Vineyard on Waiheke Island, off the coast from Auckland, New Zealand. Nice Whites 🙂

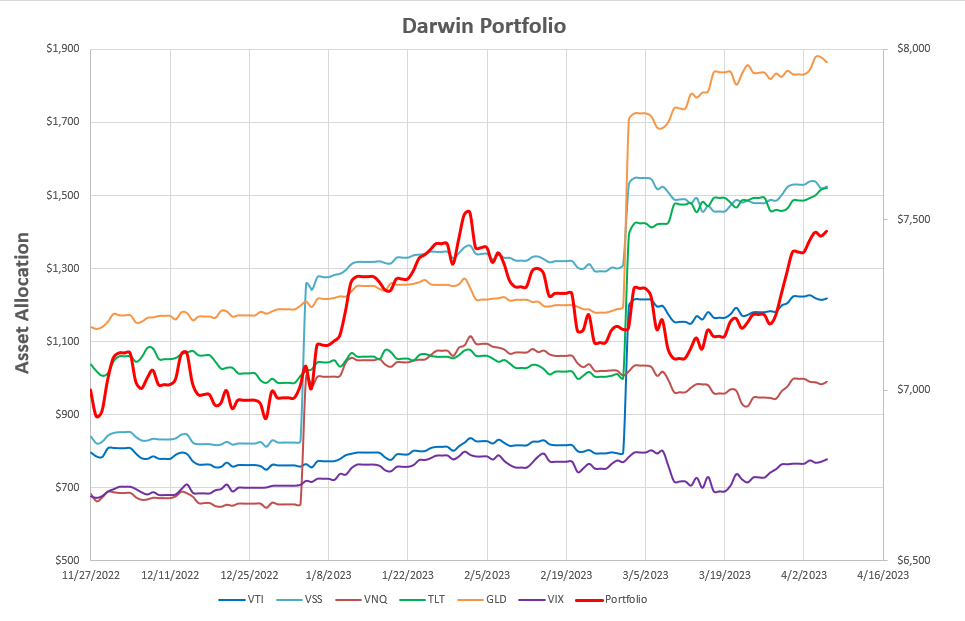

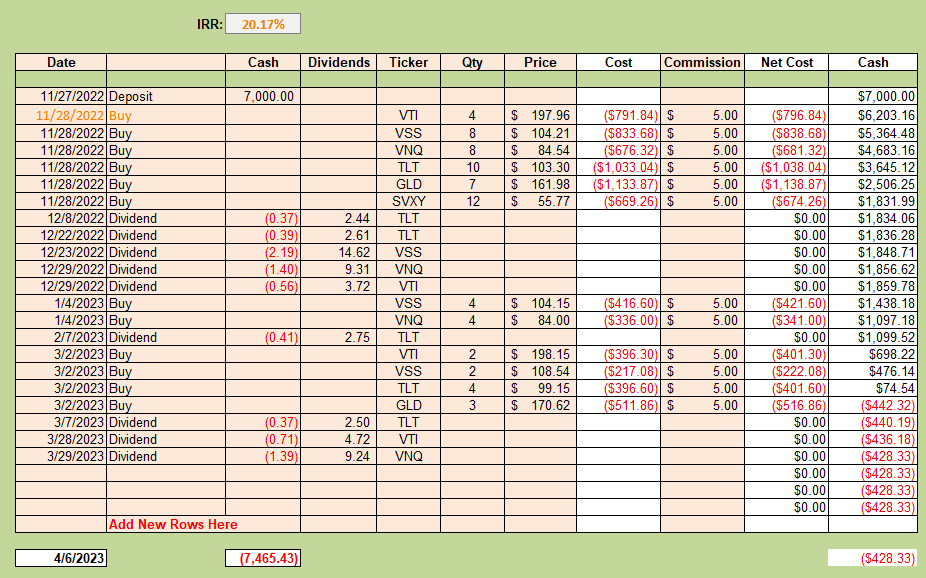

The Darwin Portfolio is a “Buy-And-Hold” portfolio of assets that is only adjusted when allocations fall out-of-line with recommendations based on risk parity (i.e. equal risk on all holdings). Performance to date (~4 months from inception) looks like this:

