Even the garbage collection areas are made to look attractive in Christchurch, New Zealand.

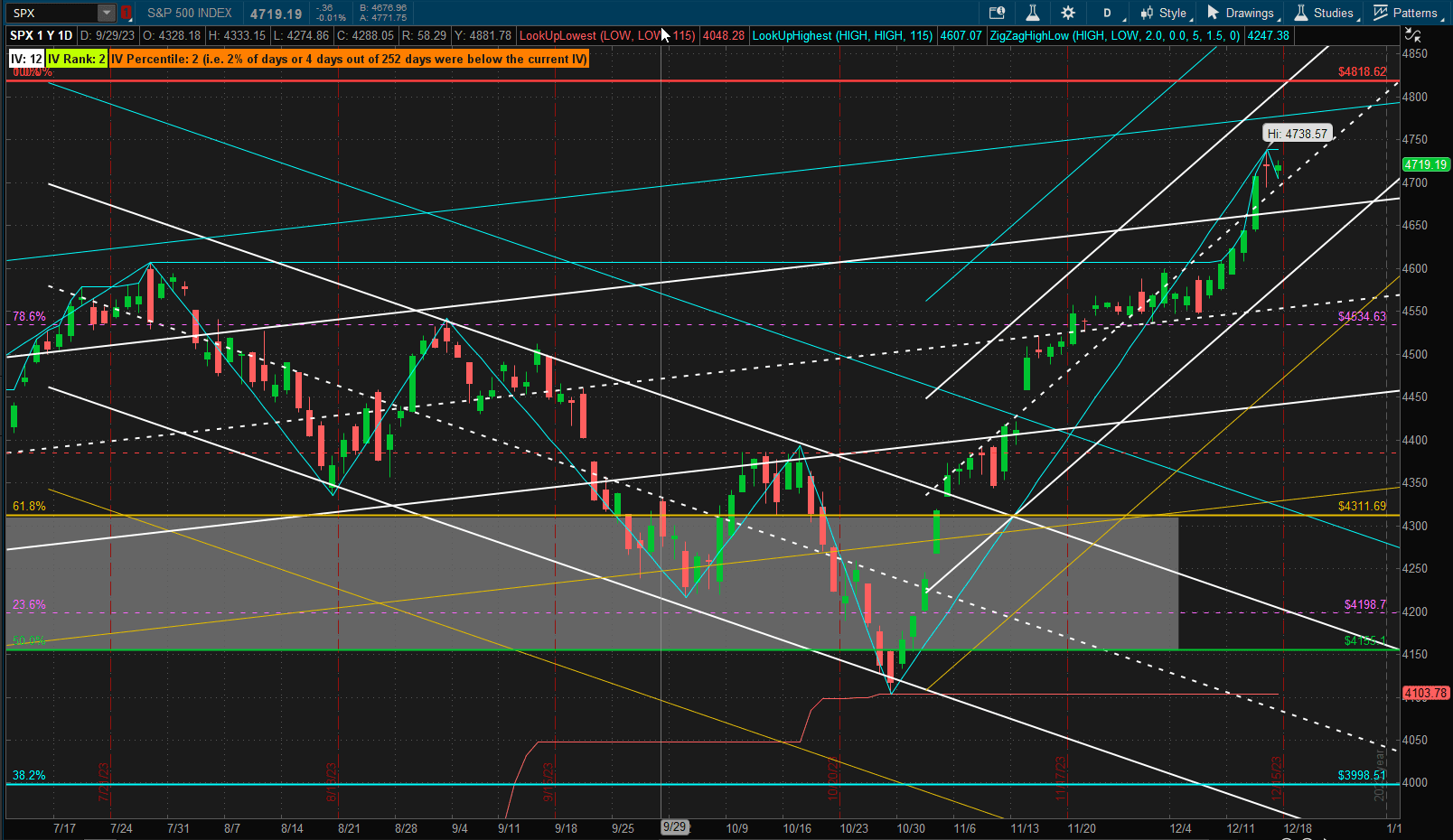

Well, Santa sure pulled us through that strong resistance zone at ~4600 in the SPX (S&P 500 Index) and US equities closed the week up ~2.8% from last week’s close after 2 weeks of sideways consolidation:

now the challenge will be to see whether we can reach the January 2022 all-time highs at ~4820.

