Welcome to Bali, Indonesia

I am a little slow posting this review as I analyzed/adjusted it last week. However, it’s a simple and slow moving portfolio so the tardiness is likely not too significant.

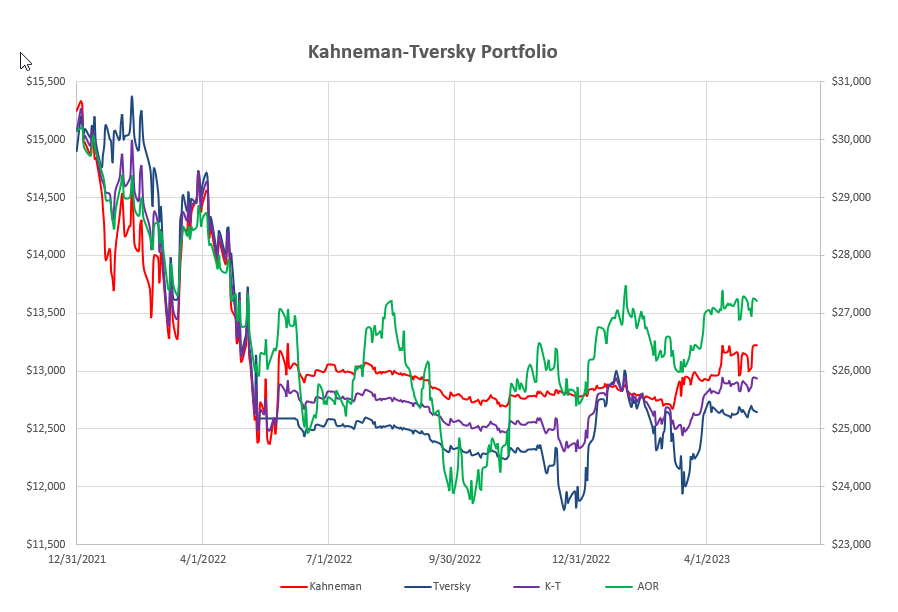

Prior to the adjustments I was holding VEA (International Equities) in the Kahneman portion of the portfolio and Cash (SHY) in the Tversky portion and performance looked like this:

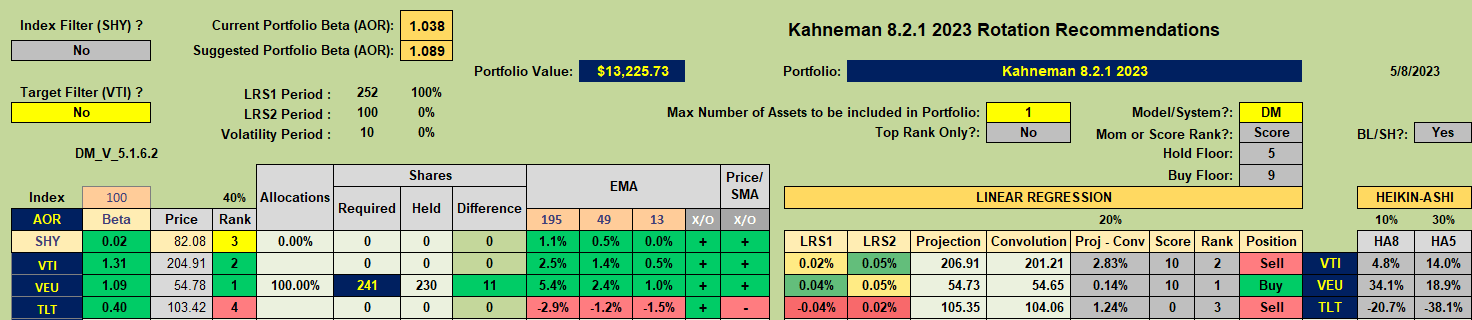

Reviewing the Kahneman portion generated the following screenshot:

suggesting that no adjustments were necessary. Checking the rotation graphs (in anticipation of possible future changes) we saw this:

i.e. no likely change in the short term.

i.e. no likely change in the short term.

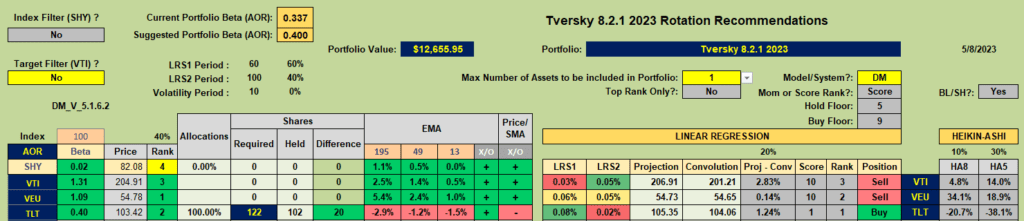

Moving on to the faster reacting Tversky portion generated the following recommendations:

