Forgotten Oregon

Pauling is one of numerous Asset Allocation (AA) portfolios. I moved several portfolios over to this model due to the outstanding performance of the Schrodinger, a computer managed AA portfolio. I am also returning to the root of my investing instincts. As a summary, here are the basic investing models I am using here at ITA Wealth Management.

- A Robo Advisor or computer managed portfolio. This is the popular Schrodinger account.

- An all-out equity portfolio where the primary ETFs are VOO and VTI. This is the Copernicus account. Thus far this is the top performer.

- The Sector BPI investing model or a unique approach using Bullish Percent Indicator data from eleven sectors. Carson is the oldest of five portfolios currently using this model.

- The remaining eight portfolios (not all eight are publicly reported monthly) are following the AA model. The Pauling is one of the eight and is quite new to this approach.

Pauling Asset Allocation Portfolio

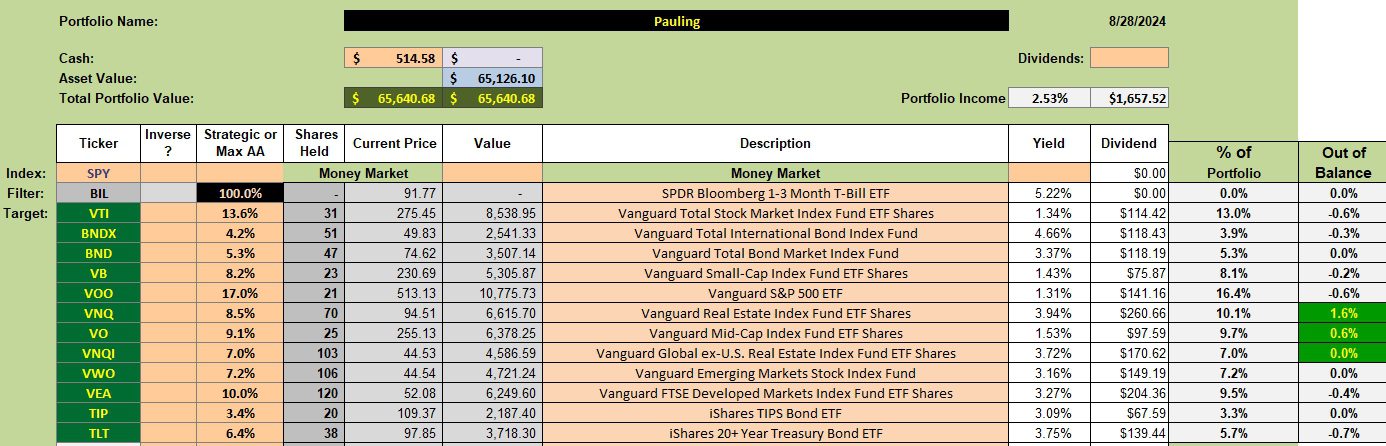

Below is the AA investment quiver for the Pauling and the current holdings. The AA percentage goal is listed in the third column from the left and the Out-of-Balance percentage is shown in the far right hand column. Initially I wanted to keep the various asset classes within + or – 0.5%. Depending on the volatility from month to month this may be difficult so I may need to raise the uncertainty percentage up to + or – 1.0%.

In general I don’t want to sell any shares so the portfolio is tax efficient. New cash and dividends are used to purchase shares of those ETFs or asset classes most out of balance on the low end. Currently that would be TLT with VTI and VOO next in line for additions. Right now VNQ and VO are holding excess shares. Should I sell shares of VNQ so rebalancing can take place or stand pat with VNQ and wait for the third quarter dividends before rebalancing? That is the critical decision.

