Autumn in Portland

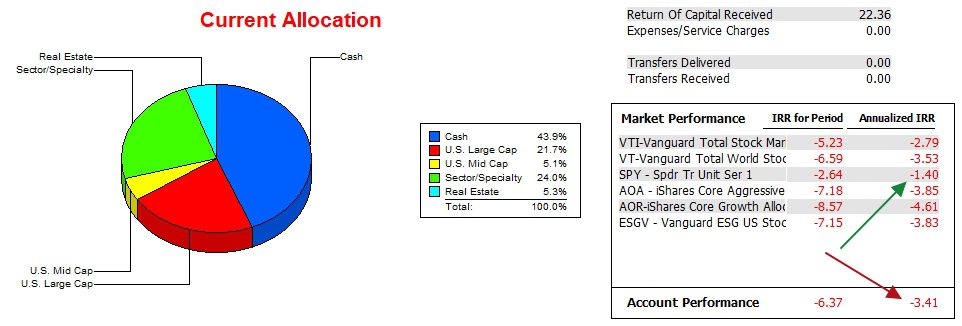

Sector BPI portfolios have entered a quite period as all sectors with exception of Technology reside in the “neutral” zone. Neutral is defined as Bullish Percent Indicators (BPI) lower then 70% bullish and above 30% bullish. The Huygens portfolio differs only in that it is carrying a high percentage (44%) in cash.

Huygens Investment Quiver and Holdings

I missed a number of purchases by setting limit orders too far below the market price. As a result, sectors that were recommended for purchase a few weeks ago are still positioned below their recommended level. For example, Materials (VAW) was recommended for purchase not long ago. The recommended percentage is 9.0% and the Huygens holds only 5.11%. Limit orders are still in place, but time may expire unless we see the market retrace some of its prior lows. Were this August instead of late November, stock prices might move lower.

Huygens Performance Data

Over the past 23 months the Huygens trails the SPY benchmark by two percentage points. However, it is outperforming both the AOA and AOR benchmarks. If the Sector BPI model works as anticipated, there is a possibility the Huygens may pull even with SPY by this time next year. While the Internal Rate of Return (IRR) is not the full story of portfolio performance, it is an important measurement.

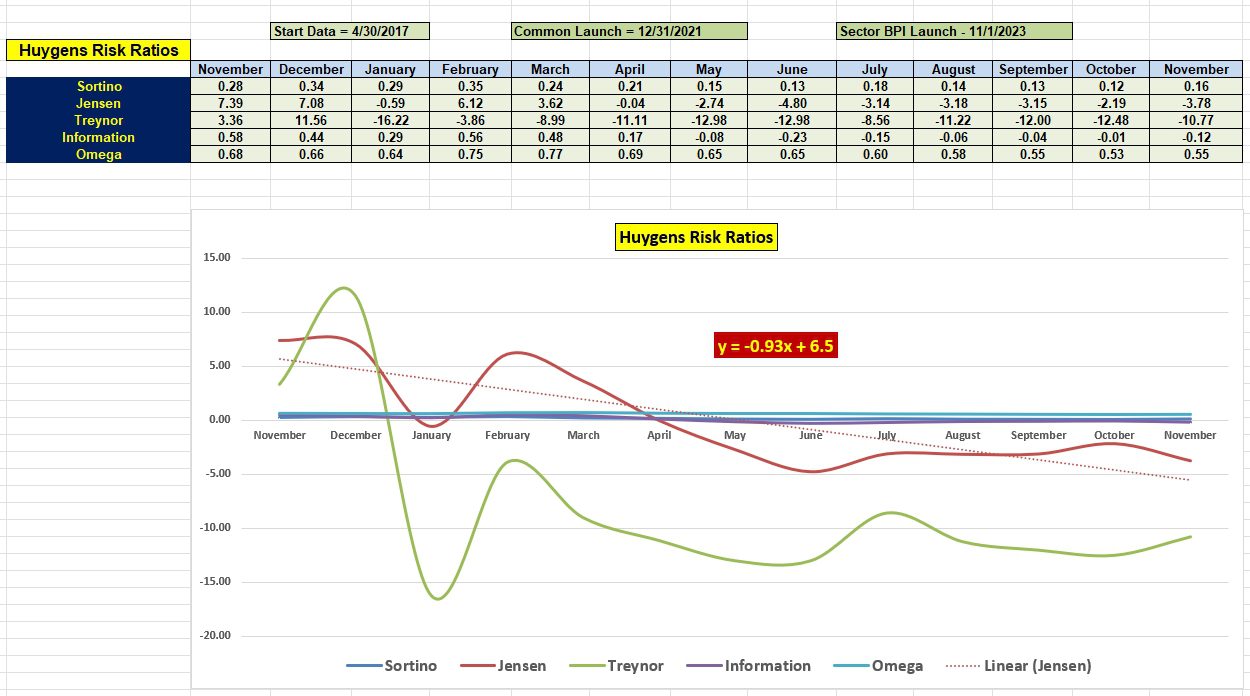

Huygens Risk Ratios

A more complete picture of how well a portfolio is performing is found in the following table as portfolio risk is taken into account. When we compare performance with last June, we see improvement. However, if we go back to last November we see a different story as the Huygens values this November are far below where they were a year ago.

It is going to take a few BPI cycles before we see much improvement in the Huygens. Keep in mind that the Huygens has been using the Sector BPI model for less than a month so it is much too early to draw any conclusions.

Questions and Comments are always welcome.

Tweaking Sector BPI Plus Investing Model: Part II

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.