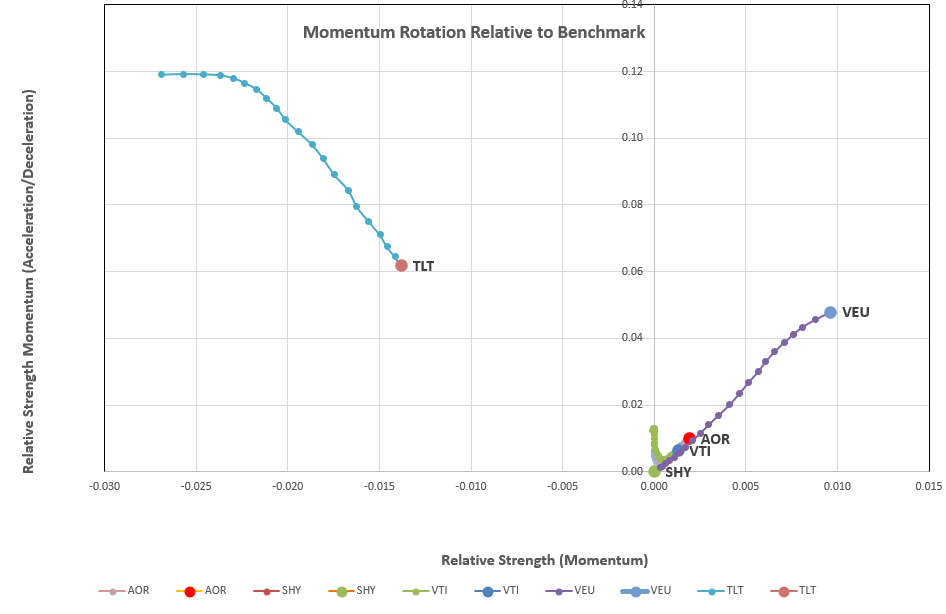

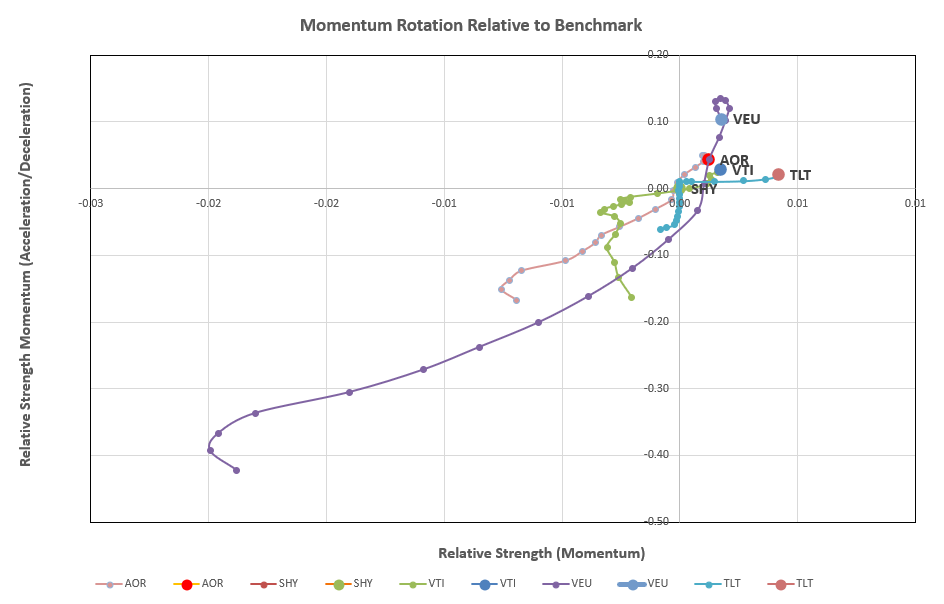

and the following graphical picture:

and the following graphical picture:

so I rotated into TLT at the beginning of last week.

so I rotated into TLT at the beginning of last week.

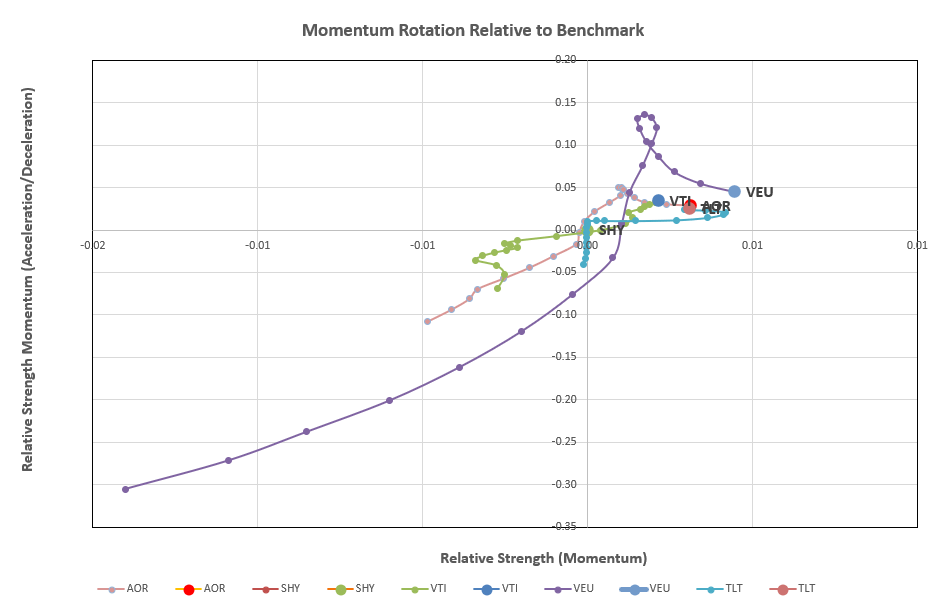

I should point out that this picture has since changed:

and VEU is now the recommended holding. However, this is a simple example of review date (timing) luck – that may turn out to be good luck or bad luck – so I’ll leave things as they are with TLT in the Tversky portion.

and VEU is now the recommended holding. However, this is a simple example of review date (timing) luck – that may turn out to be good luck or bad luck – so I’ll leave things as they are with TLT in the Tversky portion.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.