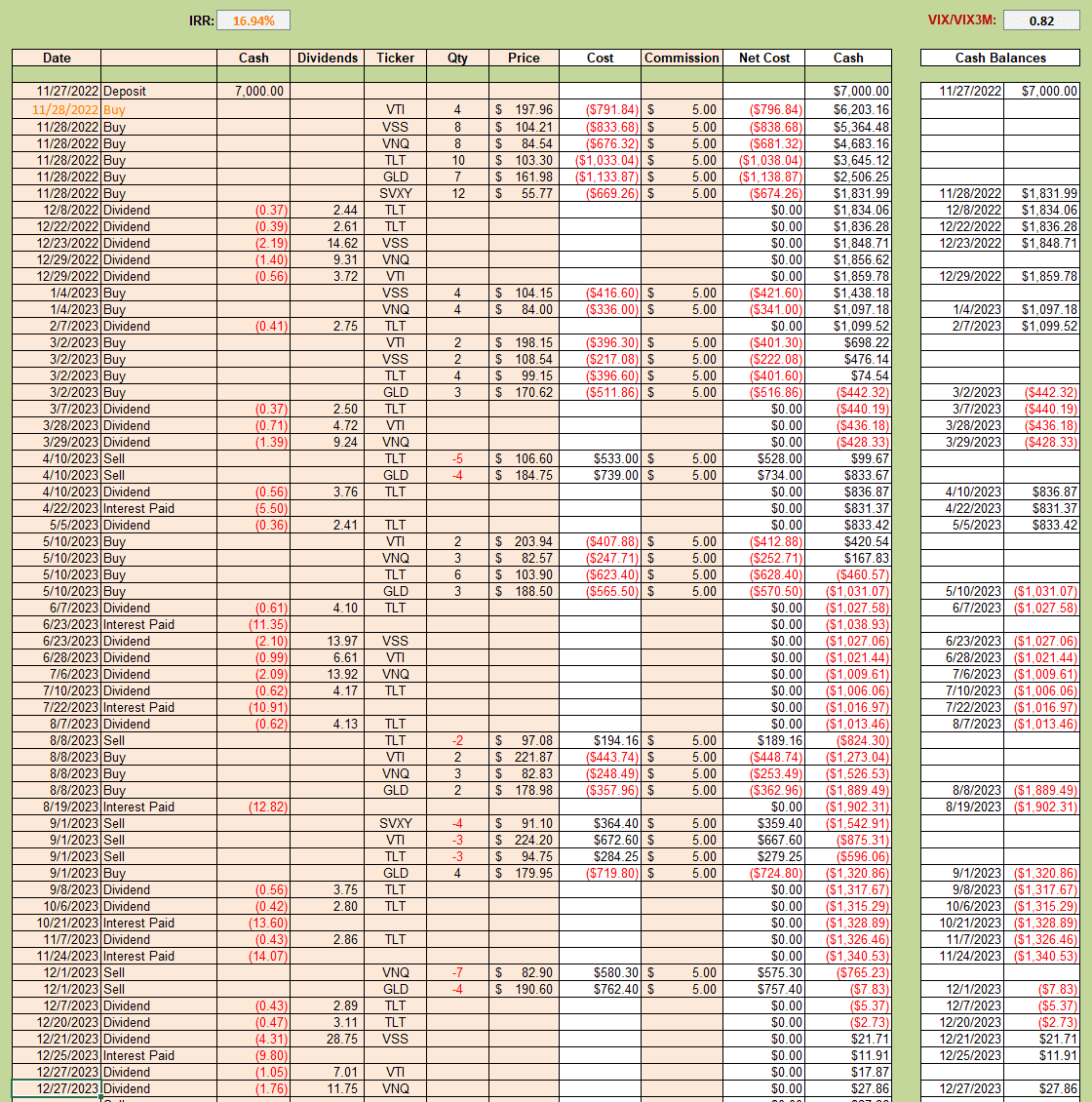

In tabular format, trading in this account, to date, looks like this:

note the 16.94% IRR.

note the 16.94% IRR.

