Hibiscus buds using photographic focus stacking technique.

Before digging into the Millikan Sector BPI review I checked to see if any sectors dropped into the oversold zone. None made this move so there are no recommendations to purchase any sectors or sector ETFs. Of the overbought sectors, TSLOs are already in place from recommendations that have been in place for several weeks.

Since there are no oversold sector recommendations I placed three limit orders for VOO and VTI. See below.

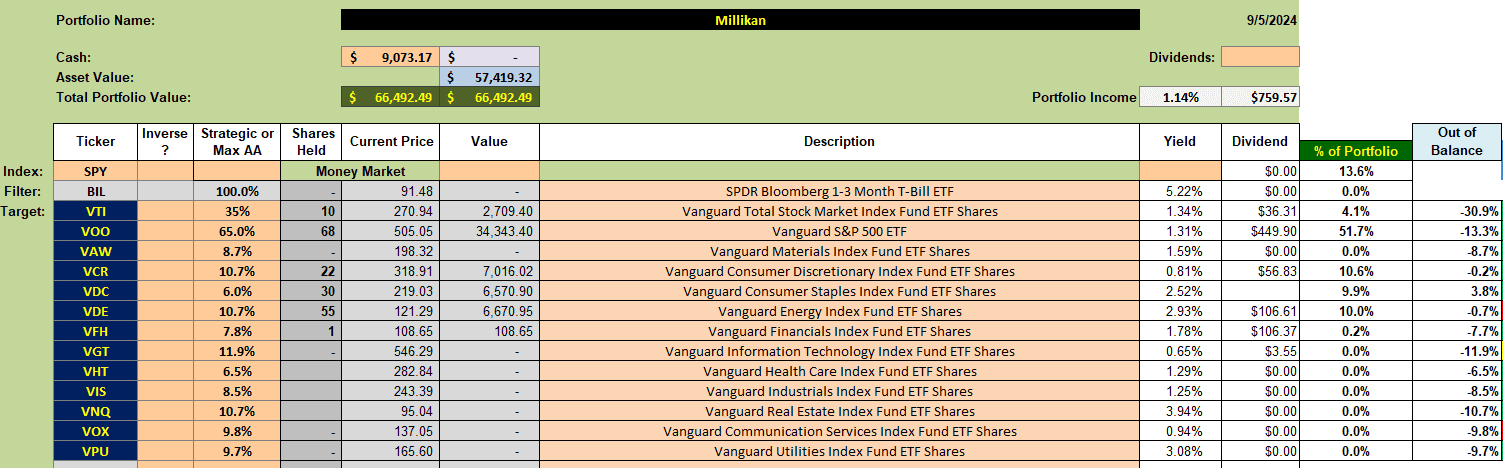

Millikan Security Holdings

Cash is abundant do to the sale of VGT since the last review plus the infusion of new money. Technology has been quite volatile. The 3% Trailing Stop Loss Order (TSLO) for VGT was struck since the last review.

Here are the limit orders placed this morning.

- Purchase 5 shares of VOO at $489.95 or 3% below the current price.

- Purchase 10 shares of VOO at $479.75 or 5% below the current price.

- Purchase 5 shares of VTI at $256.50 or 5% below the current price.

When setting limit orders I use the Good Till Canceled (GTC) plus extended hours. This portfolio is housed at Schwab and they permit extended trading hours. The three primary sector ETF holdings (VCR, VDC, and VDE) are close to the recommended percentages with VDC oversubscribed. This can happen both up and down do to price changes after the initial purchase. Compare the third column from the left with the second column from the right or check the Out of Balance column.

