Respite from current chaos.

Stay the course. Stick with the investment plan. That is the advice I am following with the Franklin Sector BPI portfolio in this update. Shares of SHV were sold to raise cash in order to populate the sectors currently in the oversold zone. Today’s strong market is most likely a “dead cat bounce.” Market action tomorrow and the rest of this week will provide a little guidance as to what is in store for this summer when we hit the “Dog Days.” Until tariffs are lifted or some deals are struck, the pain from the high tariffs are yet to be felt.

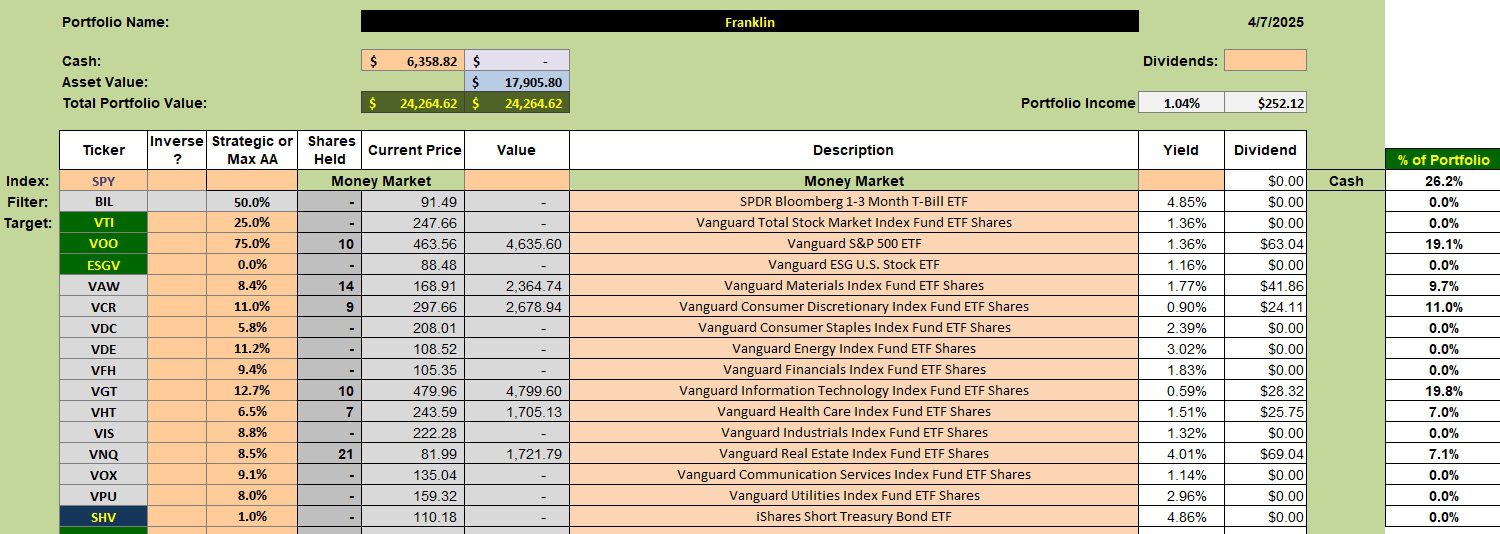

Franklin Sector Holdings

Below are the current holdings for the Franklin. Limit orders are in place to populate all sectors. I even have an order in to buy one share of Utilities as I would like to always hold at least one share in each of the eleven sectors.