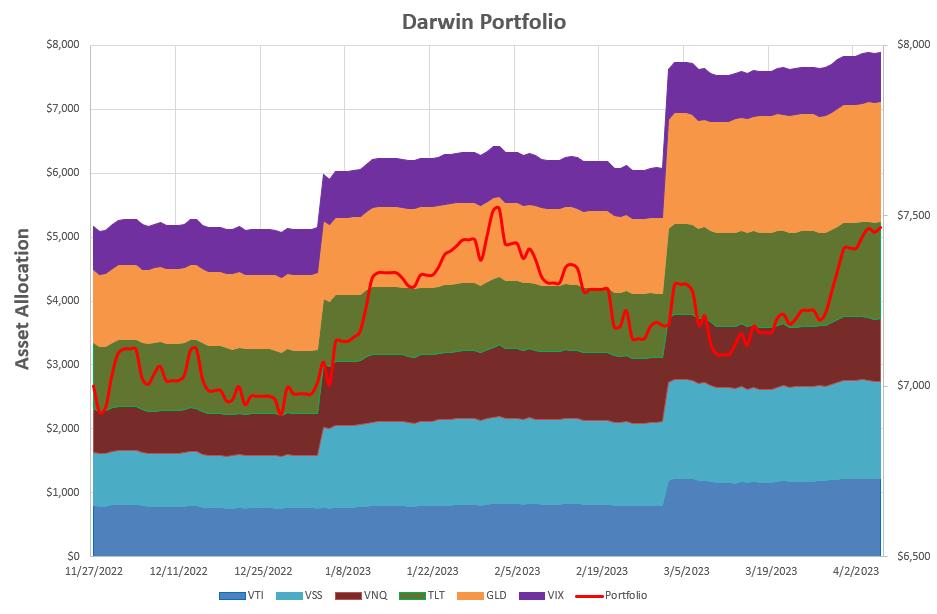

or, in stacked format:

or, in stacked format:

because of the adjustments these plots are a little difficult to follow but an analysis of the numbers shows that the Internal Rate of Return (IRR) over this period is over 20%.

because of the adjustments these plots are a little difficult to follow but an analysis of the numbers shows that the Internal Rate of Return (IRR) over this period is over 20%.

Of course, it is unrealistic to expect this level of performance to be matched going forward – but it is encouraging since this has not been an easy period for investors.

Of course, it is unrealistic to expect this level of performance to be matched going forward – but it is encouraging since this has not been an easy period for investors.

This is not my favorite investment model (hence the small size) but it is a contributor to my total portfolio holdings.

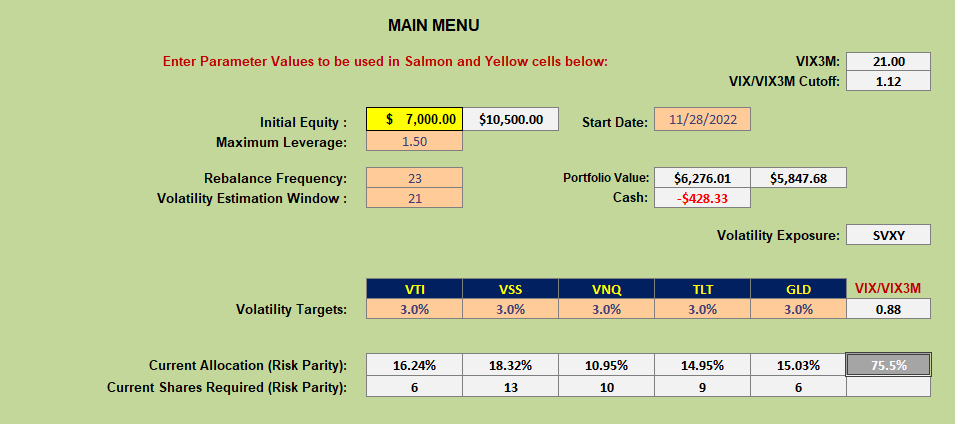

Checking the current recommended holdings:

some of the holdings are a little out of balance. Current holdings in VTI, VSS, VNQ, TLT and GLD are 6, 14, 12, 14 and 10 respectively. I want to keep adjustments to a minimum but I will reduce holdings in TLT (Long term Trasuries) by 5 shares and GLD (Gold) by 4 shares respectively. I will not adjust holdings in the other 3 assets. This will take all the leverage (set at 50%) out of the portfolio.

some of the holdings are a little out of balance. Current holdings in VTI, VSS, VNQ, TLT and GLD are 6, 14, 12, 14 and 10 respectively. I want to keep adjustments to a minimum but I will reduce holdings in TLT (Long term Trasuries) by 5 shares and GLD (Gold) by 4 shares respectively. I will not adjust holdings in the other 3 assets. This will take all the leverage (set at 50%) out of the portfolio.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.