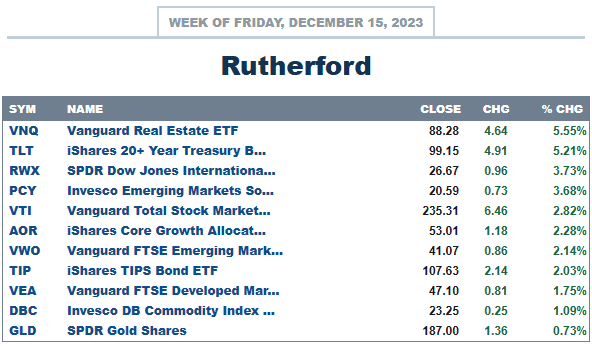

Despite the strong performance of equities through the past week this was mediocre compared with returns from Real Estate and Bonds that hit the 3.5% – 5.5% levels:

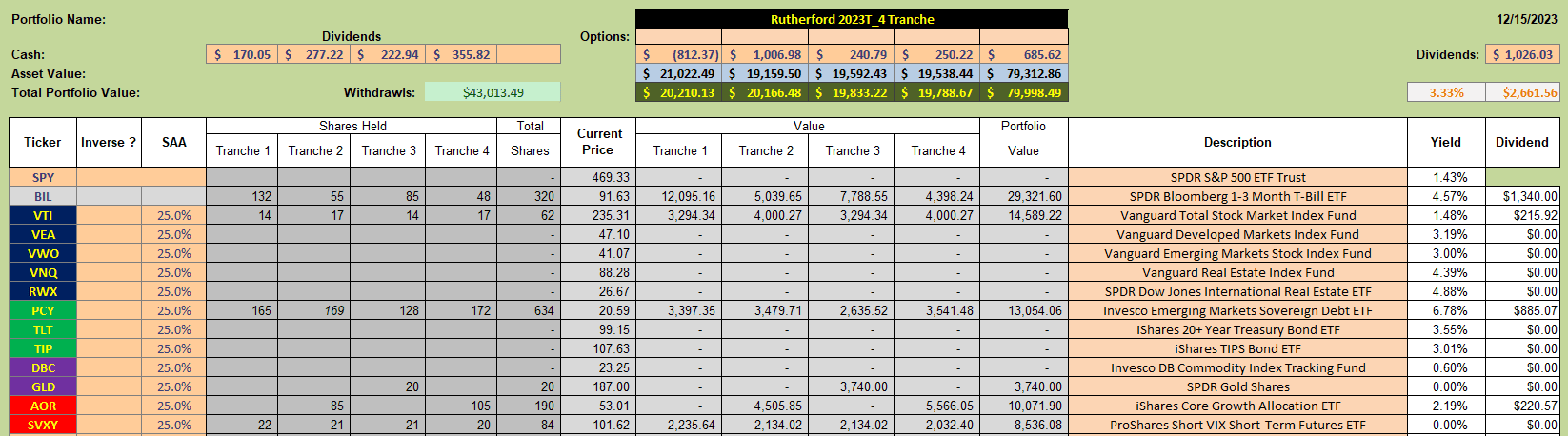

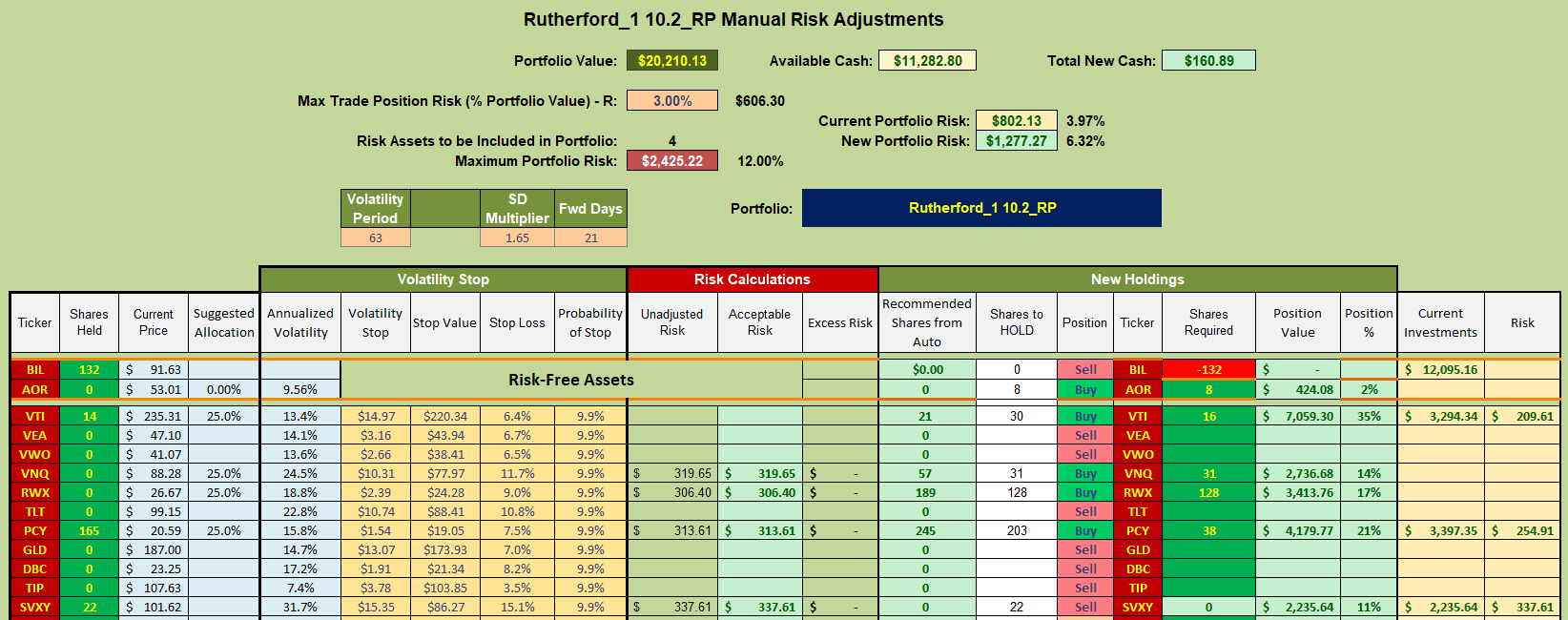

Holdings in the Rutherford Portfolio are fairly well diversified although the portfolio is still maybe a little heavy (~35% allocation) in BIL (short-term Treasuries as a proxy for Cash):

Holdings in the Rutherford Portfolio are fairly well diversified although the portfolio is still maybe a little heavy (~35% allocation) in BIL (short-term Treasuries as a proxy for Cash):

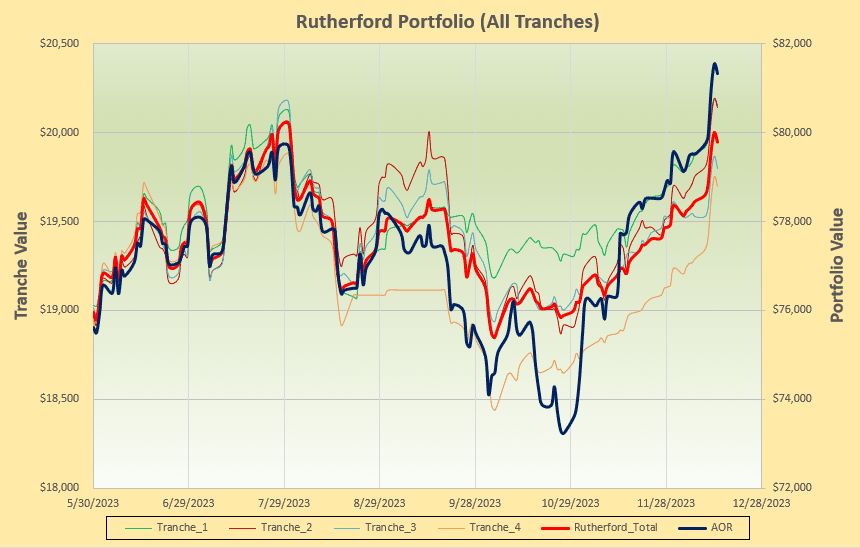

However, this has not hurt performance too much when compared with AOR, the benchmark equity/bond fund:

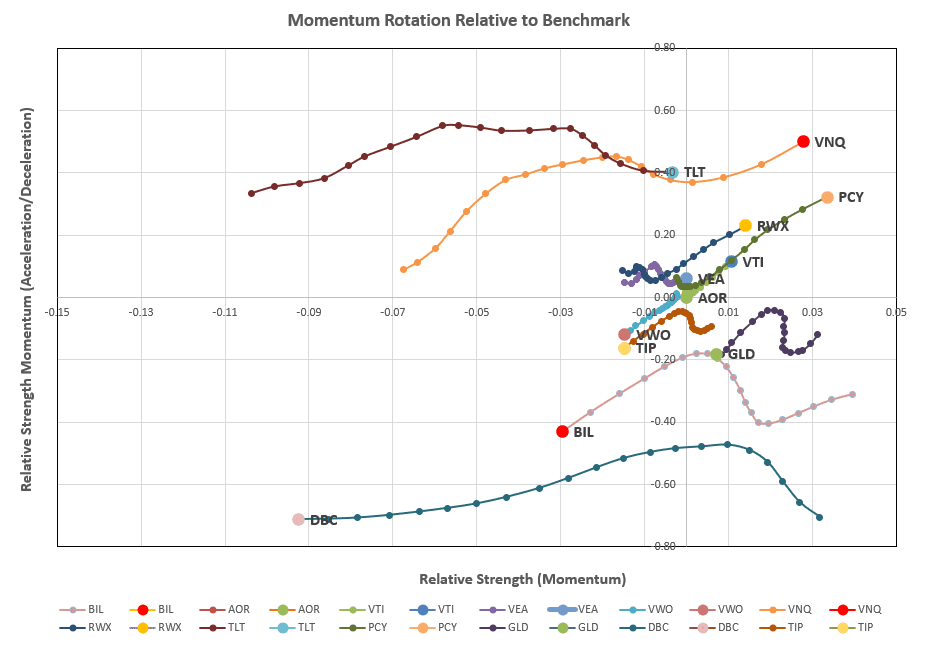

Checking the current rotation graphs:

Checking the current rotation graphs:

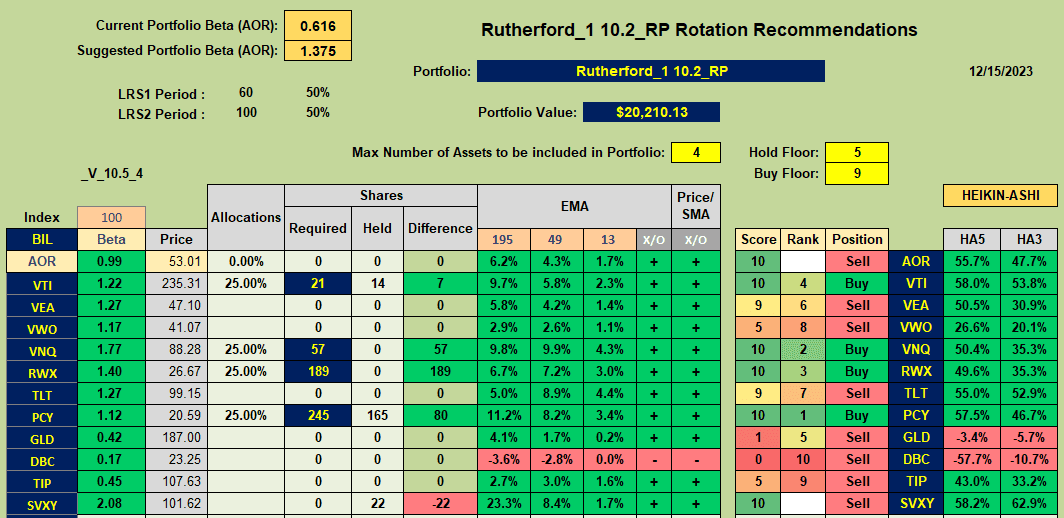

we finally see some strong rotations into the desirable top right quadrant that generate the following recommendation from the rotation model algorithm:

we finally see some strong rotations into the desirable top right quadrant that generate the following recommendation from the rotation model algorithm:

where we see Buy recommendations for PCY, VNQ, RWX and VTI.

where we see Buy recommendations for PCY, VNQ, RWX and VTI.

This leads to the following actions for next week’s adjustments;

I shall be selling all holdings in BIL (in Tranche 1) and using the cash to open positions in VNQ and RWX (US and International Real Estate) and adding existing shares to current hodings in VTI and PCY. Since AOR (the benchmark fund) is presently showing stronger momentum than BIL I will use the left-over cash to buy a few shares of AOR.

I shall be selling all holdings in BIL (in Tranche 1) and using the cash to open positions in VNQ and RWX (US and International Real Estate) and adding existing shares to current hodings in VTI and PCY. Since AOR (the benchmark fund) is presently showing stronger momentum than BIL I will use the left-over cash to buy a few shares of AOR.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.