Little has changed within the Huygens since the last review. No new money was added and the few dividends are being used to purchase another share of SHV. For any readers managing an Asset Allocation portfolio, and using the Kipling spreadsheet, follow along to see how I am rebalancing the Huygens.

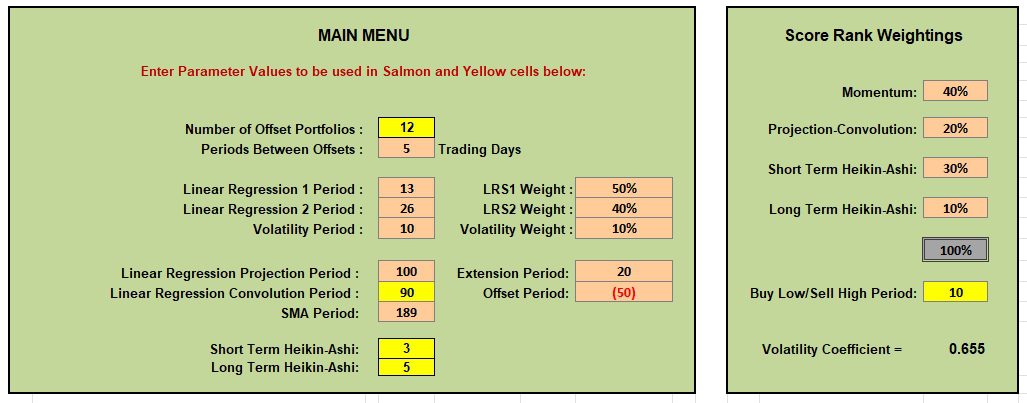

Main Menu

Here are the Main Menu settings I am using with the Huygens.

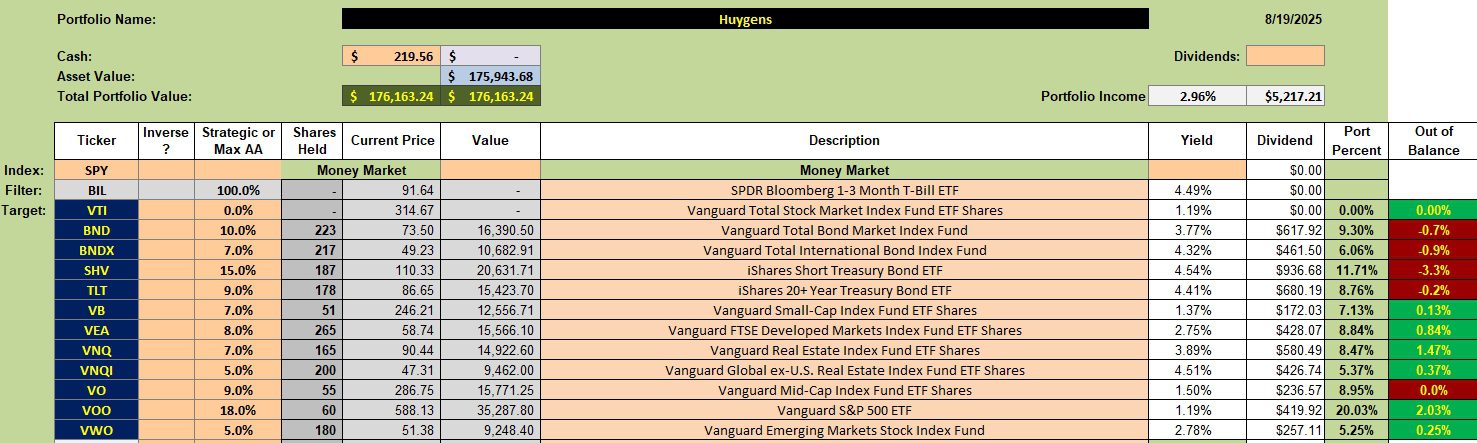

Huygens Asset Allocation Plan

Below is the Asset Allocation portfolio. The portfolio is essentially fully invested. One limit order is set to pick up one share of SHV.

