Bird-of-Paradise Plants – Botanic Gardens, Auckland, New Zealand

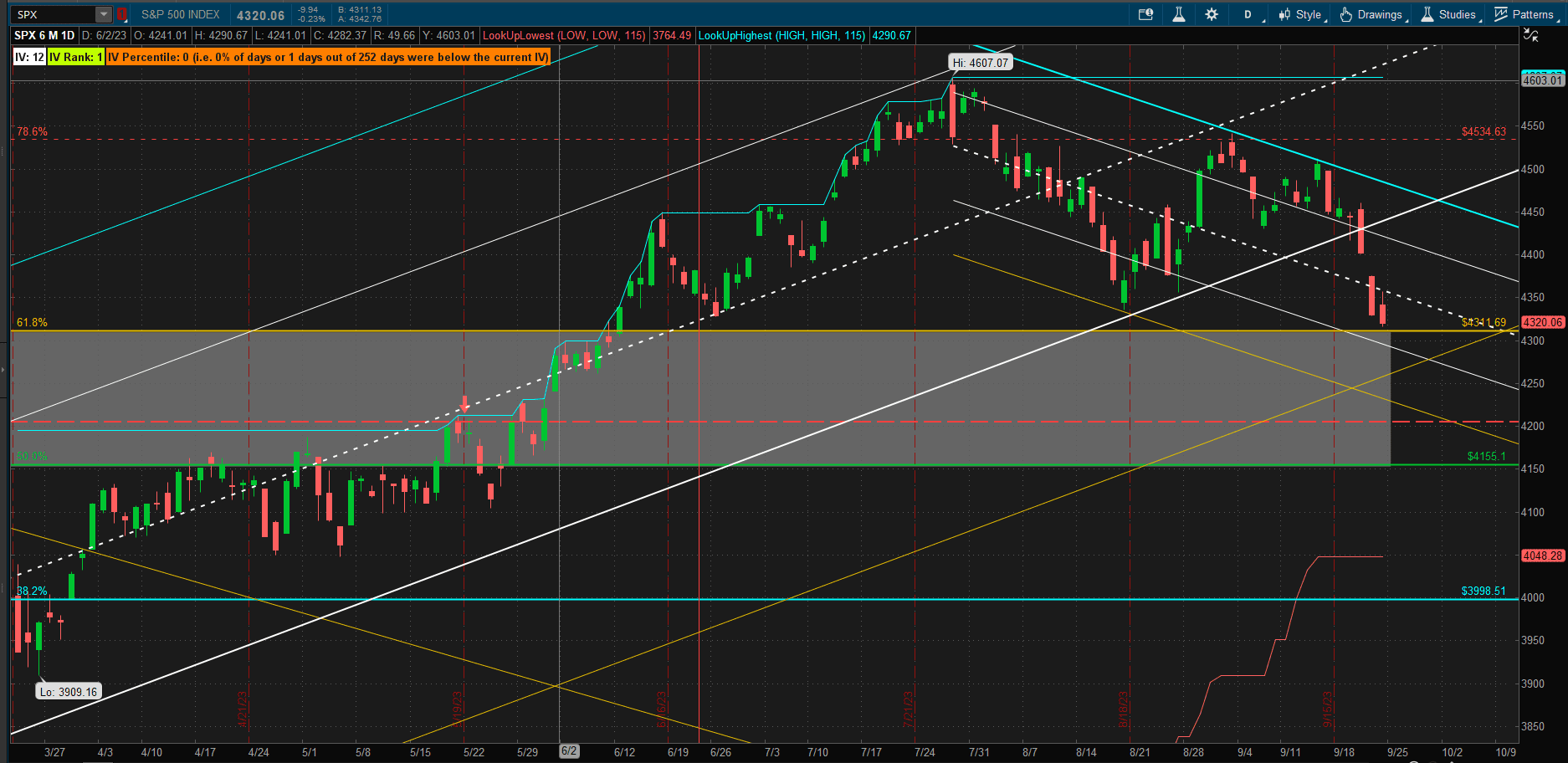

We finally got that inevitable breakout from the pendant pattern that has been setting up for a month or so – resulting in a 3% downside move in US equities over the past week and leaving us sitting at ~4300 in the SPX (S&P 500 Index) and at the top of a potential support zone:

From here we will wait to see whether we get a bounce back towards the top of the recent downtrend channel (but still within the longer term uptrend) or a continuation of the downtrend below current levels that might lead us to accept that the bullish trend is over and we are at the start of a new downtrend.