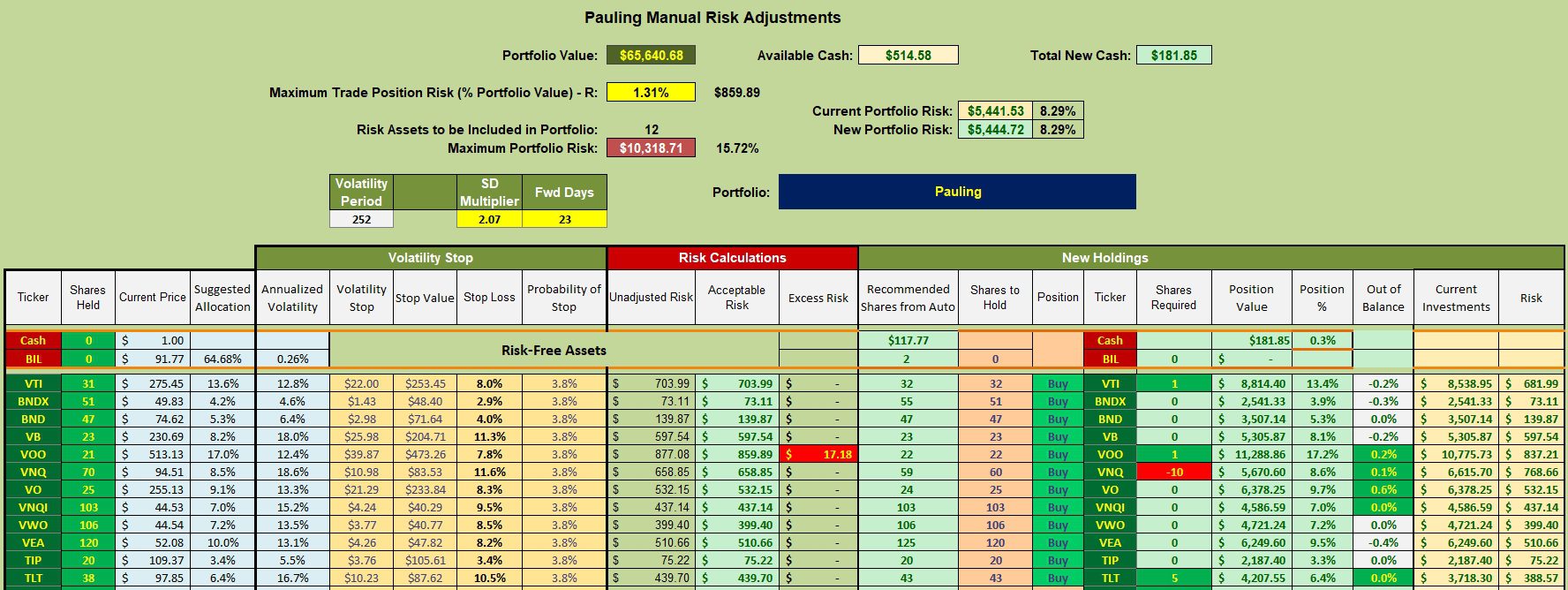

Pauling Manual Risk Adjustment or Rebalancing

If immediate rebalancing is the decision, then sell 10 shares of VNQ and purchase one (1) share of VTI, one share of VOO, and five shares of TLT. I’m inclined not to sell any shares of VNQ as it will throw off 3.9% in dividends and that money can be used to bring asset classes out of balance on the low end back into balance.

The Pauling is very close to being in balance and the owner does not need cash in the foreseeable future. When this is the case it becomes easier to manage the account as I don’t need to worry about holding a certain amount of cash in reserve.

Pauling Performance Data

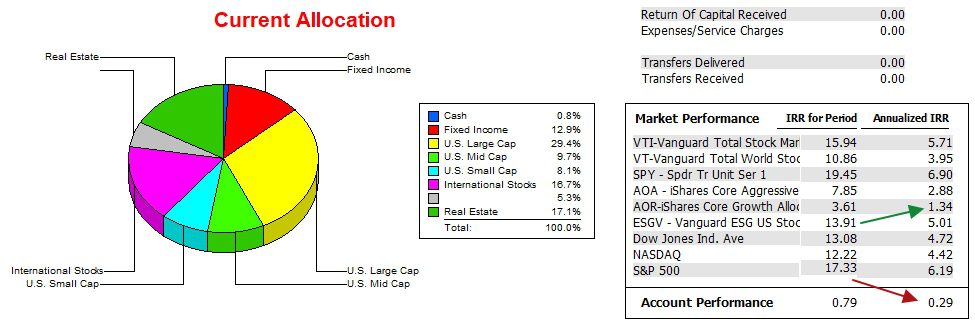

As mentioned above, the Pauling is new to the AA investing model. Pauling has been one of the poorer performing portfolios so we need to keep an eye on trends rather than current values. Since 12/31/2021 the Pauling lags the AOR benchmark by over one percentage point. Note that AOR is the new benchmark for the Pauling. When holding a broad array of asset classes, using SPY as the benchmark does not make sense. Thus the switch to AOR.

Pauling Risk Ratios

The July to August data differences are due to changing the investing model and thus using different benchmarks. It will take a year of data before we can fully see what switching to the AA investing model makes. Then we need to go through a few business cycles to further test the Asset Allocation model.

Returning To Investing Roots: 5 August 2024

Pauling II Update: 1 April 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I made the decision not to sell VNQ. Instead of selling VNQ and rebalancing I will wait for the third quarter dividends and any new cash deposits to build up asset classes that are below target. TLT is the current focus.

Lowell

One additional goal for 2025 is to reduce taxes by minimizing transactions.

As mentioned before, years ago I did a “back-of-envelope” calculations to see what additional return percentage is required to offset taxes due to income generated from buying and selling securities. As I recall, it came out to close to 2%. In other words, one needs to generate an additional 2% of return to offset taxes for an average wage earner. Of course this will vary from individual to individual.

The Schrodinger portfolio is tax managed by computer, another advantage to holding at least one Intelligent Portfolio in the family portfolio.

Lowell

If you are locked out of the blog know I am working on the problem.

Lowell

The ITA blog is back on line after an outage of nearly 12 hours. A particular plugin (piece of software) was blocking entrance into the blog. I was locked out as well. Tech support at the hosting site was able to identify and cure the problem.

Lowell