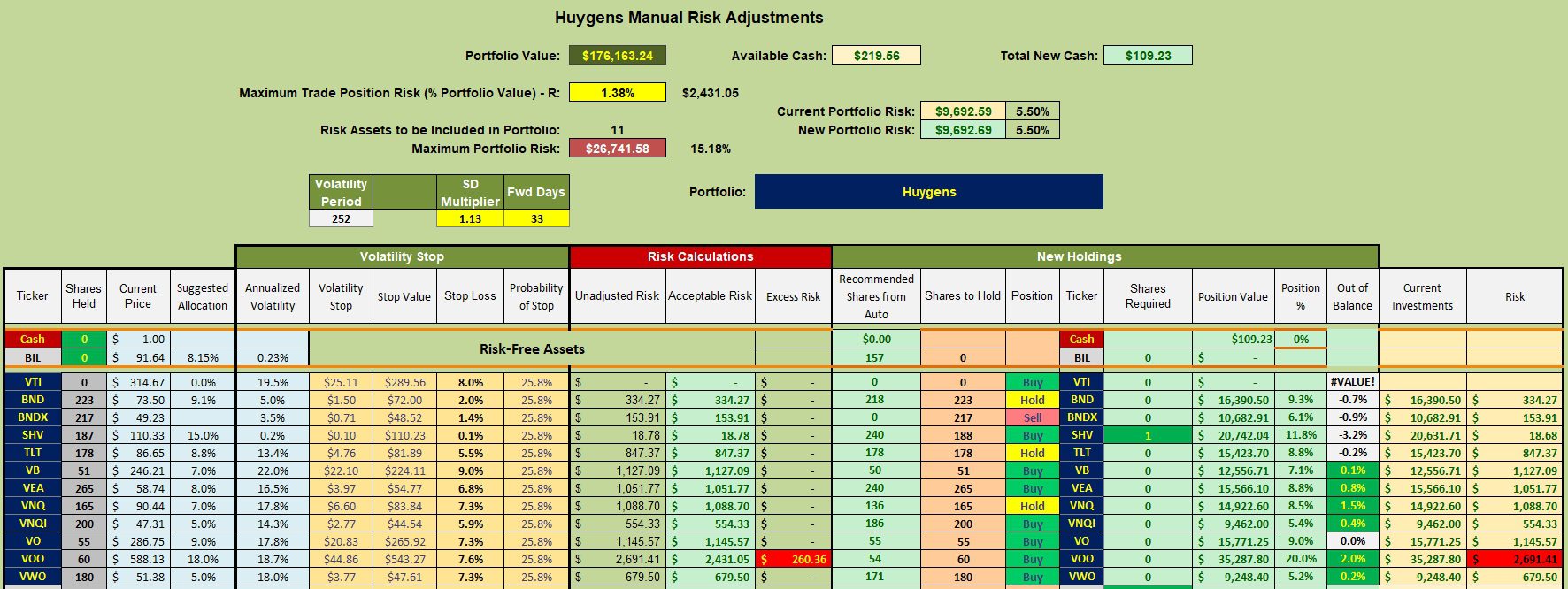

Huygens Rebalancing Recommendation

How do I rebalance this Asset Allocation portfolio?

- Assets showing a Hold or Sell are ignored and allowed to run untouched.

- I go down the list of securities (ETFs) showing a Buy and look for one or more that are most under target. This month that asset is the short-term treasury or SHV. With limited cash I placed a limit order for one share. Since SHV never varies much in price, I set the limit order one penny below the current price.

Huygens Performance Data

Since 12/31/2021 the Huygens is slightly ahead of the AOR benchmark. In a down market the Huygens should outperform the S&P 500, but lag or fall behind in a bull market. We are currently in a bull market and that accounts for the wide difference between the Huygens and SPY.

I think the gray box, which is not identified, is likely real estate.

Huygens Risk Ratios

The slope of the Jensen Alpha is negative indicating the portfolio has not kept pace with its benchmark over the past year. Gains have been made since last April. This simply reflects the strong market since Tariffs were introduced. It seems unlikely this growth will continue once we begin to see the impact tariffs have on the U.S. economy.

The goal of Huygens is to remain fully invested and to rebalance the portfolio each month using dividends from bonds to keep the various assets as close to their target percentages as possible. I classify the Huygens as a passive portfolio. Selling is rare and purchases take place to keep the different assets close to their target.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Hi Lowell,

Can you share the “Main Page settings” for this portfolio which is very similar to mine. I would like to compare them to mine.

Thanks Bob

Bob,

Check the first screenshot to see what settings I am using in the Main Menu.

Lowell