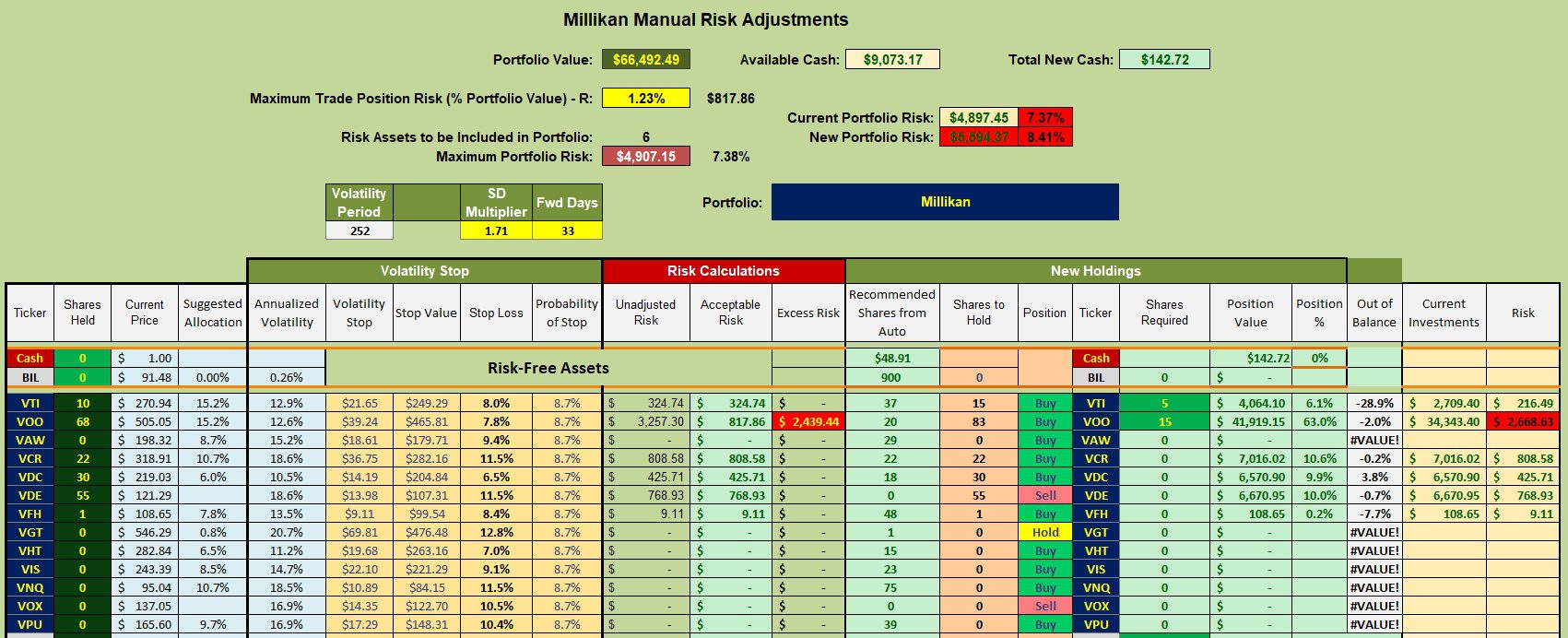

Millikan Manual Risk Adjustments

The following risk adjustment table reflects the current limit orders for VTI and VOO.

Drop me a comment if you think the precise limit order prices add value to these reviews. I added this data in response to William’s recent question.

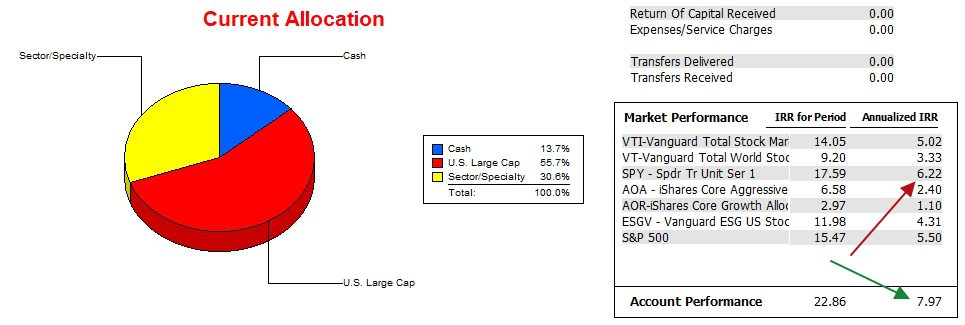

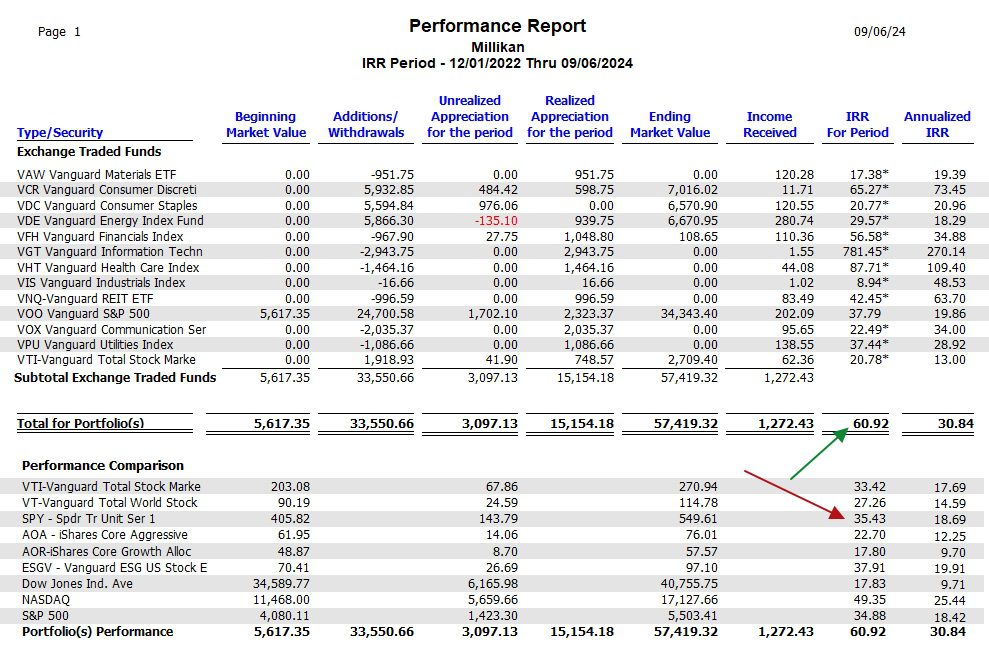

Millikan Performance Data

The following data shows performance from 12/31/2021 through 9/5/2024. The Millikan has been using the Sector BPI investing model since 11/30/2022 so we are closing in on two years of performance data.

