Delahaye: Located at Mullins Museum in Oxnard, CA

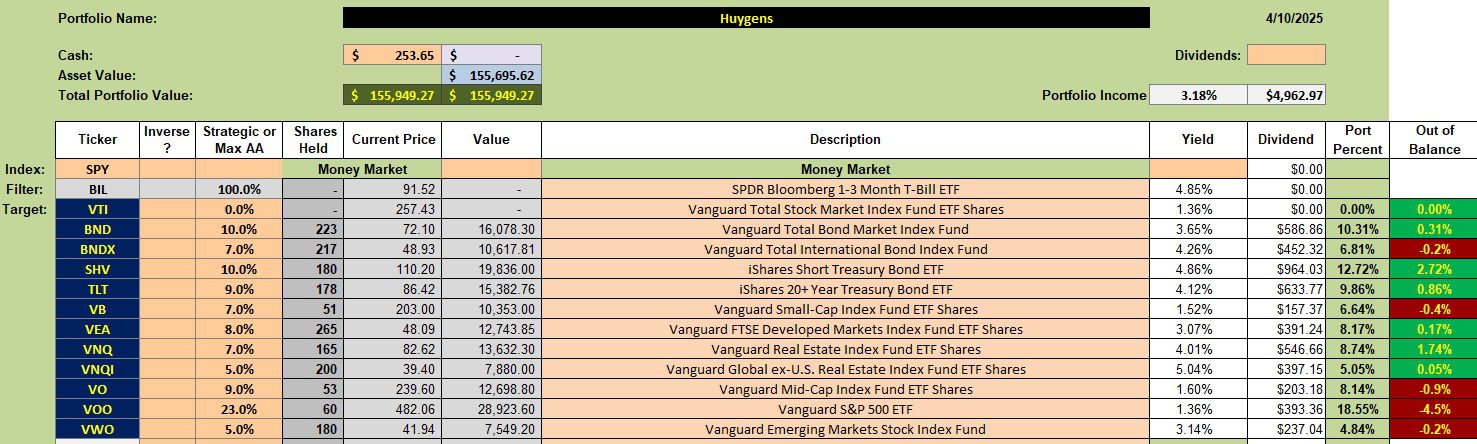

Huygens is one of numerous portfolios managed using the time tested Asset Allocation approach. While different asset classes or even different securities might be used, the basic approach is to diversify across the globe. Readers see this is the plan for the Huygens. We have domestic and international stock and bonds. Real Estate is diversified around the globe.

The portfolio is coming into balance. Anticipate several asset classes will always be above target while others are below target. Price changes from month to month will move the percentages around while the target percentages remain the same. Dividends are used to bring asset classes below target up to target. As you see in the second screenshot, limit orders are in place to add to small cap and international REITs.

Huygens Asset Allocation Holdings

Below are the current holdings for the Huygens portfolio. I would like to keep the percentages within plus or minus one percentage point. Three to five percent may be a more realistic goal, depending on the volatility of the market.

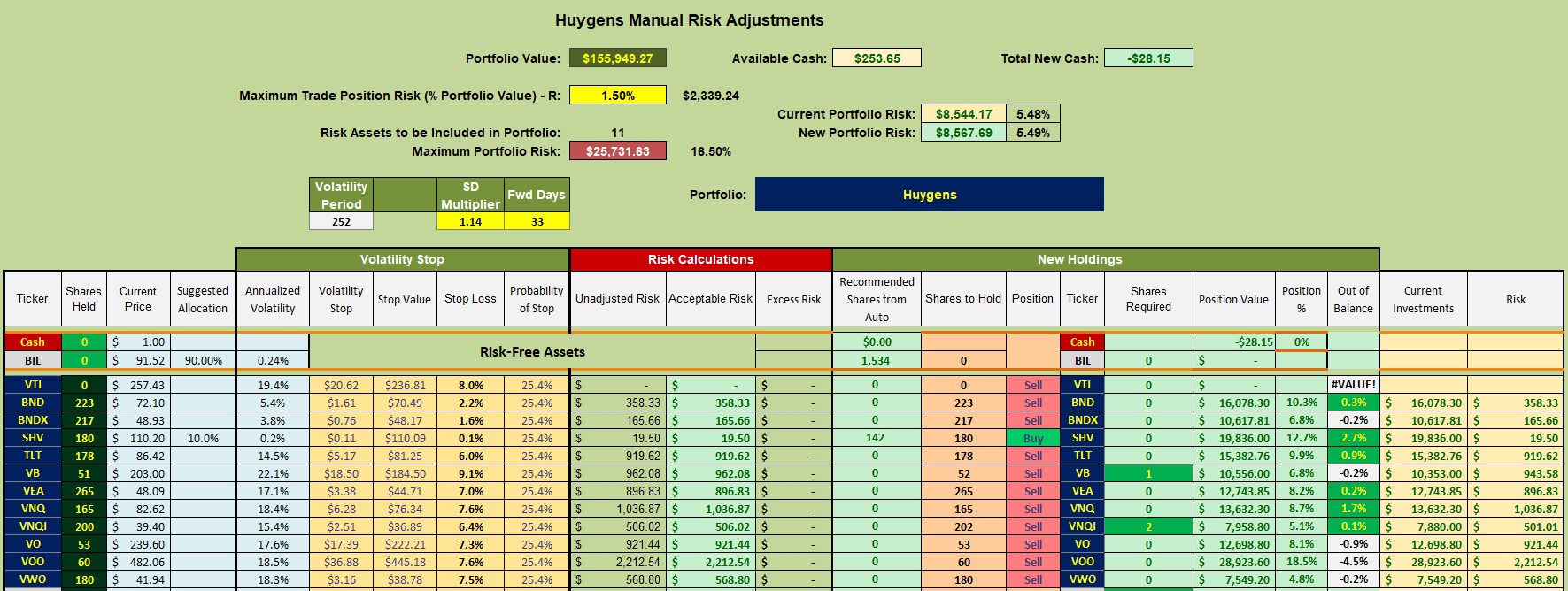

Huygens Recommended Rebalancing

Check the fifth column from the left to see the annualized volatility. Somewhere around +/- 15% is about normal for U.S. Equities. VB is now 22% or on the high side.

