“Punting” down the River Cam, St. John’s College, Cambridge, England

It has been three months since I last reviewed the Hawking Portfolio and it has continued to churn out over $1,000 per month in dividends/distributions. The portfolio is essentially a Buy-and-Hold portfolio, although some actions might be taken that could benefit the performance of the portfolio (see below for an example).

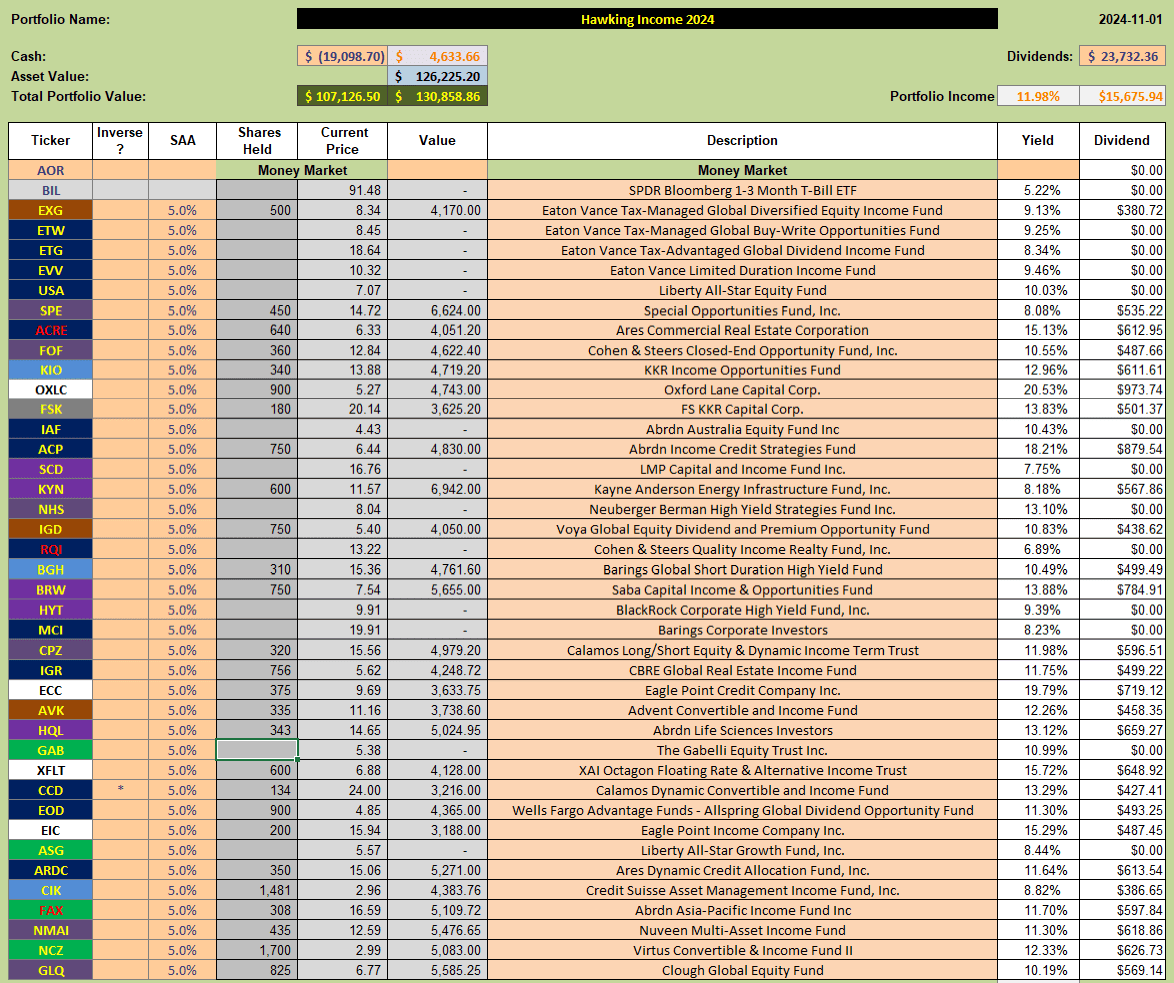

Current holdings in the portfolio look like this:

with no new additions/adjustments since the last review. As can be seen from the above screenshot the estimated distribution yield from this portfolio is ~12%.

with no new additions/adjustments since the last review. As can be seen from the above screenshot the estimated distribution yield from this portfolio is ~12%.

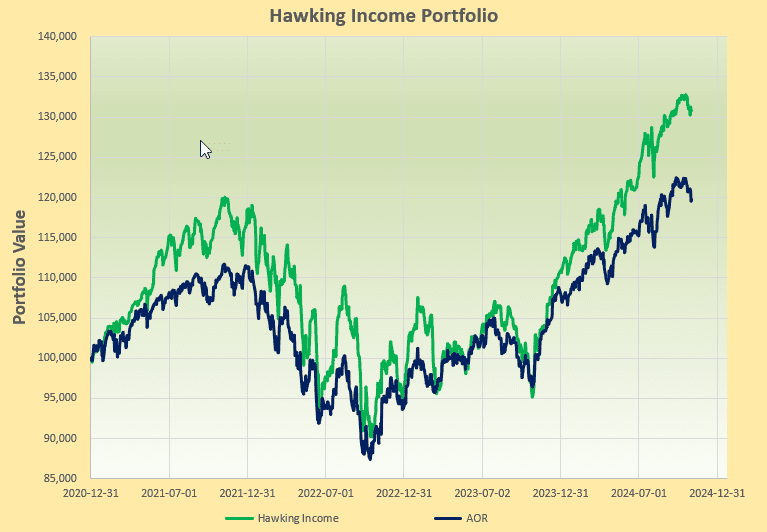

Performance to date looks like this:

with the portfolio outperforming the benchmark AOR Fund by ~$12,000 over the (almost) 4 years since inception. Total returns (including the 2022 downturn) are running at ~31% (average 8% annual) since inception compared with less than 20% for the AOR benchmark. This year, to date, has been particularly strong with the portfolio generating ~20% returns.