I consider it a victory when the portfolio outperforms the S&P 500. The Millikan portfolio is a winner.

The manager of SPY has a slight edge on the actual index.

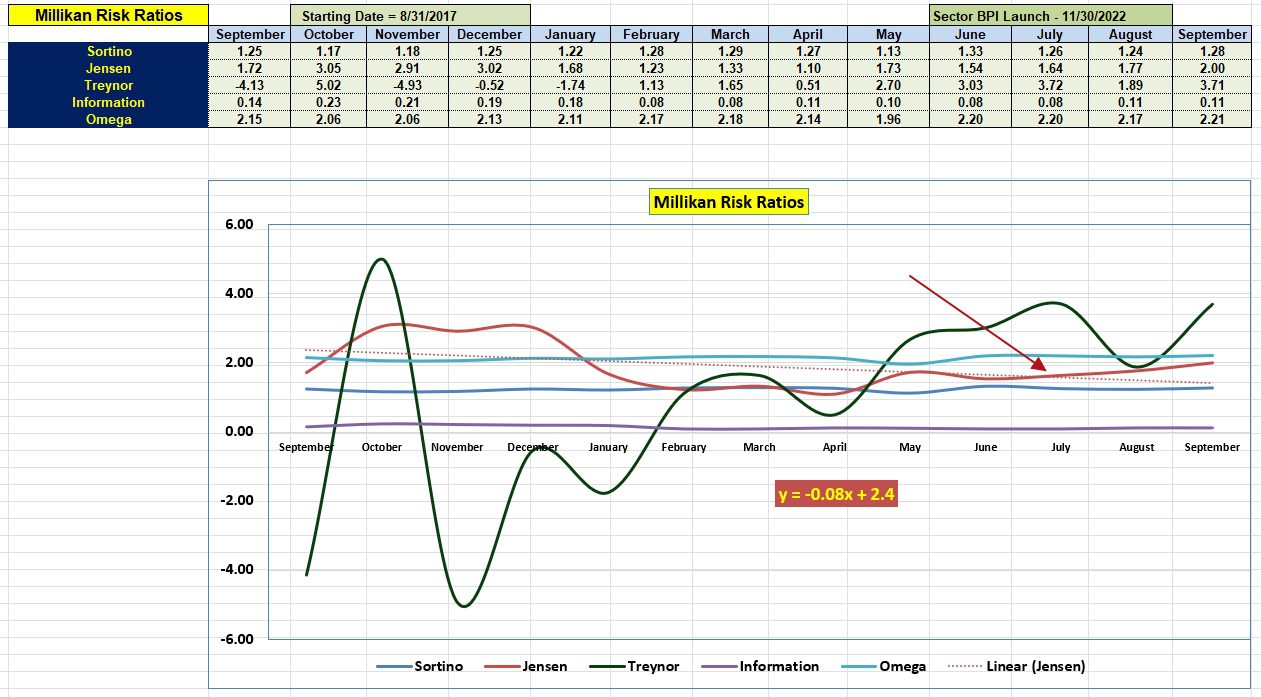

Millikan Risk Ratios

How well is the Millikan performing when risk enters the equation? While it is still early in September, the trend since last January is positive.

Pay most attention to the Jensen Performance Index as it is the most inclusive of risk measurements. It will be a few months before we see a positive Jensen slope. We need to clear October, November, and December 2023 data. Those months were very strong.

Millikan Sector Portfolio Report

The following table homes in on the period when the Millikan was using the Sector BPI investing model. The results are most positive as the Millikan returned 60.9% while the SPY returned a robust 35.4%. These past 21 months have been exceptional for U.S. Equities. Don’t assume similar returns over the next two years unless the Sector BPI model works better than I ever anticipated.

Caution: The actual portfolio performance data is not quite as strong as the following numbers project as cash is not taken into consideration. In an up market cash is a drag on portfolio performance. With this in mind, there is still no question that the Sector BPI investing model is adding alpha to the owner of this portfolio.

Millikan Sector BPI Portfolio Review: 10 May 2024

Millikan Sector BPI Update: 20 July 2023

Tweaking Sector BPI Plus Investing Model: Part II

If this blog post is useful, pass the link ( https://itawealth.com ) on to your friends and family members. The ITA blog is free to all who register as a Guest.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Special note to users of the Kipling spreadsheet. Yahoo has shut the door on downloading security data. My recommendation is to use the Tiingo Adj. Price option. That is still working.

Lowell