Geothermal Hot Springs at Rotorua, New Zealand

The Hawking Portfolio is essentially a Buy-And-Hold “Income” Portfolio built from Closed-End-Funds. Normally. the only actions required are to re-invest dividends into the Funds so as to maximize the benefits of compounding.

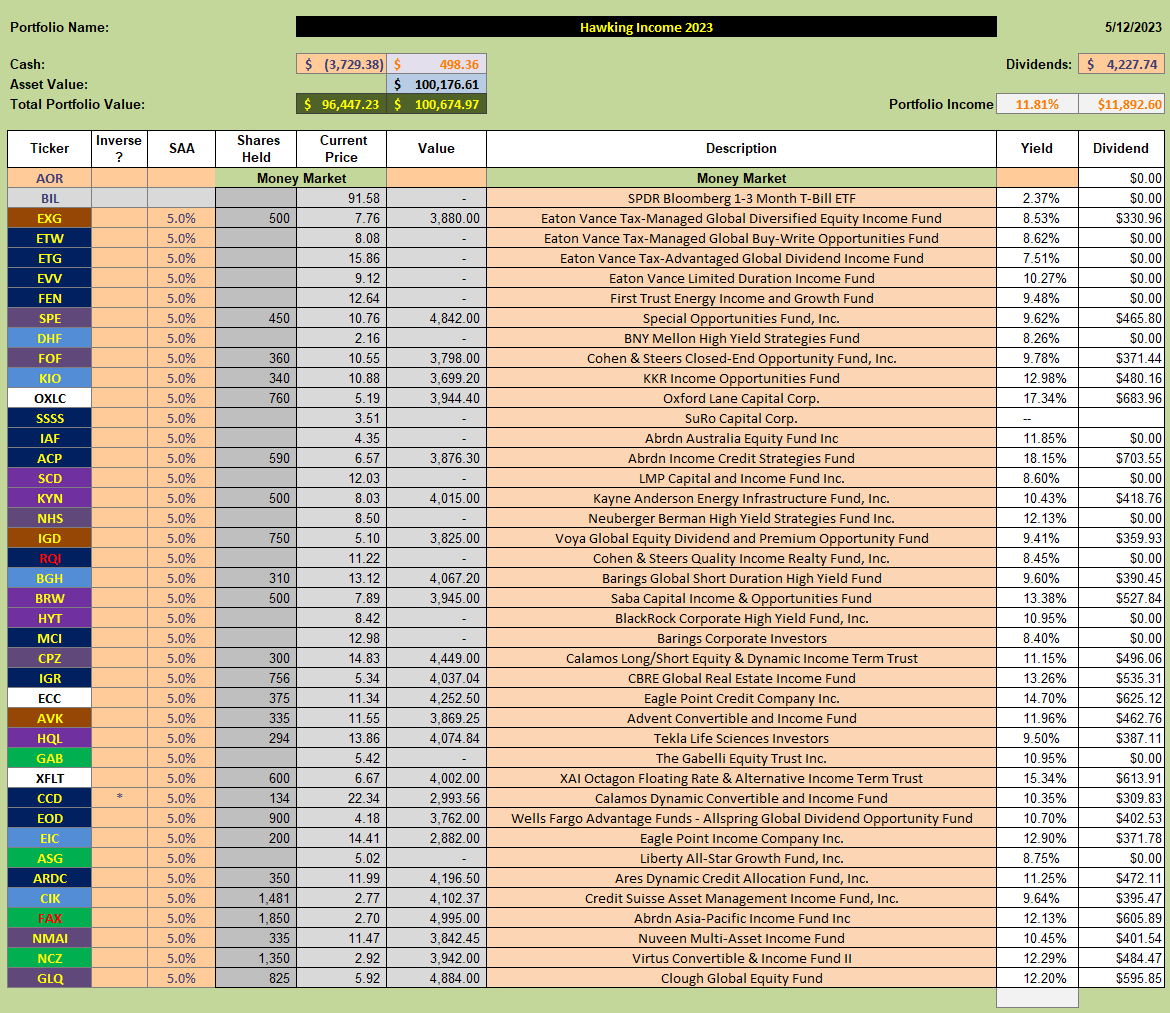

At present, the composition of the portfolio looks like this:

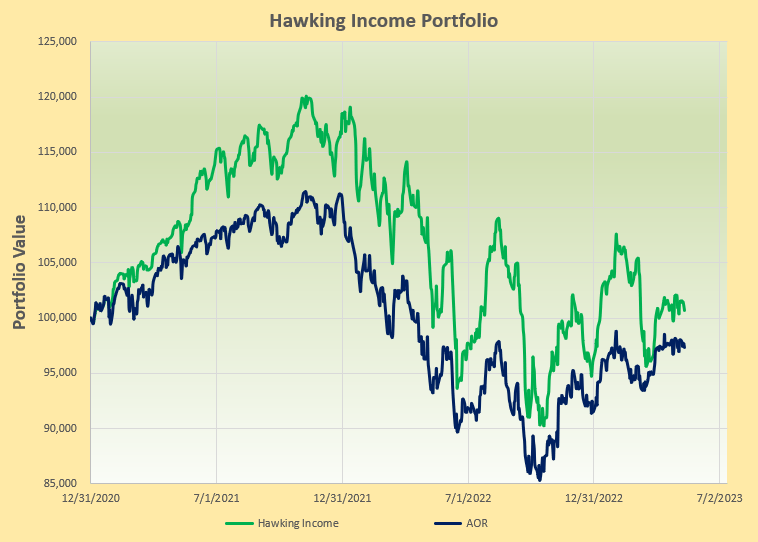

I know this type of portfolio is out of favor with Lowell at the moment 🙂 , but here’s the performance over the last 2+ years:

I know this type of portfolio is out of favor with Lowell at the moment 🙂 , but here’s the performance over the last 2+ years:

where we can see that, despite the heavy drawdown in February of this year. the portfolio has stayed well ahead of the benchmark AOR Fund. With over $4,000 in dividends in ~4 months this year (on a ~$100,000 portfolio) we are looking at something like a 12% dividend yield. If we continue to re-invest these dividends as prices go down (effectively dollar-cost-averaging with no additional contribution of new money) and, especially if funds are trading at a discount to Net Asset value (NAV) – one of our guidelines/rules for these investments – then, when markets recover, these funds should continue to outperform the overall markets.

where we can see that, despite the heavy drawdown in February of this year. the portfolio has stayed well ahead of the benchmark AOR Fund. With over $4,000 in dividends in ~4 months this year (on a ~$100,000 portfolio) we are looking at something like a 12% dividend yield. If we continue to re-invest these dividends as prices go down (effectively dollar-cost-averaging with no additional contribution of new money) and, especially if funds are trading at a discount to Net Asset value (NAV) – one of our guidelines/rules for these investments – then, when markets recover, these funds should continue to outperform the overall markets.

Most of this month’s dividends were used to buy more shares in IGR (a global Real Estate Fund) when I exercised a Rights offering. Normally, when these Rights offerings are announced I prefer to sell my shares and to repurchase after the new shares are issued – but I missed the offering while away for 2 months at the beginning of the year. These Rights offerings are just one of the complications that come with holding CEFs. I will wait for the $1,000 that I expect to come in at the end of the month before re-investing. Most of these funds pay dividends monthly rather than quarterly – so the income stream is relatively smooth.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.