Sunset in Canby, Oregon – Photo by Lin Rush

Gauss is one of five portfolios currently using the Sector BPI investing model. The other four are: Carson, Franklin, McClintock, and Millikan. To see how these portfolios are performing, check out this blog post. These five portfolios were launched at different times and are reviewed at different times of the month. These variations reduce the luck-of-review-day leading to a more honest appraisal of this investment style. Each month we build more evidence as to whether or not this investing model is beneficial to the owners. The portfolios differ in size, a minor variable.

While the Sector BPI investing model has been working quite well over the last few years, we still need to see how it performs during a recession or even worse, a depression. I consider this model to still be in the hypothesis stage of development.

For the investor not interested in spending time managing a portfolio, the two best options tracked on this blog are the Schrodinger and Copernicus. Neither of these two portfolios provide downside protection in case of a major draw-down. This is less of an issue if one is invested for the long run. Lower market conditions provide one with the opportunity of buy shares at lower prices – assuming cash is available. Copernicus is my choice for the investor with a 15-year or longer investing horizon.

Now let’s get into the analysis of the Gauss portfolio.

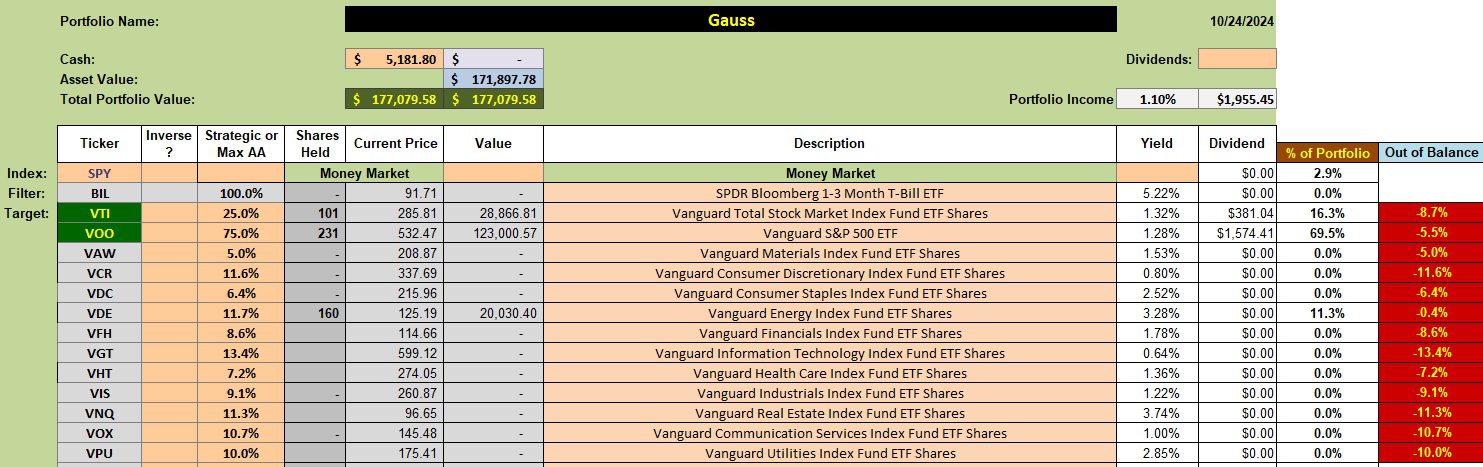

Gauss Sector BPI Security Holdings

Below is the current investment quiver and holdings for the Gauss. Energy was the last sector to drop into the oversold zone. The recommended percentage to hold is 11.7% and the Gauss currently holds 11.3%. These percentages will vary depending on the price of VDE when the portfolio is reviewed.

Since no other sectors are recommended for holding at this time, we are heavily invested in VOO and VTI. We concentrate on these two Exchange Traded Funds (ETFs) as the goal is to outperform the S&P 500. Both VOO and VTI are U.S. Equity securities.