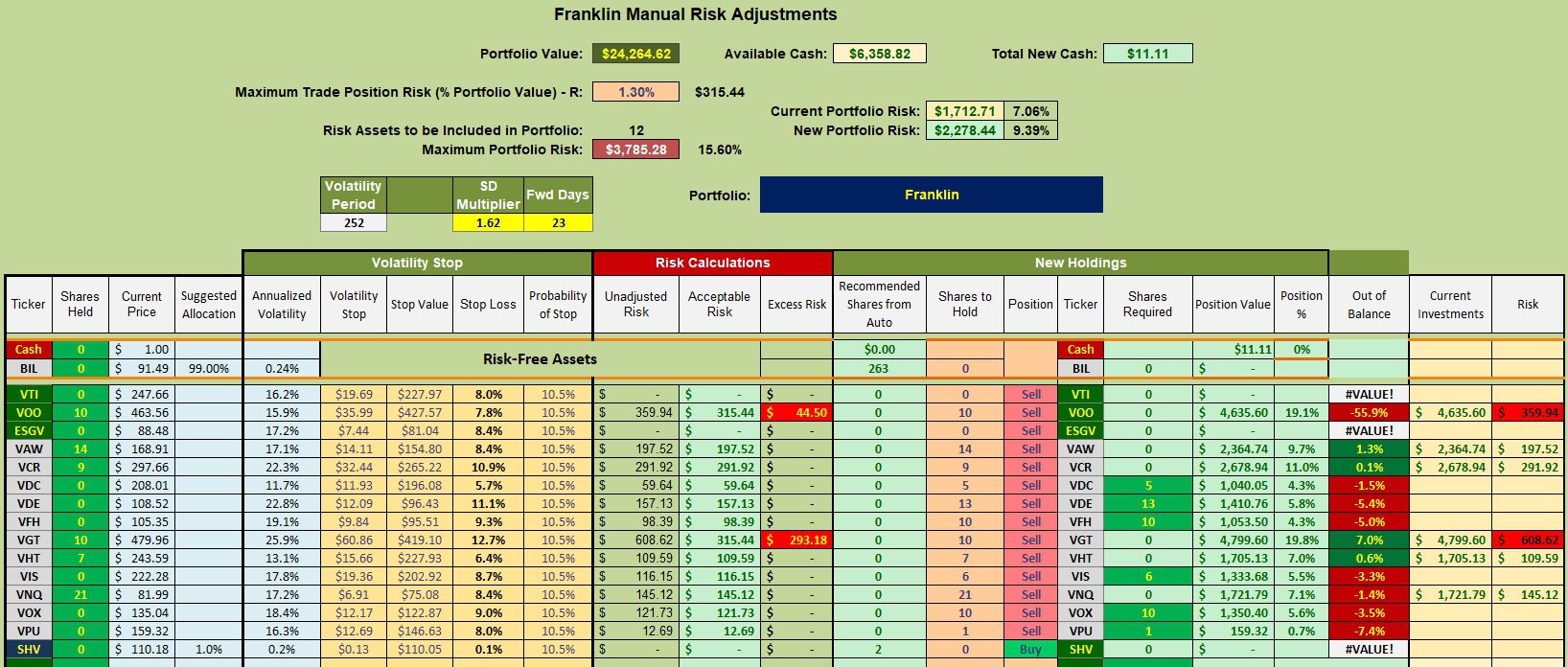

Franklin Rebalancing Recommendations

Insufficient cash is available to bring all oversold sectors up to their recommended percentages. Selling shares of VOO was the solution to raising more cash and I am reluctant to sell shares at this depressed level. With limited cash I set multiple limit orders at different levels, some well below the current price.