From here we will wait to see whether we get a bounce back towards the top of the recent downtrend channel (but still within the longer term uptrend) or a continuation of the downtrend below current levels that might lead us to accept that the bullish trend is over and we are at the start of a new downtrend.

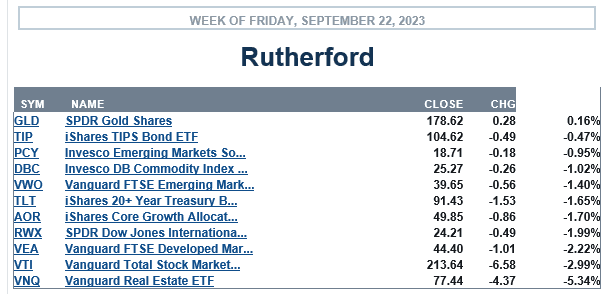

Compared to other major asset classes – US equities came in close to the bottom of the list in terms of performance over the past week:

although all classes were weak, with only Gold showing any positive returns.

although all classes were weak, with only Gold showing any positive returns.

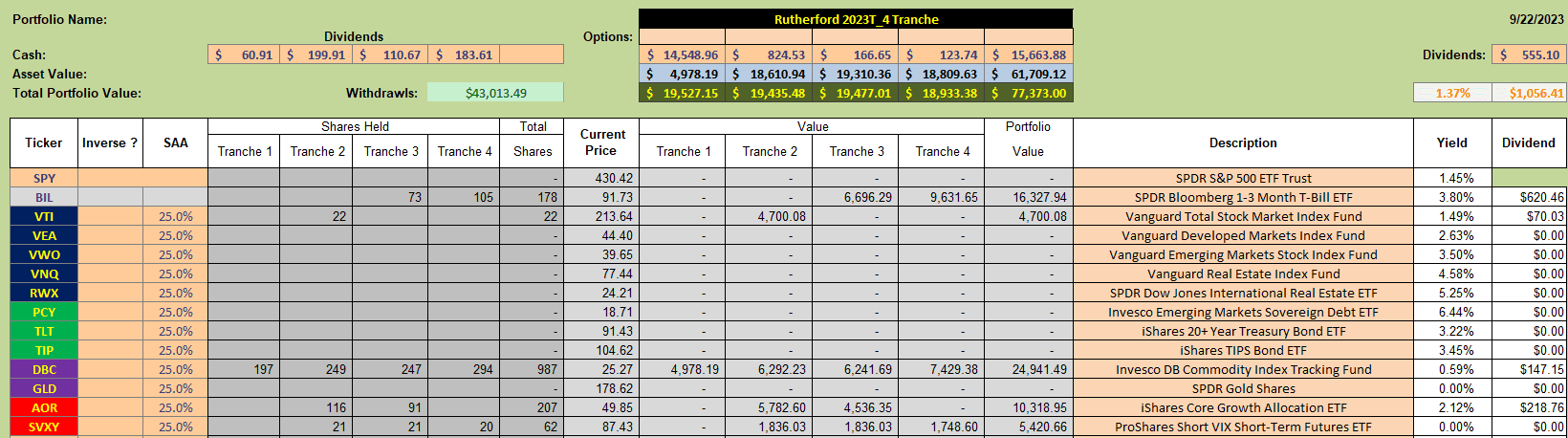

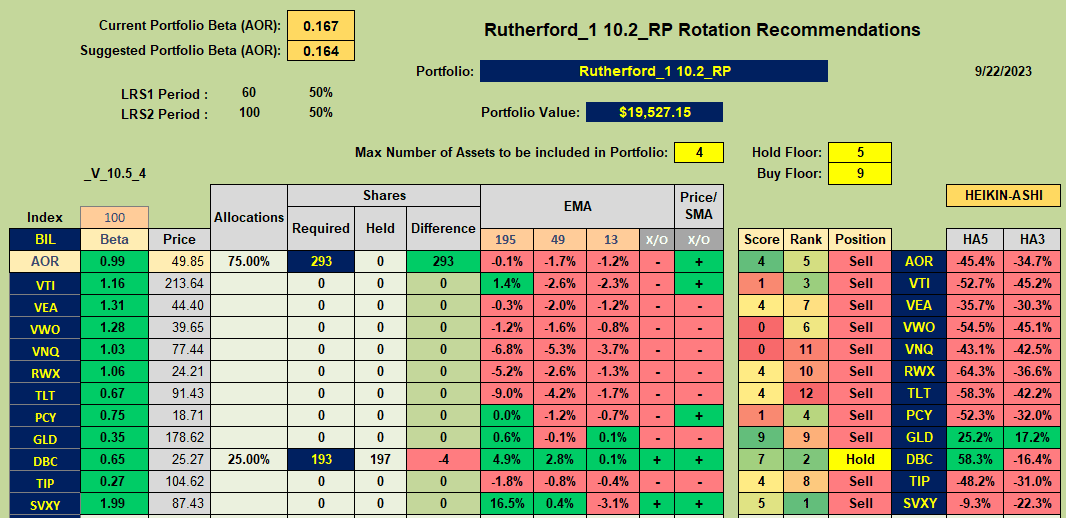

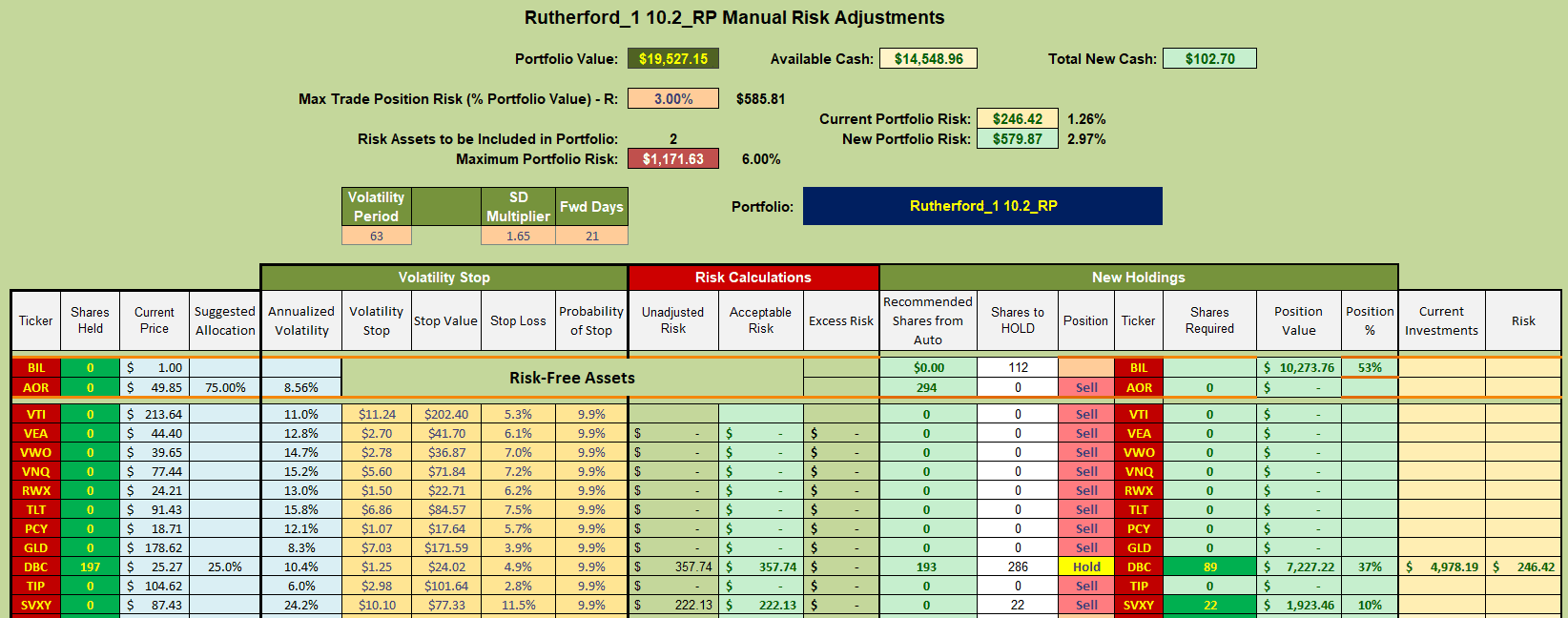

Current holdings in the (tranched) Rutherford Portfolio look like this:

with Tranche 1 (the focus of this week’s review) holding positions only in Commodities (DBC) and Cash.

with Tranche 1 (the focus of this week’s review) holding positions only in Commodities (DBC) and Cash.

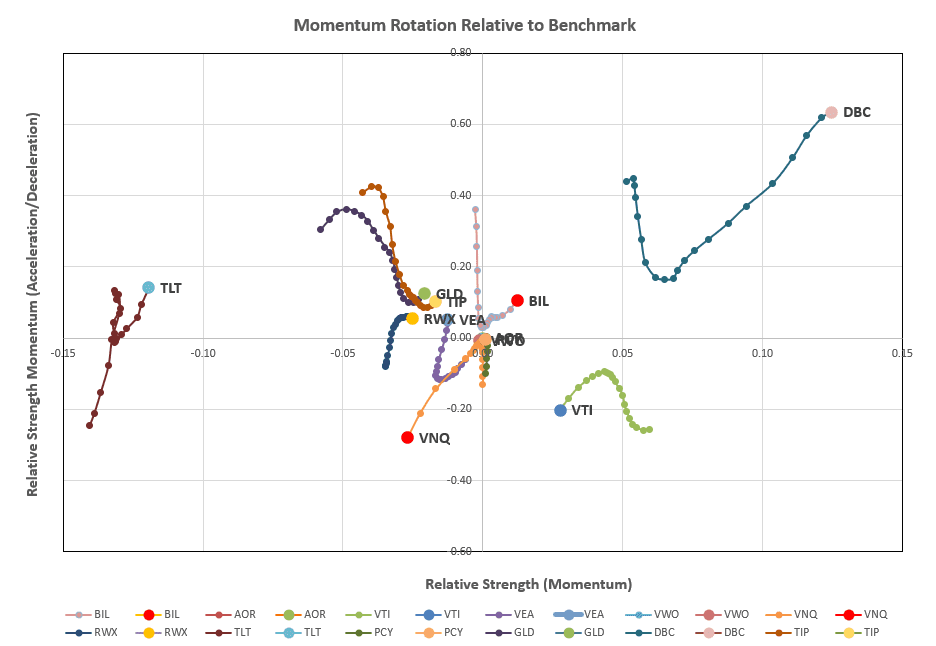

Checking the rotation graphs:

only Commodities are showing any strength, resulting in the following recommendations from the rotation model:

only Commodities are showing any strength, resulting in the following recommendations from the rotation model:

Consequently I shall be holding my current shares in DBC (but not adding additional shares) and adding 22 shares (10% allocation) of SVXY that I do not include in the Risk Parity allocation calculations:

Consequently I shall be holding my current shares in DBC (but not adding additional shares) and adding 22 shares (10% allocation) of SVXY that I do not include in the Risk Parity allocation calculations:

I will use the remaining Cash to Buy BIL (short-term Treasury Notes).

I will use the remaining Cash to Buy BIL (short-term Treasury Notes).

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.