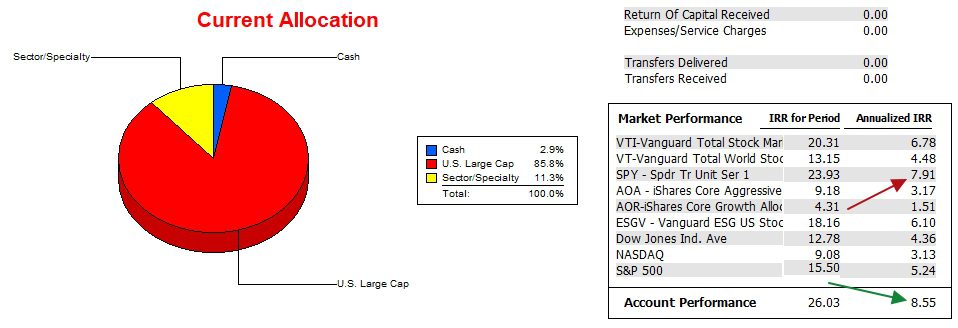

Gauss Performance Data

Since 12/31/2021 the Gauss is outperforming SPY by a small percentage. The gap is even wider when compared with the index itself.

I should mention that the Gauss has been using the Sector BPI for 23 months of this nearly three year period.

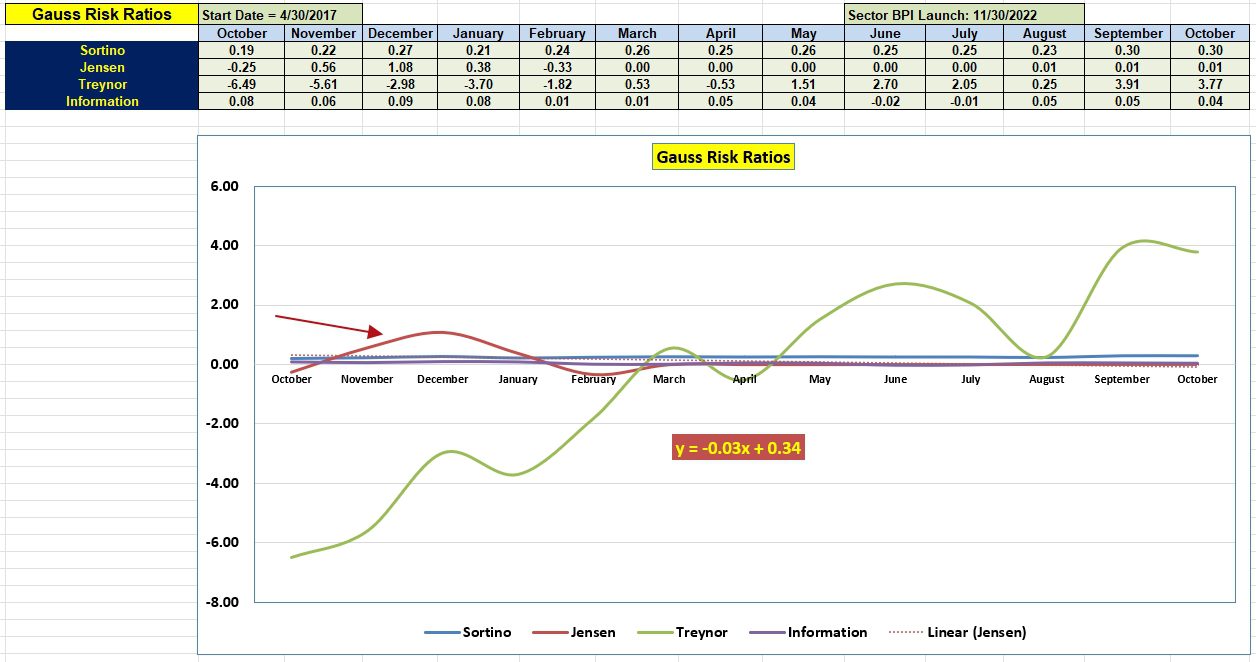

Gauss Risk Ratios

While many investors focus strictly on return, I believe in a balance between return and risk. For that reason I’ve set up what I title several risk factors. The primary one is the Jensen Alpha or Jensen Performance Index. This risk measurement takes into account the following four factors.

- Internal Rate of Return (IRR) of the portfolio.

- IRR of benchmark.

- Portfolio beta.

- Interest rate of a short-term treasury. I use the interest rate of SHV, currently at a high 5.14% value.

The Sortino Ratio is preferable to the very familiar Sharpe Ratio as the Sortino does not penalize volatility to the upside. We want to portfolio to move up, not down. The Sharpe Ratio treats up and down volatility equally.

The slope of the Jensen is currently flat indicating the portfolio is closely tracking the SPY benchmark.

If interested in following other Sector BPI portfolios, sign up as a Guest and wait for me to move you up to the Platinum level. Platinum opens up the entire blog for viewing.

Gauss Sector BPI Portfolio Update: 3 January 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question