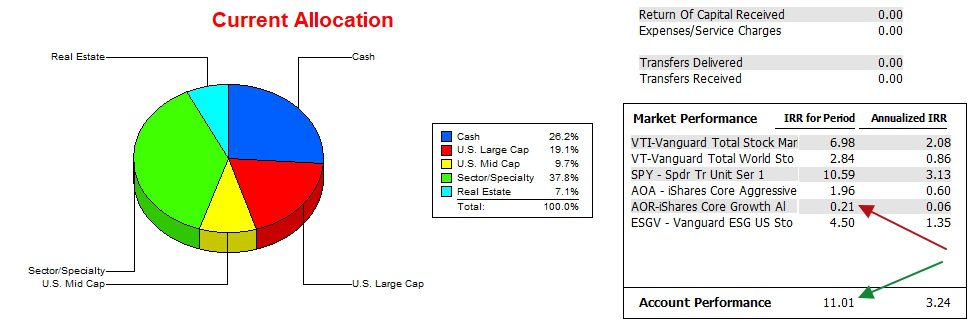

Franklin Portfolio Performance

Since 12/31/2021 the Franklin managed to outperform all benchmarks I’m tracking using Investment Account Manager software. Based on Internal Rate of Return (IRR) data the Sector BPI model is working as hypothesized.

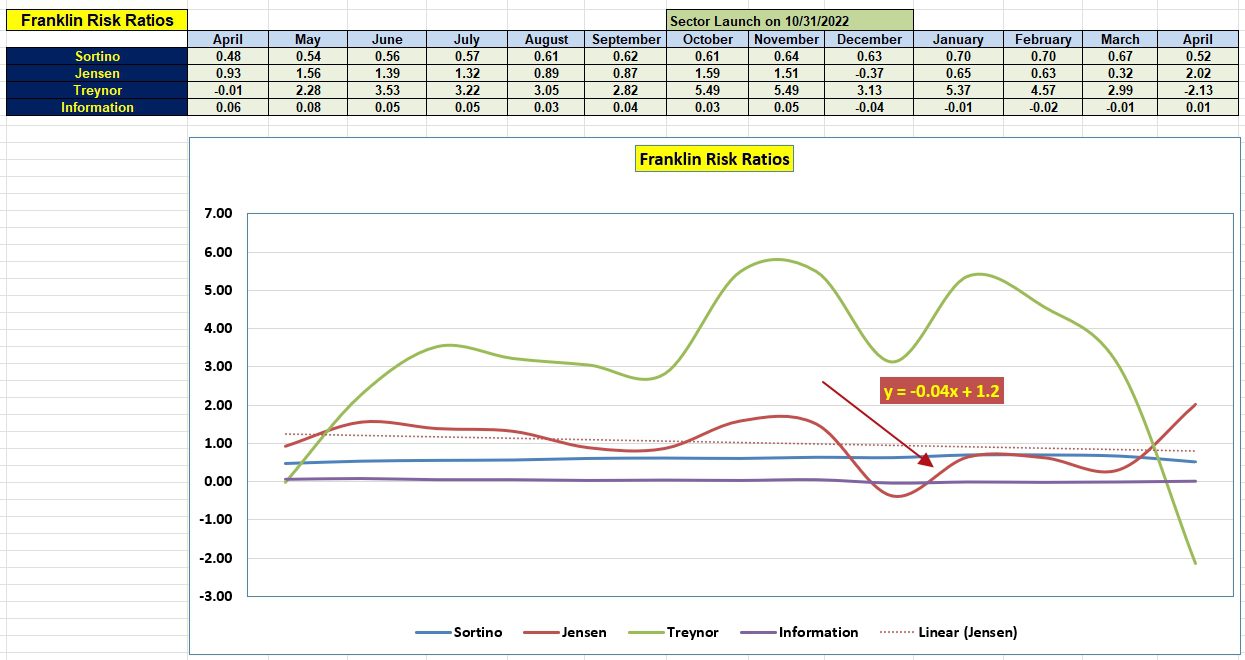

Franklin Risk Ratios

How is the portfolio performing when risk enters the equation? Not all risk ratios are above where they were last year. The Jensen Performance Index is improving, yet the slope is still negative. A few good months and the slope should turn positive.

The interest rate for the risk-free short-term treasury is declining. That helps the Jensen Alpha ratio.

The sale of SHV increased the portfolio beta and that is reflected in the Treynor turning negative.

The Franklin (named for Rosalind) will be review again before May.

Pass on this link to your friends and family.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question