A Warm Welcome from Hamish at the Scottish Border

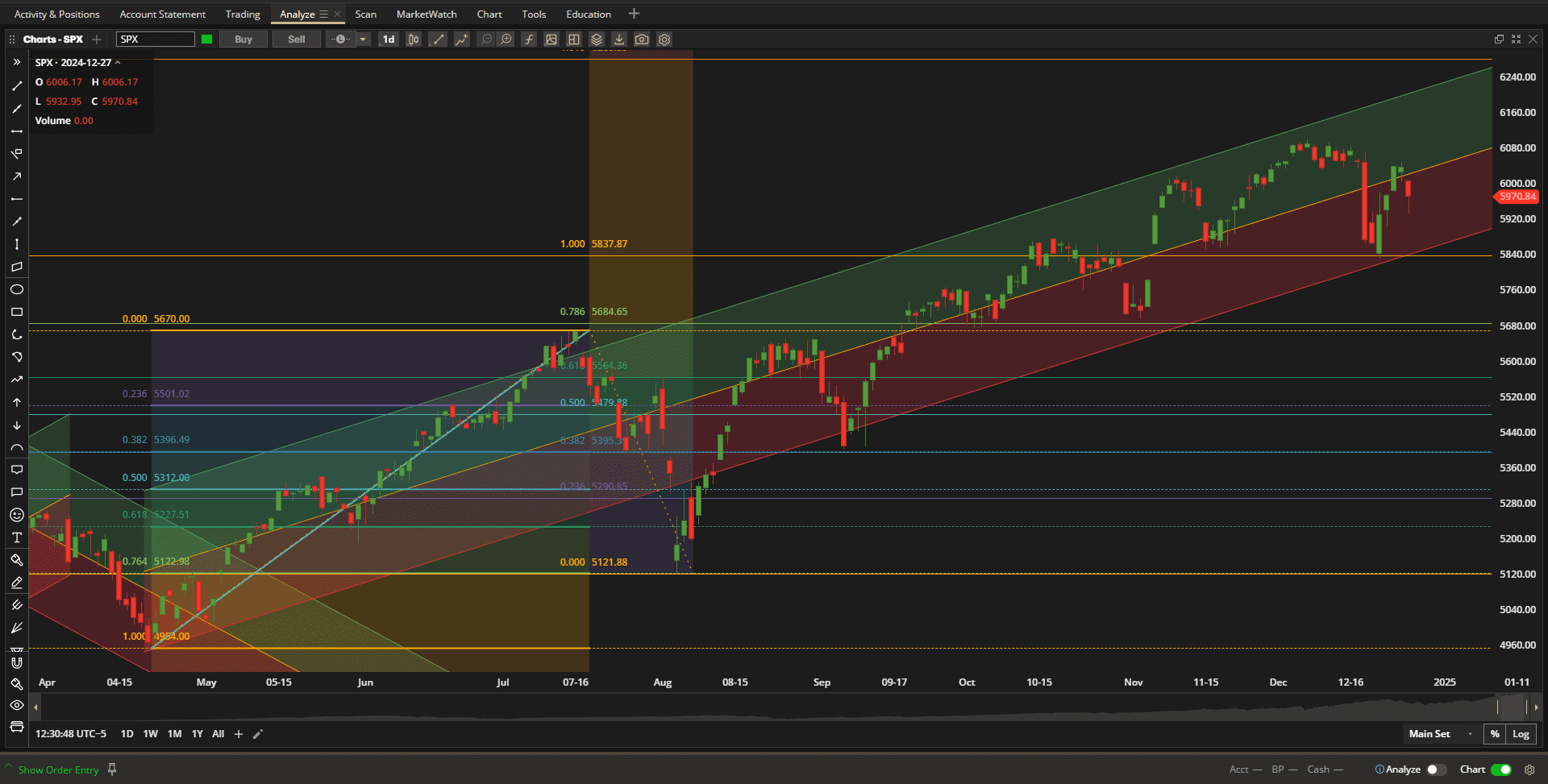

It was a rather uneventful week in the US Equity markets with relatively low volume as a consequence of the holidays. However, the SPX (S&P 500 Index) did manage to close the week ~0.5% higher than last week’s close despite a weak day on Friday:

We are still in the middle of the uptrend channel going into the last week of 2024 so it will be interesting to see whether we can close the year near the all-time highs. Investors feeling bearish might see a “Head and Shoulders” pattern in the chart and anticipate a drop out of the channel to test support at ~5680 sometime in January. We will see how it goes.

We are still in the middle of the uptrend channel going into the last week of 2024 so it will be interesting to see whether we can close the year near the all-time highs. Investors feeling bearish might see a “Head and Shoulders” pattern in the chart and anticipate a drop out of the channel to test support at ~5680 sometime in January. We will see how it goes.