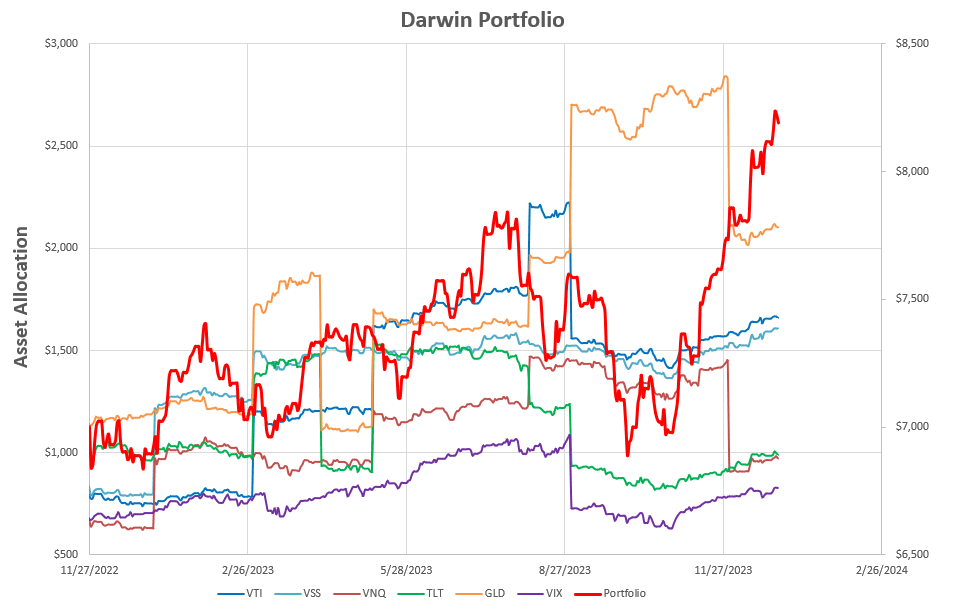

In graphical format, performance looks like this:

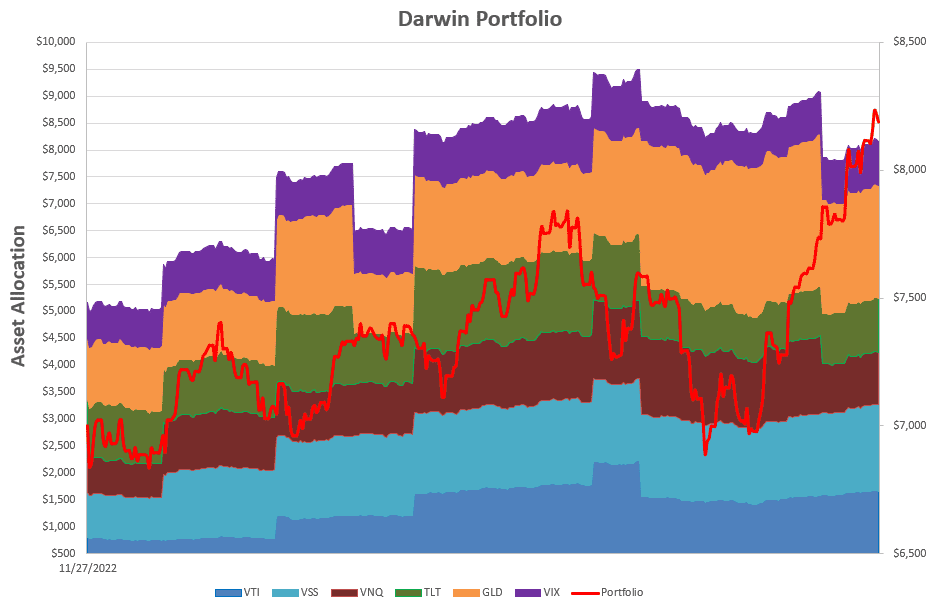

or, in stacked format:

or, in stacked format:

where the discontinuities – in all but the “Portfolio” plots – reflect the allocation adjustments to each asset.

where the discontinuities – in all but the “Portfolio” plots – reflect the allocation adjustments to each asset.

I have mentioned this before, but I will repeat again, the addition of the SVXY volatility ETF has been a significant contributor to the performance of this portfolio.

Look for adjustments at next month’s review when the account has been transferred to the new platform.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I’m very interested in this model and I am still interested in your use of the volatility ETF. I see you show the ratio of Vix to Vix3m. I assume this means you plan to do something when the ratio moves up, perhaps when it escapes contango? Since the vix is presently fairly low I’m curious how you plan to approach this? And how this interacts with the risk parity allocation process. Thanks for your work on this portfolio.

Jim

Jim,

Thanks for your comments and questions – I will write a separate, more detailed, post on my usage of volatility ETFs since it requires a little more explanation than is appropriate for this comment section – however, it may take me a little time since I am presently in the process of moving house (downsizing) and the de-cluttering is taking up a lot of my time. But it’s on my to-do list 🙂 .

However, a simple tactic would be, as you suggest, to move to a long volatility position when we escape contango and move into backwardation (VIX/VIX3M > 1). Since the “escape” is sensitive to the relative volatility level I try to refine this rule a little. You will have to decide whether it’s really worth the extra effort – and it’s difficult to test because this happens very infrequently (over 80% of the time we are in contango). From the top screenshot in the post you might notice that, since we are currently at very low volatility levels, my cut-off is at a VIX/VIX3M ratio of 0.9.

I have thought about whether to include the volatility of the volatility ETF in the risk parity (RP) calculations – and can’t decide whether this would be appropriate. So. at present, I have decided to calculate the RP based on 90% of total portfolio value and keep the volatility ETF at ~10%. In the period covered in the post I made one adjustment (9/1/2023) when SVXY had doubled in value and was representing closer to 20% allocation. Since I am allowing leverage I don’t have to worry too much about keeping everything within the no-margin limits.

Hope this will keep you going until I can get around to writing a more detailed post.

David

David

Thanks. This sis very helpful. Ive been through moving and downsizing. You have my sympathy.

Jim