with the portfolio outperforming the benchmark AOR Fund by ~$12,000 over the (almost) 4 years since inception. Total returns (including the 2022 downturn) are running at ~31% (average 8% annual) since inception compared with less than 20% for the AOR benchmark. This year, to date, has been particularly strong with the portfolio generating ~20% returns.

Because I have been a little pre-occupied with other things over the past few months the portfolio is currently holding almost $5,000 in Cash from the monthly distribution payments. In order to generate geometric growth I need to re-invest this Cash (since I do not need to withdraw money at this time) and I shall do this once the elections are over.

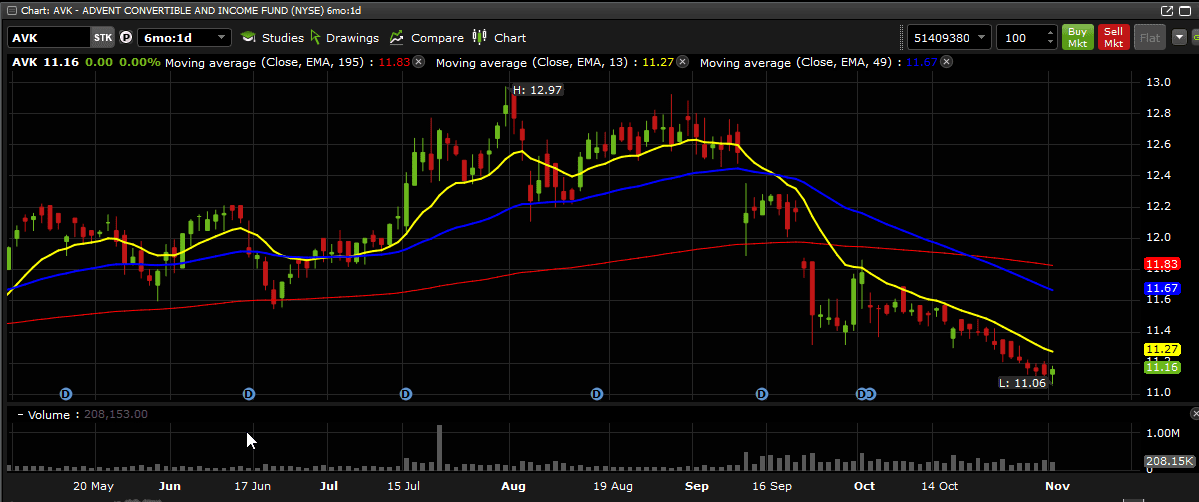

I mentioned above that little action is required with these “Income” portfolios – however, there was an action that I missed in September when Advent Convertible & Income Fund (AVK) made a “Rights” offering to sell new shares at less than the Net Asset Value (NAV) of the Fund. This is not uncommon in the Closed-End-Fund markets as Funds try to raise more Cash with which to invest, and often (usually) results in a drop in the market price of the shares (due to an anticipated dilution in share value). This is exactly what happened to AVK:

where share price has dropped from about $12.20 in September to the current level of ~$11.20. The final subscription price for new shares was $11.28 (90% of NAV at expiration of the Rights offering). What I should have done was to sell my share holding in AVK in September and then been ready to use those proceeds to buy more shares (at the lower price of $11.20) now that the offer has expired. I missed the notification on this one so I lost an opportunity to add alpha – but the fund still pays an annual distribution of 12.6% so it still isn’t disasterous and stays in my portolio in expectation of a price recovery going forward now that the dilution has been taken.

where share price has dropped from about $12.20 in September to the current level of ~$11.20. The final subscription price for new shares was $11.28 (90% of NAV at expiration of the Rights offering). What I should have done was to sell my share holding in AVK in September and then been ready to use those proceeds to buy more shares (at the lower price of $11.20) now that the offer has expired. I missed the notification on this one so I lost an opportunity to add alpha – but the fund still pays an annual distribution of 12.6% so it still isn’t disasterous and stays in my portolio in expectation of a price recovery going forward now that the dilution has been taken.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

David,

Thanks for the update.

~jim

Yesterday I picked up another 100 shares in AVK since I missed the Rights opportunity and now that the offer is closed I an anticipating a recovery in price from here – plus I will pick up the monthly dividend in a few days.

So far this looks like a good move https://www.dropbox.com/scl/fi/hag3h69exa9jfcmr4j6uq/AVK-2024-11-09_12-32-02.png?rlkey=8ovgx4jqdgg9zqrzmxos6sxxx&dl=0

David,

Thanks for the update and graph. I initiated a position in AVK, fairly close to the bottom this week.

~jim

I have also added additional shares (~$1,000 each) to each of the following CEFs: FSK, EIC, CCD. My only reason for choosing these CEFs was to balance the holdings in the portfolio.

It was a good week for the Hawking 🙂