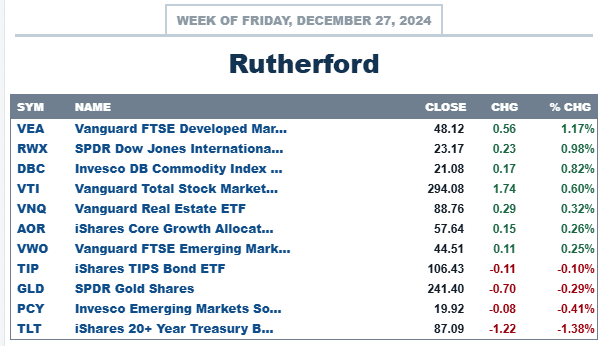

Relative to other major asset classes, US Equities stood up pretty well as Bonds were weak:

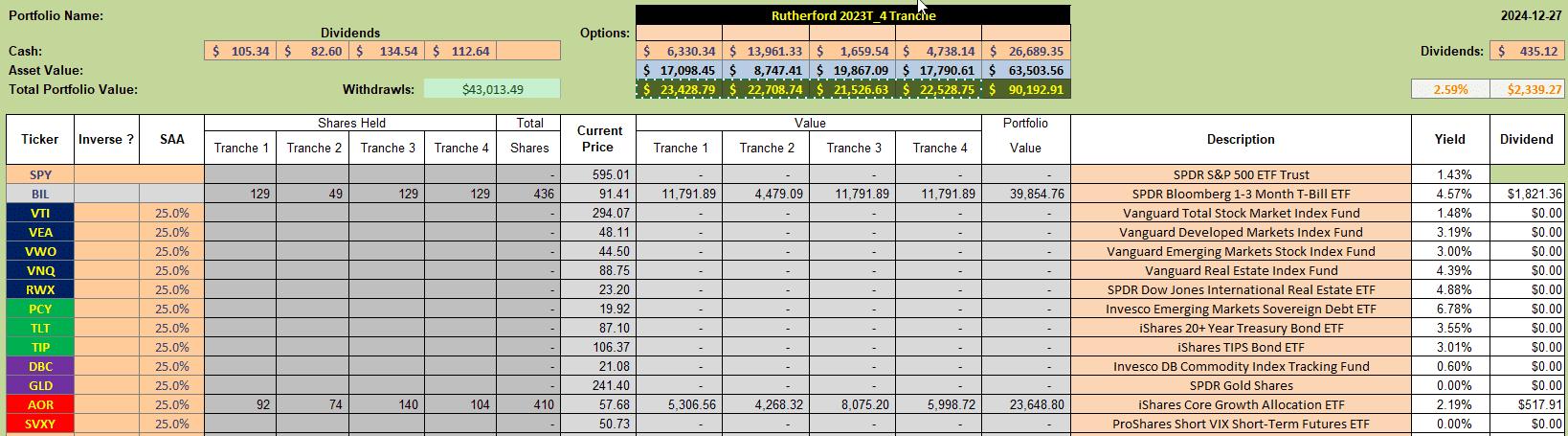

After selling my last holdings in VTI on Thursday I am left with just the benchmark AOR fund and T-Bills (BIL) in the account:

After selling my last holdings in VTI on Thursday I am left with just the benchmark AOR fund and T-Bills (BIL) in the account:

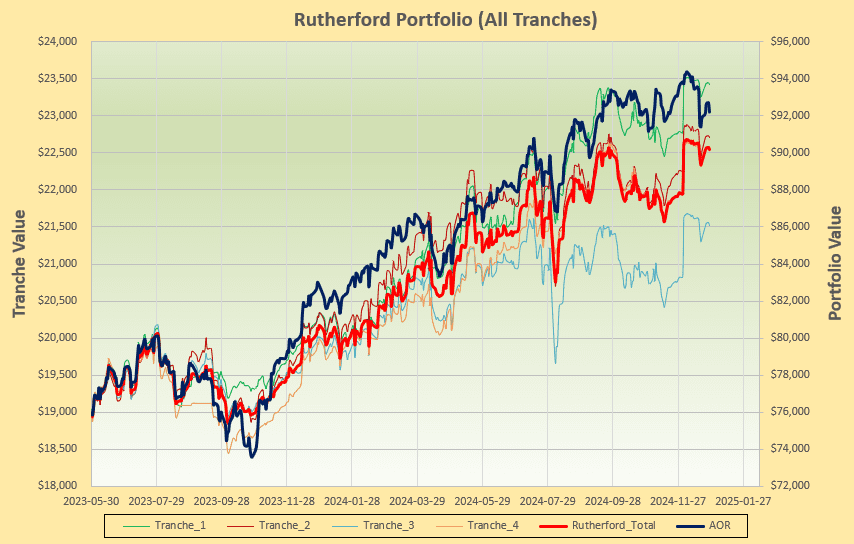

and performance looks like this:

and performance looks like this:

or $2,000 below where a simple buy-and-hold of the benchmark fund would have left me.

or $2,000 below where a simple buy-and-hold of the benchmark fund would have left me.

As I have indicated in previous posts I do not plan to continue to manage portfolios using this model going forward – it has not been disastrous, just disappointing in that I thought there should be more value in the rotation data – and yet I have not found a way to harness it effectively. However, I still contend that timing/review date luck is a major factor impacting the performance of any system reviewed on a monthly basis and the performance of this portfolio is still well within those bounds – with one tranche outperforming the benchmark.

Sometime next week I will post information on how I plan to manage a similar sized portfolio (in terms of number of assets in the quiver) next year. My focus will be on risk management even though volatility may be higher.

Best Wishes to all ITA Wealth Members for 2025 – and let’s hope we can boost our wealth a little. It might be a rough year after the long bull run we’ve been on for the past 3 years.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question