Capistrano Mission

Pauling is a recent Asset Allocation portfolio as performance has been a disappointment. Thus the change. If this Asset Allocation model does not show improvement over the next few months I’ll recommend shifting this portfolio to a Schwab Intelligent Portfolio or a model similar to the Schrodinger.

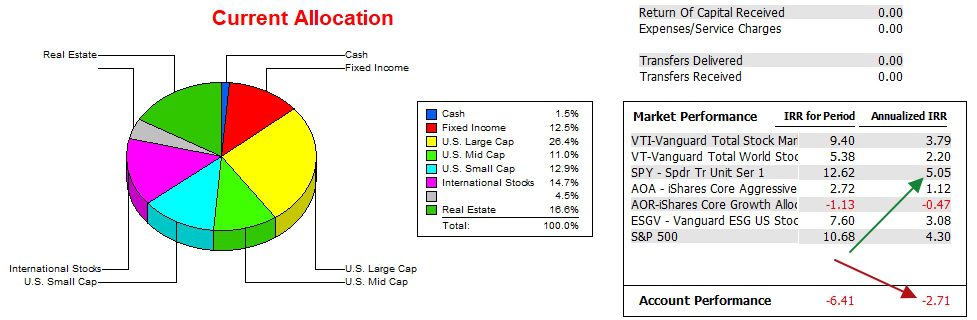

The Pauling began the AA model about a month ago or early in April. Rather than focusing on the Internal Rate of Return, we will turn our attention to the trend of the Information Ratio and Jensen’s Performance Index. See the fourth screenshot.

Pauling Asset Allocations

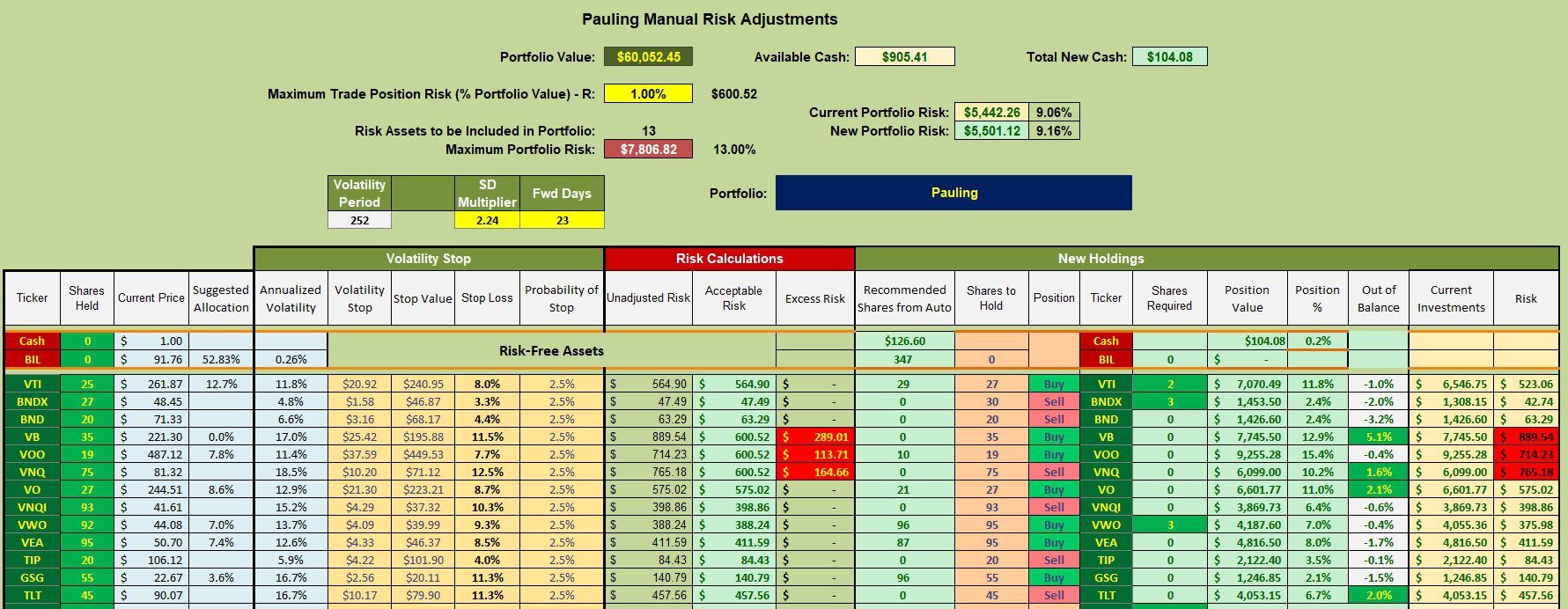

Below is the investment quiver for the Pauling and the current holdings. Over on the right is the Out of Balance column. BND and BNDX are most out of balance. However, neither are Buy recommendations so a decision is required. The decision of how to invest the remaining $900 in cash requires some balancing. The goal is to eventually see all ETFs within +/- 0.5% of the recommended asset allocation. I tend to favor assets most out of balance yet show a Buy recommendation. Another variable is to favor ETFs that throw off the highest dividend. BNDX is the winner in this area.

Over time I anticipate all assets will come close to falling within the recommended AA goals. Even though VB is well above the recommended percentage, I do not plan to sell shares. When new money is added to the Pauling and dividends become available, I will bring those assets most out of balance into balance. This will take considerable time unless the owner deposits a considerable amount of fresh cash into the Pauling. Second quarter dividends will provide some cash for new purchases.

I’m still debating whether or not to continue to hold Gold (GSG) in the portfolio as gold does not have a great historical record. Another negative is that it does not generate a dividend.

Pauling Manual Risk Adjustments

A few limit orders are in place for VTI, BNDX, and VWO. Little by little I’ll bring the various assets into balance. This may require many months so patience is required.

Pauling Performance Data

Since 12/31/2021 the Pauling has fallen far behind the SPY benchmark. This gap required a change in how the portfolio is managed and that called for a move to the rather conservative Asset Allocation investing model.

Pauling Risk Ratios

The one glimmer of good news is the positive slope of the Jensen Alpha ratio. The slippage of the Jensen from March and April is a disappointment. Over the next few months, keep an eye on the Jensen as this ratio is key to how well the Asset Allocation approach is working.

Pauling II Asset Allocation Portfolio Launch: 1 April 2024

Pauling II Update: 1 April 2024

Tentative Asset Allocation Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.