By purchasing shares of an asset class when it is below target we are dollar cost averaging when the price of an ETF is lower. Over time this model should pay off to the upside as we are consistently purchasing shares at lower prices and never selling unless there is an emergency.

As readers, if you have been following the portfolio updates you know that several portfolios use this same investing model, but with a much more simplified set of asset classes. The Einstein and Kepler are two portfolios I moved to this plan in order to improve returns.

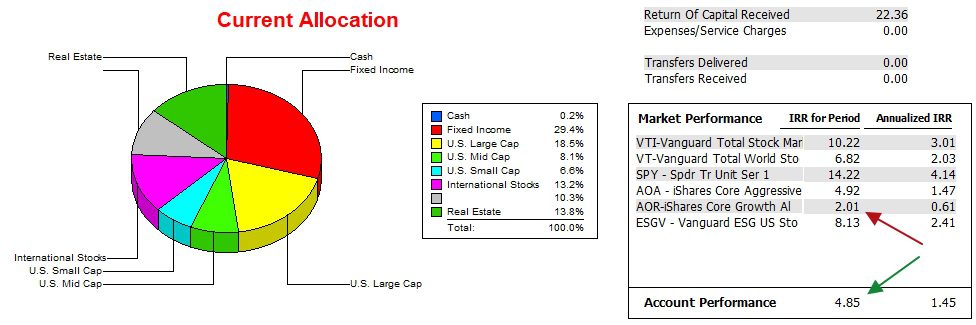

Huygens Performance Data

Since 12/31/2021 the Huygens outperformed the AOR benchmark, but trails the SPY.

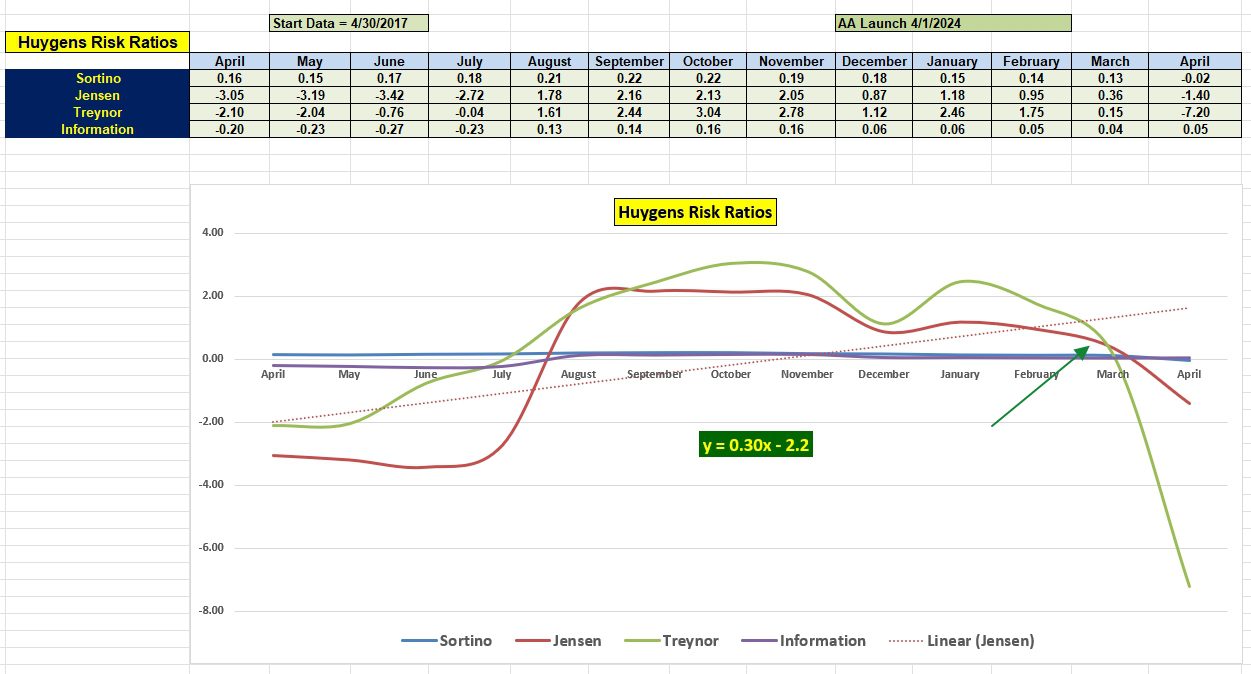

Huygens Risk Ratios

I need to recheck the Jensen value as the Information Ratio improved. When the Information Ratio moves up the Jensen generally follows in the same direction.

The good news is that the slope of the Jensen Alpha is a strong positive 0.30.

If you came into an inheritance of $100,00 what would you do in this market environment? Stay tuned for a possible plan.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question